Coal shipper Aurizon lowers cargo guidance by 10 million tonnes for FY21

Australian rail company Aurizon has lowered its guidance for coal shipments for the 2021 FY. Image: Getty

- Australian coal shipment volumes dip four per cent for rail company Aurizon

- ‘Subdued economic conditions, combined with restrictions on Australian coal imports by China, continue to weigh on export volumes’ – S&P Ratings

- About 50 coal ships are still waiting this week for berthing slots to enter Chinese ports

The relative health of Queensland’s and NSW’s coal export industries has been revealed by the latest half-year results from railway haulage company Aurizon Holdings (ASX:AZJ)

The ASX company makes most of its revenue from providing trains that deliver cargoes from coal mines to ports, and from its Queensland rail network that connects mines to ports.

Aurizon expects to ship 200 million to 210 million tonnes of coal in the June 2021-ended year, down 10 million tonnes from its previous guidance of 210 million to 220 million tonnes.

“Subdued economic conditions, combined with restrictions on Australian coal imports by China, continue to weigh on export volumes,” said ratings agency S&P Global Ratings in a report Monday on Aurizon.

In the half-year ended December, Aurizon delivered 101.8 million tonnes of coal cargo from mines to Australian ports and power plants, down 4 per cent on the corresponding 2019 half year.

Two significant contract changes were flagged by the company which are likely to reduce shipment volumes in the current financial year.

New Hope Corporation’s (ASX:NHC) 5.2 million-tonne haulage contract for its New Acland thermal coal mine in Queensland is set to end in December 2021.

And a 3.2 million-tonne annual rail haulage contract for the Stawell power station also in Queensland finished in December 2020.

China coal trade environment remains challenging

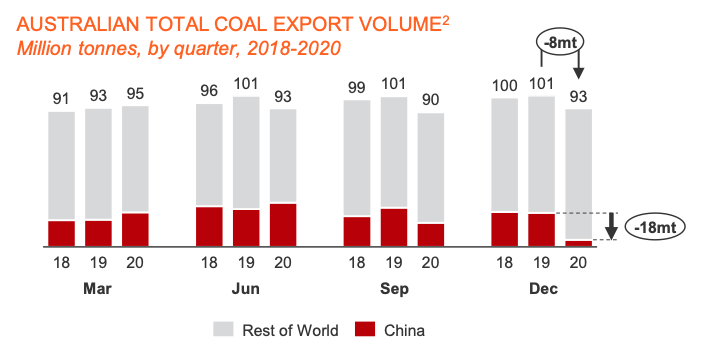

The rail company said the trading environment for coal exports into China remains challenging, with Australian shipment volumes to China down 18 million tonnes or 79 per cent in the December-ended quarter.

A total of 53 ships carrying Australian coal exports currently remain anchored off Chinese ports, unable to secure berthing slots to unload their cargo in the Asian country.

“Alternative export destinations have been found, however, it has not completely offset the negative impact with 10 million tonnes being redirected to markets outside China,” said Aurizon in a presentation.

Ratings agency S&P Global Ratings said that metallurgical or coking coal was harder hit by the port restrictions in China than thermal coal which has found alternative markets.

“Although some thermal coal will likely find its way into other Asian markets, metallurgical coal is more affected given a lack of alternative markets and slow ramp-up of demand from steel and other industries to pre-COVID levels,” said the ratings agency in a report.

The ratings agency added that it believes uncertainty remains over the extent of economic and restriction-linked effects on coal export volumes over the next 12 to 24 months.

Aurizon said it expects its customer coal haulage volumes to step down to 232 million tonnes in the 2022 financial year, split between Queensland at 169 million tonnes and NSW with 63 million tonnes.

This compares with total haulage volumes for coal customers in the 2021 financial year of 245 million tonnes, (Queensland: 174 million tonnes and NSW 71 million tonnes).

ASX share price for Aurizon Holdings (ASX:AZJ)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.