Bulk Buys: Iron ore climbs on supply crunch, trade tensions weigh on coking coal prices

Beijing city's skyline at sunset showcases a lot of steel-based construction. Image: Getty

- Iron ore fines prices traded this week at $US176.50 per tonne, up $US22 per tonne on week

- Hard coking coal prices were down $US2 this week at $US90 per tonne at Queensland ports

- China’s reinforcing bar price is at $US636 per tonne, up $US10.95 per tonne on a week ago

The iron ore market could see several long-standing price records fall in the coming weeks if prices continue on their current near vertical trajectory.

The sought-after commodity has traded at $US176.50 per tonne ($233.40/tonne) this week, a rise of $US22 on a week ago, according to Metal Bulletin.

Iron ore prices last traded at current levels in mid-2011, and are close to their all-time high of $US205 per tonne achieved in April 2008.

“A fourth consecutive weekly decline in China’s iron ore port stockpiles in the week ending December 11 signals that seaborne supply is struggling to keep up with China’s demand,” Commonwealth Bank of Australia analyst, Vivek Dhar, said in a report last week.

There are signs of pent-up demand in the iron ore market as some Chinese steel mills have held back from the spot seaborne market because of high prices.

“Steel mills have been deferring the decision to restock on hopes that iron ore prices will fall from spot levels soon,” said Dhar.

Dhar added that restocking demand is expected to continue up to the Chinese Lunar New Year holiday in mid-February.

The Australian government expects iron ore prices to remain strong for the next six months on a combination of factors.

“Prices have been held up by a combination of production constraints in Brazil, ongoing stimulus-driven demand in China, and the relatively low price of metallurgical coal, which gives steelmakers added flexibility to pay more for iron ore,” said the Australian government’s chief economist in his commodity sector report for the December quarter.

“China’s dominance in iron ore consumption gives it considerable capacity to set global prices, though the relative concentration of the iron ore supply chain may act as a counter-balance,” said the report.

Australia’s iron ore export trade is led by BHP (ASX:BHP), Rio Tinto (ASX:RIO), Fortescue Metals Group (ASX:FMG) and Hancock Prospecting.

Asian steelmakers are passing higher input costs on to steel customers

Despite rumblings of concern about soaring iron ore prices from China’s steel sector, the Asian country’s steel producers are managing to pass on their increased input costs to customers.

Steel reinforcing bar prices at the Shanghai steel trading hub in China have risen to $US636 per tonne this week, up nearly $US11 per tonne on a week ago.

The sharp rise in prices for steel rebar which is used to reinforce concrete in construction and infrastructure projects is not limited to China.

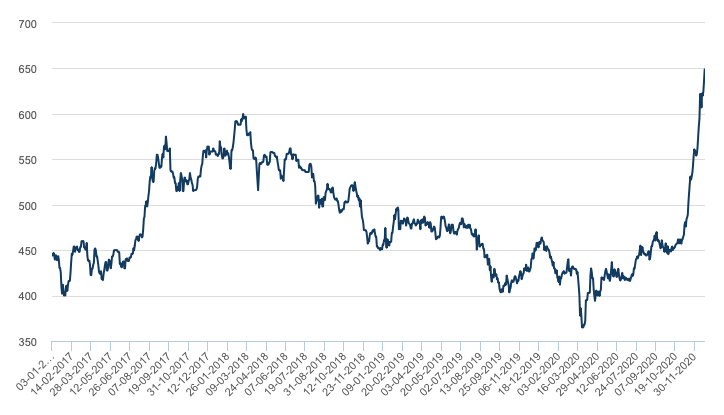

Spot-traded prices for steel reinforcing bar traded on the London Metal Exchange are up 76 per cent to $US650 per tonne since their March low of $US368 per tonne.

The LME steel rebar contract for month-ahead delivery has already surpassed its last peak of $US600 per tonne back in February 2018.

“Steel makers are used to fluctuating iron ore prices since the market turned to spot in 2009, and the cost just gets passed on,” said Mark Eames, an iron ore market expert, and director of Magnetite Mines (ASX:MGT).

“So, steelmaking profitability is independent of the iron ore price,” he added.

Magnetite Mines is accelerating the development of its Razorback project for iron ore in South Australia which is on track to ship first ore in a few years.

“Demand is relatively robust for steel, but you have other factors at play, and one of the facets has been asset price inflation,” Navigate Commodities managing director, Atilla Widnell, told the South China Morning Post.

Excess liquidity from central banks and returns-seeking capital is flooding into assets, including commodities, said Widnell.

“We have seen it in precious metals, and now we are starting to see it in industrial metals, punting on steel-related commodities as a speculative play on economic growth next year,” Widnell added.

Futures contracts, including ones traded on exchanges in China for steel, provide relatively easy access to investors wishing to speculate on price direction.

ASX iron ore company share prices

| Code | Company name | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| LCY | Legacy Iron Ore | 0.048 | 200 | 586 | 2300 | $312.4M |

| FMG | Fortescue Metals Grp | 23.55 | 6 | 39 | 115 | $74.0M |

| MGX | Mount Gibson Iron | 0.935 | 5 | 27 | 1 | $1.1B |

| MIN | Mineral Resources. | 35.06 | 1 | 17 | 109 | $6.6B |

| AKO | Akora Resources | 0.34 | 0 | 0 | 0 | $18.6M |

| FEX | Fenix Resources Ltd | 0.24 | -1 | 70 | 428 | $105.6M |

| EUR | European Lithium Ltd | 0.047 | -4 | 12 | -37 | $34.1M |

| CIA | Champion Iron Ltd | 4.84 | -5 | 11 | 66 | $2.5B |

| MAG | Magmatic Resrce Ltd | 0.175 | -5 | -19 | -19 | $31.2M |

| SRK | Strike Resources | 0.145 | -6 | 21 | 209 | $35.8M |

| ADY | Admiralty Resources. | 0.012 | -8 | -25 | 50 | $13.9M |

| TI1 | Tombador Iron | 0.056 | -11 | 22 | 166 | $39.9M |

| AKM | Aspire Mining Ltd | 0.089 | 24 | 22 | -44 | $41.1M |

Coking coal prices at Australian hub trade slightly lower

Traded prices for shipments of hard coking coal arriving at Chinese ports in January are at $US170 per tonne this week, according to Metal Bulletin.

Chinese purchasers are focused on picking up cargoes from North America for which prices are trading at a considerable premium to Australian cargoes.

At Queensland’s coal terminals, trades were heard for premium hard coking coal with a January shipment date at prices around $102 per tonne.

The size of the cargoes traded at 30,000 to 45,000 tonnes indicate the shipments are trading to India.

This is because India has fewer ports able to accommodate larger Capesize vessels with a cargo carrying capacity of 120,000 to 180,000 tonnes.

Standard-grade coking coal from Queensland is trading around $90 per tonne, said Metal Bulletin.

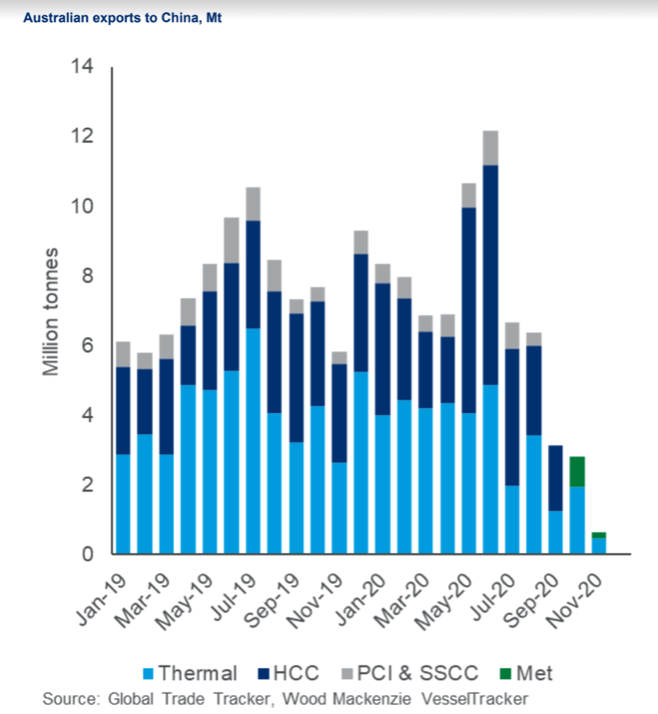

The trade in Australian coking coal to China has slowed considerably in recent months, and this has had a depressive effect on market prices.

There are several reasons for this, including the strict import quota system that China operates at its ports, and a change in Chinese buyer behaviour.

Unofficial Chinese ban on Australian coal imports

Analysts Wood Mackenzie said in a December 17 report that an “unofficial ban on Australian coal that has been in place since mid-October, and subsequently usurped by a hard stop on cargoes received after November 6, has now become semi-official.”

Typical monthly trade volumes for Australian coal shipped to China are around 6 million to 10 million tonnes per year, both thermal and coking coal.

“We estimate that shipments were only 400,000 tonnes in November,” said the report’s author, Wood Mackenzie principal analyst, Rory Simington.

“The implications of an ongoing ban for metallurgical (coking) coal at least in the short term are more serious than for thermal coal because the volume of impacted metcoal is over 10 per cent of the seaborne market, while for thermal coal the volume is less than 5 per cent,” he said.

“Around 20 per cent of Australian metcoal exports now have an uncertain future. Trade flows will shift, as Australian coals look for new homes and higher volumes of non-Australian coking coals move to China,” said Simington.

Australian hard coking coal prices have dropped by $US40 per tonne since early October, and spot prices are likely to be affected by the more than 50 vessels carrying Australian coking coal sitting off Chinese ports, he said.

“Strong directives to on-sell those cargoes could cause prices to fall below $US100 per tonne again, and perhaps to around $US90 per tonne for a short period,” said Simington.

Australian imports not easily replaceable

In the longer term, price direction for Australian coking coal will depend on the level of demand in the seaborne market, and additional supply from Mongolia and Chinese domestic producers.

“If this is not substantial, prices should recover once the backlog of coal in Chinese ports is cleared,” added Simington.

“The fact that Chinese buyers are paying $US180 per tonne CFR China for hard coking coal illustrates the difficulty of replacing Australian imports,” he said.

Domestic coking coal prices in China are heading to $US200 per tone, indicating that supplies are tight and hot metal demand in China is increasing.

“Some mills are still living off stockpiled coal, while others have already switched over to new domestic or Mongolian blends required if no Australian material is available,” he said.

Tigers Realm Coal ships Russian coal into Asian market

One ASX coal company with an operation in Russia appears well positioned to supply the Chinese market with coking coal shipped from its Pacific port.

Astute investors have been buying shares in Tigers Realm Coal (ASX:TIG) which shipped 760,000 tonnes of coal through its Beringovsky Port in 2020.

The port in Russia’s eastern Chukotka region loaded 17 coal ships in the 2020 year, including three for coking coal in 160,000 tonnes, and 14 for thermal coal or 600,000 tonnes.

The company increased its loaded volumes by 31 per cent on 2019, while reducing port operating costs by 50 per cent, and has assumed control of the port.

Tigers Realm Coal is investing in a coal handling and preparation plant at its Russian coal mine that will increase its volumes of coking coal shipments.

The company is aiming to produce 70 per cent of its output as coking coal, and the rest as thermal coal, with its new coal washing plant.

China, Korea and Japan are the main markets for Tigers Realm Coal’s coal shipments, and are a relatively short shipping distance away.

ASX coal company share prices

| Code | Company name | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| AKM | Aspire Mining Ltd | 0.089 | 24 | 22 | -44 | $41.1M |

| SMR | Stanmore Coal Ltd | 0.795 | 14 | 14 | -22 | $215.0M |

| PAK | Pacific American Hld | 0.023 | 10 | -8 | -7 | $7.2M |

| NCZ | New Century Resource | 0.24 | 4 | 12 | 2 | $302.5M |

| LNY | Laneway Res Ltd | 0.007 | 0 | 0 | 17 | $22.7M |

| BRL | Bathurst Res Ltd. | 0.039 | 0 | -9 | -61 | $66.7M |

| BCB | Bowen Coal Limited | 0.048 | 0 | -6 | -6 | $45.1M |

| AHQ | Allegiance Coal Ltd | 0.05 | 0 | -9 | -70 | $41.6M |

| WHC | Whitehaven Coal | 1.61 | 0 | 25 | -38 | $1.7B |

| TER | Terracom Ltd | 0.17 | -3 | 17 | -54 | $131.9M |

| YAL | Yancoal Aust Ltd | 2.38 | -4 | 20 | -18 | $3.3B |

| MCM | Mc Mining Ltd | 0.19 | -5 | 0 | -62 | $29.3M |

| PDZ | Prairie Mining Ltd | 0.18 | -5 | -10 | -22 | $41.1M |

| CKA | Cokal Ltd | 0.07 | -5 | 3 | 52 | $62.6M |

| NAE | New Age Exploration | 0.011 | -8 | -8 | 175 | $11.9M |

| JAL | Jameson Resources | 0.11 | -8 | -8 | -41 | $33.4M |

| CRN | Coronado Global Res | 1.04 | -9 | 15 | -50 | $1.4B |

| MEY | Marenica Energy Ltd | 0.11 | -15 | 21 | 22 | $22.1M |

At Stockhead, we tell it like it is. While Magnetite Mines is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.