Bulk Buys: China’s steelmakers demand government action as iron ore flirts with $US160

Shareholders in iron ore miners can expect to rake in profits from higher ore prices. Image: Getty

- Iron ore fines prices traded this week at $US154.50 per tonne, up $US7 per tonne on week

- Hard coking coal prices were down 50c this week at $US92 per tonne at Queensland ports

- China’s reinforcing bar price is at $US624.75 per tonne, up $US13.40 per tonne on a week ago

Iron ore prices briefly touched $US160 per tonne this week — their highest for nine years — as demand from China for the steelmaking commodity outpaced available supply in the seaborne market.

Spot prices are still up $US7 on-week at $US154.50 per tonne ($205/t), a level last seen in mid-2011, at the height of the China-based commodity boom.

The wobble in iron ore prices may have been sparked by media reports that China’s Iron and Steel Association has spoken out about the high cost of iron ore.

The CISA, which represents China’s larger steel companies, has issued a call for government action to intervene in the market.

“The iron ore market pricing mechanism has failed and steel companies unanimously call on the State Administration for Market Supervision and the China Securities Regulatory Commission to take effective measures to intervene… in a timely manner and crack down on possible violations of regulations,” said the CISA in a statement.

Market analysts said, however, that it is China’s rising demand created from infrastructure construction that is fuelling the strong market for iron ore.

“There is no doubt that Chinese demand has been stronger than expected amid fiscal stimulus measures,” ANZ bank analyst Hayden Dimes told CNBC.

China’s strong pull on iron ore exports is expected to carry on for some time, until it winds back its economic stimulus program.

“In our view, Chinese steel output will continue to grow at a moderate pace through 2022-2023, and coupled with a recovery in ex-China demand, will require high cost supply,” said analysts at UBS bank in a report.

ASX iron ore miners and explorers benefit

Higher iron ore prices are starting to be reflected in the share prices of major producers on the ASX, and even in the prices of some iron ore explorers.

BHP Group (ASX:BHP) this week saw its share price touch $42.50 per share, its highest since 2011, while Rio Tinto (ASX:RIO) shares hit a 12-year high at $116 per share last week.

Another iron ore shipper, Fortescue Metals Group (ASX:FMG) traded at an all-time high of nearly $23 per share on Friday, although its price has now slipped a little.

The current weakness in the Australian dollar exchange rate to the US dollar is magnifying the flow of revenue to miners from higher iron ore prices.

Each tonne of iron ore shipped to China earns the shipper $205 per tonne in Australian currency, and much higher than in US currency terms.

The share prices of a raft of junior exploration companies are benefitting from the spike in iron ore prices, such as Shree Minerals (ASX:SHH) and Eastern Iron (ASX:EFE).

“The average Australian dollar price received during the quarter of $182.50 per tonne ($US130.20/tonne) FOB Port Latta, increased by 6.8 per cent from $170.90 per tonne for the June quarter,” said Tasmania-based iron ore company Grange Resources (ASX:GRR) in its September report.

Iron ore royalty company Deterra Resources (ASX:DRR), which recently listed on the ASX, also stands to benefit from higher iron ore prices.

Higher iron ore prices bite into China’s steel industry profits

The higher price of iron ore is starting to eat into Chinese steel mill profit margins, and iron ore prices may have to give to ease this price pressure, said analysts.

“Iron ore spot prices fell sharply overnight due to weak buying interest in China as margins for some steel mills have already started to deteriorate,” said Commonwealth Bank of Australia analyst, Vivek Dhar, in a report.

The price of steel reinforcing bar (rebar), which is used in construction, has risen to $US624.75 per tonne, up $US13.40 per tonne on a week ago.

Rebar prices had touched $US629.20 per tonne in late November, and traded at $US611 per tonne in early December.

“End users in China are also looking to procure iron ore from the port rather than the seaborne market because prices at the port are cheaper,” added Dhar.

Chinese steel industry margins are expected to remain under pressure for the rest of 2020, before improving in 2021, said S&P Global Ratings in a report.

“We believe steel margins will be under pressure for the rest of the year, given elevated iron ore prices, before improving in 2021 based on what we assume will be moderating iron ore prices,” said S&P Global Ratings.

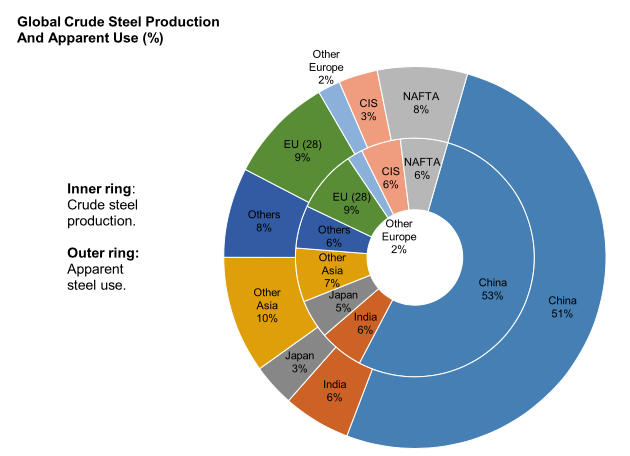

China is by far the largest producer of steel in the world, accounting for approximately 50 per cent of world tonnage, according to the company.

Other countries such as India, Korea and Japan have reduced their steel production while they grapple with the COVID-19 pandemic.

“Steel production and sales from Indian majors were down 24 per cent on year, with a 30 per cent drop in domestic demand,” said the ratings agency in a report.

ASX iron ore company share prices

| Code | Company | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| LCY | Legacy Iron Ore | 0.038 | 443 | 443 | 1800 | $99.9M |

| TI1 | Tombador Iron | 0.059 | 11 | 55 | 180 | $45.4M |

| MGT | Magnetite Mines | 0.013 | 8 | 18 | 248 | $39.0M |

| MGX | Mount Gibson Iron | 0.9 | 6 | 29 | -1 | $1.1B |

| EUR | European Lithium Ltd | 0.049 | 4 | 17 | -39 | $35.6M |

| SRK | Strike Resources | 0.15 | 3 | 55 | 213 | $38.3M |

| FEX | Fenix Resources Ltd | 0.2175 | 1 | 61 | 418 | $103.4M |

| AKO | Akora Resources | 0.43 | 72 | $12.4M | ||

| FMG | Fortescue Metals Grp | 21.3 | 0 | 28 | 99 | $68.2M |

| MAG | Magmatic Resrce Ltd | 0.17 | -3 | -23 | 0 | $32.1M |

| MIN | Mineral Resources. | 32.22 | -7 | 17 | 89 | $6.5B |

| CIA | Champion Iron Ltd | 4.85 | -7 | 23 | 76 | $2.4B |

| ADY | Admiralty Resources. | 0.013 | -13 | -24 | 63 | $15.1M |

Uncertainty clouds coal exports for China

The market for Australian coal exports into the Chinese market has entered a period of uncertainty with an evident increase in trade tensions.

Exports into China were already being slowed by Beijing’s strict quota system for coal imports that runs from January to December each year.

A large amount of quotas have already been used up, as shipping tends to run ahead of schedule, and the quotas are not evenly spaced across the year.

There is a log-jam of vessels carrying Australian coal that are waiting to enter Chinese ports to discharge their cargoes.

Some customers in China have given up on waiting to take delivery of coal cargoes, and have arranged to re-sell these on the open market, according to reports.

Now, adding to these issues is another market complication, as according to reports in Chinese media, Australian coal shipments are falling out of favour.

Mongolian, Russian coking coal increase market share

Australian exports of coking and thermal coal to China dropped by 49 per cent and 60 per cent on year, respectively, in October.

Mongolia and Russia, which share land borders with China, and possibly Kazakhstan in central Asia, are being talked up as coal suppliers for China.

Indonesia, which produces a type of lower energy content coal for power stations, is also being touted as a growing supplier for China.

“China accounted for 23 per cent and 24 per cent of Australia’s coking and thermal coal exports in 2019,” said Commonwealth Bank of Australia in a report.

Indian steel mills have been stepping in to buy Australian coking coal cargoes in an absence of Chinese buying interest.

“Without Chinese end users purchasing Australian coal, the premium hard coking coal price in the free-on-board market is kept low, struggling at around $US102 per tonne fob Australia,” a trader told Metal Bulletin.

For standard-grade hard coking coal for spot shipment from ports in Queensland, prices are around $US92 per tonne this week.

ASX coal company share prices

| Code | Company name | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| AKM | Aspire Mining Ltd | 0.115 | 64 | 62 | -34 | $36.5M |

| TER | Terracom Ltd | 0.17 | 3 | 13 | -47 | $131.9M |

| LNY | Laneway Res Ltd | 0.007 | 0 | -7 | 0 | $26.4M |

| JAL | Jameson Resources | 0.11 | 0 | -12 | -42 | $36.4M |

| NCZ | New Century Resource | 0.225 | -2 | 32 | -19 | $278.3M |

| BRL | Bathurst Res Ltd. | 0.038 | -3 | -3 | -64 | $66.7M |

| CKA | Cokal Ltd | 0.072 | -4 | 16 | 53 | $68.3M |

| SMR | Stanmore Coal Ltd | 0.725 | -5 | 7 | -29 | $187.9M |

| PDZ | Prairie Mining Ltd | 0.19 | -5 | -5 | -17 | $43.4M |

| MCM | Mc Mining Ltd | 0.19 | -5 | 0 | -58 | $30.9M |

| AHQ | Allegiance Coal Ltd | 0.05 | -7 | -17 | -67 | $43.4M |

| NAE | New Age Exploration | 0.012 | -8 | -8 | 200 | $14.2M |

| YAL | Yancoal Aust Ltd | 2.28 | -8 | 15 | -22 | $3.3B |

| WHC | Whitehaven Coal | 1.54 | -9 | 34 | -44 | $1.7B |

| BCB | Bowen Coal Limited | 0.043 | -9 | -10 | -17 | $41.8M |

| CRN | Coronado Global Res | 1.03 | -9 | 22 | -50 | $1.6B |

| PAK | Pacific American Hld | 0.02 | -9 | -20 | -22 | $6.6M |

| AKM | Aspire Mining Ltd | 0.115 | 64 | 62 | -34 | $36.5M |

| TER | Terracom Ltd | 0.17 | 3 | 13 | -47 | $131.9M |

Coking coal futures curve starts to flatten

Forward prices for Australian coking coal on the Chicago Mercantile Exchange (CME) have adjusted mostly $US1-2 per tonne lower this week.

For January 2021 settlement, the futures price is US$111 per tonne, up $US2 on a week ago.

While for February 2021 settlement, the price has dipped $US1 to $US125 per tonne. China’s Lunar New Year holiday takes place in February 2021, and will likely result in less industrial activity.

March 2021 coking coal futures are trading at $US137 per tonne, down $US3 per tonne from a week ago.

For the rest of 2021, forward prices for coking coal average around $US144 to $US150 per tonne, and are similar to levels a week ago.

The shape of the futures market’s forward curve could mean that supply and demand in the market is steady.

It could also suggest there is less risk of cyclones affecting exports of Queensland coking coal.

Australia’s tropical cyclone season traditionally starts in November and lasts through to April the following year.

The Bureau of Meteorology in its Tropical Cyclone Outlook said it is expecting a higher than average number of cyclones this season.

There are not any warnings for cyclones currently on the BoM website.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.