You might be interested in

Mining

Bulk Buys: Wet weather keeps iron ore exports in check and From Russia with a Shove

Mining

Reporting Rodeo: Here's how analysts think the ASX's big miners will shape up in March quarter reporting season

Mining

Mining

The skywards movement in iron ore prices to reach $US160 per tonne ($212/tonne) this week has created a huge incentive for a bunch of ASX small caps to bring forward iron ore mining capacity or to take idled mines out of hibernation.

The price of iron ore is nearly double its early May level of $US82.50 per tonne, and was last at current levels back in October 2011, a heyday for producers.

Australian iron ore producers are indicating that major consumer China is not going to let up in its rush for iron ore cargoes for months, possibly years.

“We expect seaborne iron ore demand to be well-supported in the medium term,” Fortescue Metals Group (ASX:FMG) sales and marketing director, Danny Goeman said at the company’s investor day last week.

China’s fast rate of iron ore consumption is starting to reveal itself at the country’s ports, where stockpile levels have been trekking lower since peaking at 132 million tonnes in mid-November.

Some market commentators suggest China’s iron ore port stocks could drop to 100 million tonnes in the first quarter of 2021, surpassing April’s low.

By drawing down supply from its strategic portside stockpiles of iron ore, China’s steel industry is showing that its demand is starting to exceed available imports.

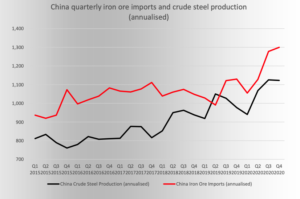

China’s production of crude steel is on track to surpass 1 billion tonnes this year, and had already reached 874 million tonnes in the January-October period.

Asia’s largest economy has recovered strongly from the setback of the COVID-19 pandemic, thanks to government measures to promote economic growth.

This increased spending on infrastructure is highly stimulative for China’s steel industry, as construction is a highly steel-intensive activity that consumes a lot of steel in concrete structures.

“The more that governments stimulate their economy through infrastructure spending, the more that is going to translate to demand for steel,” Mark Eames, director of Magnetite Mines (ASX:MGT) told Stockhead.

Investment in China’s property sector has risen 12 per cent compared with the year-ago period, and consumes half of all the steel produced in China.

Manufacturing is another steel intensive sector, and this too has been a beneficiary of China’s economic recovery this year.

“A strong V-shaped recovery has occurred as a result of the government stimulus measures earlier in the year, and this momentum is expected to provide ongoing support for steel demand in 2021,” said Goeman.

It is not just China that is driving demand in iron ore markets; other Asian countries such as India, Japan and South Korea are also increasing steel output.

Korean company Posco and Japan’s Nippon Steel are restarting blast furnaces which consume iron ore in order to meet increased demand for steel.

Fortescue Metals Group is expecting world steel production to increase by 170 million tonnes to nearly 2 billion tonnes by 2025.

Assuming it takes 1.6 tonnes of iron ore to produce 1 tonne of steel, 2 billion tonnes of steel will require 3.2 billion tonnes of iron ore, which may be pushing industry production limits.

China’s iron ore imports are set to hit 1.37 billion tonnes in 2022, from 1.15 billion tonnes in 2020, according to Australian government forecasts.

Australian exports of the product are expected to touch 922 million tonnes in 2022, up from 874 million tonnes in 2020, an increase of only 48 million tonnes over two years.

Brazil’s major iron ore producer Vale is unable to step in to bridge the market’s growing supply gap, as its production is still in recovery mode.

Vale’s forecast 2020 iron ore output of 305 million tonnes is lower than its 310 million tonnes in 2018 — the time of the Brumadinho dam accident.

The miner’s Brazilian ore production is forecast to reach 330 million tonnes in 2021, representing an addition to the market next year of only 25 million tonnes.

“We may see additional supply from India, Russia, and Ukraine, but much of this material will be higher cost and in circumstances where seaborne iron ore prices moderate, some of this material will become uneconomic and exit the market,” Goeman said.

This leaves the heavy lifting to Australian miners, but they too are struggling to keep up with China’s accelerating iron ore demand.

A number of Australian iron ore producers are opening new mines for iron ore — BHP with its South Flank project for 80 million tonnes per year, Rio Tinto’s 43 million tonne per year Koodaideri project, and Fortescue’s Eliwana mine that started up last week and is for 30 million tonnes per year.

“In Australia, numerous projects are forecast to be completed in the next five years,” said Goeman in his company’s investor day webinar last week.

“Many of these projects, however, are sustaining existing production volumes and as such, we don’t see material incremental supply emerging from Australia in this period,” he said.

Other existing producers such as Hancock Prospecting’s Roy Hill mine, and Citic Pacific Mining’s Sino Iron operation, have steady production runs.

The rising iron ore price is encouraging smaller iron ore companies and explorers to restart some idled mines in Australia.

Several projects have been reactivated in recent months, including in Tasmania, the Northern Territory, and Victoria.

In Tasmania, Grange Resources (ASX:GRR), Shree Minerals (ASX:SHH), and Venture Minerals (ASX:VMS) all have iron ore projects in the island state.

Venture Minerals has in development the Riley iron ore mine, and the Livingstone hematite DSO project, both in north-west Tasmania.

The company expects to ship its first iron ore through Tasmania’s Burnie Port in early 2021, and has appointed Qube as its haulage company.

“The outlook for the iron ore price remains positive with the continuation of Chinese government infrastructure spending and COVID-19 related disruption of supply from key global producer Brazil,” said the company in its September quarter report.

The explorer noted that the economics for mining at Riley continue to improve on lower fuel prices and a strong iron ore market outlook.

Shree Minerals said it is actively advancing its Nelson Bay River project in north-west Tasmania for direct shipping ore as iron ore prices improve.

The project is able to produce at an initial rate of 150,000 tonnes per year and is for direct shipping iron concentrate.

The company noted a lack of additional supply options for iron ore in Australia.

“Any near term supply response is expected to be limited, particularly with little latent capacity left at major iron ore exporting ports and railways in Australia,” said the company in an update.

The Nelson Bay River project had been producing iron ore up until it was placed into care and maintenance in June 2014 “following sharp iron ore price falls,” it said.

First ore was shipped from Nelson Bay River in late 2013 and all-in costs for its 58 per cent iron ore was $72 per tonne FOB Burnie Port.

“Following the ongoing improvement in iron ore prices since 2018, the company has been actively engaged in re-permitting activities at NBR,” it added.

The project has an iron ore resource of 11.3 million tonnes that covers a 1km strike length of mineralisation that survey data suggests could extend to 2.3km.

Grange Resources last year shipped 2.2 million tonnes of iron ore from its Savage River mine which has a cash operating cost of $101 per tonne.

The company is reaping the rewards of higher iron ore prices, and has undertaken underground exploration at its North Pitt operation.

“The average Australian dollar price received during the quarter of $182.50 per tonne ($US130.20/tonne) FOB Port Latta, increased by 6.8 per cent from $170.90 per tonne for the June quarter,” said the company in its report for the September quarter.

Grange Resources is seeking a strategic investor to partner in its Southdown magnetite project in WA.

Victoria-focused Eastern Iron (ASX:EFE) saw its share price take off on Monday and it then went into a trading halt pending a market announcement.

The explorer is developing its Nowa Nowa project in Eastern Victoria, 270km east of Melbourne, which is the Australian state’s first iron ore project in more than a century.

The company has undertaken a review of its feasibility study for the Nowa Nowa project “driven by a sustained improvement in [the] global iron market and high level external interest in the project”, it said in a December 2019 report.

“Integral to the development and commercialisation of Nowa Nowa will be the identification of a suitable port for handling and loading of iron ore on to suitably sized ships for export,” it said.

The port of Eden in NSW is the company’s preferred export option, a distance of 235km from its Nowa Nowa project.

In the Northern Territory, two mines for iron ore have returned to production in recent months — Nathan River Resources’ Roper Bar mine 760km from Darwin, and NT Bullion’s Frances Creek mine.

Nathan River Resources is a subsidiary of UK company British Marine Group, and the Roper Bar mine is processing two to three shipments each month.

The company has invested $250m in its Roper Bar mine that is expected to produce up to 2 million tonnes per year through an integrated pit-to-port operation.

In its second phase of development, the mine has forecast production stepping up to 5 million tonnes per year at 62 per cent iron.

First ore was shipped from Bing Bong port in the Northern Territory in November, reported the ABC.

NT Bullion, a private company with four local founders, plans to export 2 million tonnes per year of iron ore from its Frances Creek mine which started in August.

The company is currently shipping ore from its mine stockpile and has a marketing agreement with Anglo American.

South Australia is host to a number of promising iron ore projects, some of which are preparing to enter into production next year.

They include Iron Road (ASX:IRD) with its Central Eyre and Gawler projects in South Australia, and Magnetite Mines has its Razorback project that is under development with a 3.9 billion tonne resource.

The company is targeting a high-grade 68.5 per cent iron ore product that can be shipped through two existing iron ore handling ports in South Australia.

The Razorback project has an expected production date of sometime in 2024.

In WA, there is also Flinders Mines (ASX:FMS) with its $5bn Pilbara iron ore project for shipping through Balla Balla port, and partly owned by New Zealand’s Todd Minerals.

Strike Resources (ASX:SRK), also in WA, has its Paulsens East iron ore project in the Pilbara, and is targeting production of 1.5 million tonnes per year starting in 2021.

The project has a net present value of $140m and a capital expenditure cost of $15.7m, indicating a near 10-fold return on investment.

GWR Group (ASX:GWR) starts production from its WA project in 2021.

At Stockhead, we tell it like it is. While Strike Resources and Magnetite Mines are Stockhead advertisers, they did not sponsor this article.