ASX mining royalty company Deterra Resources is cashed up and ready to buy

Deterra Resources de-merged from Iluka Resources and is well placed to benefit from higher iron ore prices. Picture: Getty

- Iron ore royalty company Deterra Resources’ is well-placed to benefit from higher iron ore prices

- ‘Bulk commodities, precious metals, base metals, battery materials and energy will all be considered’

- Deterra Resources is a pure-play royalty company, some other ASX companies receive royalty revenue

Deterra Resources (ASX:DRR) listed on the ASX back in October after splitting from its parent Iluka Resources (ASX:ILU) and since that time both companies’ share prices have done well.

Iluka Resources’ shares are trading at a two-year high, and Deterra Resources is approaching the $5 per share barrier having made its debut at $4.60 per share.

Deterra Resources is one of a few ASX mining royalty companies. The others are Emmerson Resources (ASX:ERM), a gold miner in the Northern Territory’s Tennant Creek area, and gold companies Gullewa (ASX:GUL) and Horizon Resources (ASX:HRZ).

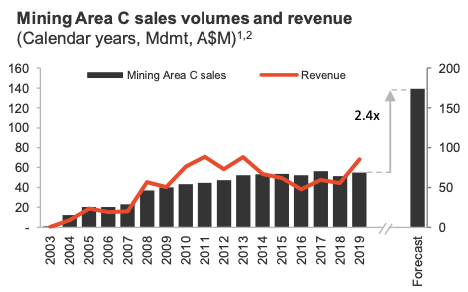

The main royalty stream for Deterra Resources is from BHP’s (ASX:BHP) Mining Area C in the Pilbara region of WA.

The mining zone includes BHP’s South Flank mine which starts production in 2021 at a rate of 80 million tonnes per year.

Deterra’s focus is broad and it seeks value-adding opportunities

Deterra Resources told Stockhead it is interested in opportunities that add value to its business, rather than targeting specific commodities.

“Deterra will have a broad commodity focus. Bulk commodities, precious metals, base metals, battery materials and energy will all be considered,” the company said.

The company does not intend to buy mine assets, or to acquire equity stakes in mines, it said.

Deterra’s business model is focused on investing in royalties and streams, and the company is not setting any arbitrary growth targets for its business, it said.

However, the company is looking further afield for royalty revenue beyond Australia.

“Investment in other countries will be considered as well on a case-by-case basis,” it said.

It pointed to the substantial, organic growth potential within its existing royalties business, with BHP’s South Flank mine expected to double production in future years.

Royalty revenue to increase with higher iron ore prices

The Mining Area C royalty is linked to iron ore prices — currently in an upswing — which it collects from sales of iron ore mined in the MAC royalty zone.

Deterra Resources is entitled to 1.232 per cent of the sales revenue from the MAC zone based on prevailing market prices for iron ore sold at WA shipping ports.

A sales volume of 28.6 million tonnes for the MAC zone will generate royalty revenue of $48m in the January-June 2020 half year, based on an iron ore price of $87.40 per tonne, it said in a November presentation.

Royalty revenue for Deterra Resources may increase this year with iron ore prices touching a seven-year high of $185 per tonne.

In addition, the start-up of BHP’s South Flank mine is expected to double iron ore sales from the MAC royalty zone from 2023 to 145 million tonnes per year.

The company declined to comment on the future direction of iron ore prices.

“Regardless of whether they go up or down, we know that production at South Flank, which is part of MAC, will grow considerably between 2019 and 2023,” Deterra Resources said.

Deterra to benefit from South Flank production

A one-off capacity payment of $1m per 1 million dry metric tonne increase in annual mine production above the current 57 million dmt capacity is also payable to Deterra Resources.

“Detterra will benefit from expansion at South Flank through its revenue royalty, which is a function of volume and price, and its capacity payment which is determined by volumes,” it said.

The company added that two iron ore deposits, Tandanya and Mudlark, lie partially or fully within the MAC area and have been identified by BHP as potential mining areas in the longer term.

Other ASX royalty companies

Emmerson Resources said in a presentation that it aims to generate future royalty streams from a centralised processing facility with multiple small mines providing feedstock.

The gold company has negotiated royalty payments that are some of the most competitive in the industry, including 12 per cent of gold revenue produced in its Edna Beryl mine, and for its Mauretania and Jasper Hills projects.

In the 2019 financial year, $420,000 of royalties were payable to Emmerson Resources.

“We saw this [royalty streaming] as a terrific model and a low risk path to monetising the Tennant Creek assets,” managing director and chief executive Rob Bills told Stockhead in August.

“The benefits include mitigating the risks around moving from discovery to mining, which is where many companies fail. Moreover, the royalties are aimed to self-fund our exploration, which is where Emmerson see the biggest driver of value [providing it is successful].”

Drilling is starting at its Mauretania discovery in December, followed by its Jasper Hills project which also contains cobalt and copper in 2021.

Gold company Gullewa receives a royalty payment from Silver Lake Resources’ (ASX:SLR) Deflector gold mine.

Horizon Resources owns a number of royalties linked to gold projects including a 2.5 per cent net smelter royalty from Saracen Mineral Holdings (ASX:SAR).

The royalty stream is for production between 42,000 and 100,000 ounces from its former 10 per cent interest in 14 tenements to the north of Saracen’s Thunderbox mine in WA.

ASX share prices for Deterra Resources (ASX:DRR), Emmerson Resources (ASX:ERM), Gullewa (ASX:GUL), Horizon Resources (ASX:HRZ)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.