Brownfield gold is hot right now – here’s a rundown of who’s jumped on the bandwagon lately

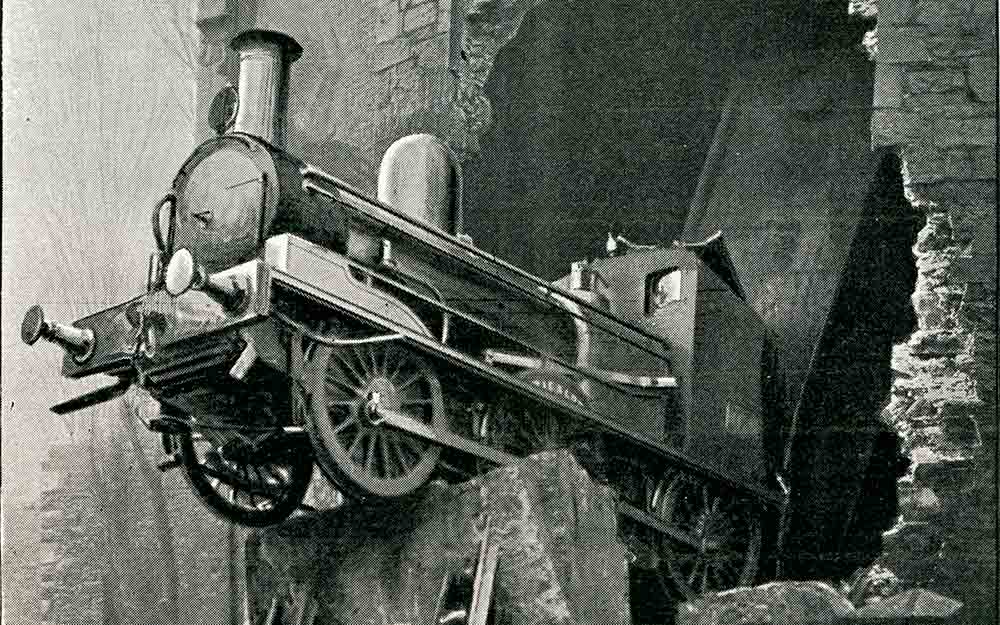

All aboard the hype-train / Getty

In what is quickly becoming a trend, yet another small cap metals play is getting into brownfield gold exploration — the latest being Greenpower Energy (ASX:GPP).

Greenpower, which started its listed life as a coal seam gas hopeful and then transitioned into battery metals to capitalise on the electric vehicle hype, is now getting on the gold train.

It told its shareholders this morning that it had picked up a swag of gold mines in Queensland from Q-Generate with a cumulative historic production of 153,315 ounces from just under 2.5 million tonnes of ore — for an average grade of 1.91g/t.

The mines at what’s dubbed the ‘Golden Ant’ project last operated in the 1990s, when the price of gold was about $US400/oz ($A593).

Given gold has recently touched $US1500/oz, there’s no great mystery why Greenpower would want to get into gold.

The next steps for Greenpower are to release an interim JORC resource, gain environmental approvals for drilling, do that drilling, and then release a resource update.

Greenpower isn’t the first junior taking an interest in brownfield (previously mined or explored) gold projects, and given gold is keeping its lustre for now it’s unlikely to be the last.

Here are some of the companies which have piled into brownfield gold projects in recent months to spark investor curiosity:

Piling into gold

With the gold price booming over the last year, plenty of juniors have picked up distressed gold assets hoping to spark investor attention.

Here are a few examples:

Graphite player Metals Australia (ASX:MLS) has dusted off its Manindi project after seeing the share prices of surrounding gold explorers go up.

Meanwhile, Kingswest Resources (ASX:KWR) ran the ruler over the historic Menzies gold project, causing its shares to jump by 30 per cent at the time.

Spectrum Metals (ASX:SPX) has benefitted from a decision to ditch rare earth in favour of gold, shaping as a small-cap darling thanks to its Penny West play.

Estrella Resources (ASX:ESR) on the other hand was a nickel-focused explorer, but earlier this year dusted off its Munda open pit in WA, last held by Resolute Mining. At the time it announced the new focus, its share price went up by 15 per cent.

Red River (ASX:RVR) announced plans earlier this year to purchase the failed high-grade gold-antimony mine in NSW for $4 million in shares, aiming to capitalise on a booming gold price.

Norwest Minerals (ASX:NWM), which was spun out of battery metals focused Australian Mines (ASX:AUZ), has managed to attract attention for its attempt to revitalise the Bulgera gold project.

Elsewhere, Great Southern Mining (ASX:GSN) has piled into multiple brownfield projects near Laverton in WA.

With gold continuing to shine, don’t expect Greenpower to be the last to pick up new brownfield gold assets.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.