Gold: Kingwest buys historic high-grade gold project, shares jump 30pc

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Kingwest Resources (ASX:KWR) is the latest gold explorer to run the ruler over a historic, high-grade Australian gold project acquisition.

There wouldn’t be many Australian gold miners suffering losses at ~$2000/oz prices, which could be why explorers are keen to focus on brownfields (historically mined or explored) projects right now.

- Scroll down for more ASX gold news >>>

Old mines usually come with an existing resource and new gold is fairly easy to chase down, which means a quicker path to production.

Today Kingwest, which only listed in August last year, made a potentially company-making acquisition near Kalgoorlie.

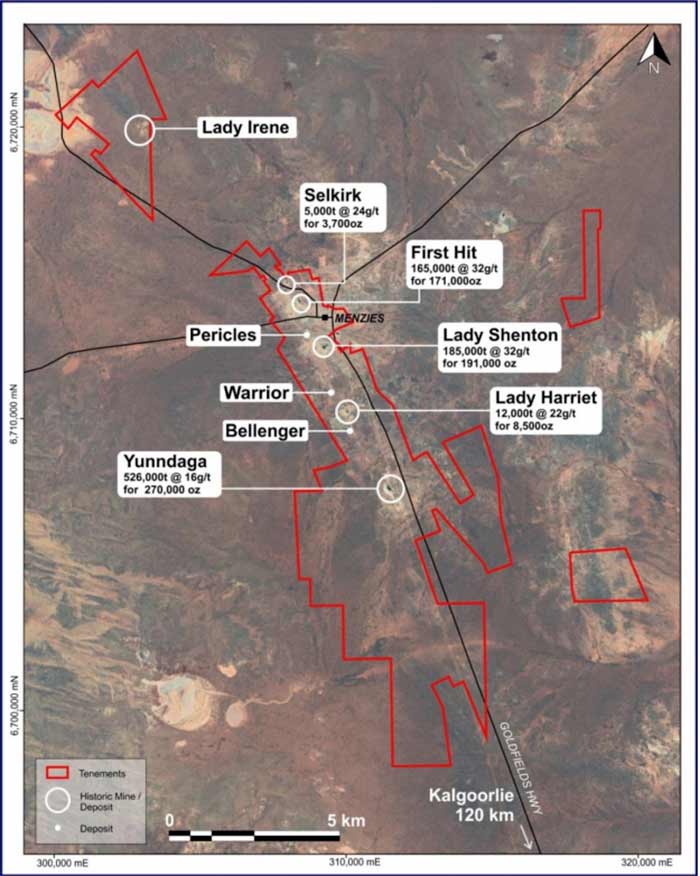

It will, subject to due diligence, buy the historic high-grade Menzies gold project (MGP) from Intermin Resources (ASX:IRC) for about $8m in cash and shares.

The market loved the news, sending Kingwest up 30 per cent in early trade.

The 15km long MGP produced 643,200oz at 22.5 grams per tonne (g/t) from underground between 1895 and 1943 plus 145,000oz at 2.6g/t from open cuts between 1995 and 1999.

If a deposit grading above 5g/t is generally considered high-grade, then 22.5g/t is astounding.

Kingwest says the MGP hasn’t been properly explored for 20 years, and the existing deposits include easy, walk up drilling targets.

The explorer is heading straight for the high-grade, structurally controlled mineralisation at depth.

“While KWR believes there is potential to increase the resource inventory close to surface and exploit these with open cut mining, KWR believes that immediate economic potential exists for high-grade underground mining,” the company says.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

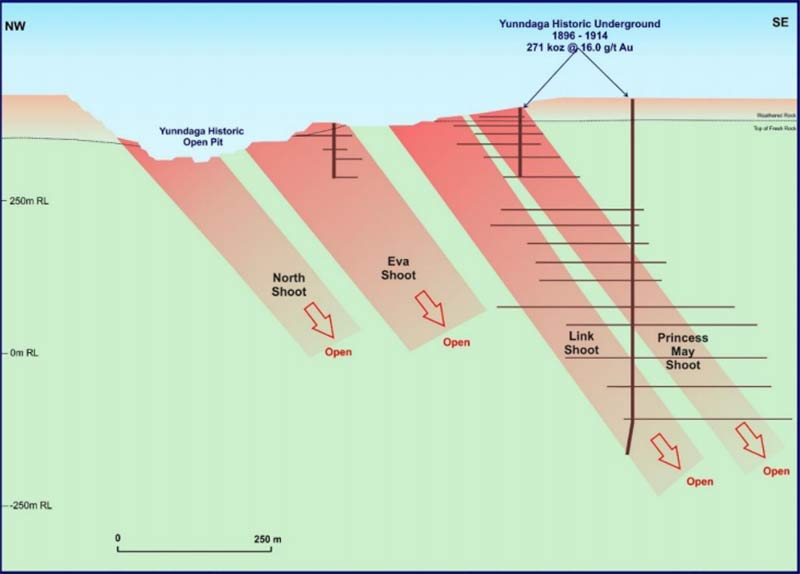

A priority target is Yunndaga underground — a significant, deep-seated lode gold deposit with multiple under-explored ore shoots.

Yunndaga was mined underground between 1896 and 1943, producing 526,000 tonnes at 16g/t for 270,000oz of gold. In the 90s, open cut mining produced another 64,000oz.

Kingwest says while the Princess May shoot was mined to 600m, other known high-grade shoots — Eva and Link — have not been drilled below 250m:

On settlement of this deal it is expected that Intermin will hold approximately 19.9 per cent of the total issued capital in Kingwest.

For Intermin this is a great deal as well — it means divesting a lower priority project while retaining exposure to both the MGP and Kingwest’s other gold projects in the north-eastern Goldfields.

In other ASX gold news today:

NSW miner Alkane Resources (ASX:ALK) is chasing a juicy exploration target near its Tomingley gold operations. Up to 23.8 million tonnes grading 2.2g/t gold could be discovered across three primary prospects; Roswell, San Antonio and El Paso. The company says the massive 12-month, 60,000m drilling campaign to test these targets is already underway.

“The exploration target highlights the potential to significantly increase the resource around Tomingley gold operations in the coming years,” Alkane boss Nic Earner says. “Given the potential size and grade of San Antonio alone, Alkane has already commenced the resource definition drilling of this exploration target in order to minimise the potential development timetable.” The Alkane share price hit two and a half year highs in late June as gold breached $2000/oz for the first time.

Calidus Resources (ASX:CAI) and First Au (ASX:FAU) are increasing their respective landholdings in the gold-fertile Pilbara and Kalgoorlie regions.

Calidus has bought tenements covering most of the historic, high-grade Marble Bar goldfield — just 25km from the explorer’s 1.25moz Warrawoona gold project in the Pilbara. The Marble Bar goldfield produced more than 1oz/t ore during its life, Calidus managing director Dave Reeves says. “With the Marble Bar goldfield stretching across a distance of 10km and with no drilling having been conducted since 1983, Calidus look forward to applying modern exploration techniques to this exciting target area.”

And First Au (ASX: FAU) has increased its ground holding around the flagship Gimlet gold project, near Kalgoorlie. The White Flag tenement is 5km from Northern Star Resources’ (ASX:NST) prolific Kundana mining camp, the company says.

Popular explorer Black Cat (ASX:BC8) is drilling deeper at the Myhree deposit and “a resource upgrade is imminent”. Deepest-ever drilling at the Myhree system returned assays like 9m at 3g/t from 329m. This deeper drilling, plus shallower infill drilling, will drive the upcoming resource upgrade at Myhree, which has an inferred resource of 486,000t at 3.2g/t for 50,000oz gold. The upgrade will be announced mid-July 2019, Black Cat says.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.