Great Southern Mining gears up for North Queensland hunt

Special Report: Great Southern Mining is gearing up for exciting exploration campaigns on its North Queensland and Western Australian gold projects with an entitlement issue of new options to shareholders set to raise over $1 million.

Great Southern Mining (ASX:GSN) is a junior explorer with multiple brownfields drill-out projects in WA and greenfields discovery opportunities in North Queensland. All of these projects are within 25kms of active mining and milling operations.

As part of the $1m raising, Great Southern is giving existing shareholders an opportunity to pick up a new option at 1c for every three shares held.

To participate in the offer, GSN shares must be held by record date being 8th August 2019, and the options will be exercisable at 5c up to three years from the issue date.

Meanwhile, Great Southern Mining chairman John Terpu has already chipped in — lending the company $500,000.

Terpu was head at Conquest Mining when it discovered the world-class Mt Carlton gold-silver-copper project in Queensland in 2006 and he is now hunting for his second company-making tier 1 deposit at Great Southern’s Edinburgh Park project, just 20km from Mt Carlton.

In February, the explorer discovered a new intrusive related gold system (IRGS) at Edinburgh Park. Follow-up drilling earlier this month intersected what could be the edges of a massive, Mt Carlton-like gold-silver-copper system.

Fresh drilling at the discovery, called Rocky Ponds, intersected significant zones of mineralisation including gold up to 0.2 g/t, silver up to 49.7 g/t, and copper up to 0.44 per cent.

These are very promising drill results from what was just a reconnaissance drill program, and planning for follow-up exploration has already kicked off.

High grade copper

The funds may also go towards early work at ground the explorer picked up right next to the historic Dianne copper mine.

That mine produced just under 70,000 tonnes of shipping grade ore of a grade of 18-26 percent copper and 359g/t silver between 1979 and 1983.

At the time of the acquisition, the company said there was potential for high-grade gold deposits at depth below “a number of key prospects” — which it will look at using modern techniques.

“There are a number of historical references to VMS prospects within the application area, where noted mineralisation is similar to the geology of the incredibly high-grade Dianne copper mine deposit,” Terpu said.

“This provides the company an immediate focus area to undertake detailed exploration activities to potentially identify similar style high-grade copper deposits for follow up drill programs.”

>> Learn more about Great Southern Mining

WA: early cashflow opportunities

Great Southern also has some exciting near-term development opportunities in the gold rich Laverton region of Western Australia.

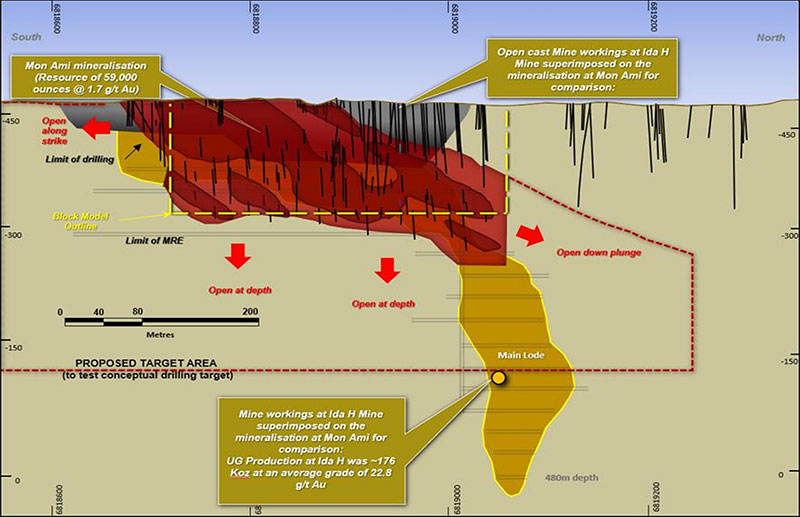

In November last year, Great Southern released a very conservative 60,000oz resource estimate for the newly discovered Mon Ami Gold deposit, based on just 10,052m of drilling.

But Great Southern has barely scratched the surface. Mon Ami mirrors the historic Ida H mine (approximately 6km away), which produced 172,000oz at 22.6 g/t down to 480m in the early 1900s.

Ida H started out as a small open pit and progressed into a high-grade underground development – and there’s enough data to suggest that Mon Ami could develop in a very similar way.

Great Southern is now planning deeper drilling under the existing Mon Ami resource to test depths and the extent of mineralisation.

In June, Great Southern entered into an agreement to acquire three granted mining leases near Laverton hosting the historic high-grade Cox’s Find gold mine.

Cox’s Find, which produced 77,000 ounces at more than 21 g/t between 1935 and 1942, was Western Mining Corporation’s (WMC) first foray into Australian gold production. The mine has been dormant for over 30 years under private ownership.

This means Great Southern will be the first company to apply modern exploration and development techniques to this poorly understood, and ultimately under-explored, high-grade deposit.

The acquisition is still subject to due diligence, however should the due diligence prove successful, funds from this raising will be allocated to the project to ensure exploration activities can commence ASAP.

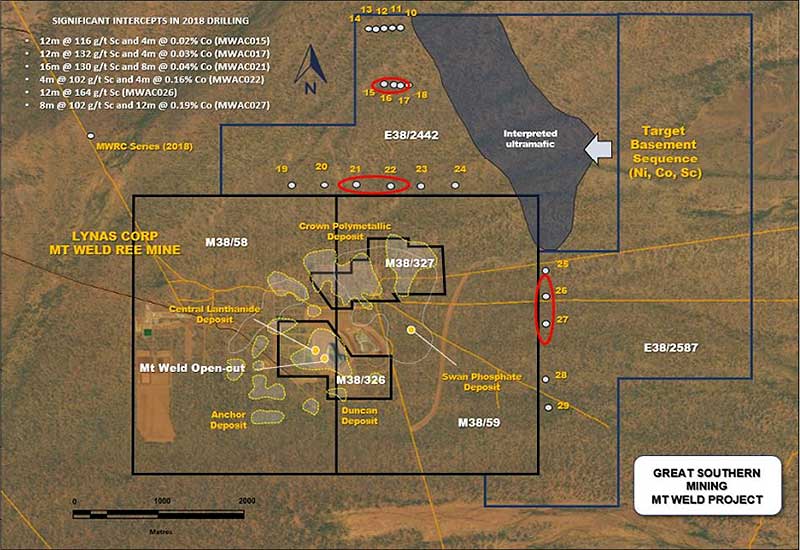

Also in Laverton is the Mt Weld rare earths project, which is immediately adjacent to the world class Mt Weld mine owned by Lynas.

Combined with $150,000 in co-funded drilling funds to be received,Great Southern is set to embark on significant program to test the extent of the mineralisation.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

This story was developed in collaboration with Great Southern Mining Limited, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.