Brazilian carnival beckons for the reborn Australian Mines

Mining

Mining

Special Report: Australian Mines has executed a binding agreement with a local Brazilian vendor to acquire two critical minerals projects, supported by a $2.5m oversubscribed equity raise to expedite exploration.

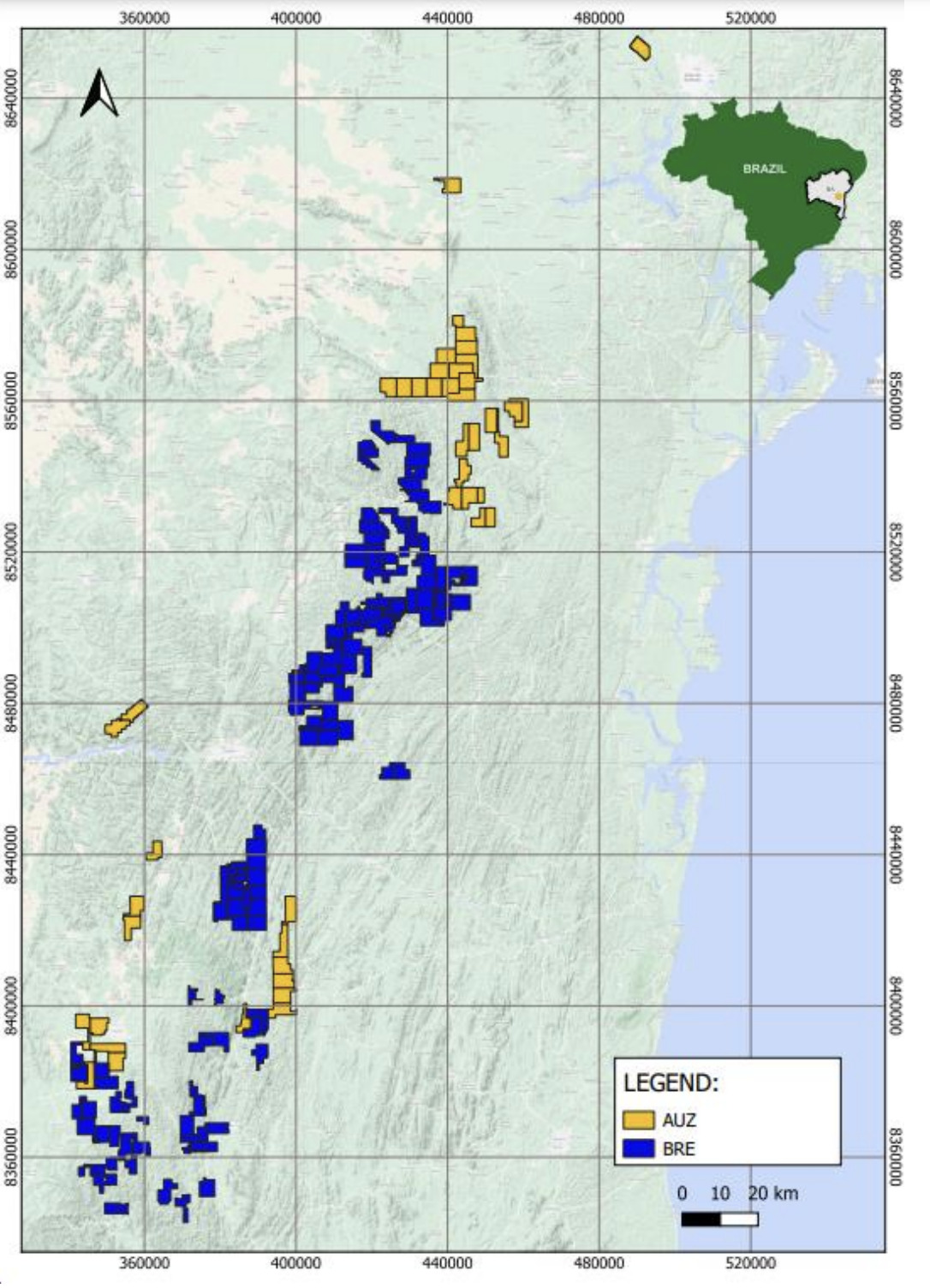

The first is the Jequie rare earth-niobium project in the state of Bahia in northeast Brazil, immediately adjacent to the Gina Rinehart-backed, soon-to-be listed explorer Brazilian Rare Earths and its 510Mt Rocha de Rocha rare earths project.

Brazilian Rare Earths, which is set to list under the code “BRE” on December 18 with a $315m valuation, believes its resource – comparable to the world’s biggest non-Chinese rare earth clay project at Serra Verde – will potentially translate into multibillion-tonnes.

According to Australian Mines (ASX:AUZ), this has resulted in “large-scale pegging activity” in the area with many companies hoping an element of nearology might play out in their favour.

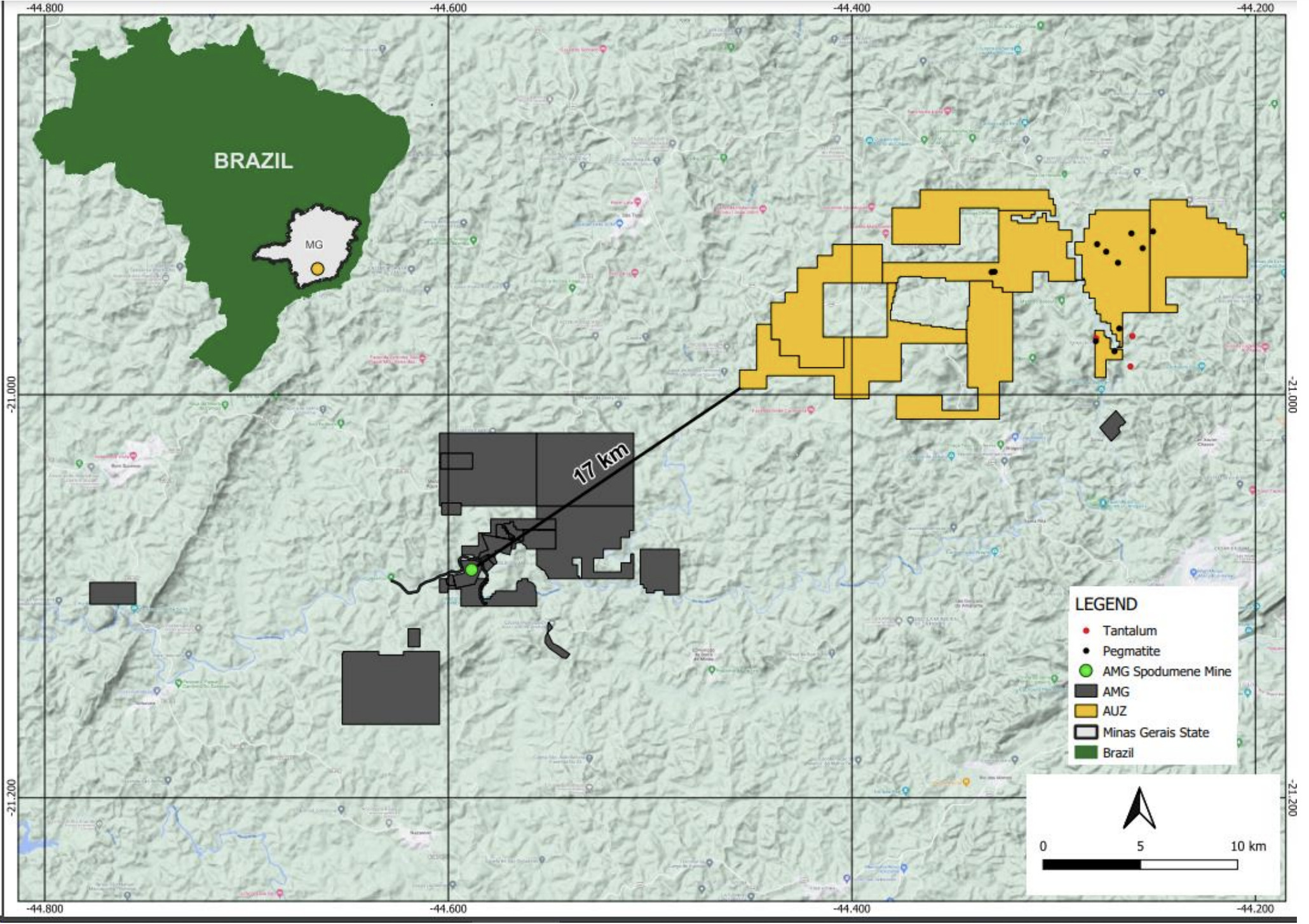

The second is the Resende lithium project within the Sao Joao del Rey pegmatite province, about 17km to the east of AMG Lithium’s producing Mibra spodumene mine which has been in operation since 1945.

Mibra is focused on tantalum, niobium and lithium concentrates and has the capacity to produce 130,000 tpa of lithium concentrate.

With two new, “very prospective” projects under its wings, AUZ CEO Andrew Nesbitt says the company plans to begin work as soon as possible.

“Leveraging the geological and regulatory skills and knowledge of our local Brazilian vendor will hopefully result not only in a top tier discovery but positive news flow in the short-term,” he says.

“To reflect our increased exposure to the battery metals, I think a renaming of Australian Mines to EcoMetal Resources is appropriate.”

The total cost of the acquisition is deemed to be $1.14m consisting of $150,000 in cash and 90,000,000 AUZ shares at a deemed price of $0.011 per share.

AUZ has the right to acquire the licences by paying $50,000 within five days of executing the term sheet.

The closing of the acquisition is subject to a number of conditions, including shareholder approval and all licences being granted by the vendor, which must be completed by 28 February 2024.

Alongside the acquisition, AUZ has raised $2.5m to spend on fast-tracking exploration in Brazil.

Meanwhile, Nesbitt says the company is continuing its efforts to de-risk the Sconi nickel-cobalt-scandium project in Queensland which is targeted for production in 2028.

Backed by offtake partner LG Energy Solution, one of the largest producers of advanced batteries for the EV industry, the US$1bn project is estimated to support 800 jobs and increase Gross Regional Product by $2.2 billion over its 30-year life.

That 30-year mine life could produce enough battery grade nickel and cobalt to power 5-6 million high-performance electric vehicles.

“We are also simultaneously continuing our efforts to establish a collaborative partnership with and commitment from a strategic player for an investment decision,” Nesbitt says.

This article was developed in collaboration with Australian Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.