Blackstone shares are on a tear thanks to its strategic move into Asian nickel

Pic: John W Banagan / Stone via Getty Images

Special Report: Blackstone Minerals (ASX: BSX) couldn’t have timed its foray into Asian nickel any better, with Indonesia implementing a new export ban and electric car makers ramping up production.

Shareholders obviously agree it was a good move. Since announcing it was picking up an advanced nickel sulphide project in Vietnam in May, Blackstone has surged 189 per cent to a 52-week high of 18.5c this week.

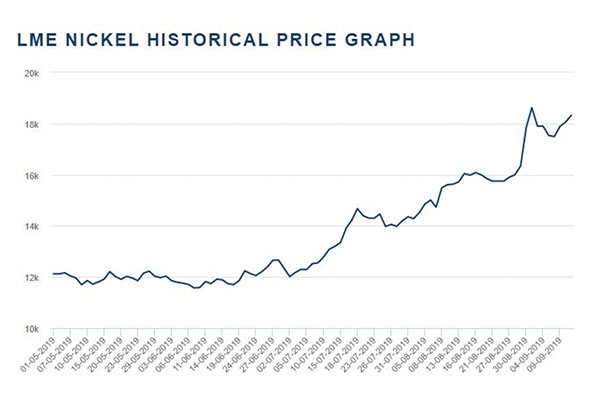

And with Indonesia bringing the implementation of its nickel export ban forward to the end of this year, and the ever-growing demand for nickel thanks to electric vehicle makers ramping up their production plans, the nickel price has also risen strongly.

Since May, it has jumped over 59 per cent to $US18,620 ($27,089) a tonne.

“Given the tsunami of demand for nickel we see coming from the battery sector over the next three to five years we don’t expect the nickel price to slow down in the medium to long term,” managing director Scott Williamson said.

Blackstone has secured a 12-month option to acquire a 90 per cent stake in the Ta Khoa project, which is about 160km west of Hanoi.

The Ta Khoa project includes the Ban Phuc nickel mine, which successfully operated as a mechanised underground mine from 2013 to 2016 and is currently on care and maintenance.

With that mine comes a 450,000-tonne-per-anum processing plant which is connected to a nearby hydro power grid with a fully permitted tailings facility.

On top of that, Blackstone started out with 25 prospective nickel sulphide targets, but after running an induced polarisation (IP) survey – the first time it has been done on the project –found a bunch more targets for it to look at.

Blackstone is aiming to deliver a maiden resource for the project over the coming months and is looking into restarting the existing concentrator.

This has given the company a head start on becoming one of the first ASX small caps to produce battery grade nickel.

Directors putting more skin in the game

Blackstone’s directors are also demonstrating their confidence in the project by buying more shares on market.

Collectively, the board and management already had a 26 per cent stake between them, but that is now on the rise after further purchases.

Non-executive director Steve Parsons dropped another $77,900 on topping up his shareholding by 475,000 shares.

Parsons’ past successes include Gryphon Minerals, which made a multi-million-ounce discovery in West Africa and was taken over by Canadian company Teranga Gold for $84m.

He has also transformed Bellevue Gold (ASX:BGL) from a $5m shell to a $365m company with a growing gold inventory of 1.8Moz.

Meanwhile, Williamson – a seasoned expert in the underground mining and capital markets – has added another 750,000 shares to his portfolio at a cost of $123,000.

>> Now watch: 90 seconds with Blackstone managing director Scott Williamson

This story was developed in collaboration with Blackstone Minerals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.