Blackstone finds a bunch of new nickel sulphide targets in Vietnam

Pic: Schroptschop / E+ via Getty Images

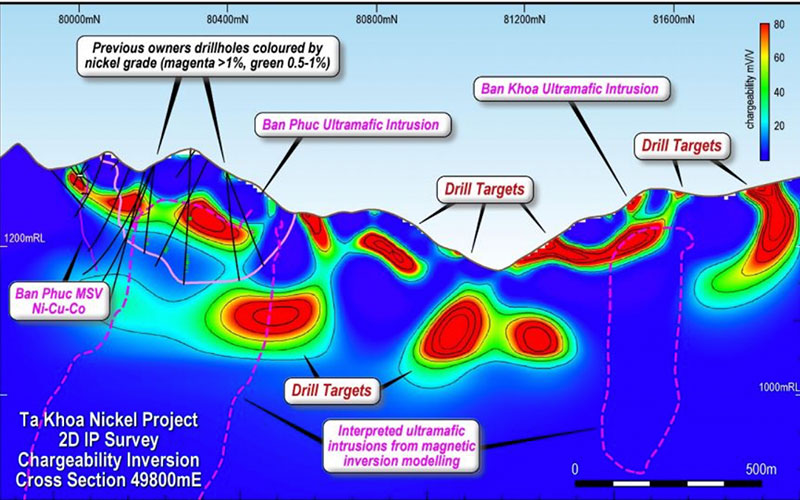

Special Report: A maiden induced polarisation (IP) survey at the company’s Ta Khoa nickel project in Vietnam has opened up a whole new raft of targets for Blackstone Minerals.

Blackstone Minerals (ASX:BSX) was the first company to use the method on the project, which has found that there’s a strong correlation between high grade disseminated (DSS) targets and massive sulphide vein (MSV) mineralisation.

Previous owners at the project had only focused on the MSV at the project, but the new work gives Blackstone the possibility of going after DSS targets as well.

Blackstone will use the results of the IP survey to firm up new targets, with drilling set to take place in a couple of weeks.

“Our maiden results from the first ever IP survey at Ta Khoa suggest we have an extensive system of magmatic nickel-copper-cobalt sulphides,” managing director Scott Williamson said.

“We look forward to continuing our shallow drilling and commencing the deeper drilling of the new targets with a second drill rig mobilising over the coming weeks.”

Blackstone is aiming to deliver a maiden resource for the project over the coming months and is looking into restarting the existing concentrator on site — which has a 450,000-tonne-per-annum processing capacity.

Interestingly, while the project is still in the early stages, Blackstone is already thinking big with the company telling shareholders that it is considering developing downstream processing capabilities — with an eye toward processing nickel and cobalt.

It’s also due to start metallurgical testing on the ore already found at the project in order to come up with a flowsheet specifically designed to develop product suitable for the lithium-ion battery market.

Altogether, Blackstone is shaping up as being in the right place at the right time.

Why a nickel project in Vietnam makes sense

Nickel has been one of the breakout stars of the commodities market this year, and it has very little to do with its use in stainless steel.

Several end users have sounded the alarm on the need to secure more nickel as its role turns from being a stainless steel play to being one for the electric vehicle revolution.

Principal consultant at Benchmark Mineral Intelligence, and former head of Tesla’s battery supply chain management, Vivas Kumar, said this had led to car makers getting more involved in the metals procurement process.

“Two or three years ago, carmakers generally left the responsibility to source battery raw materials to their cell suppliers,” Kumar told Stockhead previously.

“Now, because of impending shortages and a continuous push towards lowering $/kWh cost of battery cells, automakers are becoming more educated about battery metals procurement.

“As a result, we have seen that automakers are now staffing up their own battery metals procurement teams and are signing direct contracts with mining and chemical supply chain players.”

But it’s also a great time to be a supplier into Asia, the Chinese government is now demanding that EVs manufactured within China have a range of more than 400km per charge.

This involves manufacturing a battery with more nickel content.

With a project in Asia, Blackstone appears to have made a solid bet.

A quick look at Ta Khoa

Earlier this year Blackstone took a 12-month option to acquire a 90 per cent stake in the Ta Khoa project, which is about 160km west of Hanoi.

The Ta Khoa project includes the Ban Phuc nickel mine, which successfully operated as a mechanised underground mine from 2013 to 2016 and is currently on care and maintenance.

With that mine comes a 450ktpa processing plant which is connected to a nearby hydro power grid with a fully permitted tailings facility.

Blackstone’s drilling to date has been promising, with hits including:

-

- 22m from 138m at 0.8 per cent nickel

- 8m from 106.6m at 1 per cent nickel and;

- 5m from 56.5m at 1.2 per cent nickel

In fact, there was even a peak assay figure of 3.4 per cent nickel.

While the company has previously told shareholders there were 25 targets to follow up on, the new IP survey results suggest they may have more to chew on in the coming months.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebookor Twitter

This story was developed in collaboration with Blackstone Minerals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.