Blackstone leaps in front to be one of the first ASX small caps to produce battery grade nickel

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: Blackstone Minerals has given itself a head start to becoming a producer of battery grade nickel with an option to buy an already permitted and established mine.

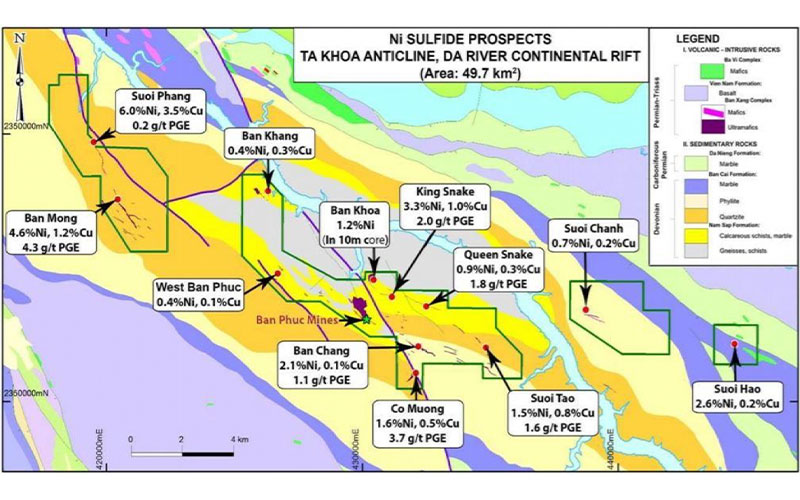

The junior explorer (ASX:BSX) recently negotiated a deal that gives it a 12-month option to acquire a 90 per cent interest in the Ta Khoa project, located 160km west of Vietnam’s capital, Hanoi.

The Ta Khoa project includes the Ban Phuc nickel mine, which successfully operated as a mechanised underground mine from 2013 to 2016 and is currently on care and maintenance.

The acquisition also includes a 150 sq km land package that hosts more than 25 advanced-stage massive sulphide targets.

This is a lucrative deal for Blackstone that ticks all the boxes, starting with the fact it is a nickel sulphide project.

Sulphide is superior

Nickel is usually found in two main ore types – sulphide or laterite.

Sulphides are much cheaper and easier to turn into battery grade nickel sulphate than nickel laterites and fetch a higher price.

Supply of nickel sulphides is also declining because of a lack of new discoveries at the same time that demand continues to climb.

The previous owners spent over $US136m ($195.1m) on building the infrastructure, including the underground mine and 450,000-tonne-per-annum concentrator.

“So that’s capital that’s already been sunk and we don’t have to worry about,” managing director Scott Williamson told Stockhead.

“That allows us to focus on the downstream processing.

“We believe we will be one of the first junior companies on the ASX to deliver what will be a nickel product for the battery industry, and the reason we’re able to do that is because it’s a sulphide and we’ve got the existing infrastructure.”

This means that Blackstone would only need to consider a capital spend of “tens of millions” as opposed to the billion-dollar spend likely to be facing the company’s nickel laterite peers.

The Ban Phuc mine was shut down because of the falling nickel price and the fact the previous owners didn’t define more resources beyond their first target, which they mined out in 3.5 years.

Nickel set to run

But now the nickel price is well on its way up and Blackstone has 24 other high-quality targets to explore.

“It actually was a very successful mine, but they mined in a falling nickel price and they closed it at some of the lowest nickel prices we’ve seen in the last 10 years,” Williamson explained.

When the mine was closed in 2016, the nickel price had slumped to around $US10,000 a tonne, but it’s now back up near $US12,000 a tonne, and all indicators are that the nickel market looks set for a good run over the next three to five years.

And the advantage for Blackstone is that it has halved its time to production.

“The first two years will be very much around exploration and study work, but there’s no reason why over the next two to three years we can’t look at very much getting this thing back up and running,” Williamson said.

“If we were to build a concentrator and go through the process it would be at least three to five years.”

Low-cost, no jurisdictional risk

Another tick for Blackstone is the company doesn’t have to worry about jurisdictional risk and it can build a downstream business in a country with some of the lowest labour costs in the world.

“When you go into a jurisdiction the biggest thing is permitting, and this infrastructure is permitted and ready to go,” Williamson said.

“So that removes a lot of that jurisdiction risk.

“It could be very lucrative for us to build the downstream process in Vietnam because we can do it a lot more cost effectively than if we were in Australia.”

Globally significant

Blackstone likens the Ta Khoa mine to the major Nova-Bollinger discovery in Western Australia’s Fraser Range.

The Nova-Bollinger nickel, copper and cobalt mine was discovered in 2012 by Sirius Resources.

The major discovery caught the eye of much larger miner Independence Group (ASX:IGO), which eventually swallowed Sirius in a $1.8 billion takeover deal.

“We believe we’ve got what could be potentially a globally significant nickel sulphide system,” Williamson said.

“It’s a magmatic nickel sulphide, which is different to the stuff in Kambalda. So it’s a bit like a Nova-Bollinger type, which can produce significant tonnages of nickel.

“We think there’s a lot of nickel here to be mined over many, many years.”

Top notch team

Interestingly, two of the key people behind Blackstone in the past have built companies up to the point they became irresistible to the majors.

Chairman Hamish Halliday made a multi-million-ounce discovery in West Africa through his company Adamus Resources.

Adamus, which started out as a $3m float, was taken over by Canadian miner Endeavour Mining in 2011 in a $C313m deal.

Non-executive director Steve Parsons had similar success with Gryphon Minerals, which also made a multi-million-ounce discovery in West Africa and was taken over by Canadian company Teranga Gold for $84m.

He has also transformed Bellevue Gold (ASX:BGL) from a $5m shell to a nearly $300m company with a growing gold inventory of 1.5Moz.

Williamson, meanwhile, has the underground mining and capital markets expertise. He has over 10 years of experience in technical and corporate roles in the mining and finance sectors.

The board and management have skin in the game, with a collective 26 per cent stake between them.

And with the option to acquire the Ta Khoa project, Blackstone has added metallurgist Stephen Ennor to its team.

“That’s a really important skillset, particularly when we need to start looking at the downstream processing routes,” Williamson noted.

“Stephen knows this asset better than anyone.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebookor Twitter

This story was developed in collaboration with Blackstone Minerals, a Stockhead advertiser at the time of publishing.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.