Battery metals: EU carmakers are hungry for raw materials and European Metals is right next door

Mining

Mining

European Metals is in a pretty good spot right now, both literally and figuratively.

The EU wants to shore up its EV supply chains, from battery manufacture all the way back to raw material production.

Access to locally sourced lithium chemicals will be a big part of this plan, which puts local, advanced explorers like European Metals (ASX:EMH) and Infinity Lithium (ASX:INF) in a pretty good spot going forward.

European Metals’ Cinovec lithium project is nestled in the Krusne Hory mountains in a historic mining region between the Czech Republic and Germany.

It’s plugged away at Cinovec since about 2014, well before the EV thematic really started to ramp up.

In 2017, a PFS concluded that Cinovec could be a low-cost producer of lithium carbonate. But a new process, unveiled in today’s updated PFS, enables the production of either battery grade lithium hydroxide or carbonate “as markets demand”, the company says.

This has boosted the project economics pretty significantly.

From the 2017 PFS, net present value (NPV) is up 105 per cent $US1.108 billion, internal rate of return (IRR) up 37 per cent to 28.8 per cent, while cost of production remains a low $US3,435/t.

The only downside: start-up construction costs have increased from about $US390m to $US480m.

By that’s nothing in the big scheme of things, and maybe someone like VW – which just sunk about $1.46 billion into Swedish battery maker Northvolt – is willing to shell out a few hundred million if it means they guarantee some supply for the next 20-plus years.

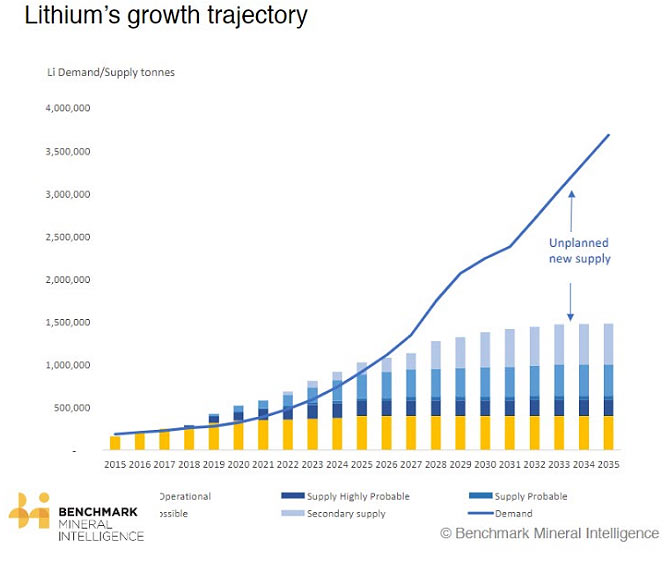

You only have to look at a basic demand/supply outlook to see how dicey things are going to get.

European Metals managing director Keith Coughlan says Cinovec, the largest lithium resource in Europe, is strategically located in central Europe in close proximity to the continent’s vehicle manufacturers.

“With increasing demand for EVs and the expected demands of grid storage capacity, the project is very well placed to supply the European lithium market for many decades,” Coughlan says.

Australian Mines (ASX:AUZ) is drilling its secondary battery metals project Flemington, right next door to Clean TeQ’s (ASX:CLQ) advanced Sunrise nickel-cobalt project in NSW. Initial results suggest Flemington may extend more than 1km beyond the boundary of the current resource. Interestingly, Australian Mines also hit copper grades up to 0.5 per cent.

“This will require further analysis by the Company’s geological team to understand its significance (if any), and the project’s potential to host copper mineralisation,” Australian Mines says.

Tando (ASX:TNO) will implement parallel development strategies at its high grade Steelpoortdrift vanadium project in South Africa. The ~$20m capex Phase 1 focusses on the direct sale of an unprocessed concentrate to end users to generate early cash flow. This is help fund Phase 2, which envisages value-added production of 98 per cent V2O5 flake.

“The Project now has real momentum which will gain pace as we undertake the PFS, complete Reserve drilling, finalise offtake contracts and move to secure project funding, says Tando boss Bill Oliver. “With the excellent geological and financial metrics that flowed from the Scoping Study, the project is now poised to gain momentum and to take its rightful place as a globally significant Vanadium deposit and one of the next producing projects of the world.”

Anson (ASX:ASN) announces maiden 118,000t lithium carbonate resource for its Paradox brine project in Utah. Bonus: the indicated and inferred resource also includes 427,000t bromine, 21,400t iodine, and 304,000t boric acid.

Anson says this resource estimate “forms a solid platform to advance a Scoping Study and to highlight mine-life estimates”. And there’s scope to increase this pretty significantly; an additional exploration target of 30 – 46 million tonnes of brine grading 150 mg/L – 300 mg/L lithium has also been estimated for ‘Clastic Zone 31’.