You might be interested in

Mining

Sticking to the Pilbara: These juniors are right now attached to world-class lithium and gold deposits

Mining

The big names are back for this year’s Tribeca Future Facing Commodities Conference in Singapore

Mining

Mining

Special Report: Azure Minerals (ASX:AZS) is acquiring a package of remarkable gold and nickel projects in the Pilbara from legendary prospector Mark Creasy.

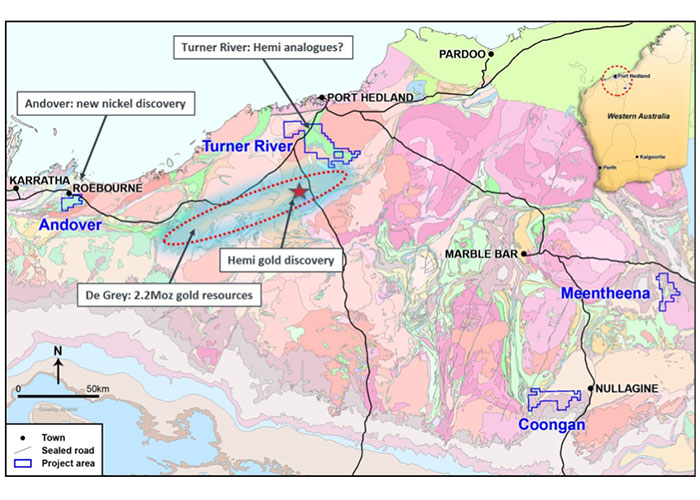

Azure will acquire the Andover nickel-copper project and the Turner River, Meentheena and Coongan gold projects — all in WA, the #1 mining jurisdiction in the world.

Creasey will emerge with a cornerstone holding of 18.6 per cent in the explorer.

“Mr Creasy has been an Azure shareholder since 2003 and we are excited to take our relationship to the next level with this acquisition and to partner with him to explore and develop these exciting projects,” Azure managing director Tony Rovira says.

“We’re delighted to have acquired these four exciting projects which have strong potential due to historical exploration results, underlying geology and project locations,” he says.

“This acquisition enables the company to reduce risk by diversifying across commodities and jurisdictions, giving shareholders exposure to both the hottest gold exploration district in WA and an advanced nickel-copper project.”

The unexplored Turner River gold project is within seven kilometres of De Grey Mining’s (ASX:DEG) Mallina project (2.2Moz of gold resources), which includes the regionally defining Hemi gold discovery.

Turner River hosts similar geology to De Grey’s ground, including 12km of the fertile Berghaus Shear and parallel structures which are associated with the Hemi deposit.

Extensive sand cover which traditionally ‘masks’ deposits deeper down, minimal historical exploration, proximity to De Grey’s strongly mineralised project area and gold deposits, favourable rock types and fertile structural setting – these all highlight the significant potential for Turner River to host substantial gold mineralisation.

Incredibly, there are no indications of drilling or other historical exploration within the Turner River project area.

Azure will kick off geophysical surveys and early stage reconnaissance drilling as soon as the tenements are granted.

The 223km2 Meentheena and 141km2 Coongan gold projects in the eastern Pilbara are exciting on their own terms.

Meentheena, which is prospective for epithermal gold deposits, has been held by the Creasy Group for more than 25 years.

Geological mapping and geochemical sampling over several years defined a large (~20km2) zone of epithermal ‘alteration’ at surface.

The Creasy Group drill-tested this zone with five RC holes totalling 2,204m and one 706m diamond hole.

Several holes intersected epithermal-style geology with anomalous (low grade) precious metals and ‘pathfinder’ elements. This indicates that Creasey was in the process of dialling in on something significant.

Azure plans to undertake further exploration, initially comprising surface studies followed by drilling.

The Coogan project adjoins Novo Resources’ Beatons Creek Gold Project, which contains resources of 903,000 ounces at 2.53 g/t gold and was – until recently — a joint venture with Creasy-related entities.

Coogan is considered prospective for alluvial and conglomerate-hosted gold, similar to that at Beatons Creek, and also bedrock-hosted primary gold mineralisation.

The 70sqkm Andover project, south-east of Karratha, is on similar rocks to the Fraser Range, home to the Nova-Bollinger nickel-copper mine, and the Gonneville Intrusive Complex near Perth, host to Chalice Gold Mine’s (ASX:CHN) exciting Julimar nickel-copper-PGE discovery.

Artemis Resources’ Carlow Castle gold-copper-cobalt deposit is 3.5km from Andover, while the now-closed Radio Hill nickel-copper mine and plant is 28km to the south-west.

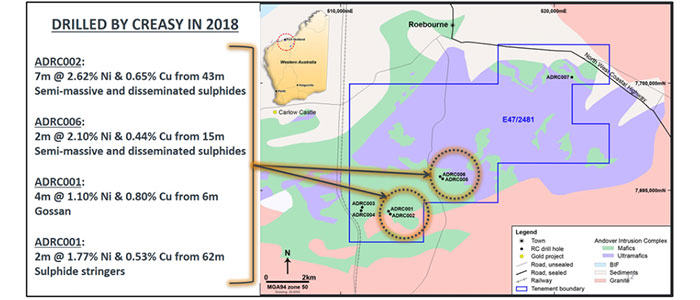

In 2018, the Creasy Group made a significant nickel-copper sulphide discovery at Andover.

They drilled seven holes for 1,126m to test four targets characterised by geophysical anomalies and surface gossans (the exposed part of a mineralised vein) containing nickel and copper.

Six holes intersected sulphide mineralisation.

Three of these holes intersected disseminated and semi-massive nickel and copper sulphides with potentially economic grades and widths in two separate zones.

Highlights included:

Mineralisation remains open in all directions. No follow up drilling was ever undertaken making this one of the most exciting nickel copper exploration plays in Australia

Multiple other EM targets and surface gossans remain untested throughout the property.

Azure plans diamond drilling to follow-up these two nickel-copper discoveries and to test additional geophysical and gossan targets.

In conjunction with the acquisition, Azure has received binding commitments from professional and sophisticated investors to raise $4 million through a share placement.

Under the placement, the company will issue 40 million shares at a price of 10c each.

This represents a small 7 per cent discount to the stock’s 15-day volume weighted average price (VWAP) and a 2.1 per cent premium to the 30-day VWAP.

Rovira said the company’s Alacrán gold-silver project remains a key part of the Azure portfolio, but the severity of the COVID-19 pandemic in Mexico prompted the company to seek high quality gold and nickel projects in WA.

“It’s important for our shareholders to understand that our projects in Mexico remain an important core business for the company, however, these new projects are an exceptional opportunity to explore quality ground in partnership with a proven world-class mine-finder,” Rovira said.

Azure has stated that ‘activities in Mexico have resumed but remain low-key’.

This story was developed in collaboration with Azure Minerals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.