You might be interested in

Mining

REE Survival Guide Part 4 – These Aussie projects aim to be ready to supply refineries... and soon

Mining

REE Survival Guide - Part 1: Rare earths explorers are getting smarter - here’s what to look for

Mining

Mining

Special Report: Development of the Nolans rare earths project in the Northern Territory has received a US$533 million ($804.9 million) show of support from the Australian Federal Government that will unlock further funding options for Arafura Rare Earths.

Besides making up nearly half of the estimated $1.68 billion price tag for Nolans, the government’s debt finance package is also the catalyst needed to advance the remaining debt and equity funding requirements.

This includes indicative interest from international and commercial financiers for a further US$550m of senior debt facilities.

The Australian government’s decision to back Arafura Rare Earths (ASX:ARU) and its planned development of the Nolans project isn’t surprising given the strong interest in building a non-Chinese REE supply chain, particularly for valuable magnet REEs being highly sought for electric vehicle motors and wind turbines.

And if there’s anything that makes Nolans stand out, it is the project’s rich endowment of magnet REEs neodymium and praseodymium.

Nolans is expected to produce about 4,400tpa of NdPr oxide along with 474tpa of heavy rare earths oxide and 144,393tpa of phosphoric acid for a minimum 38 years.

This accounts for 5% of the world’s current NdPr demand, which could also explain why binding offtake agreements have been reached with two customers for 53% of the targeted 85% annual production from Nolans under long-term sale arrangements.

Discussions are with GE Renewables on converting their non-binding MoU into binding terms are also at an advanced stage.

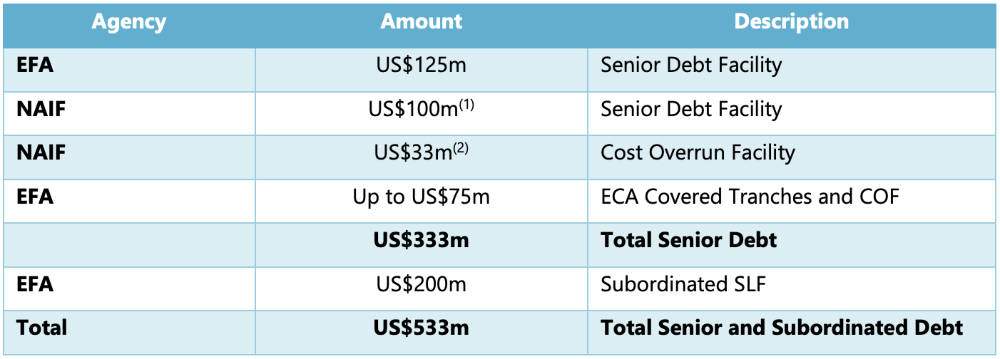

The government’s debt finance package includes a US$125 million limited-recourse senior debt facility under its $4 billion Critical Minerals Facility (CMF) that is administered by Export Finance Australia (EFA) and a $150 million limited-recourse senior debt facilities from the Northern Australia Infrastructure Facility (NAIF).

Both facilities have a 15-year tenor with interest rates and conditions precedent to financial close customary to arrangements of this nature.

EFA will also provide a subordinated Standby Liquidity Facility (SLF) of up to US$200 million under the CMF to help manage any increases in capital expenditure and operating costs incurred during ramp-up and has conditional approval to provide further funding of up to US$75 million on its commercial account to participate in the ECA covered tranches and cost overrun Facility (COF).

Rounding up the funding, the NAIF has agreed to provide additional funding up to $50 million via a proportion of the COF.

“Securing debt facilities of US$533 million from EFA and NAIF is a critical achievement for the Nolans project and signifies its economic importance to Australia and the Northern Territory,” ARU managing director Darryl Cuzzubbo said.

“Gaining this level of support from the Commonwealth Government is a critical milestone in becoming a globally significant producer of NdPr, a product essential for electric vehicle and wind turbine manufacturers to achieve future growth targets as part of the energy transition.

“Being able to secure these debt terms reflects the quality of the Nolans project. It brings us significantly closer to making a final investment decision and contributing to a lower carbon future.

“We are thrilled to be in partnership with EFA and NAIF, other government stakeholders, our customers and communities to create jobs and economic opportunities for many decades to come.”

The debt funding provided by the Australian Government is unlikely to enable debt finance commitments from export credit agencies representing other interested countries.

Export Development Canada (EDC) previously provided a letter of interest for debt financing up to US$300 million, while the Export–Import Bank of Korea (KEXIM) gave in-principle debt financing support for a US$75 million loan, in addition to a US$75 million untied loan guarantee.

Germany’s Euler Hermes also proposed in-principle support for an untied loan guarantee up to US$600 million, although utilisation of this entire facility is contingent upon additional German offtake and subject to debt metrics.

ARU expects to use about US$100 million of the Euler Hermes untied loan guarantee.

It is also seeking funding for ECA covered tranches of up to US$175 million, supported by untied loan guarantees from Euler Hermes and KEXIM. Request for proposals have been issued to numerous domestic and foreign banks in relation to project financing and ancillary banking services requirements.

ARU intends to the use the US$775 million of senior debt with all lenders as a catalyst for a significant equity raising.

The equity raising will complete the funding to enable construction, commissioning and first production at the project.

Engagement with a number of key strategic investors is ongoing, action with these groups and other potential cornerstone investors is scheduled to escalate in parallel with the lenders’ credit approval processes.

Early works – including a range of access and critical infrastructure as well as construction camp facilities – have already been completed.

These will allow a timely and efficient mobilisation and start of development when financing activities are complete.

ARU has also procured a range of long-lead and critical path items, plus advanced contract development for the key hydrometallurgical plant.

This article was developed in collaboration with Arafura Rare Earths, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.