You might be interested in

Mining

All the richest people in the world are stockpiling gold. These ASX stocks are racing to supply it

Mining

Gold Digger: Gold vs Bitcoin, analysts vs analysts – store of value narratives get in the ring

Mining

Mining

Special Report: De Grey Mining has flagged future resource increases at Eagle and Diucon and potential upside to the already impressive production metrics for its Hemi gold project in the Pilbara.

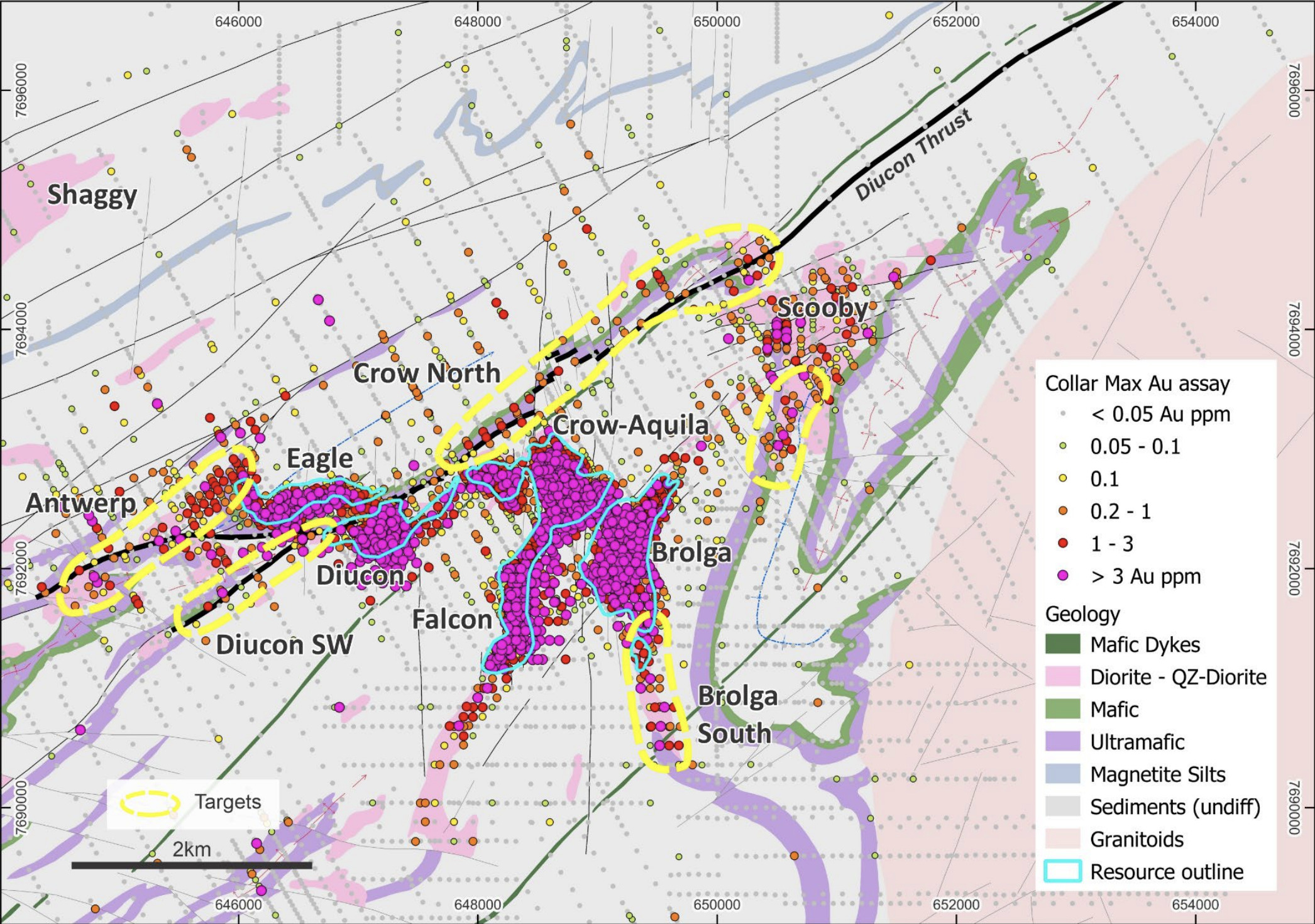

Hemi was earmarked as a future top-5 Australian gold mine when the results of the DFS were made public just in September, but the new mineralisation intersected at Eagle and Diucon from recent drilling, De Grey Mining (ASX: DEG) could very well be looking at an even better outcome for its flagship project.

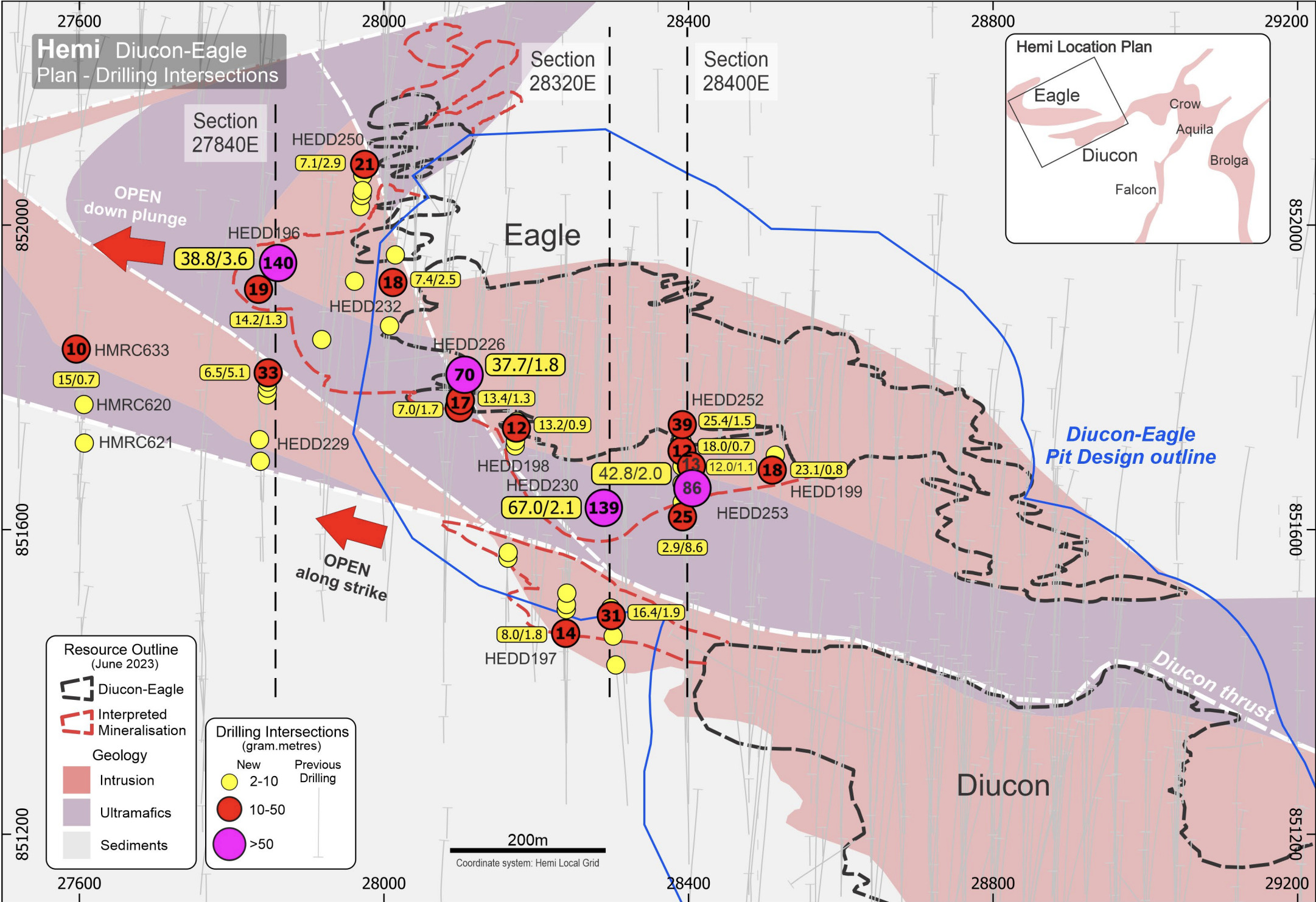

Recent drilling targeted extensions to the June 2023 MRE down plunge and down dip at Eagle, and along strike at Diucon. Both deposits are on the western side of the Hemi project area.

De Grey believes the latest extensional drill results represent further upside to the outstanding financial metrics reported in the DFS which envisaged average annual production of 530,000ozpa over the first 10 years at Hemi at a cost of $1,295/oz.

And that’s without the any contribution from underground mining or the 2.2 Moz Regional deposits, two major areas of potential upside for the project which is located 85km south of Port Hedland.

“The extensions below the Eagle DFS pit and shallower Diucon extensions have the potential to result in a substantial expansion of the current Diucon-Eagle open pit shell outline,” De Grey general manager exploration Phil Tornatora said.

“In addition to potential resource increases, deeper drilling at Hemi will support our conceptual studies into potential underground mining in the future. RC drilling at Hemi is continuing along the Diucon Thrust north of Crow and extending towards Scooby, aiming to define additional shallow resources.”

Drilling extended mineralisation at Eagle beyond the June 2023 MRE for at least 250m down plunge to the west and over 300m down dip beneath the current Eagle pit plan.

Significant intersections included 38.8m @ 3.6g/t gold (including 20.7m @ 6.3g/t gold), 37.7m @ 1.8g/t gold (including 5.1m @ 8.1g/t gold) and 67m @ 2.1g/t gold (including 3.1m @ 28.7g/t gold).

De Grey indicated the substantial widths and tenor in this recent drilling demonstrates strong potential to expand the June 2023 MRE and also the pit shells defined in the DFS.

Mineralisation is still open down dip and down plunge. Assay results from ten diamond holes which have been completed are pending.

Drilling at Diucon targeted mainly shallow, open-pittable resources along the Diucon Thrust to the west of the Diucon MRE and between the Diucon and Eagle proposed pits.

Encouraging intercepts from the lodes in the hanging wall included 8m @ 1.8g/t gold from 379m, 5.7m @ 1.6g/t gold from 405.3m and 16.4m @ 1.9g/t gold from 446.6m (including 10.6m @ 2.8g/t gold from 452.4m).

Shallow lodes were also intersected in the hanging wall at Eagle. These lie north of the Diucon Thrust and have now been named the Antwerp Link lodes. Best hits include 15m @ 0.7g/t gold from 15m, 5m @ 1.6g/t gold from 278m and 6.5m @ 5.1g/t gold from 298.1m (including 0.9m @ 33.6g/t gold from 298.1m).

Drill programs are being developed to follow up at Diucon West and better define the Antwerp Link mineralisation.

De Grey is also currently undertaking RC drilling along the Diucon Thrust to the north of Crow, extending towards Scooby. Diamond drilling is also continuing to target Eagle extensions, with one rig assessing the moisture content and geotechnical data to advance “operational readiness”.

A single aircore rig is focused on regional targets, while an additional RC rig is turning within the Becher area as part of the first drilling managed by De Grey under its Egina joint venture with Novo Resources (ASX: NVO).

This article was developed in collaboration with De Grey Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.