A prospective nickel play at the feet of a sulphide giant

Mining

Mining

The signing of a framework agreement between the UK’s Kabanga Nickel and the Tanzanian government in January to develop the world’s largest battery grade nickel sulphide deposit in the country’s north-west left plenty of people excited.

For those following nickel, it’s a sure sign of confidence that the recent price strength won’t be going anywhere any time soon.

For those looking at investment in the EV sector, it’s a boost too – this is clearly a reality now, if the EV revolution isn’t already here it’s on its way at the speed of a Tesla Model S P100D gunning it down the Nevada stretch of US Route 50.

For those with interests in Tanzania, it’s the latest in a long run of signs that the mineral rich nation is open for some serious business, allaying jurisdictional concerns which often plague investment in that part of the world.

The green flags are lining up, the red flags nowhere to be seen. Imagine how it must feel to own the project next door to Kabanga.

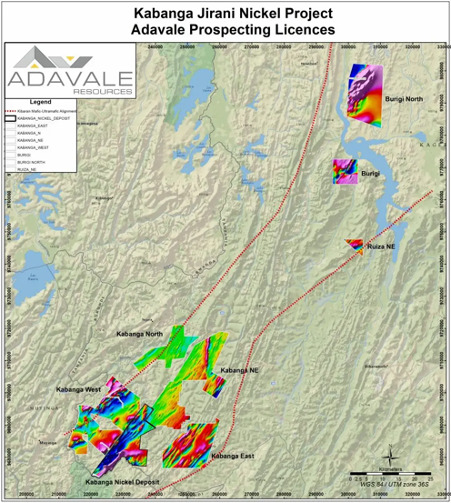

That’s exactly the welcome predicament faced by ASX-listed Adavale Resources (ASX:ADD), the 100% owner of the Kabanga Jirani nickel project, a collection of six granted licences spanning 1145km2 in a world-class nickel district adjacent and along strike from the world’s largest undeveloped nickel sulphide resource.

Speaking to Stockhead, Adavale CEO Allan Ritchie said the development of Kabanga, a deposit of 58 million tonnes at 2.62% nickel, was a boost for the region as a whole.

“When you think that $664 million is about to be spent on that project and a class-one nickel refinery a little bit down the road, it’s just a very exciting place to be,” he said.

“I think for Adavale, we’re in a very exciting position to take advantage of that – the change it could make to our mineral resource economics is significant.”

The land Adavale sits on at Kabanga Jirani is far from unknown. Part of the BHP portfolio from the 1970s through to 2008, there’s been an extensive amount of work carried out by the major miner and the United Nations Development Program over the years – a substantial collection of data ADD is now able to leverage to guide its work in the region.

“The BHP and UNDP data we’ve got includes extensive soil and stream sediment geochemical data, aeromagnetic and airborne electromagnetic data, and were run at a significant cost in at least a 160km line of strike,” Ritchie said.

“That gives us fantastic geological data which we can interpret. We’ve laid out some of those maps and the anomalies we see are very much like what overlies the Kabanga nickel deposit at our doorstep.”

One of the significant advantages Ritchie believes Adavale has on the ground is its team, with a wealth of in-country experience.

Two of the company’s board members – Rod Chittenden and Grant Pierce OAM – are long-term Tanzanian residents who between them have three decades of in-country experience.

Pierce’s extensive involvement in Tanzania includes time spent as executive general manager (Tanzania) for Barrick Gold and as a member of the development team which discovered and built Resolute’s (ASX:RSG) Golden Pride project – the nation’s first modern gold mine.

Pierce was operations manager at that project for six years.

Chittenden has extensive experience in the region, having played a key role in the commissioning of Paladin Energy’s (ASX: PDN) Langer Heinrich and Kayelekera projects.

Former Poseidon Nickel chair Geoff Brayshaw is Adavale’s CFO, bringing extensive nickel experience to the plate, while Richie himself has a long background in investment banking and leadership at public and privately owned resources companies.

Dave Dodd is the company’s competent person and will be leading the targeting and is currently on the ground at Kabanga Jirani.

Ground exploration is currently underway and will be followed by infill sampling guided by ADD’s interpretation of the project.

This is expected to then be followed up with focussed ground electromagnetic surveying, following the sampling team as they work, over a period of around three months.

“If we can see evidence of nickel sulphide mineralisation in the sampling and identify a conductivity anomaly indicative of a nickel sulphide deposit at depth then we will be in a position to immediately test the target with RC or diamond drilling.”

“I hope to be able to deliver on getting those holes in in the first half of 2021.”

This article was developed in collaboration with Adavale Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.