Resources Top 5: Life is a (nickel) Highway for Mantle, Cyclone blows in with 50pc gain

Pic via Getty Images

- Who said nickel was in the dumps right now? Oh, wait, we did… still, Mantle is up on an upgraded nickel resource estimate

- Iggy Tan-backed Lithium Universe back amongst the double-digit gainers

- Hang on, is Cyclone about to steal the ressie show? It’s up 50% on no news as yet

Here are some of the biggest resources winners in early trade, Friday January 19.

Mantle Minerals (ASX:MTL)

Gold, nickel ‘n’ lithium explorer Mantle was an early riser this morning, quickly notching a stonking gain of +30%, which has now settled back a tad.

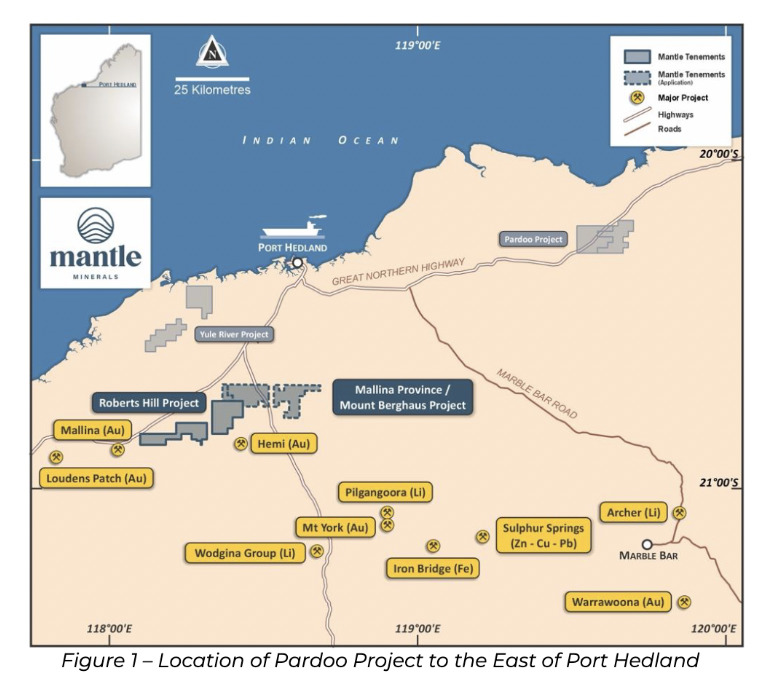

The company has announced a resource upgrade at the Highway deposit, which lies within its Pardoo Ni-Cu project in the Pilbara region of WA.

The nickel upgrade follows an infill drilling program completed in September 2022.

The total (Indicated and Inferred) MRE is now 16.5Mt at 0.407% Ni for a total of 67,005t of nickel metal.

Nickel and lithium may not be having the best of time of it lately re spot pricing, but it’s long-term outlook is solid, thanks to a multi decade electric vehicle growth story.

For Mantle, the nickel is a bonus right now. Its efforts largely remain funnelled into the Robert’s Hill and Mt Berghaus gold exploration tenements immediately north of De Grey Mining’s (ASX:DEG) 12.5 million ounce Hemi gold deposit.

MTL share price

Lithium Universe (ASX:LU7)

(Up on no news)

Like most lithium stocks, Lithium Universe didn’t exactly burst out of the gates price-action wise in 2024. That said, it’s looking to change that today with a very solid 25% intraday gain at the time of writing.

Nothing fresh is rolling off LU7’s comms lines, so let’s take a look back at the big entrance it made onto the bourse last year.

In fact, the company, backed by trailblazer Iggy Tan, was the year’s second-most-successful IPO, following the completion of its 2023 summer/fall exploration work program at the Apollo lithium project in Canada.

The project apparently boasts geological and geophysical characteristics similar to well-known spodumene pegmatites in the area such as Patriot Battery Metals’ (ASX:PMT) 109.2Mt Corvette property – just 29km away – and Winsome Resources’ (ASX:WR1) Adina property, another 28km away.

Read further about what’s in store for LU7 2024 > here.

LU7 share price

White Cliff Minerals (ASX:WCN)

(Up on news earlier this week)

Serial project hopper White Cliff pivoted towards uranium earlier this week, which has served the $23m explorer very well indeed so far.

It revealed plans to acquire a historical uranium project in the Northwest Territories of Canada called Radium Point, which reportedly provided 11% of all the uranium used in the Manhattan project.

The Iron Oxide Copper Gold Uranium (IOCGU) plus silver operation produced 13.7Mlb uranium, plus silver, copper gold, nickel and lead pre-1982.

And WCN says exploration has been largely non-existent in the area since uranium production ceased in the ’60s and silver and copper mining stopped in early ’80s.

Read more here…

.@CliffMinerals (#ASX:$WCN) has added the Radium Point IOCG-#uranium #silver project in Canada's Northwest Territories to its burgeoning offshore portfolio. 🇨🇦 https://t.co/A0BOr30iX6

— Stockhead (@StockheadAU) January 15, 2024

WCN share price

Adavale Resources (ASX:ADD)

Nickel sulphide and uranium hunter Adavale is up on fairly modest gains at time of writing, but makes this list courtesy of a fairly weak ressie-gains day overall on the bourse so far, and also for the fact it has some news released into the wild.

The 2024 exploration program at the company’s Kabanga Jirani nickel project in Tanzania is currently being finalised after encouraging 2023 results.

Some of that evaluation includes “detailed, deep penetrating ground EM at HEM 4, and potential follow-up drill testing; completion of hole DDLUHC006 at Luhuma Central; and testing coincident geochemical and geophysical anomaly at HEM 2E”.

Adavale’s executive director David Riekie clarified further: “The company’s exploration in 2023 provided a valuable understanding of the various exploration targets, in particular the Luhuma Central massive sulphide target.

“To date, all Luhuma Central drill holes drilled to planned depth have intersected nickel sulphide mineralisation within an EM anomaly with a 700m strike extent.

“HEM 4 was also tested in 2023 involving RC drilling of coincident soil and geophysical anomalies and remains highly prospective.”

The company also notes that longer term it’s setting its sights on a multitude of other targets its geological surveying has identified over the past couple of years.

ADD share price

Cyclone Metals (ASX:CLE)

(Up on no news)

Hold the presses, because this one’s just blown in, right to the top of the ressie gainers on… no news.

Nevertheless, this magnetite/iron ore exploration company has shot up 50% at the time of writing.

Its prime focus is its flagship Block 103 magnetite iron ore project located in Canada’s Labrador Trough.

Late last year the $15m stock released some head-turning news, achieving a major milestone after metallurgical test work on ore from its Block 103 ‘Iron Bear’ magnetite project produced a world-class direct reduction magnetite concentrate grading 70.6% iron.

And that came just two weeks after testing successfully produced a high-grade blast furnace (BF) magnetite concentrate grading 68.7% iron with very low deleterious elements and silica below 3.5%.

Read more on that > here.

CLE share price

At Stockhead we tell it like it is. While Adavale Resources, Lithium Universe and Cyclone Metals are Stockhead advertisers at the time of writing, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.