‘A growing nickel resource’: Golden Mile’s unique 26.3Mt Quicksilver nickel cobalt project is getting bigger, and better

Mining

Mining

Recent RC drilling has intersected thick, high grade nickel and cobalt mineralisation, confirming the potential for Golden Mile’s 26.3Mt Quicksilver deposit to get a lot bigger.

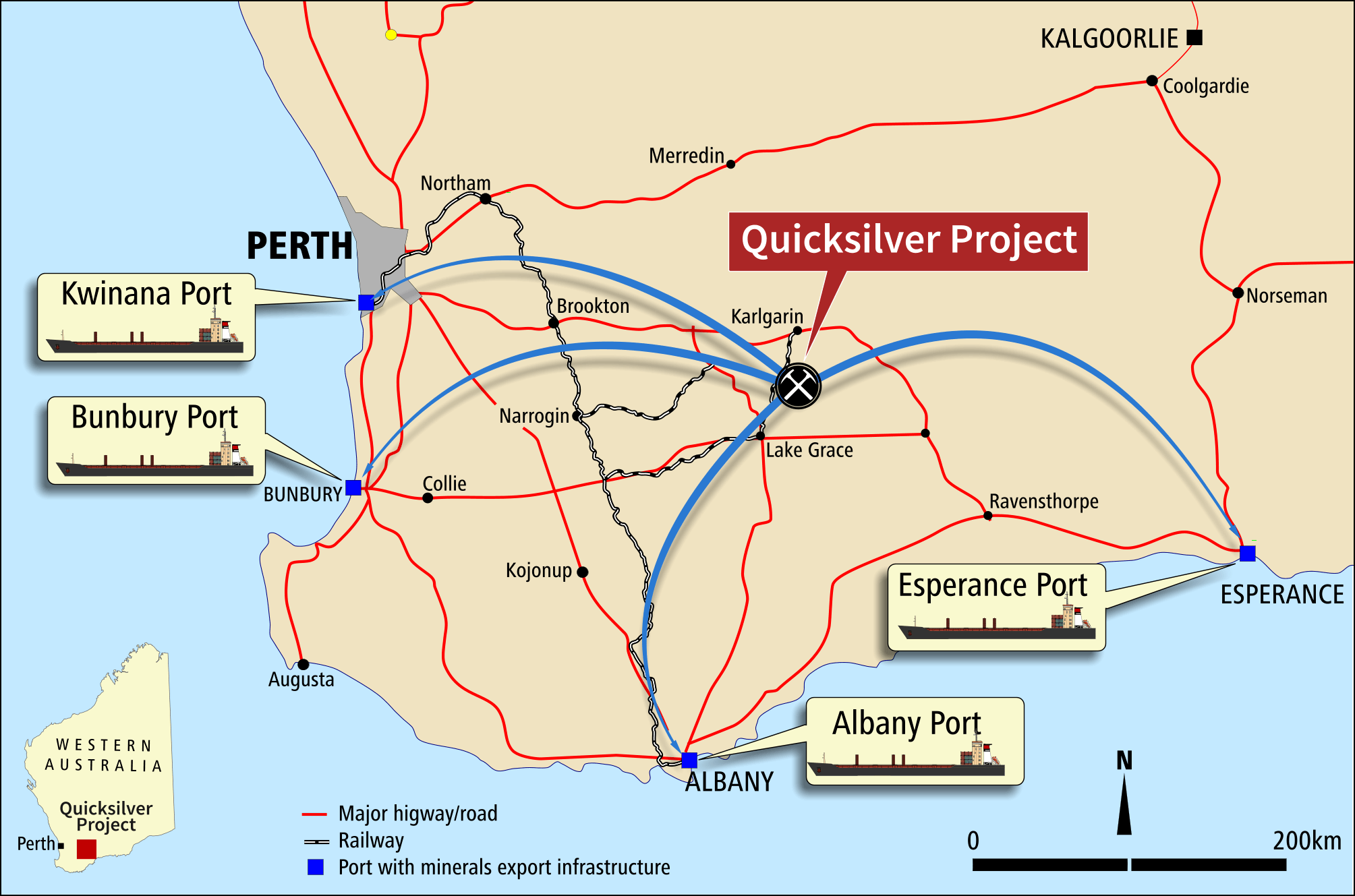

Golden Mile’s (ASX:G88) Quicksilver nickel-cobalt project, located about 300km south of Perth, is an oxide clay hosted nickel-cobalt deposit with a current indicated and inferred resource of 26.3Mt at 0.64% nickel and 0.043% cobalt for a contained 168,500t of nickel and 11,300t of cobalt, with some rare earths and scandium to boot.

Quicksilver is also a stone’s throw from Lake Grace on privately owned farmland in an area with excellent local infrastructure, including easy access to grid power, sealed roads, and a railway line connected to key ports.

G88 is currently advancing Stage 3 metallurgical test work programs and quickly progressing towards a scoping study, the first proper look at the economics of building a project.

Adding to its business case are some primary rare earths targets at the project site, which indicate a potential carbonatite source for the significant oxide clay hosted REE mineralisation.

The deposit could get a lot bigger, with G88 intersecting significant nickel and cobalt below the existing resource in both the oxide layer and below the base of oxidation, which indicates the potential for further nickel at depth.

Highlight results from the latest 7-hole RC drilling program include:

This is not the typical setting for nickel-cobalt oxide resource in WA, the company says.

Data obtained from drilling through the oxide and into the primary zone has resulted in an improved understanding of the controls of mineralisation at this unique resource.

While these are preliminary results, the intersections suggest that sub vertical structures may have provided additional conduits and depositional sites for accumulation of higher-grade nickel mineralisation at Quicksilver.

These structures can be targeted for higher grade nickel zones associated with the mica within and below the deposit.

Whilst remobilisation through weathering may have enhanced some grades, G88 says there is the possibility that these conduits may also host significant nickel mineralisation below the oxide zone.

“These results add further confidence in the potential for Quicksilver as a growing nickel resource, utilising the existing oxide resources but also potentially primary nickel mineralisation within a fertile ultramafic protolith,” G88 MD Damon Dormer says.

“The ongoing analysis of the significant data collected to date reinforces the potential of high-grade zones which would add further value uplift from these metallurgical opportunities.”

Interrogation of the geological data, assay results and metallurgical data to date has motivated Golden Mile to undertake work to identify the orientation of the higher nickel grade mineralisation.

Planning and design has begun on an orientation drill program to confirm the positioning of the high-grade nickel seams within the deposit, which is the first step of a staged scoping study. Timings of the study program will be released upon confirmation of the drill program schedule.

This will enable an optimal infill drill programme to be designed, ensuring the most comprehensive data set is obtained for updating the Resource, and developing a conceptual mine design and economic evaluation.

This article was developed in collaboration with Golden Mile Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.