A-Cap’s original MD Tunks is back in the saddle and ready to ride the Letlhakane Uranium rodeo

Mining

Mining

A-Cap Energy is champing at the bit to restart its Letlhakane Uranium Project in Botswana after the project was mothballed post Fukushima disaster in 2011.

Original MD Dr Andrew Tunks is back as CEO – and he has big plans for the project which has a total JORC resource of 365.7 million pounds (822.1Mt at 202ppm uranium using a 100ppm cut-off grade).

“This is the great unfinished job of my life,” he said. “I discovered it in a modern sense, I put the first drill hole into it, and built the team that grew into one of the world’s largest uranium deposits.

“I’m very bullish on nuclear, and I believe that it’s time has come and I’m very excited to be involved again.”

It’s good timing for A-Cap Energy (ASX:ACB) to restart the project, especially with energy supply front of mind in Europe and America – not to mention the uranium spot price recently hit an 11-year high of US$60/pound which is magic number often touted by uranium players that would push them to get into production.

“I’m an absolutely firm believer that uranium is the immediate solution to so many of our issues around carbon, CO2 in the atmosphere and getting rid of fossil fuels which really are 1800s technology, it’s time we moved on,” Tunks says.

“Renewables are fantastic and wonderful, but they simply do not provide industrial baseload power, so you’re left with hydro, fossil fuels, or nuclear for continuous baseload power.

“And I believe that in Australia we should absolutely be looking at the nuclear option.”

The project has a large, low-grade resource but that is offset by the fact that it is very close to surface in flat lying orebodies amenable to mining without drilling and blast.

Plus, prior to the project being put on care and maintenance, the company completed the environmental study, finalized the resource, finished the feasibility study and got a mining license.

Dr Tunks says the next steps will involve redoing parts of the environmental impact assessment which has expired – as well as reworking the feasibility study where there’s room for economic upgrades.

“What they didn’t incorporate into the study was sorting the material before you treat the ore,” he says.

“In 2010 we did a study that showed radiometric sorting could increase the grade by about 1.7 times – that’s a huge uplift.

“But the technology has improved massively since then, the sensors are smaller, the computing power and processing power has stepped up radically but there’s been no more test work on how to increase the grade with sorting.

“So, my first goal is to get in and establish some test work around upgrading the ore grade.”

For the first 10-15 years, the company is contemplating mining the high-grade parts of the resource and looking at a tank leach instead of a heap leach.

“That implies some capital costs, but it gives you much better recoveries, much faster processing routes, and in general really improves the economics of a project,” Dr Tunks says.

A-Cap will also look at alternative sorting technologies to remove of feldspar which previously consumed a considerable amount of acid in the processing phase. This will have the dual benefit of further increasing the uranium grade.

“We’ll be using sorting to not only upgrade the uranium, but to get rid of the acid consuming minerals and I think these two steps can make absolutely fundamental difference to the economics of this project.

“If you combine that with what’s happening to Uranium coming back into the fold and being an exciting commodity again, I think this project is absolutely a go-er.

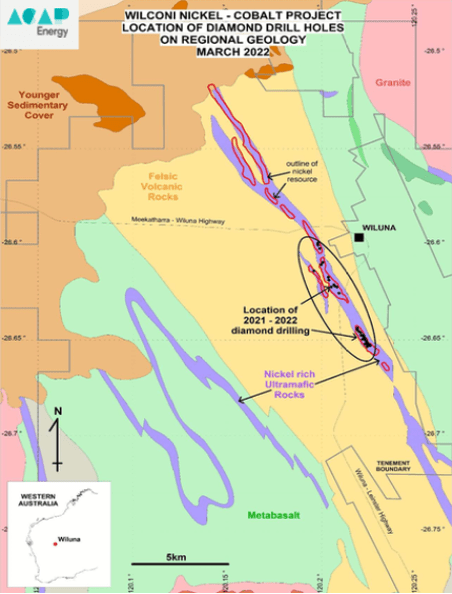

At the company’s Wilconi nickel-cobalt joint venture with Wiluna Mining Corporation (ASX:WMC), drilling is expected to recommence in the next month or so.

That resource is also huge and shallow and is about 15kms long and still open to the north and south, Dr Tunks says.

“Although these deposits are different commodities with one being uranium, the other one being nickel-cobalt, in many other ways they are very similar,” he says.

“They are giant deposits, with enormous amounts of contained metal, they are flat lying, they are near the surface, and they can be mined without drilling and blasting – so very cheaply.

“With nickel laterites, the key to unlocking that value is in the metallurgy and processing, so we’re currently doing test work with our partners and looking at a whole bunch of different possible metallurgical scenarios.”

With nickel and cobalt demand being driven by the renewable energy space, the company has two different avenues to low carbon energy.

“Nickel and cobalt are vital in the lithium battery world, used in the cathodes of the lithium batteries there is really no alternative with the current technology, so they are crucial metals if we want to progress to a more renewable energy storage solution,” Dr Tunks says.

“If you want a lithium battery in your home and in your car, then nickel and cobalt are essential.”

This article was developed in collaboration with A-Cap Energy Ltd, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.