63.5Mt and counting: Latin Resources records one of biggest lithium hits to date as it gears up for Salinas resource update

Mining

Mining

Special Report: Ongoing resource drilling at Latin Resources’ Colina deposit continues to deliver consistent and thick spodumene-bearing intersections.

Latin Resources (ASX:LRS) was one of the best lithium performers in 2023, benefiting from growing interest in the Brazilian spodumene industry which has emerged as one of the largest hard rock lithium producers outside Western Australia and Africa.

The company’s Salinas project boasts a 63.5Mt at 1.3% Li2O resource, around two thirds of that indicated and measured. Including Fog’s Block, LRS is sitting on more than 70Mt at a grade of 1.27% Li2O, competitive with operations founds in jurisdictions such as WA.

A DFS is due for completion in mid 2024 after A preliminary economic assessment (like a scoping study) suggested the mine had the potential to produce 405,000 tpa of 5.5% Li2O spodumene concentrate a year and 123,000 tpa of 3% Li2O concentrate at an all-in sustaining cost of US$536/t with Phase 1 capex of US$253m, targeting first production in 2026.

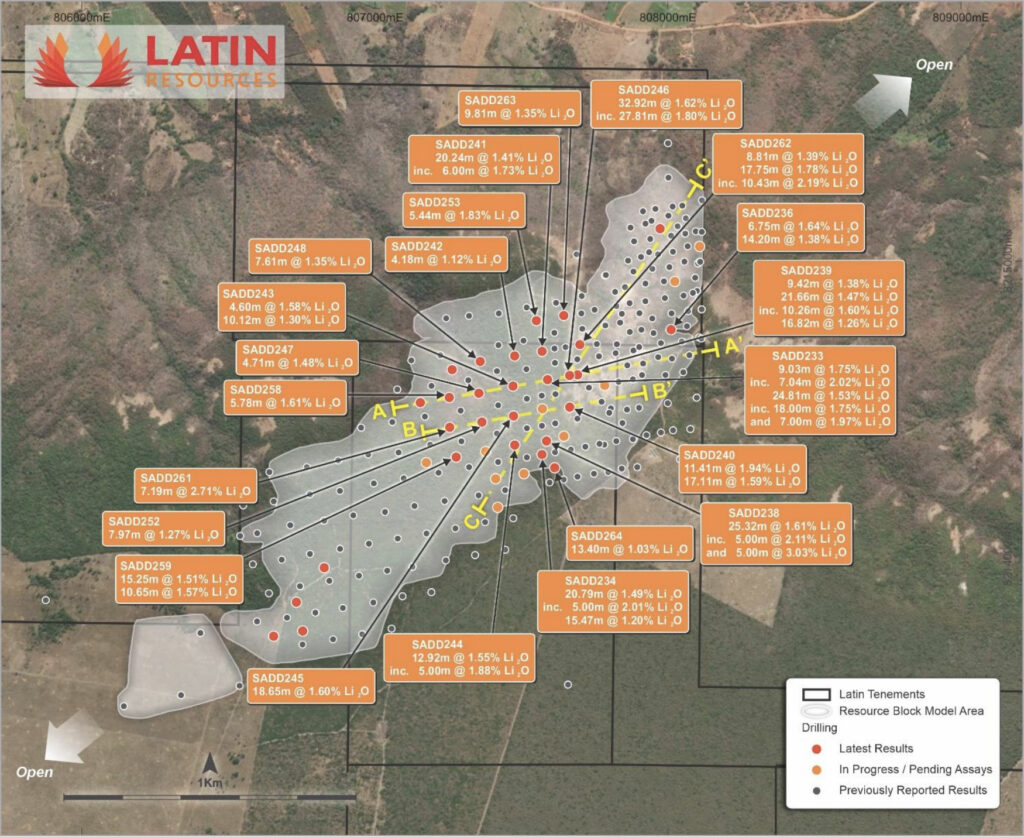

The latest round of assays results from resource definition drilling, which started in December, has returned one of the largest continuous intersections ever encountered at Salinas.

Hole SADD246 returned 32.92m @ 1.62% Li2O from 325.19m, closely matching existing data and confirming the robustness of early interpretations for the Colina pegmatites.

Another 29 completed diamond drill holes returned thick hits including:

The pegmatite intersections demonstrate that 75%, or 48.3Mt, of the current resource is derived from pegmatites greater than 5m true thickness, while another 39% or 24.8Mt of the December 2023 resource estimate derived from pegmatites greater than 15m thickness.

To date, 323 diamond core holes have been completed for 104,662m at the Salinas project with 306 diamond holes for 98,454m carried out at the Colina deposit alone.

“With infill drilling almost complete, we are gearing up to run our next mineral resource estimate,” LRS vice president of operations – Americas Tony Greenaway says.

“This update will be focused on increasing the JORC mineral classification of the existing 63.5Mt resource to enable the declaration of mineral reserves as part of the DFS which is currently underway.

“Once the infill drilling is completed, we will refocus some of our drilling fleet back onto our high priority exploration target at Planalto, where our first drill hole intersected thick high-grade mineralisation.”

With 16 rigs on site, LRS says the drilling programs will continue throughout 2024 and encompass resource definition, metallurgical and geotechnical aspects to increase tonnage and upgrade the confidence level in the current Colina model.

LRS also hopes to identify and validate new priority drill targets across Colina, Planalto, Salinas South and Fog’s Block.

The fourth resource update for Colina is planned for Q2.

This article was developed in collaboration with Latin Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.