You might be interested in

Coinhead

Animoca Brands reveals strong financial position as it looks to capitalise on a big web3 year

Coinhead

The Bitcoin Halving: This Time it’s Institutional – coming to a crypto portfolio near you

News

Coinhead

Binned your Blockfolio app in disgust yet? With Bitcoin dumping below US$30K for the first time in four weeks and the crypto market looking shakier by the second, we’ve rounded up some intel to help you make sense of it all.

At the time of writing, Bitcoin is playing musical chairs and looking for somewhere to sit. It’s been nervously bumping around in the mid-29Ks, and is currently at US$29,765.

Consensus across the more technical of crypto analysts indicates there is not much to prop up Bitcoin below US$29K and above an old area of all-time-high interest – US$20K.

That said, Dutch trader Michaël van de Poppe still believes Bitcoin is a decent chance of bottoming out around this current area. In one of his latest YouTube videos, the analyst also said that if it does break below US$28K, the next level down with potential to hold could be the US$24,000 mark.

#Bitcoin lost the $31K support zone and is at the next area of support.

Full explanation was granted yesterday:https://t.co/cEg1ZRGmsc pic.twitter.com/c6sZDtj7fB

— Michaël van de Poppe (@CryptoMichNL) July 20, 2021

Another respected analyst, Arcane Bear, however, thinks Bitcoin has moved out of Phase D of the Wyckoff redistribution pattern. This would indicate some pretty dramatic downside to come very soon.

If it’s true that Bitcoin is in a Wyckoff redistribution scheme and not the reaccumulation pattern many have believed it’s been in for a few months, then US$20K could indeed be on the cards.

The Wyckoff charts are based on market movements identified some 100 years ago by Richard D. Wyckoff, an American pioneer of technical analysis.

– #Bitcoin is going lower,

We have exited Phase D of the #Wyckoff Redistribution

Hoe you are set for the downside!

Big shoutout to our awesome private member @FreddieOctopus for helping us keep this visual representation so slick! pic.twitter.com/Jq8U8rXo7p

— ArcaneBear.sol/.eth🔺👽 (@arcanebear) July 20, 2021

If drawing triangles on charts isn’t your bag, on-chain data can be a good way to try to figure out what’s happening in the market. Crypto intelligence platform Glassnode has just put out its latest weekly report, by analyst Checkmate. Here are some takeaways…

Bearish

• Glassnode’s Grayscale Bitcoin Premium chart shows that even though GBTC is trading at a premium discount as low as -15.3%, there is presently a lack of demand from institutional buyers.

• On-chain activity is “extremely muted” for Bitcoin, dipping sharply this week and significantly lower than it has been for months.

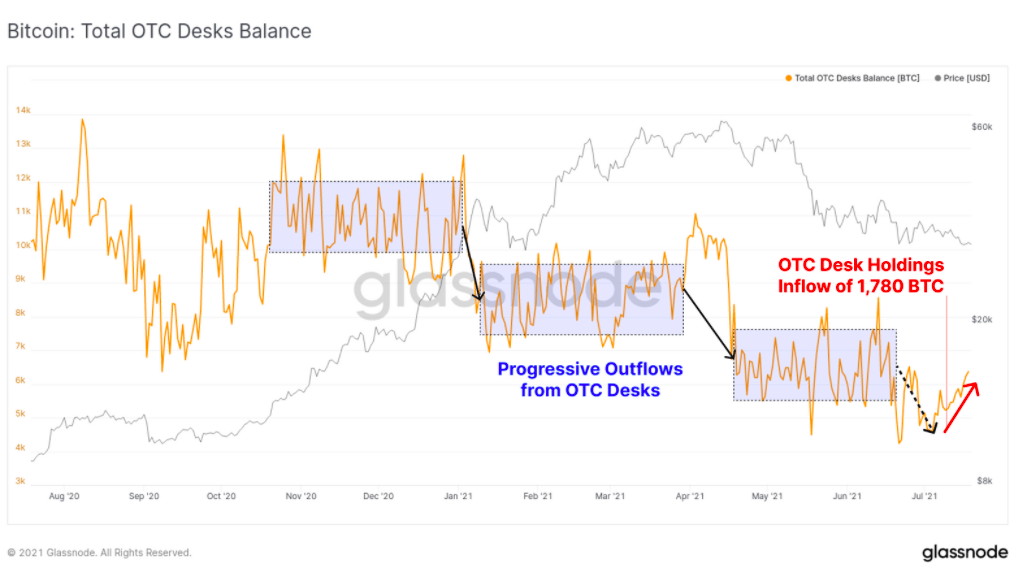

• OTC (over the counter) desk inflows have been increasing lately. Institutions typically buy Bitcoin OTC, so could it mean they’re moving the asset for a sell-off? It’s not a confirmed trend reversal yet.

Bullish

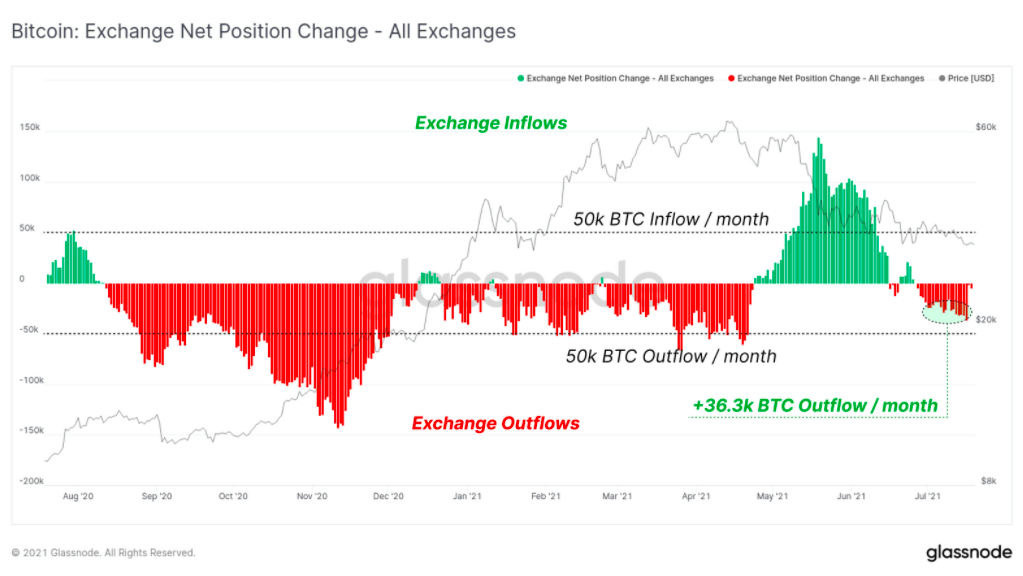

• In contrast, crypto exchanges are seeing an increase of net outflows. This could mean there are some significant diamond-handed investors moving BTC off exchanges to HODL.

• Bitcoin miners have stopped selling and have begun accumulating again, despite likely cost of the “Great Migration” out of China, where they’re no longer authorised to operate.

The famed Bitcoin Stock-to-Flow model, created by pseudonymous quantitative analyst PlanB is a (very) bullish chart that maps Bitcoin’s long-term price targets. It’s been historically accurate, but has it just been invalidated with this week’s price dip?

According to the chart, Bitcoin’s price should be sitting more in the vicinity of about US$88,000 right about now.

It’s moved away from the model before, but this is a very hefty deflection to the downside that has some chart watchers questioning if it’s time to bin the model for good.

Having been uncharacteristically cagey about it recently, PlanB was defending the model today and calling for a bounce.

Earlier this year, the chart’s creator suggested Bitcoin could hit US$450,000 by the end of the year, with a worst-case scenario of US$135,000.

My thoughts exactly. Also see March 2019, when I created S2F model at the bottom of the bear market .. large deviation and certainly not broken. I bet on a bounce (again).

— PlanB (@100trillionUSD) July 20, 2021

Fears surrounding the spread of the Delta variant virus have been creating havoc in more traditional markets in the past 24 hours, sending stocks plummeting.

And while the cryptoverse is also in a sea of red right now, it still likes to frame Bitcoin as a longterm safe-haven asset that isn’t, or ultimately won’t be, correlated to the fluctuations of the S&P 500.

There’s always a handy comment on Twitter to support this…

New FUD narrative that I am seeing across headlines- people are selling #Bitcoin because of Covid.

We have now returned to the "Bitcoin is correlated argument."

Even though it was clearly not correlated for months.https://t.co/OBeeNx3kg0

— The Wolf Of All Streets (@scottmelker) July 20, 2021

And it’s always just as easy to find the counter argument…

Today as risk assets tanked investors took shelter in their safe haven of choice. The Japanese yen, Swiss franc, U.S. dollar, Treasuries, and #gold all traded higher on the day. You will notice that investors didn't seek refuge in #Bitcoin, as it's a risk asset not a safe haven!

— Peter Schiff (@PeterSchiff) July 19, 2021

“Rebellions are built on hope”… right?

There’s really no sugar-coating the technicals at present, but here are some news bites from today that might keep you going…

• MasterCard has announced a partnership with peer-to-peer payments technology Circle to settle USDC payments. The stablecoin will be a bridge between crypto assets and fiat money.

• Grayscale is launching a new DeFi fund in partnership with CoinDesk indexes. The fund will include Uniswap, Aave, Compound, Curve, Synthetix and more.

• JP Morgan, the US investment bank, is reportedly on a new hiring spree for its blockchain division. Despite the bearish OTC data from Glassnode, institutional plays keep grabbing headlines.

Jai Bhavnani, the founder of DAO and DeFi protocol Rari Capital (RGT), gave Stockhead his take on things at the moment, in a brief Discord chat.

“Honestly, having been through the 2018 bear market, I’m excited to just build heads down,” said Bhavnani. “I think we saw a lot of froth, crap and even scam projects come out over the past few months and a bear market should flush it out.

“[It should also flush out] all of the people who aren’t true believers, and leave those of us who are here to change the way finance works to actually do it,” he added.

Fighting talk. And there’s been plenty of it elsewhere in the cryptoverse today, too.

The worst part about bitcoin's price dropping is that we have to listen to bears claim victory while they completely ignore the fact that the asset is up 220% over the last 12 months.

— Pomp 🌪 (@APompliano) July 20, 2021

We're all a part of generation Ethereum ⟠

— sassal.eth 🦇🔊🐼 (@sassal0x) July 20, 2021

You can’t take it with you, unless it’s #bitcoin.

— Michael Saylor⚡️ (@saylor) July 20, 2021

At press time, Bitcoin (BTC) was down 3.62% in the past 24 hours, while Ethereum (ETH) was -2.62%, trading at US$1,782.

After a spurt of positive activity yesterday on the back of its Webull platform listing, privacy coin Dash (DASH) sold off to become one of the day’s biggest losers in the top 100 by market cap, down 12.1%.

Meanwhile, Axie Infinity (AXS), THORChain (RUNE), Kusama (KSM), Decentraland (MANA) and just about every other top 100 coin you like, were all having a day to forget.