What the ETF? Australian ETF industry falls in value in September

Pic: Getty Images

- The Australian ETF industry fell in value in September despite positive inflows as share markets declined

- ASX ETF value decreased 11% month on month for a total of $9.1 billion in September

- Fixed income and cash ETFs receive largest share of industry inflows reversing trend of focus on equity ETFs

Despite positive buying from investors, the Australian ETF industry declined in value in September following sharp sharemarket declines.

According to BetaShares’ latest monthly Australian ETF industry report, assets under management (AUM) fell 4.3% (-$5.6 billion) month on month with total industry market capitalisation at $124.4B at end September.

Despite significant global market volatility on the back of inflation and recession concerns, industry flows remained positive, although as per September were muted, with $800 million of net flows for the month.

ASX ETF trading value decreased 11% month on month for a total of $9.1 billion.

With continued asset value depreciation, industry growth over the last 12 months is now flat, recording a small decline year on year of 0.7% or -$0.9B.

As Stockhead’s Eddy Sunarto so aptly put it risk assets all over the world were crushed in September with rising interest rates to combat stubborn inflation sparking recession concerns. All 11 sectors on the ASX were down in September with the S&P/ASX 200 (ASX:XJO) down more than 7% for the month.

Leveraged short equities top performers

Given the significant falls in global sharemarkets in September, the best performing funds were all leveraged short equities products, including Global X Ultra Short Nasdaq 100 Hedge Fund (ASX:SNAS), which returned 28.3%.

BetaShares US Equities Strong Bear Hedge Fund – Currency Hedged (ASX:BBUS) returned 23% and BetaShares Australian Equities Strong Bear Hedge Fund BBOZ, returned 15%.

The continued strength in the US dollar saw the BetaShares Strong US Dollar Fund Hedge fund (ASX:YANK) also performed strongly.

Fixed Income and cash ETFs popular

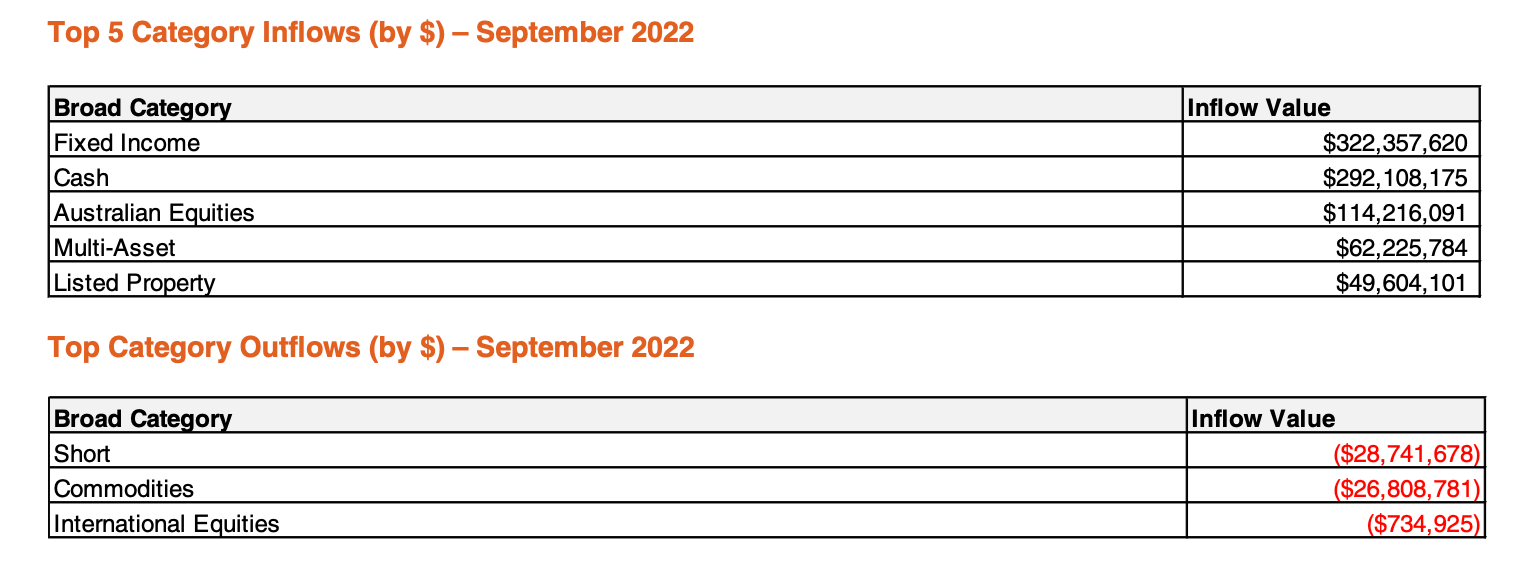

The BetaShares report noted category flows were markedly different in September compared to the trend in the year to date, with fixed income and cash ETFs receiving the lion’s share of industry flows – with more than 50% of the industry’s monthly net inflows between them.

Up until last month the trend has been a focus on equities, but investors are turning to fixed income and cash on the back of rising inflation globally.

With investors remaining cautious on equities and yields continuing to rise it has been high interest cash and floating-rate Australian bond exposures that have seen the highest level of investor interest in September.

Net outflows were recorded in short exposures as investors took advantage of the falling markets to take profits in these positions.

Royalties ETF launched in September

There are now 304 ETF products trading on the ASX. In September there was one new product launched, being the BetaShares Global Royalties ETF (ASX:ROYL).

ROYL expects to hold Universal Music and Warner Music Group, two global music labels which earn royalty income from singers, musicians and other artists.

The two companies own the back catalogues of leading artists like Sting, David Bowie, Bob Dylan and the King of Rock himself. (That’s Elvis.)

Funds still flow into Australian ETF industry

BetaShares chief commercial officer Ilan Israelstam told Stockhead despite the volatility investors are still putting money into ETFs.

“Notwithstanding significant market volatility, the ETF industry saw another month of positive flows and new fund launches – continuing two of the key trends of 2022 of positive flows and product development,” he said.

“In terms of overall performance, funds under management for the ETF industry fell last month, with positive inflows insufficient to make up for underlying asset value declines.”

“The fact that flows remain positive in this volatile climate illustrate the extent to which ETFs are continuing to be used as a convenient and cost-effective tool for investors as they seek to meet their investment objectives in all market conditions.”

“In terms of asset allocation, the rise in yields on the back of continued inflationary pressures made fixed income and cash ETFs very topical with investors in September.”

Israelstram said for example, there was strong interest in BetaShares High Interest Cash ETF (ASX:AAA) and the BetaShares Australian Bank Senior Floating Rate Bond ETF (ASX: QPON) during September.

“Overall, there was muted interest in equities ETFs, although our broad market Australia 200 ETF (ASX: A200) did receive strong flows in the month,” he said.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.