This ETF promises access to ‘one of the best kept secrets in finance’ – royalties

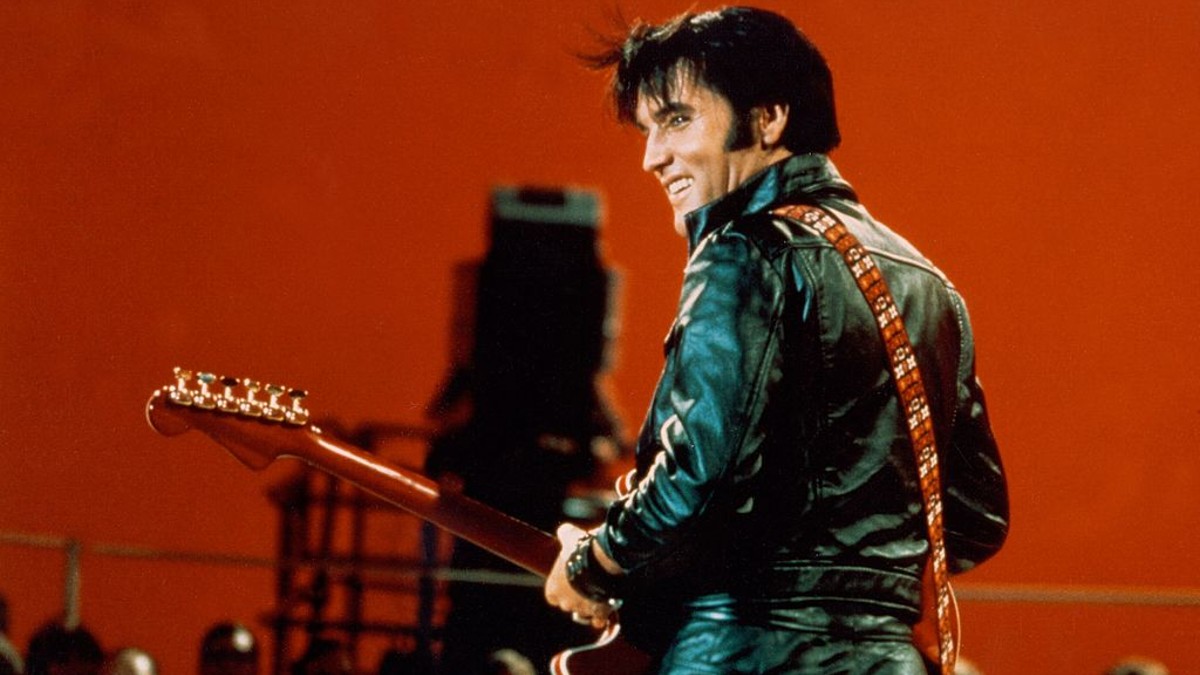

Pic: Getty Imagers

- BetaShares has launched one of the first global products to invest in royalty streams including music, pharmaceutical and mining

- The EFT provider believes ‘royalty companies are one of the best kept secrets in finance’ but have tended to be overlooked by investors

- BetaShares Global Royalties ETF (ROYL) will track the Solactive Global Royalties Index which has returned ~12% p.a. since 2018

Ever thought how cool it would be to get a share of royalties from Elvis Presley’s music? The rise of Exchange Traded Funds is continuing with BetaShares announcing this time it plans to launch a world-first global royalties ETF on the ASX in September.

BetaShares Global Royalties ETF (ROYL) expects to hold Universal Music and Warner Music Group, two global music labels which earn royalty income from singers, musicians and other artists. The two companies own the back catalogues of leading artists like Sting, David Bowie, Bob Dylan and the King of Rock himself.

In a broad definition royalties are payments made to owners of an asset by others wishing to use it. While many people will associate royalties with the music industry, it includes mining royalties as well as intellectual property (IP) and tangible royalties.

Mining royalties generally relate to mining companies selling royalty interests in future production or revenues in return for an up-front or ongoing cash payment.

IP and tangible royalties are paid to the owner of IP rights, such as music, authors, biotech and IT or physical assets, for licensed use of those rights or assets. Forbes lists Michael Jackson and Prince among highest paid deceased musicians along with Bing Cosby (is it really Christmas without playing Bing classics). Children’s authors Roald Dahl and Dr Suess also continue to earn pretty good pay packets beyond the grave.

As Stockhead’s The Secret Broker (who professes to love royalty payments) discovered deep in the middle of the night recently, there’s even a royalty to keep your breath fresh. Listerine, which has been around since 1879 and started life as a surgical antiseptic before being adapted to a mouthwash, has a royalty share listed on an over the counter (OTC) exchange.

First ETF to track royalty companies

The fund will track the Solactive Global Royalties Index, providing what BetaShares describes as an exposure that is a unique and attractive investment opportunity, albeit one that remains undiscovered by a majority of investors.

According to BetaShares, since inception on November 7, 2018 to July 31, 2022, the index that ROYL aims to track has returned 12.2% p.a. (vs. the MSCI World Index’s return of 10.8% p.a.).

BetaShares CEO Alex Vynokur said ROYL will be the first ETF in the world which provides exposure to a portfolio of royalty companies across multiple sectors, including mining and energy, music, medical and biopharma technology.

While not always household names themselves, royalty companies often earn substantial revenue. Examples of companies that ROYL expects to hold include:

- Royalty Pharma which owns a portfolio of pharmaceutical royalties for more than 35 drugs and therapies marketed by leading brands like AstraZeneca, Roche, GSK, Pfizer and Johnson & Johnson. These pharmaceutical drugs are helping treat a range of common, chronic and rare illnesses like diabetes, asthma, migraines and a range of cancers.

- Global music labels Universal Music and Warner Music Group which earn royalty income from singers, musicians and other artists. The two companies own the back catalogues of artists like Sting, David Bowie, Bob Dylan and Elvis Presley.

- Deterra Royalties that derives its revenue from BHP’s Mining Area C, a project that will form the largest operating iron ore hub in the world, and

- Franco-Nevada Corporation, gold-focussed royalty and streaming company based in North America.

Attractive fundamentals of royalty companies

BetaShares said royalty companies generally display attractive fundamentals, including strong and recurring cashflow, high gross margins, strong debt servicing, and high return on capital. These companies also tend to have limited exposure to operational and business risks associated with generating the revenue linked to their royalty payments and consequently lower return volatility compared to the underlying businesses through which they generate their revenues.

Vynokur said the new Global Royalties ETF will offer investors an innovative way to gain exposure to a portfolio of companies with attractive fundamentals and the potential to benefit from inflationary environments.

“We believe Royalty companies are one of the best kept secrets in finance,” he said.

“Royalty companies generally allow investors to maintain exposure to the underlying sources of revenue growth for key sectors while at the same time mitigating operational and business risks including rising input costs associated with generating that revenue. As a result, royalty companies tend to display attractive fundamental qualities and opportunity to benefit from inflationary environments where prices are rising.”

He said for many investors, royalty companies have tended to fly under the radar despite their long history of value creation.

“The innovative nature of ROYL is expected to offer investors exposure to the royalty income associated with cutting edge pharmaceutical drugs, carbon credits, the music of hit artists like Sting, Bob Dylan and David Bowie as well as the extraction of gold, precious metals and iron ore,” Vynokur said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.