WHAT THE ETF? Aussie industry sets AUM record in January, and it was led by… crypto?

You guys have some cojones. Picture: Getty Images

- Australia’s ETF industry sets record in January with assets under management (AUM) rising to $138.5 billion

- Rally was in line with a broader trend across global markets during first month of 2023

- Fixed income continues to be in favour as Aussie equities see net outflows in January

The global sharemarket rebound in January and net investor inflows caused the Australian ETF industry to grow to a new all-time high in assets under management (AUM) of $138.5 billion.

According to the latest BetaShares monthly Australian ETF industry report, AUM grew 3.6%, for a total monthly market cap increase of $4.7 billion.

Ending January at $138.5 billon, AUM eclipsed the all-time record set back in December 2021 of $136.9 billion.

BetaShares chief commercial officer Ilan Israelstam said the Aussie ETF industry is off to a great start for 2023.

“This year started with a bang for the Australian ETF industry with assets under management reaching a new all-time high on the back of a global sharemarket rebound and new money from investors,” he said.

“In a classic example of what a difference a year makes, the month just passed was a far better result than January 2022 when global sharemarkets sold off heavily.”

Market rally leads to growth

AUM for the ETF sector fell in December after the traditional market rally failed to eventuate. However, it has been a different story for January with the sharemarket rally contributing to the bulk of industry growth, with only ~12% of the growth attributable to net flows (net new money) amounting to $600 million.

ASX ETF trading value increased 5.1% month on month for a total of $7 billion, which the report noted was a decent result given the typically lighter January summer period.

Industry growth over the last 12 months remains positive, albeit slow, with an increase of 5.1% year on year, or $6.7 billion.

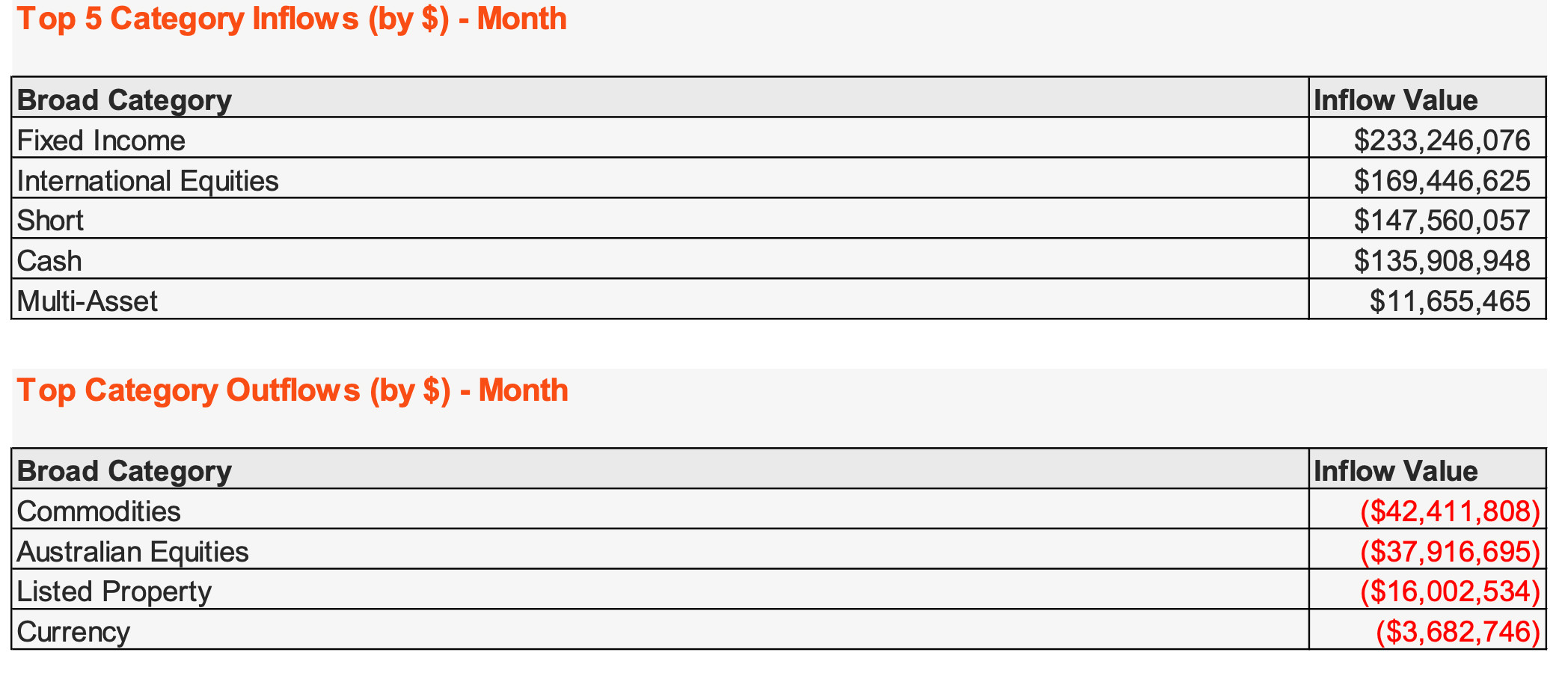

Fixed income receives highest inflows

As has been the case for the last few months, the fixed income category received the highest level of inflows of $233 million followed by international equities with $169 million.

The usually popular Australian equities category, however, received net outflows of $38 million.

“In a change from last year, Australian equities saw net outflows after being in hot demand over the course of 2022, while fixed income and international equities received the highest level of inflows for the month,” Israelstam said.

Notably, however, and notwithstanding the strong gains for the month, investors continued to buy short exposures which received ~$150m of net inflows, potentially illustrating that investors believe the worst is not yet over for the sharemarkets.

“That being said, there were still solid flows into short funds last month, perhaps illustrating that some ETF investors believe the worst is not yet over for markets,” Israelstam said.

Crypto and tech stage a turnaround to start 2023

It was a much better month for performance in the crypto sector which as Stockhead’s Rob Badman reported, staged a significant turnaround from the doom and gloom in November and December last year.

The Betashares Crypto Innovators ETF (ASX: CRYP) was the best performing ETF in January, returning ~48% for the month.

Tech also rebounded heavily, resulting in tech-focused exposures rallying – the Betashares Online Retail & E-Commerce ETF (ASX: IBUY), for example, returned 15% for the month.

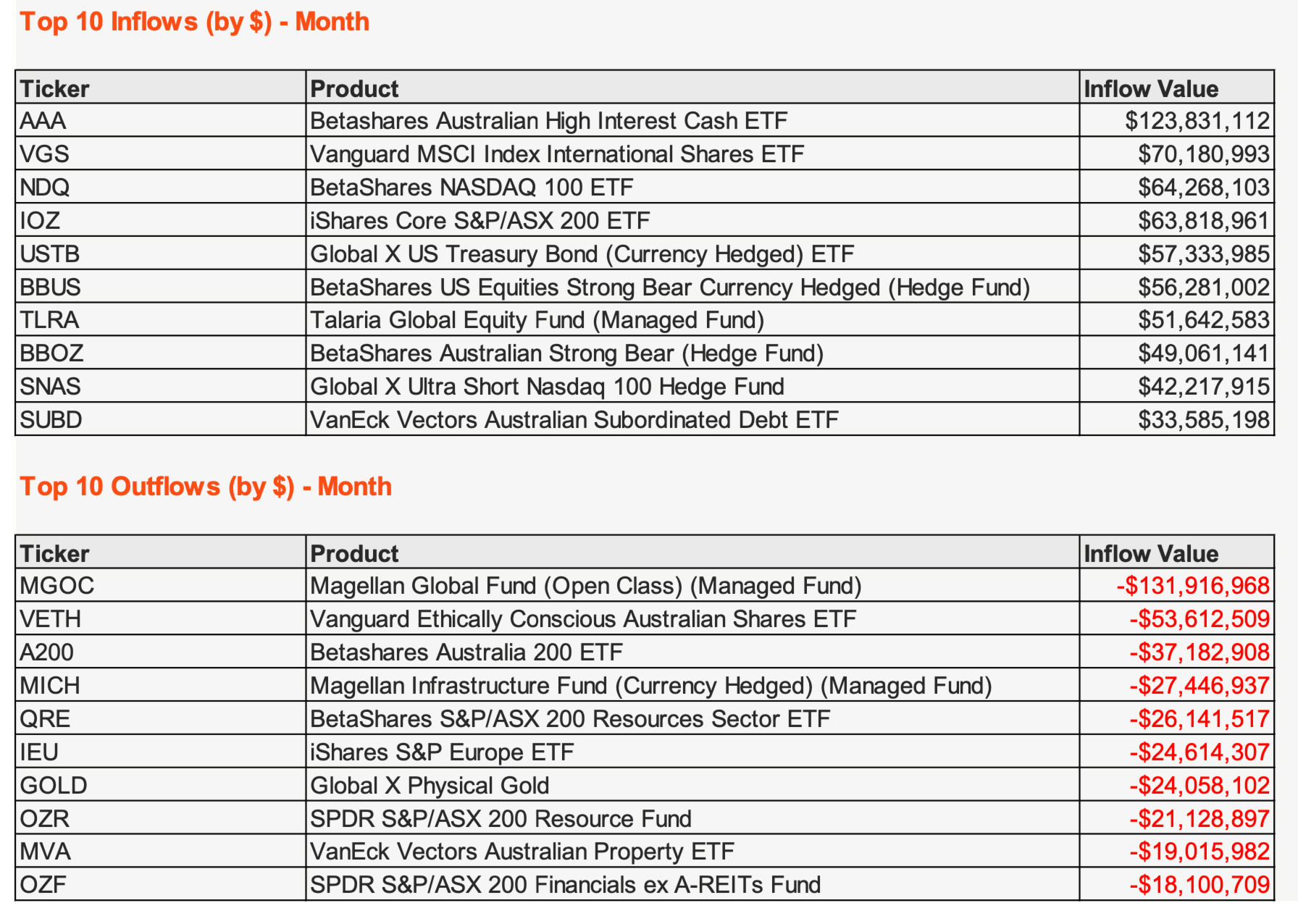

In terms of specific funds, the Betashares High Interest Cash ETF (ASX:AAA) topped the leaderboard in terms of flows, as investors took advantage of higher yields on cash.

New product launches

Three new products were launched in January, all of which were active ETFs. Two new issuers entered the ETF industry.

New Zealand founded Milford launched the Australian Absolute Growth (Hedge) Fund (ASX:MFOA) on January 16.

Alphinity Investment Management listed two global equities funds on the ASX – the Alphinity Global Equity Fund (ASX:XALG) and the Alphinity Global Sustainable Equity Fund (ASX:XASG).

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.