What the ETF? No Santa rally for a let down Aussie ETF sector in December

Source: Getty Images

- Australia’s ETF industry comes to end in December with AUM falls 1.8% for the month

- Fall was in line with a broader trend across global markets during last month of 2022

- There was a move to ETFs offering exposure to fixed income and cash over December

Oh where oh where did our Santa rally go? That was the question among Australia’s ETF industry for December which declined in line with markets after the traditional December rally failed to eventuate in the final month of a tumultuous year for global markets.

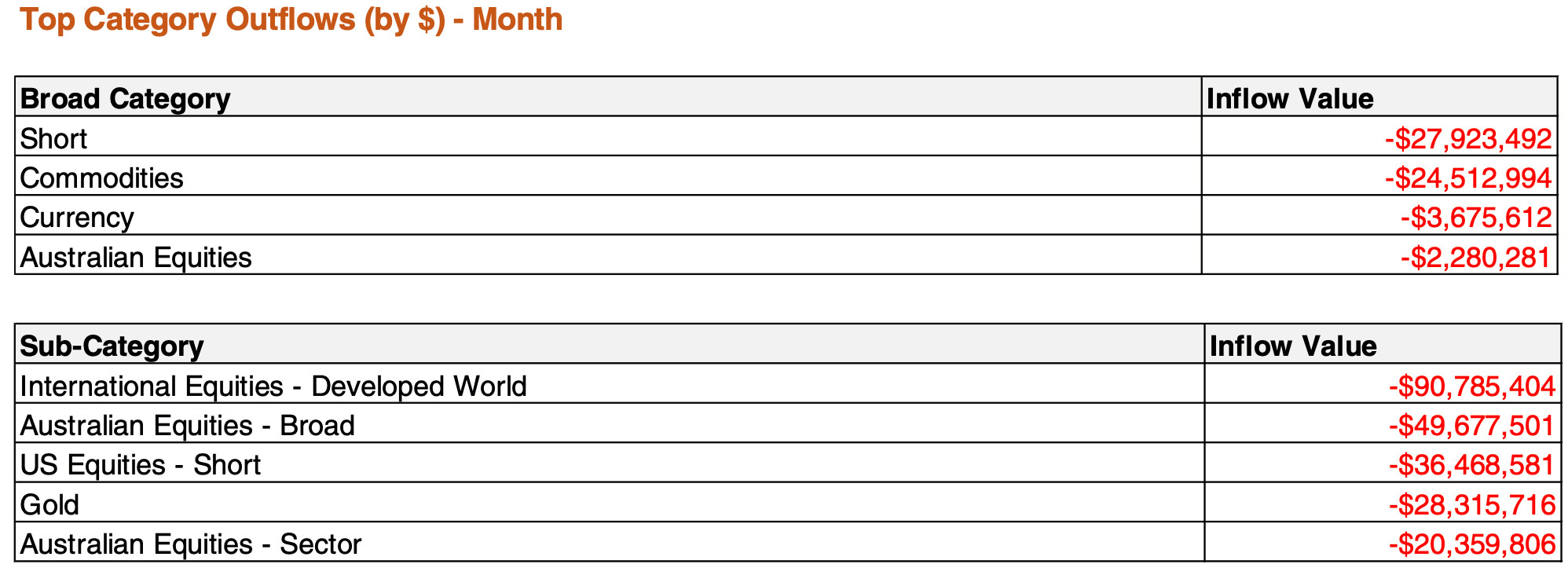

According to the latest BetaShares monthly Australian ETF industry report, assets under management (AUM) fell 1.8% in December for a total monthly market cap decrease of $2.4 billion.

After making gains in October and November markets dropped off in December with investors skeptical heading into 2023, amid talk of a global economic slowdown, the ongoing war in Ukraine and an unknown impact of China’s loosening of tough covid-19 restrictions.

However, despite the slowdown BetaShares chief commercial officer Ilan Israelstam said the Aussie ETF sector saw $1.1 billion of net positive inflows in December.

“The month of December was a reflection of the broader trend playing out throughout the 2022 year – strong positive inflows from investors on the one hand offset by declines across global sharemarkets causing the overall industry to fall in value,” he said.

“Notably, despite the volatility, Australian investors continued to turn to ETFs to assist with their long term financial goals.”

End of year product launches

There were nine new products launched in December, including two new active ETFs from JP Morgan and

four single bond products listed on CBOE.

Two funds closed in December, feeling the pinch of a bitterly cold crypto winter. After just launching in June the 3iQ CoinShares Ether Feeder ETF (CBOE:ET3Q) and the 3iQ CoinShares Bitcoin Feeder ETF (CBOE:BT3Q) were removed from quotation on CBOE Australia.

According to its launch statement “the Bitcoin ETF and the Ether ETF aim to provide investors with exposure to bitcoin and ether, respectively, and the daily price movements of the US dollar price of underlying crypto asset and the opportunity for potential long-term capital growth”.

Fixed income ETFs prove popular

There was a significant move to ETFs offering exposure to fixed income and cash over December which has continued in January.

“Investors looked to ETFs like the Betashares Australian High Interest Cash ETF (ASX:AAA) and the Betashares U.S. Treasury Bond 20+ Year ETF (ASX: GGOV),” Israelstam said.

“These exposures are very topical as central bank action continues to dominate investor thinking and news headlines.”

Israelstam said despite the market volatility Overall, 2022 was a strong year for the Australian ETF industry, as investors favoured the convenient and cost-effective investment vehicle to meet their financial objectives.

“There was a total of $13.5 billion in net inflows from investors while the industry launched 53 new products including innovative exposures such as Energy Transition Metals, Solar, and interest rate hedged fixed income,” he said

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.