Domestic bond ETFs in favour as investors get defensive amidst global volatility

Pic: Getty Images

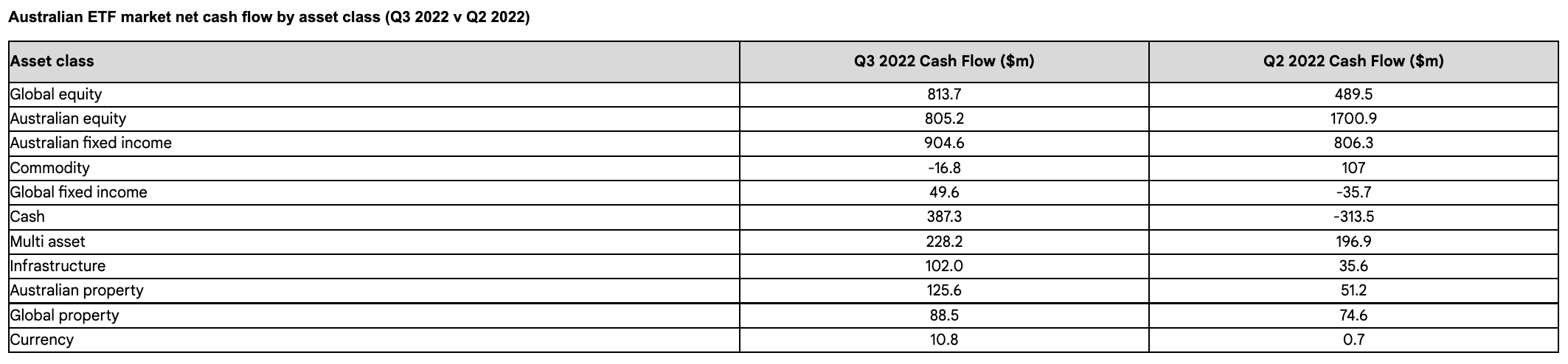

- Domestic bond ETFs receive strongest flows of any asset class in Q3 2022 as investors seek to manage risk

- Global bond ETFs were also back in favour with investors in Q3 receiving $50 million of inflows in Q3

- Online investment advisor Stockspot sees a renewed interest in cash ETFs from clients as interest rates have risen

As global markets continue their gloomy theme for the year domestic bond ETFs experienced the strongest flows of any asset class in Q3 CY22 as investors sought to manage risk amidst the volatility.

In a quarter marked by increasing interest rates, rising inflation and weaker economic growth, investors allocated more of their funds to safer havens such as bonds, according to latest data released by the ASX and Vanguard.

Australian bond ETFs received $905 million in inflows, up 12% since Q2. Global bond ETFs also received $50 million in Q3, which was a big turnaround from Q2 when it experienced negative flows of $36 million.

Domestic equity ETFs out as bond ETFs in favour

Domestic equity ETFs received $805 million in inflows, down 53% from Q2. However, despite the global downturn in markets, international equity ETFs received $814 million in inflows, up 66% from Q2.

In a positive sign, the Australian ETF market expanded in Q3, recording $121 billion in AUM as at September end, an increase of $2.4 billion or 2% from Q2, despite falling asset values.

It has been an unusual year where both bonds and equities have fallen together. When bonds go down, stock prices tend to rise. The opposite also happens – when bond prices rise, stock prices tend to fall.

Vanguard’s Head of ETF Capital Markets, Asia-Pacific, Minh Tieu, said investors have been tested by the unusual positive correlation between bonds and equities this year but there’s good indication that this lockstep is ending.

“Bonds will continue to be an effective portfolio diversifier and resume their role as a long-term source of income given the rise in interest rates,” Tieu said.

“We’re also seeing a preference for high yield and fixed income ETFs as interest rates continue to rise and investors look for sources of income and stability.”

Diversified ETFs: popular in times of uncertainty

Inflows into diversified/multi-asset ETFs increased in Q3, recording $228 million, up 16% since Q2.

“There’s been steady interest in diversified ETFs this quarter, an all-in-one solution for investors who want broad diversification across asset classes and regions tailored to their risk profile,” Tieu said.

“This is consistent with what we typically see – a surge in diversified ETF flows when markets are particularly volatile as investor confidence drops in selecting individual investments.”

He said diversification is a good tonic for uncertainty.

“Our long-term outlook for fixed income and equity markets has improved and if history is any indication, investors who own a balanced portfolio may be rewarded for their patience in due course,” he said.

Despite the move to fixed income and a fall in domestic equities ETFs inflows, the Vanguard Australian Shares Index ETF (ASX:VAS) attracted the most flows of any ETF on the market in Q3, followed by BetaShares Australian High Interest Cash ETF (ASX:AAA).

Tieu said this would be in keeping with investors favouring diversity during this period of market and economic instability over thematics.

“The VAS popularity suggests investors are still favouring broadly diversified ETFs over thematic or leveraged ETFs – a sound strategy particularly in times of heightened volatility where diversification can help to mitigate market risks,” Tieu said.

Tune out to recession noise

There’s no doubt investors are facing a period of heightened anxiety. The ASX is officially in correction mode with the S&P/ASX 200 falling 11% year to date, which is more than the official definition of 10% from its most recent peak.

Other global markets are faring worse and in bear territory, defined as falling 20% or more from recent highs. In the US the S&P 500 is down ~23% year to date.

Tieu has urged investors to try to remain calm during the market volatility and economic uncertainty.

“While you can’t escape talk of recession, the best thing investors can do at present is to tune out the noise and focus on meaningful portfolio diversification,” Tieu said.

“Financial markets are forward-looking and have likely already priced in the threat of recession so there’s little value in attempting to time markets based on daily commentary.

“Investors who remain focused on long-term returns and stay invested even during down markets have a better chance of achieving their investment goals than those who cash out or change tack based on daily market swings.”

Cash ETFs are king during market turbulence

Stockspot senior manager of investments and business initiatives Marc Jocum told Stockhead the online investment advisor, which builds custom portfolios using ETFs, had seen a renewed interest in cash ETFs from clients as interest rates have risen.

“As an example, we’ve seen more clients investing in our Stockspot Savings product which invests in a high interest cash ETF that offers returns above a typical savings account,” Jocum said.

He said it is encouraging to see index ETFs attracting inflows as “we believe these ETFs are safer than actively picking stocks or investing into active ETFs”.

“However, investors need to be wary that just following where the money is going won’t necessarily lead to positive returns.”

“To help cushion falls and protect their capital, investors should stick with a diversified strategy – especially during tough times – that invests in various asset classes like bonds and also gold, international shares and domestic shares.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.