What CBA really thinks of our lithium future, in pics and graphs and such

News

Lithium demand is set to surge in the remainder of this decade because of demand for Li-ion batteries in zero-emissions transport, and energy storage in the power sector.

Upside risks for lithium demand are linked to the commercialisation of solid state batteries. Downside risks for lithium demand reflect the emergence of sodium-ion batteries.

Everyone’s going to want more lithium before the decade is out, says CBA’s legend of lithium and colonel of commodities Vivek Dhar.

“Lithium demand is expected to increase substantially over the remainder of this decade because of demand for Li-ion batteries. Li-ion batteries enable the decarbonisation of the transport and power sectors.

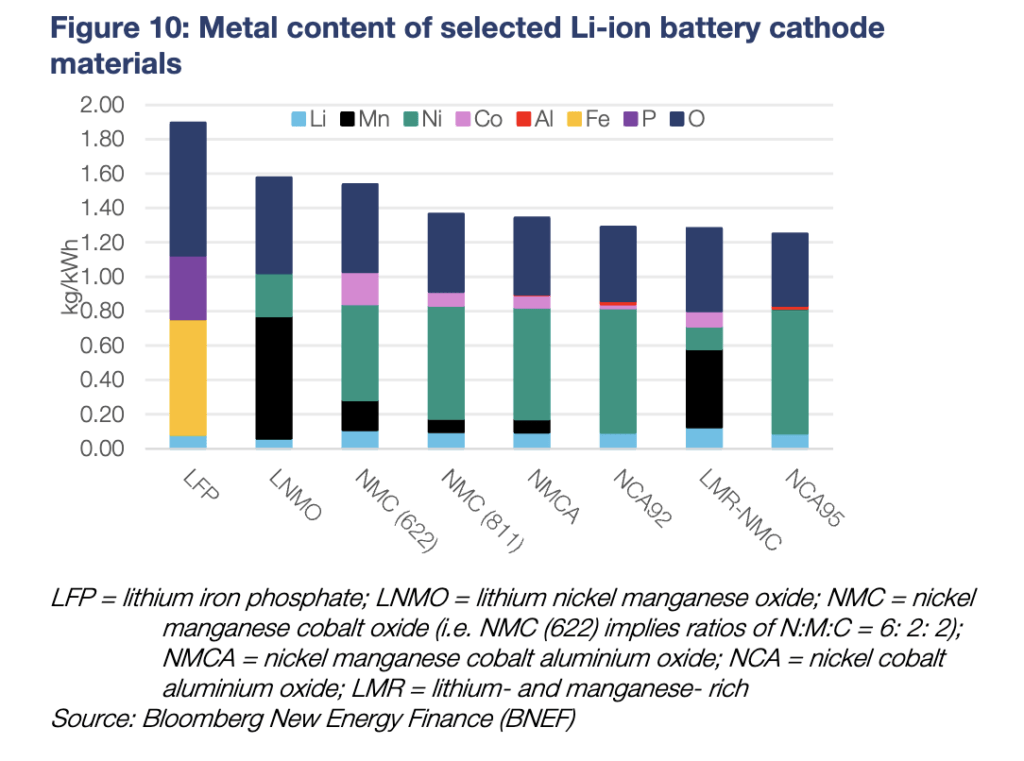

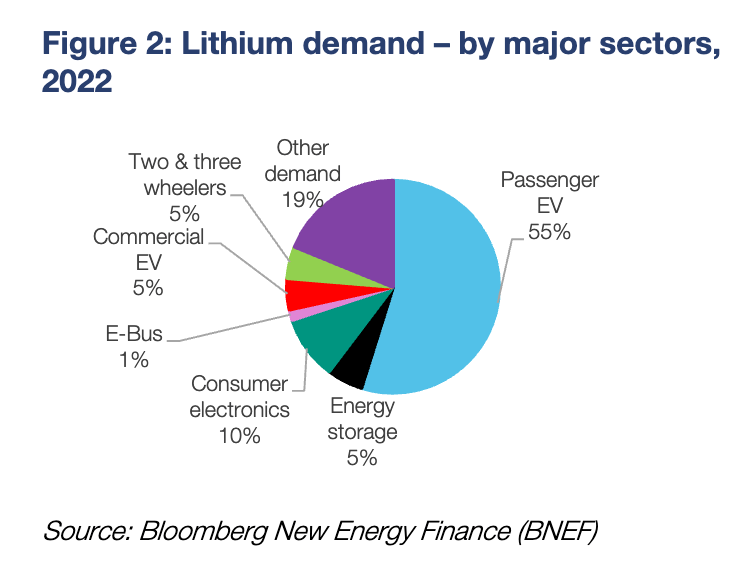

The transport sector (i.e. electric vehicles (EVs)) accounted for two thirds of all lithium demand last year, CBA says. The metal content of Li-ion battery cathode materials ultimately determines lithium demand.

There are broadly 3 major classes of cathode chemistries that dominate industry today

The lithium intensity with these Li-ion battery chemistries are similar…

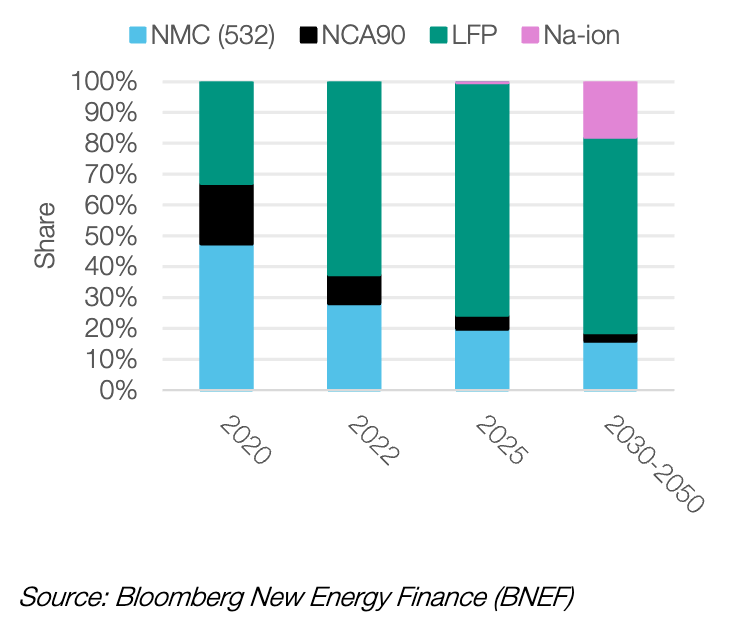

…Of new, low cost battery chemistries like sodium-ion (Na-ion) can reduce lithium demand by more.

Na-ion batteries currently have less energy density than Li-ion chemistries. As such, Na-ion is expected to play a larger role in energy storage in the power sector than zero-emissions transport by 2030.

Here comes the Na-ion boom

Bloomberg (BNEF) estimates that Na-ion battery chemistries will have a share of ~2% by 2030 in passenger EVs and a share of ~18% in energy storage by 2030.

However, lithium intensity per unit of energy is likely to decline 5-10% with these cathode chemistries as improvements are made in battery cell and battery pack technologies.

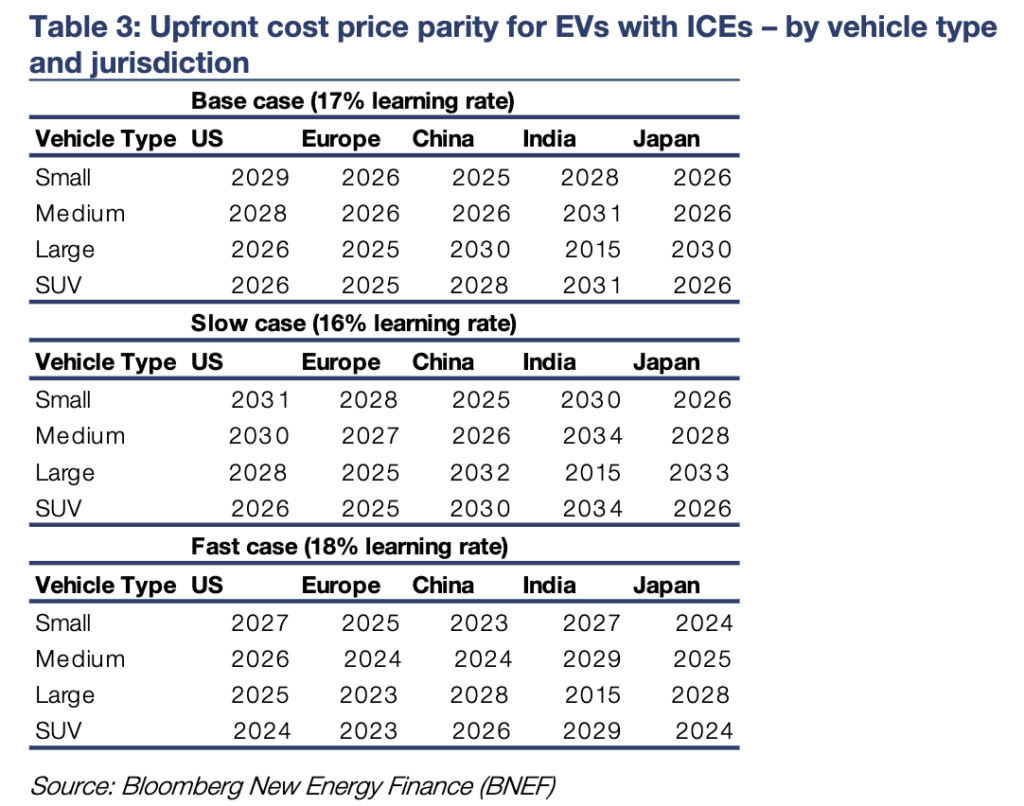

The economics of switching from internal combustion engines (ICEs) to EVs will be a major driver of EV uptake this decade.

According to Bloomberg New Energy Finance (BNEF), the upfront purchase cost of EVs will fall to ICE levels across a number of jurisdictions and vehicle sizes from 2025 to 2030.

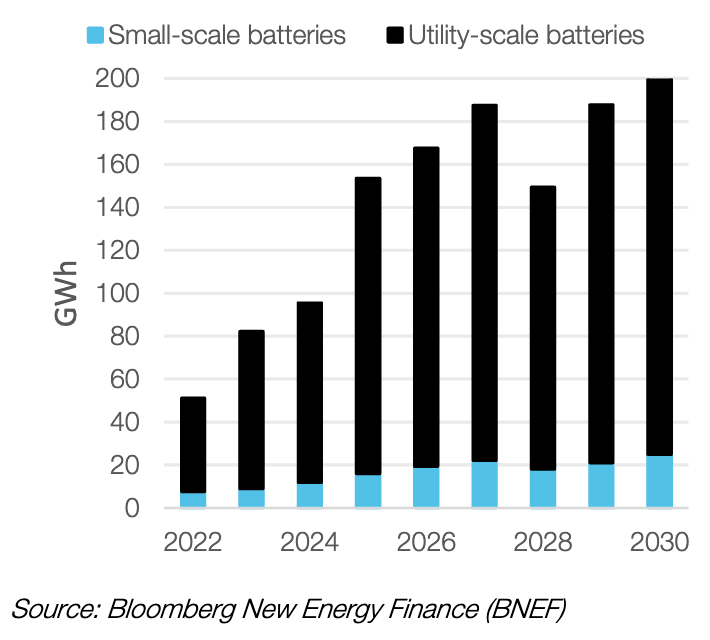

Energy storage applications in the power sector are also expected to increase substantially in coming years.

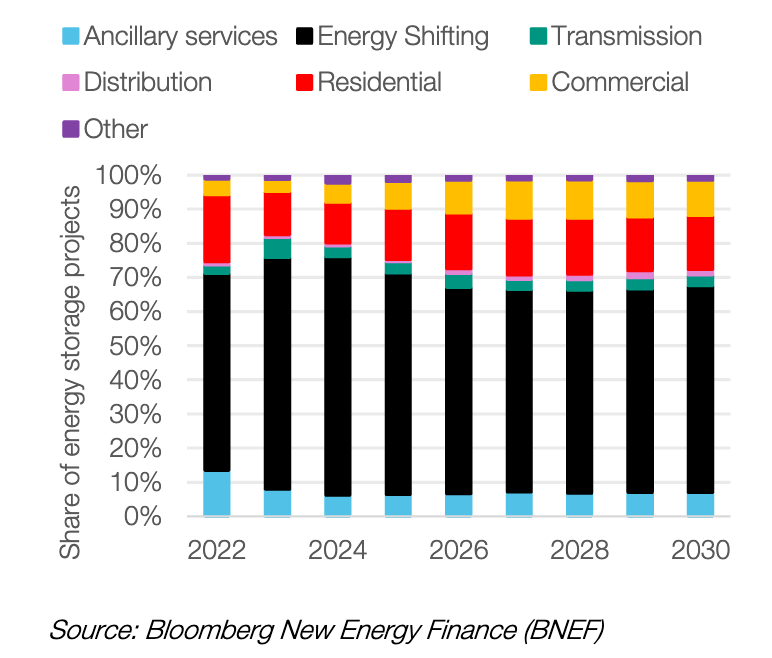

Batteries provide numerous benefits to power grids beyond storing variable solar and wind power.

However, as wind and solar power expand, there will be an increasing need to store this power for use at a later period.

The most popular Li-ion batteries today have a significant variance in raw material needs. However, the lithium required across the different battery chemistries is fairly similar for every unit of energy deployed.

Even by 2030, while there may be technological advances that reduce the lithium required for every unit of energy deployed by 5-10%, a shift away from Li-ion batteries looks unlikely.

“Demand for lithium will therefore be largely driven by climate ambition.”

—

CBA’s Vivek Dhar

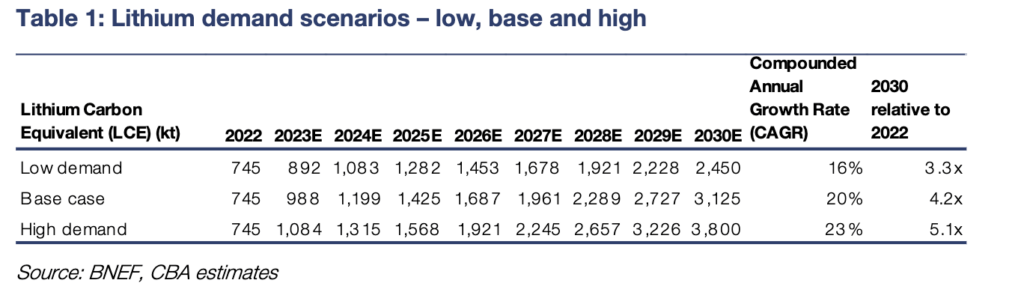

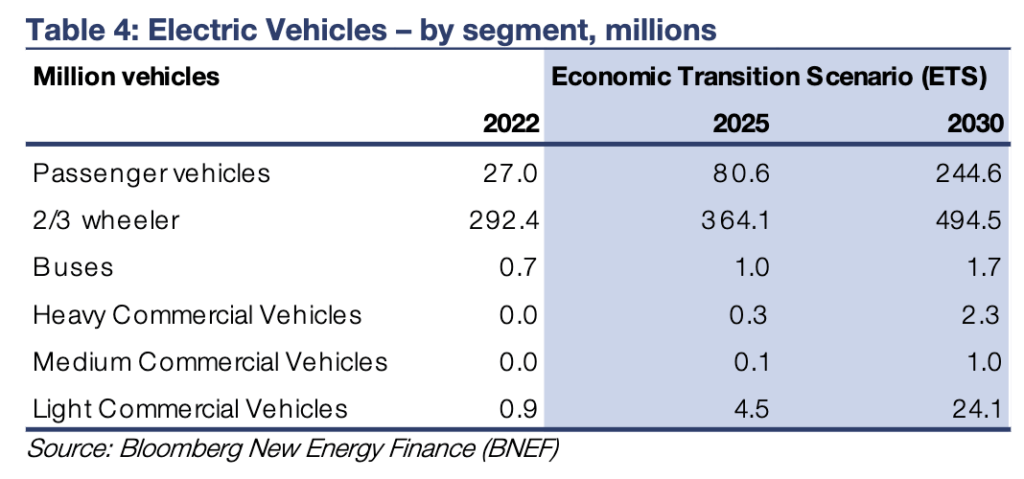

CBA’s Vivek Dhar says his ‘low case for lithium demand aligns with BNEF’s Economic Transition Scenario (ETS), where “techno-economic trends and market forces” drive decarbonisation. This scenario aligns with a 2.6C increase in global temperatures.

“Our high case for lithium demand aligns with BNEF’s Net Zero Scenario (NZS), where decarbonisation technologies are adopted beyond what market forces would suggest in order to keep global temperatures from rising well below 2C.”

Er. So his base case is the mid-point of his low and high case. Just in case that was unclear…

The key risks to our outlook are linked to emerging battery technologies. Upside risks are driven by the commercialisation of solid-state batteries. These batteries move away from liquid electrolytes and ultimately enable next generation anode technology.

The most relevant for lithium demand is the use of lithium metal as the anode.

Downside risks to our outlook are driven by the emergence of sodium-ion batteries. These batteries use sodium in place of lithium, and while they have glaring disadvantages to Li-ion batteries at present, technological advances could see sodium-ion batteries expand significantly by the back end of this decade.

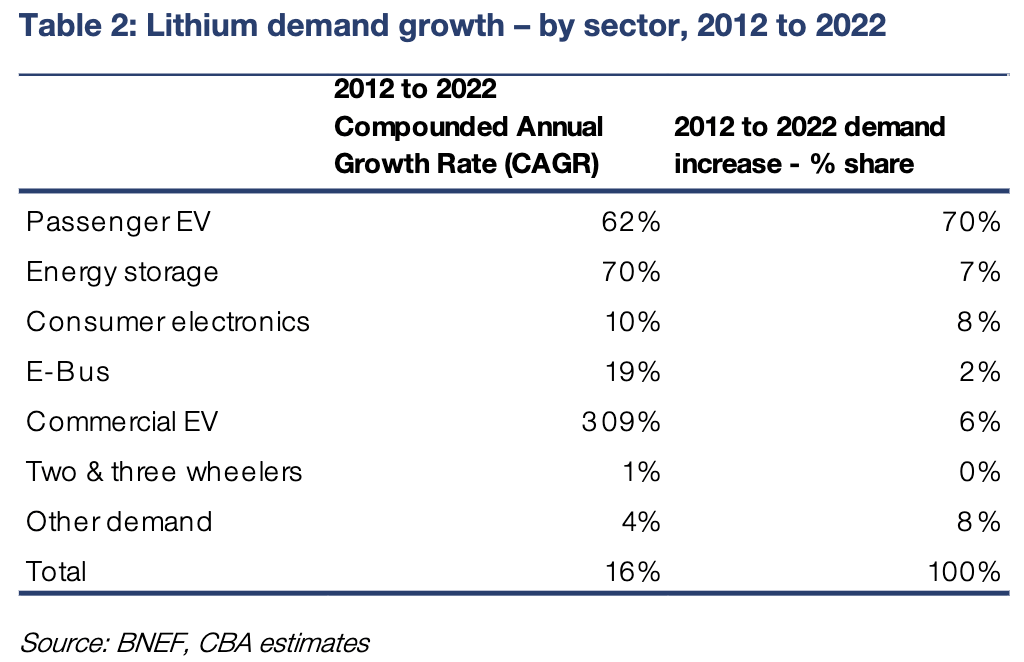

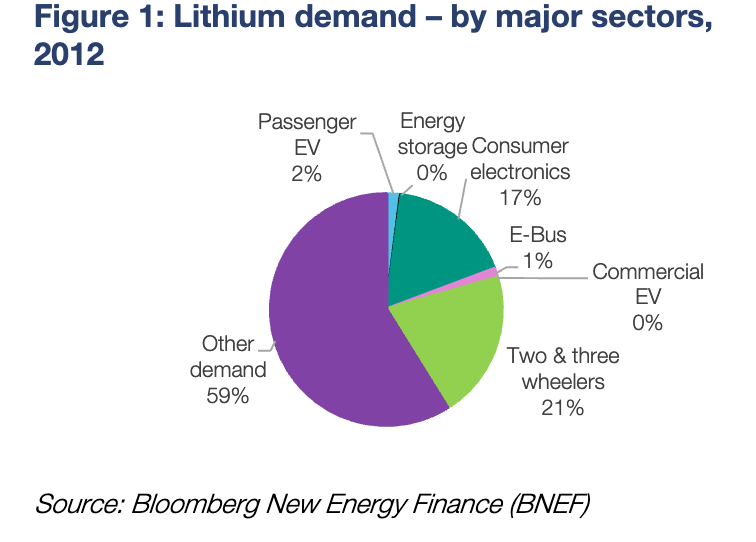

The composition and size of lithium demand has changed dramatically over the last decade.

In 2012, zero-emission transport accounted for not even one quarter (~24%) of global lithium demand. (And the bulk of that zero-emission transport was tied to two and three wheelers).

From 2012 to 2022, global lithium demand surged by 4.5 times or 16% Compounded Annual Growth Rate (CAGR).

The sector that has accounted for the largest increase in lithium consumption has unsurprisingly been passenger electric vehicles (EVs)

The significant uptake of passenger EVs over the past decade stems from the cost reduction in Li-ion battery packs.

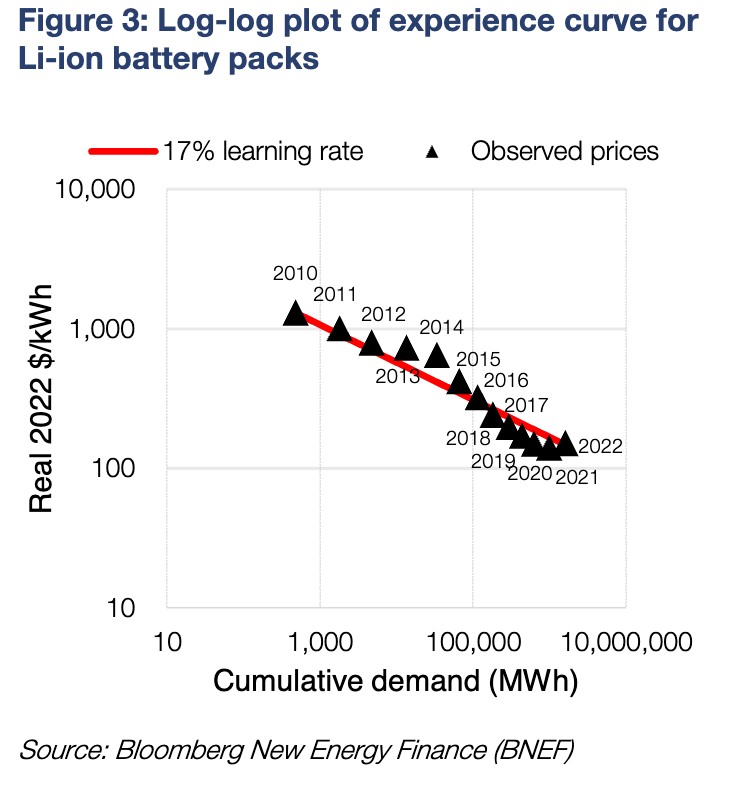

The reduction in battery pack costs relative to the cumulative battery pack demand have shown a 17% learning rate (below).

For context, solar modules have had a learning rate of ~28%. Onshore wind turbines have had a learning rate of ~14%.

Despite the impressive learning rate, the volume-weighted battery pack costs across all sectors lifted by 7% in 2022 because of higher raw material costs. The increase was the first since battery pack costs started to be tracked in 2010. The increase in battery pack costs in 2022 occurred despite rising popularity of lower cost chemistries such as Lithium Ferro-Phosphate (LFP).

However, price movements in early 2023 suggest battery pack costs could resuming decreasing, Vivek says.

Lithium demand for the energy transition is driven by the uptake of the Li-ion battery chemistry (see Appendix A for more details on how a Li-ion battery works). The proliferation of the Li-ion battery chemistry in zero-emission transport and energy storage in the power sector will ultimately determine how quickly lithium demand will grow for the remainder of this decade and beyond.

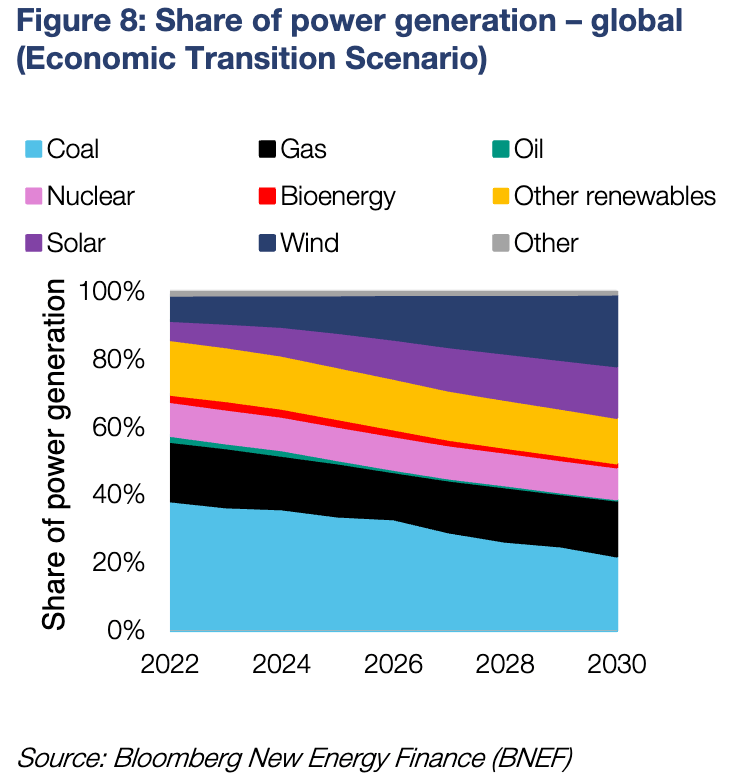

Bloomberg New Energy Finance’s base case outlook –the Economic Transition Scenario (ETS) –assumes that decarbonisation technologies are only adopted “by techno-economic trends and market forces.”

This scenario is consistent with a 2.6C increase in global temperatures relative to the pre-industrial age.

Now Bloomers’ more climate-ambitious Net-Zero Scenario (NZS) models achieving net-zero emissions by 2050. This scenario is consistent with a 1.77C in global temperatures relative to the pre-industrial age. Naturally, the NZS assumes a more aggressive energy transition. This means a much stronger uptake of Li-ion batteries in both the transport and energy storage sector.

Therefore, the NZS means a much larger increase in lithium demand relative to the ETS.

Finally, technological breakthroughs will have an enormous bearing on the energy transition. Breakthroughs in next-generation battery chemistries can boost and restrict lithium demand growth. The key uncertainties are when (and if) these breakthroughs take place, and the timing of commercialisation, especially in scaling up supply chains. These uncertainties likely mean that next-generation battery chemistries are more relevant for post-2030 than the remainder of this decade.

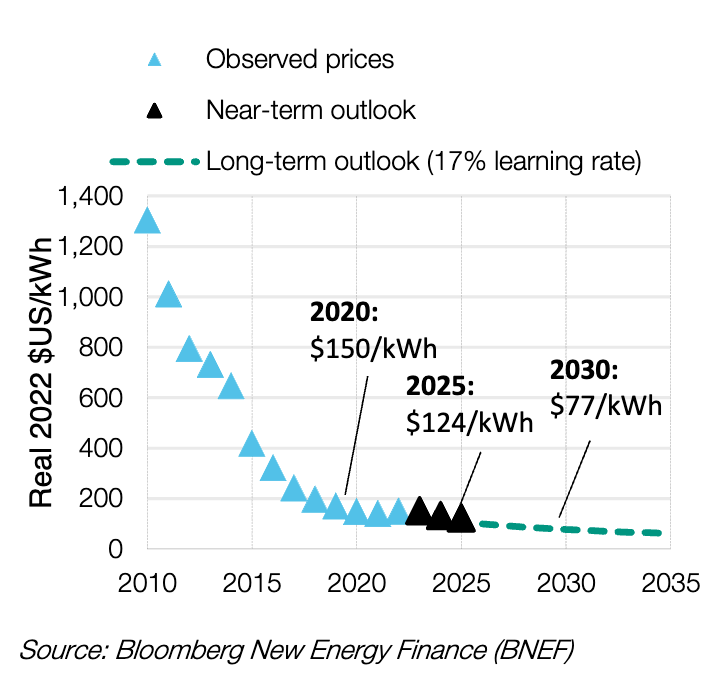

Bloomberg estimates that Li-ion battery pack costs are on track to reach $US100/kWh level by 2026:

Bloomers also assumes an enormous increase in the number of passenger EVs by 2030:

Energy storage in the power sector makes up a small share of Li-ion demand relative to zero-emissions transport.

However, energy storage will grow rapidly…

And to help store energy from surging variable renewable generation such as solar and wind power for use later…

Using batteries in this manner is known as ‘energy shifting’.

Bloomberg says energy shifting to account for the dominant share of energy storage use for the remainder of this decade.

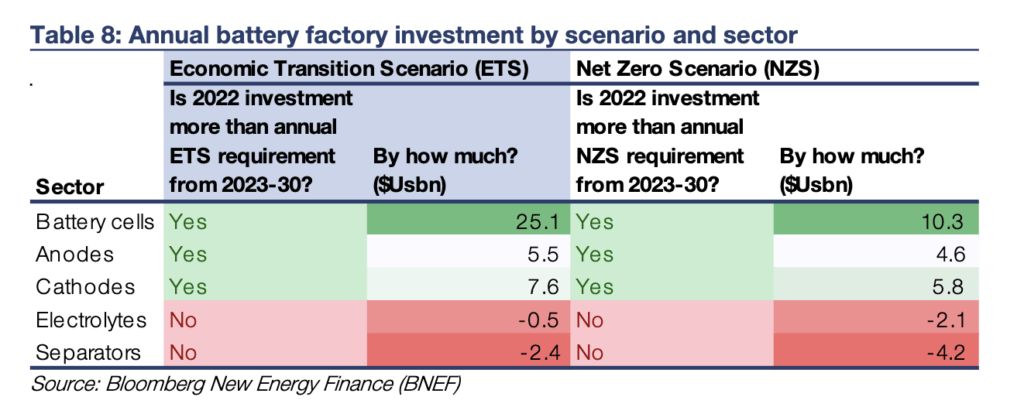

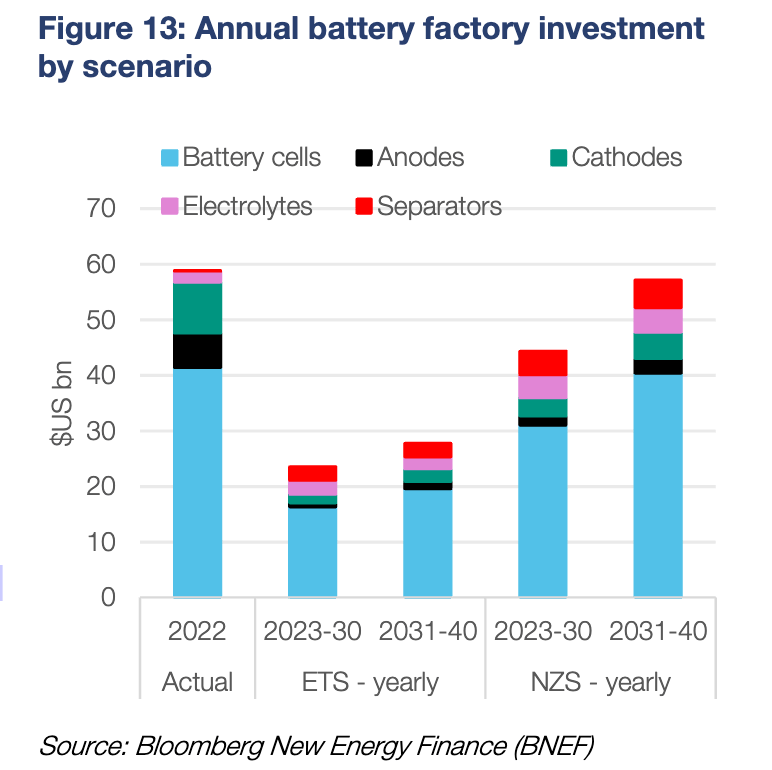

Finally, it’s worth pointing out that not all sectors of the battery supply chain achieve sufficient investment. Investment in electrolytes and separators are falling short of what is required –even in the ETS. Meanwhile, investment in anodes, cathodes and particularly battery cells are tracking well above what is required.

Given all these components are needed in batteries, insufficient investment in one component may potentially derail total battery growth. These supply chain bottlenecks are not unique to batteries, but across several sectors in the energy transition.

Multiple supply chains need to respond together to deliver decarbonisation technologies: