ASX Small Caps Lunch Wrap: Who’s ready to have their appetite destroyed before lunch today?

The Australian cricket team has a lot to answer for. Pic via Getty Images.

Local markets are struggling to make headway this morning, on the heels of another soft lead-in from Wall Street overnight.

The benchmark made it to a high of +0.2% over the course of the morning, but by lunchtime was back around flatline, despite a push from the banking sector, which I’ll explain shortly.

But first, a quick round up of news from the world of food, because news about stuff people put in their faces has been a little thin on the ground for a while, but this week there’s tons on the menu.

As an amuse bouche, reports that residents of the US state of Arkansas were left stuck in the middle of nowhere, after a truck carrying several tons of creamy, golden nacho cheese spilled its load on Interstate 30.

It was just the latest in a lengthy list of similar events in the US, where Food Spills are set to replace baseball as the nation’s most beloved sport – the most memorable of which was the dropping of 150,000 sausages worth of hot dog “meat” in the middle of summer last year.

And here, for your viewing pleasure, is an image that A) will ruin hot dogs for you forever, and B) looks very much like celebrity glutton Matt Preston has been seriously injured in a freak skydiving accident.

I’ll follow that up with some more cheese-related news, as we mark the sad passing of 74-year-old cheesemaker, Giacomo Chiapparini, who was murdered by the Grana Padano he so dearly, dearly loved.

Chiapparini was reportedly attending to an alert from his warehouse, where the cheeses are stored and matured, nurtured lovingly by cheese robots in a centuries-old Italian tradition that involves lifting, cleaning and rotating the 20kg wheels.

Sadly, a number of the cheeses had been set precariously on the shelves – also a centuries-old Italian tradition – but after they’d been repositioned and the robot put back to work, Chiapparini was crushed by hundreds of cheeses.

Rescuers worked through the night to reach Chiapparini, who had long since perished beneath the weight.

For mains, a quick dip into the most captivating food-based news story Australia has seen for a while – the growing mystery behind the poisoning deaths of three people in rural Victoria.

Despite days of solid armchair analysis, the story just keeps getting weirder – and this morning’s news of a food dehydrator (allegedly) from the home where the ill-fated lunch took place turning up at a local tip has certainly got true crime fans buzzing.

Someone at the ABC will undoubtedly win an award for one of the thousands of podcasts this story is set to inspire, but it serves as a warning to every mushroom lover in the nation: The ones called “Death Caps” are probably best not to eat.

Cooking food with the wrong kind of mushroom is an easy mistake to make, though – something I know all too well, after an ex-girlfriend of mine cooked us an extremely tasty risotto with “those mushrooms you had in the freezer”.

It tasted amazing, but after about nine hours, the unexpected delights of being able to smell colours and see through time had begun to wear very thin indeed.

And a last-minute post dinner cocktail to finish up: beverage manufacturer Asahi has come under fire over its latest effort, an alcoholic variant of Australia’s Favourite Thirst-Crusher, which packs a solid 4.5% alcohol content.

The Cancer Council of Western Australia has lodged a complaint that the drink’s packaging looks too much like the original Solo soft drink cans, and could provide “strong and evident appeal” to underage drinkers.

I’m not sure there’s that much to be concerned about, though – the name of it alone should be enough to turn anyone with even a shred of self-respect away.

Asahi’s marketing team clearly didn’t think the name “Hard Solo” all the way through – even the most cursory Google search would have shown them a whole new level of sweaty, grunting brand association.

TO MARKETS

Local markets are flat at lunchtime, after a morning spent struggling to get beyond +0.2% in the wake of another sad performance on Wall Street overnight.

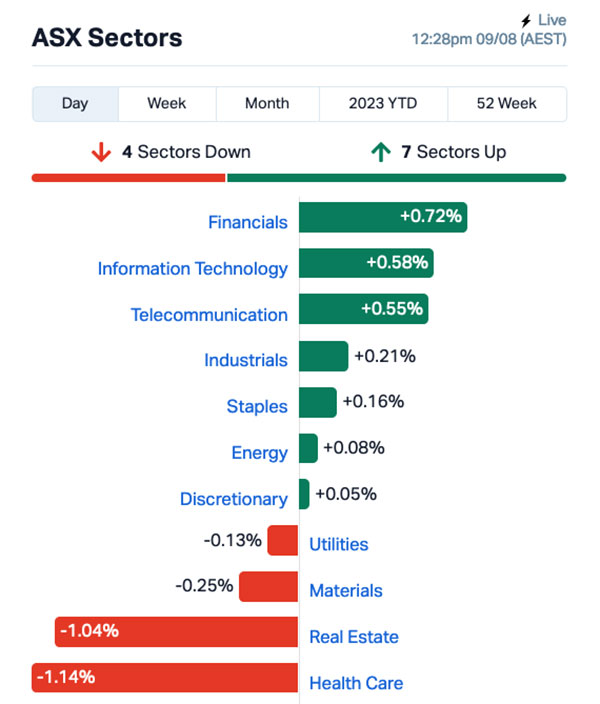

The main culprits are the Health Care and Real Estate sectors, who have each had a day in the sun this week, but today are giving up recent gains (and then some), both lower by more than 1.0% today.

On the happy side of the coin, however, InfoTech and Financials are beavering away in an attempt to keep the benchmark above zero.

There’s a push on among banking stocks today, with the ASX XBK Banks index outpacing the market quite handsomely at +1.2% so far, after Commonwealth Bank (ASX:CBA) was the first of the Big Four to release its results today.

CBA has reported a 5% increase in profit (after tax) for the year, to more than $10.1 billion, attributed to (you guessed it…) “growth in net interest income”.

I am as shocked as you are.

Naturally, CBA has seized the opportunity to immediately lower fees and interest rates for its customers, providing immediate relief for the many thousands of Aussie households struggling under the burden of hellishly massive mortgage repayments.

… just kidding. They’ve launched a $1 billion on-market buy-back, because of course they have.

NOT THE ASX

It was a bumpy ride on Wall Street overnight, which saw the S&P 500 fall -0.42%, blue chips Dow Jones by -0.45%, and tech heavy Nasdaq by -0.79%.

As Earlybird Eddy reported this morning, a shock move from Moody’s to downgrade a bunch of regional US banks has caught investors with their pants down.

The agency also said it may downgrade bigger players such as Bank of New York Mellon and State Street.

“Risks may be more pronounced if the US enters a recession – which we expect will happen in early 2024 – because asset quality will worsen and increase the potential for capital erosion,” Moody’s report said.

In US stock news, Eli Lilly & Co gained 15% after sales of its weight-loss treatment blew past forecasts.

Co-working space stock WeWork Inc fell -27% post-market after saying there’s “substantial doubt” about its ability to continue operating, citing growing cancelled memberships.

Ride-hailing stock Lyft fell 7% after the bell after reporting the slowest revenue growth in two years.

In Japan, the Nikkei is down 0.38% this morning, over concerns that local Tokyo celebrity “Bloomers Man” hasn’t been spotted in the wild for more than a month.

Bloomers Man is just your basic, garden variety Japanese weirdo who likes to dress up in schoolgirl sporting gear and dance provocatively in the streets, for reasons that I’m simply unable to fathom.

【発見】ブルマおじさんまたも発見されるw

初めはただの変態じじいかと思ってたんですが、だんだんみんなをハッピーな気分にしてくれるパフォーマーって気がしてきた・・・#ブルマおじさん pic.twitter.com/N6xVhb4Uyk

— 爆サイ.com【公式】ツイッター (@bakusai_com) April 22, 2023

If anyone spots him, please let me know – he’s handy for reminding me that no matter how far off the rails I’m ever feeling, there’s always someone in far worse shape than me.

In China, Shanghai markets are down 0.25%, and in Hong Kong the Hang Seng is faring slightly better, down just 0.17% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 09 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap DXN DXN Limited 0.002 100% 250,000 $1,721,315 CCE Carnegie Cealn Energy 0.0015 50% 1,044,599 $15,642,574 MTL Mantle Minerals Ltd 0.0015 50% 4,143,817 $6,147,446 PEC Perpetual Res Ltd 0.0295 34% 15,567,361 $12,000,647 AXP AXP Energy Ltd 0.002 33% 255,473 $8,737,021 MCT Metalicity Limited 0.002 33% 500,000 $5,604,129 OPN Open Negotiation 0.008 33% 1,494,061 $6,700,078 IR1 Iris Metals 2.04 32% 3,041,991 $123,581,500 BMM Balkan Mining and Minerals 0.23 31% 24,290 $10,687,602 1CG One Click Group Ltd 0.023 28% 7,014,680 $11,067,848 AGR Aguia Res Ltd 0.024 26% 190,000 $8,243,231 CCO The Calmer Co International 0.005 25% 21,703,157 $2,968,477 CT1 Constellation Tech 0.003 20% 241,989 $3,678,001 FAU First Au Ltd 0.003 20% 150,000 $3,629,983 GTG Genetic Technologies 0.003 20% 806,186 $28,854,145 TMX Terrain Minerals 0.006 20% 12,000 $5,415,997 WC1 Westcobar Metals 0.096 20% 4,883,802 $6,910,699 AEV Avenira Limited 0.014 17% 2,218,614 $20,760,087 RIE Riedel Resources Ltd 0.007 17% 141,434 $12,356,442 AD1 AD1 Holdings Limited 0.008 14% 50,000 $5,757,983 NGS NGS Ltd 0.016 14% 1,758,598 $3,479,104 SKN Skin Elements Ltd 0.008 14% 153,337 $3,986,403 DCL Domacom Limited 0.025 14% 100,843 $9,581,039 AW1 American West Metals 0.335 14% 12,864,041 $103,036,790 AHI Advanced Health 0.215 13% 276,051 $41,363,754

In top spot among the small caps this morning, it’s IRIS Metals (ASX:IR1), coming out of a trading halt waving exploration results that have been welcomed by investors to the tune of a 38.7% pop.

Iris says it’s bitten into multiple wide, high-grade and shallow lithium intersections at its Beecher project in South Dakota, USA, with assays from the first six drillholes of a 38-hole RC program “confirming the potential for economic lithium”.

The intercepts include 60m @ 1.21% Li₂O (true width) from 16m in hole BDH-23-001, including 40m @ 1.40% Li₂O from 36m, and 22m @ 1.90% Li₂O from 46m.

And hole BDH-23-009 has returned 54m @ 1.30% Li₂O (true width) from 1m, including 35m @ 1.58% Li₂O from 4m, and 13m @ 2.10% Li₂O from 24m.

In second place, Perpetual Resources (ASX:PEC) is up 31.8% on news that the company has entered into an additional binding option agreement to acquire a further three highly prospective exploration permits, covering approximately 5,000ha in Brazil’s “Lithium Valley” region, within Brazil’s mining-friendly state of Minas Gerais.

On top of that big news, PEC has also revealed that it’s received firm commitments from professional and sophisticated investors to raise $1.5 million (before costs) through a placement of shares at $0.022 per share.

And in third place this morning, American West Metals (ASX:AW1) has jumped 17% on no fresh news – however, the gain has reversed a sudden dip in trading price seen yesterday, pushing it back past $0.34 from the morning’s open of $0.0295.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 09 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap EDE Eden Inv Ltd 0.003 -25% 250,611 $11,987,881 PNR Pantoro Limited 0.054 -23% 41,156,059 $329,282,136 ADS Adslot Ltd 0.004 -20% 57,648 $16,333,088 EMU EMU NL 0.002 -20% 100,000 $3,625,053 RGS Regeneus Ltd 0.008 -20% 50,000 $3,064,369 DLI Delta Lithium 0.675 -18% 8,713,738 $431,124,118 SCT Scout Security Ltd 0.015 -17% 107,142 $4,152,024 CYQ Cycliq Group Ltd 0.005 -17% 500,000 $2,085,100 RML Resolution Minerals 0.005 -17% 75,000 $7,543,751 PCL Pancontinental Energy 0.016 -16% 21,262,162 $153,030,233 BOD BOD Science Ltd 0.075 -15% 370,327 $13,474,691 DOU Douugh Limited 0.006 -14% 178,000 $7,398,827 RNU Renascor Res Ltd 0.155 -14% 19,222,503 $457,093,350 SIX Sprintex Ltd 0.032 -14% 114,479 $10,780,555 FRS Forrestania Resources 0.091 -13% 630,585 $9,777,853 ZEU Zeus Resources Ltd 0.013 -13% 1,239,687 $6,889,215 DTM Dart Mining NL 0.033 -13% 251,280 $6,546,915 EVG Evion Group NL 0.034 -13% 143,235 $13,492,408 1MC Morella Corporation 0.007 -13% 2,443,747 $48,788,644 88E 88 Energy Ltd 0.007 -13% 655,944 $160,862,946 CAV Carnavale Resources 0.007 -13% 1,008,250 $26,668,414 OAU Ora Gold Limited 0.007 -13% 4,208,520 $35,495,401 THR Thor Energy PLC 0.0035 -13% 2,025,000 $5,837,166 TKL Traka Resources 0.007 -13% 1,605,068 $6,970,634 YPB YPB Group Ltd 0.0035 -13% 129 $2,973,846

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.