Weekly Small Cap and IPO Wrap: In a pickle? Just buy Nordic Nickel

Via Getty

- ASX200 finishes up 0.7% for the week

- China reopens, oil rises, inflation weighs

- Nordic Nickel rises on debut

Share markets moved ahead this week, the ASX200 ended 0.7% higher, the ASX Emerging Companies (XEC) up 0.8%.

But oh, how things can turn – on Monday we were talking up ‘peak inflation’ and by Friday we’d kill our own grandmother for a cheap lettuce and a real fireplace.

China started to reopen after not quite dealing with COVID-19 but also not quite dealing with the mad lockdowns imposed on some 40 plus cities.

The commodities complex, itself swinging like Jed Cooper out of Oklahoma saw rises for precious metals, copper and iron ore.

The Aussie dollar-buck rose, as the Greenback fell.

FIIIIIIVEE DOLLAR BUCKS! #Bluey pic.twitter.com/FeiUgTV1Hw

— Official Bluey TV (@OfficialBlueyTV) December 28, 2021

The surprise bump for oil during the week was something of a ‘forget you man’ to the producers over at OPEC, who agreed to lift production by circa 650k barrels a day for July and August which pretty much no one reckons they’ll achieve.

The EU finally announced a bit of a ban on Russian oil, which no one really believed either.

“The EU’s ban on the two thirds of Russian oil that it imports by sea and China’s reopening being the latest source of upwards pressure on oil prices,” says AMP Capital’s Dr Shane Oliver.

“The EU move raises the risk that Russia will cut off some more of its gas exports to Europe in retaliation,” he added.

As of this week, suddenly gas is a bit of a problem in this part of the world too.

Gains in local shares were largely driven by materials, consumer staples and industrials offsetting falls in utilities where surging energy prices weighed. The tech sector continues to be the plaything of twitchy volatility out of the Nasdaq.

The Bank of Canada followed the RBNZ to lift rates by 0.5% as central banks move in concert to a more hawkish footing.

“Another stronger than expected rise in Eurozone inflation to US levels has increased expectations that the ECB’s first rate hike will be 0.5%,” says Dr Oliver.

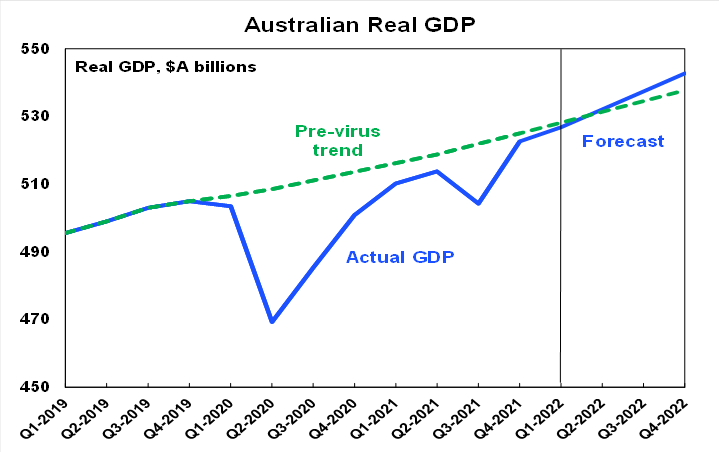

Australian March quarter GDP growth of 0.8% was more good news than bad, likewise April trade data delivered an unexpected pick up in the trade surplus.

How did this week’s IPOs perform?

The first IPO of June, Nordic Nickel (ASX:NNL) closed 16% higher on its Thursday debut at 29c after raising an impressive $12 million at 25c a pop.

NNL is chasing up some old Outoukumpu targets at its 395sqkm Pulju Project over in Finland and hopes to deliver an initial JORC resource estimate on the back of re-assays from the project’s remaining core within months of listing.

It is also planning to drill deeper to make discoveries akin to Anglo American’s 44Mt development stage Sakatti nickel-copper-PGE project, one of three major orebodies in the Nordic neighbourhood along with Boliden’s 307Mt Kevitsa nickel-copper-gold open cut and Agnico Eagle’s 7.4Moz Kittila mine.

MD Todd Ross says Finland remains underexplored despite this bountiful endowment.

“Our vision is to discover and develop traceable, sustainably sourced, low-carbon, high purity class-1 nickel sulphides in Finland, at a time when demand for battery metals is growing exponentially,” he said.

ASX SMALL CAP WINNERS:

Here are the best performing ASX small cap stocks for May 30 – June 3:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| 14D | Southern Cross Gold | 0.69 | 245% | $36,735,023 |

| 1AD | Lindian Resources | 0.1 | 156% | $70,595,981 |

| 1AE | Tyranna Res Ltd | 0.019 | 111% | $27,582,492 |

| 1AG | Oklo Resources Ltd | 0.1525 | 101% | $73,151,989 |

| 1ST | Australresources | 0.635 | 74% | $148,354,222 |

| 1VG | Astro Resources NL | 0.004 | 60% | $18,820,965 |

| 2BE | Diatreme Resources | 0.04 | 60% | $97,221,844 |

| 3MF | Analytica Limited | 0.0015 | 50% | $6,920,702 |

| 8CO | Carbonxt Group | 0.2425 | 43% | $45,900,937 |

| 8IH | BBX Minerals Ltd | 0.16 | 39% | $75,903,543 |

| 99L | Merchant House | 0.075 | 39% | $7,069,987 |

| 9SP | Bellavistaresources | 0.34 | 39% | $11,496,716 |

| A1G | Bubs Aust Ltd | 0.615 | 35% | $379,920,860 |

| A3D | Ausquest Limited | 0.028 | 33% | $19,803,581 |

| A8G | Argonaut Resources | 0.004 | 33% | $10,818,614 |

| AAJ | Oilex Ltd | 0.004 | 33% | $32,971,837 |

| AAP | Titomic Limited | 0.22 | 33% | $46,581,921 |

| AAU | Lark Distilling Co. | 3.23 | 32% | $249,264,108 |

| ABE | Mtmongerresources | 0.21 | 31% | $7,977,207 |

| ABV | Xtek Limited | 0.42 | 31% | $42,260,502 |

| AC8 | Horseshoe Metals Ltd | 0.038 | 31% | $17,662,172 |

| ACP | Pentanet | 0.345 | 30% | $75,316,504 |

| ACR | Odin Metals Limited | 0.022 | 29% | $10,259,575 |

| ACS | Nuchev Limited | 0.355 | 29% | $17,851,817 |

| ACU | Invigor Group Ltd | 0.045 | 29% | $8,732,392 |

| AD1 | Jayride Group | 0.18 | 29% | $31,749,166 |

| ADD | Close Loop | 0.45 | 29% | $156,252,195 |

| ADR | Noxopharm Limited | 0.295 | 28% | $90,593,765 |

| ADS | Tigers Realm Coal | 0.023 | 28% | $274,400,750 |

| ADV | Eden Inv Ltd | 0.014 | 27% | $30,109,399 |

| ADX | Internationalgraphit | 0.375 | 27% | $29,743,159 |

| ADY | Audeara | 0.091 | 26% | $5,328,544 |

| AEI | OZZ Resources | 0.12 | 26% | $4,509,827 |

| AER | Arafura Resource Ltd | 0.48 | 26% | $722,671,534 |

| AEV | Galileo Mining Ltd | 1.78 | 26% | $325,431,033 |

| AFL | Kingfisher Mining | 0.34 | 26% | $9,759,825 |

| AFW | Cardiex Limited | 0.44 | 26% | $30,787,036 |

| AGC | PYC Therapeutics | 0.088 | 26% | $267,197,793 |

| AGN | Complii Fintech Ltd | 0.094 | 25% | $31,333,607 |

| AGR | Avira Resources Ltd | 0.005 | 25% | $9,534,555 |

| AHC | Gas2Grid Limited | 0.0025 | 25% | $10,145,255 |

| AHI | Mamba Exploration | 0.125 | 25% | $5,271,875 |

| AHK | New Zealand Coastal | 0.005 | 25% | $4,108,020 |

| AHN | Victory Goldfields | 0.155 | 24% | $5,768,722 |

| AII | Greenstone Resources | 0.063 | 24% | $57,750,129 |

| AIR | Meteoric Resources | 0.016 | 23% | $21,368,163 |

| AIV | Way2Vatltd | 0.059 | 23% | $9,671,154 |

| AJJ | Meeka Gold Limited | 0.07 | 23% | $60,745,427 |

| AJX | Taruga Minerals | 0.0245 | 23% | $13,295,110 |

Southern Cross Gold (ASX:SXG), is up over 200% since Monday. This spinout of TSX-listed Mawson Gold explorer is enjoying the dream start to life on the ASX.

SXG is currently up 240% on its May 12 listing price of 20c per share, thanks to a speccy 119m at 3.9g/t gold equivalent drill hit at the ‘Sunday Creek’ project in Victoria.

This hit in hole SDDSC033 included a bunch of higher-grade zones like:

- 1m @ 17.7g/t Au and 1.6% antimony (20.3g/t AuEq) from 160.5m

- 3m @ 26.2g/t Au and 3.7% antimony (32g/t AuEq) from 180m, and

- 2m @ 14.7g/t Au and 4.8% antimony (22.3g/t AuEq) from 189.9m

Antimony is alloyed with lead and tin for use in products like bullets, batteries, and semiconductors.

This latest result — drilled to test a 120m gap between three mineralised shoots — is “unprecedented”, managing director Michael Hudson says. This sort of width of high-grade mineralisation is rarely, if ever, seen in the Victorian goldfields.

“A result of 119.2m @ 3.9g/t AuEq places the Sunday Creek project into a new realm and builds on what was already a remarkably successful drill program,” he says.

Been a big week too for the team at CardieX’s (ASX:CDX), which got hearts racing after equities research shop MST Access placed a $1.50 valuation on the Australian cardiovascular medtech stock this week.

The price equates to an overall market cap of about $165 million versus $32 million currently, as the company is currently trading just below 30c a share on market.

MST is the second leading analyst to put a buy on CardieX in the last six months. In December, Blue Ocean Equities initiated coverage with a “spec buy” recommendation and target price of 16 cents. This was on a pre-consolidation basis equating to a target price of $1.60.

Blue Ocean said there’s “early-stage growth potential and the impending nature of the FDA clearance process for the new product suite.”

CDX is up over 40% this week.

The hands down winner for the month of May still gets a special mention for the first week of June. Galileo Mining (ASX:GAL), is a full blown monster, at one stage this week it had gained 750% for the month to date.

For our purposes we can take Peter Farquhar’s blow by blow summary from the fun bits:

May 26: “Discovery confirmed!” says GAL. More highlights with big numbers in them, and news drilling’s about to start on the the actual thick and high grade stuff next week. Share price hits $1.41.

Creasy’s $1.75m investment 12 days ago alone is worth $4.25m now. And it was just a 2% top-up on his 24% stake.

But wait, there’s more…

May 27: Rhodium struck. Assays from the Norseman project are now confirming the presence of rhodium. It’s only one of the rarest and most valuable precious metals in the world, currently selling for $US15,500/oz.

Most global rhodium production is used in catalytic convertors, which control emissions in ICE and hybrid vehicles.

GAL hits its high of $1.91. About 800pc on its price three weeks earlier. Creasy’s stake has roughly popped from $9m to somewhere north of $70m. What a ride.

Galileo finishes the month at $1.44, after some of the more giddy participants exited the rollercoaster.

ASX SMALL CAP LOSERS:

Here are the best performing ASX small cap stocks for May 30 – June 3:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Description | Last | % Week | Market Cap |

|---|---|---|---|---|

| ZIP | Firefinch Ltd | 0.345 | -68% | $1,122,181,060 |

| ZER | Geopacific Resources | 0.105 | -51% | $48,809,185 |

| WTN | Carnegie Cln Energy | 0.001 | -50% | $22,653,861 |

| WSA | Deferred Settlement | 0.075 | -38% | $6,859,436 |

| WQG | Finder | 0.12 | -35% | $9,000,000 |

| WMI | Javelin Minerals Ltd | 0.001 | -33% | $9,354,153 |

| WMA | Manypeaksgoldlimited | 0.28 | -30% | $9,951,620 |

| WGX | Allup Silica Ltd | 0.135 | -29% | $4,816,773 |

| WHF | Hydrocarbon Dynamic | 0.017 | -29% | $9,980,029 |

| WGN | Desert Metals | 0.22 | -28% | $11,757,995 |

| WBT | Ioupay Limited | 0.06 | -27% | $32,533,312 |

| WGB | Bikeexchange Ltd | 0.019 | -27% | $5,070,722 |

| WAF | BIR Financial Ltd | 0.017 | -26% | $3,447,287 |

| WAX | Cycliq Group Ltd | 0.014 | -26% | $5,212,750 |

| VMY | Applyflow Limited | 0.0015 | -25% | $4,436,412 |

| VRT | Medibio Limited | 0.003 | -25% | $8,389,465 |

| VSL | Sihayo Gold Limited | 0.003 | -25% | $12,754,158 |

| VUL | Victory Offices Ltd | 0.042 | -25% | $5,682,529 |

| VGL | Kincora Copper | 0.076 | -24% | $6,298,263 |

| VML | Rightcrowd | 0.072 | -24% | $23,524,676 |

| VG1 | Appen Limited | 6.4 | -23% | $764,980,775 |

| VG8 | Pearlgullironlimited | 0.027 | -23% | $1,647,069 |

| VGI | Duke Exploration | 0.1 | -23% | $9,923,227 |

| TUA | Coopermetalslimited | 0.4 | -22% | $12,159,000 |

| TWR | Biotron Limited | 0.072 | -22% | $58,260,415 |

| TYR | Catapult Grp Int Ltd | 0.8 | -22% | $176,262,821 |

| UMG | Eneco Refresh Ltd | 0.021 | -22% | $7,353,675 |

| UNI | Red Mount Min Ltd | 0.007 | -22% | $13,138,911 |

| UOS | Pancontinental Energ | 0.007 | -22% | $50,079,560 |

| URW | Halo Technologies | 0.435 | -22% | $53,097,308 |

| TRJ | Fintech Chain Ltd | 0.026 | -21% | $18,221,548 |

| SXL | EVE Health Group Ltd | 0.001 | -20% | $4,309,809 |

| SYA | Alterra Limited | 0.012 | -20% | $3,345,315 |

| SYM | Akora Resources | 0.2 | -20% | $12,284,404 |

| SYR | Intelligent Monitor | 0.12 | -20% | $11,996,079 |

| TER | Incentiapay Ltd | 0.012 | -20% | $15,180,764 |

| TGR | Laneway Res Ltd | 0.004 | -20% | $31,510,082 |

| TIE | Metalicity Limited | 0.004 | -20% | $13,829,533 |

| TIG | Orion Equities | 0.28 | -20% | $4,381,784 |

| TLG | Peak Minerals Ltd | 0.012 | -20% | $12,496,449 |

| TLX | Roots Sustainable | 0.004 | -20% | $3,373,347 |

| TPW | Volt Power Group | 0.002 | -20% | $18,689,067 |

| TRA | Latin Resources Ltd | 0.096 | -20% | $181,347,418 |

| SSR | AMA Group Limited | 0.175 | -19% | $178,926,191 |

| SST | Elixinol Wellness | 0.039 | -19% | $13,599,420 |

| STA | Lordresourceslimited | 0.26 | -19% | $8,157,925 |

| STX | Activex Limited | 0.038 | -19% | $8,215,698 |

| SVL | Fitzroy River Corp | 0.125 | -19% | $13,494,281 |

| SVM | Crowd Media Limited | 0.029 | -19% | $19,425,332 |

| SWM | Eastern Resources | 0.029 | -19% | $28,838,662 |

| SSM | Xpon Technologies | 0.135 | -18% | $21,583,764 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.