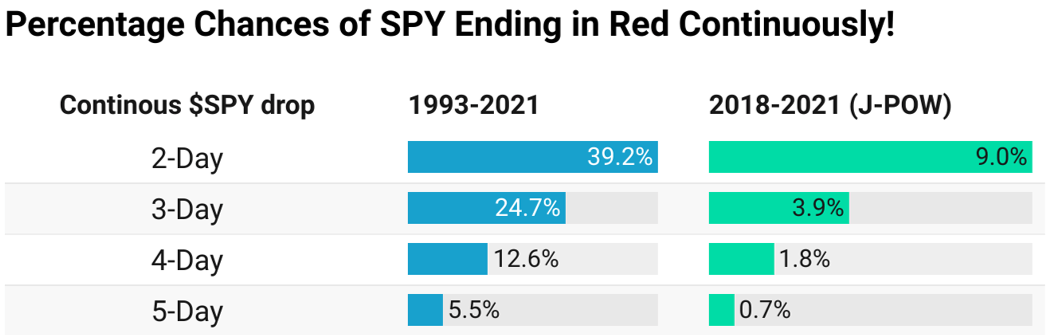

Wallstreetbets analysis shows only 3.9% chance US markets will finish red more than 2 days in a row

News

News

It’s either brilliant, totally wrong, or a great wallstreetbets meme.

A bunch of Reddit users argued that US Fed Reserve chair Jerome Powell would not allow Wall Street to finish red three days in a row, so Wallstreetbets user nobjos did a “quick and dirty” analysis.

This I what they came up with:

“Lots of chatter around how JPow does not allow the market to finish in red continuously for x days,” nobjos said on r/ wallstreetbets.

“So wanted to check the validity of that. The numbers shown in the graph are the probability that if you take a random day, what are the chances of the market finishing in red the next x days.”

The theory can be broadly tied to the idea that when things go pear-shaped, Jay Powell’s money printer goes brrrr.

But if you really want to get to the bottom of it, just jumping onto Reddit to check wallstreetbets won’t be enough. You’re going to have to DYOR (do your own research), nobjos says.

“If you invest based on this without going through my data and validating the results, good luck lol.”

The data is here, for those interested.

And speaking of the Fed, Powell and his fellow committee members will take centre stage from tonight when they meet for the Federal Reserve’s two-day policy meeting.

However, the Westpac economics teams says that “while the FOMC will likely show comfort in the outlook for the labor market following the latest readings, we do not expect anything more in terms of guidance on the outlook”.

Instead, Westpac says the next key set of updates will come at the September FOMC meeting, “when fresh forecasts will be made available”.