Turning tide has Sydney property market most vulnerable says Lawless, CoreLogic’s rule-breaking research director

News

News

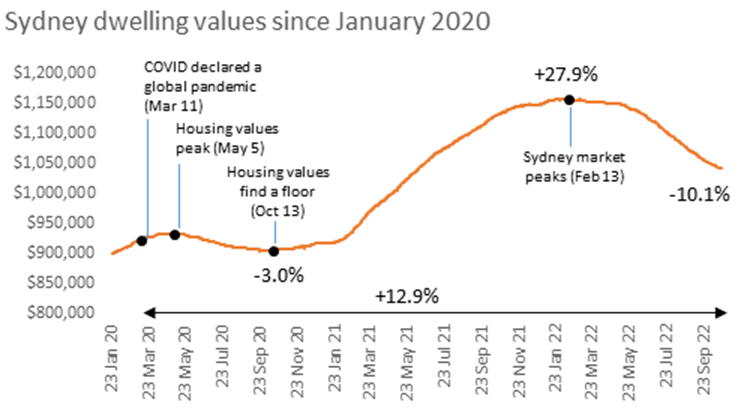

This morning, Sydney home values are down over 10% – or about $116,500 on average – since prices in the City that’s Pretty topped out at the record average highs of February earlier this year.

That’s according to new data in the hands of CoreLogic.

The property data firm has Melbourne values down some 6.4% since January, while BrisVegas home values have fallen 6.1% in just four months.

Hobart is down -4.7%. Canberra is depressing. And it’s down -4.4%. Ha!

But while dwelling values remain -10.1% below Darwin’s record high (back in 2014), the Northern Territory megalopolis is the only capital city left where housing values haven’t started to trend down.

“Despite the -10.1% decline so far, Sydney home values still have a way to go before wiping out the capital gains accrued over the recent growth cycle. Home values would need to fall a further -11.4% to get back to the levels seen at the onset of COVID,” says the research director who knows no rules, Tim Lawless.

“The good news for Sydney home owners is that the rate of decline has continued to moderate through October, improving from a -2.2% decline over the four-week period ending 3 September to -1.3% over the most recent four-week period ending 23 October.”

The double-digit fall follows a pandemic-led frenzy of rising Sydney prices which gained about 28%% – circa $253,000 a pop – from the COVID-trough to peak.

CoreLogic’s Tim Lawless said it was unsurprising Sydney was leading the capitals in the current downturn given it is the country’s most expensive capital city housing market and arguably has the greatest susceptibility to rising interest rates.

“Although Sydney’s housing values were already in decline when the rate hiking cycle began, the pace of decline accelerated sharply following the first interest rate increase in May,” he said.

“Sydney values are now down –9.5% since 3 May, and -10.1% since peaking on 13 February this year.”

And while Sydney property is still “highly overvalued” it doesn’t classify as a property bubble according to UBS and their annual global property thingy.

UBS, BTW, after studying up house price growth across 25 of the world’s most capital cities, came to the utterly shocking conclusion that it’s possible the global housing boom is coming to an end.

It’s not the answer to Life, The Universe and Everything, but it’s very close to 42.

It’s the only question that matters.

The full extent of how far housing values will/can fall remains highly contentious. Lawless says it’s also largely dependent on the trajectory of interest rates.

Since April, CL says dwelling values are down 4.8% to the end of September, ranging from a 9.0% fall from peak in Sydney, to Darwin, where home values remain at a cyclical high and don’t care what the rest of us do.

Mainstream forecasts for a peak to trough decline also vary remarkably, (although all can agree prices are trending lower from a great height) but largely range from around 15% to 25% across the combined capital cities.

a 15% drop from the peak in April 2022 would take CoreLogic’s combined capital cities index back to circa March 2021 levels.

a 20% drop in values would see the index 2.2% lower than the onset of the pandemic in March 2020.

a 25% drop in capital city dwelling values would take the index 8.3% below March 2020 levels; a similar reading to August 2016

a 50% drop and it’ll be so mad, not a single economist or property data firm has even gamed it out. I for one will be selling my eldest who is robust, well-fed and multi-lingual. My wife will be too busy organising her vigilante street gang to notice.

And anyway, when she returns from the hunt she will praise me for keeping the boy and for only accepting payment in weapons and meat.