Time to buy a first home Part Deux: Has CoreLogic’s Eliza Owen gone rogue? And what is the property data firm hiding?

Last time, on 24. Via Getty

No, she’s good.

And I’m pretty sure CoreLogic’s on the level. So no worries there.

Asking those really tough questions in the form of a headline is, you’ll agree, just damn good journalism.

In the second and final part of this stunning Stockhead two-part series, brought to you by the team behind the first part (except the photographer, him we fired) we go back round the block with CoreLogic’s brilliant, yet totally rogue Head Of Residential Research Eliza Owen, as she explores the ‘pros’ and ‘cons’ of buying property in a falling market.

The following is based on true events.

Aussie property prices are falling like flies. The gathering pace is reminding punters and professionals of the first flutters which brought on the 2008 global financial crisis (GFC).

Except in Sydney, home to the world’s greatest suburb and where the price decline is more pronounced, more precipitous and more prosaic than in any other time or anywhere else.

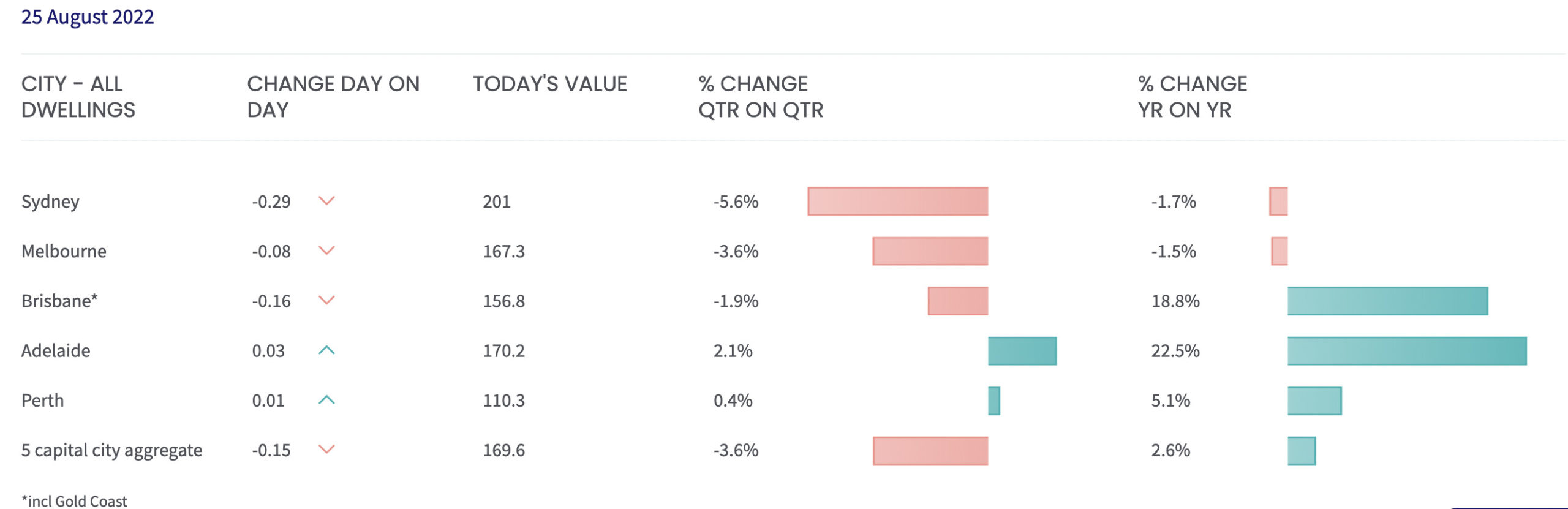

Back in July alone, dwelling values fell 1.3% on average nationally, according to CoreLogic, a property data firm.

“We’re definitely seeing housing prices falling quite rapidly at the national level, on par with the GFC,” said Tim Lawless, CoreLogic’s aptly-named above-the-law research director.

For Sydney, though, values in the pretty city are down 5.2% from January’s peak, making a farce of the 3.9% so-called collapse at the start of the GFC.

“Even going back to the early 1980s, it wasn’t going down as rapidly as this,” he said.

But some advice first: Don’t get cocky

INT. Day.

Eliza Owen’s WFH apartment.

She stands with her back to us, statuesque and looking ever so evilly out the window, absently petting the hastily arranged pot plant (see above) by her side. There is something in the moment that is both deeply meditative and very wrong… After about six minutes she speaks:

While buyers may aspire to purchase at the bottom of the cycle and then sell at the top, ultimately, it’s notoriously difficult to time the market perfectly. Further to this, most buyers and sellers will generally work towards a more practical timetable based on their personal situation and housing requirements or investment strategy. Even when prices fall, it’s not a straightforward decision to get into the market.

Cons to buying a first home in a falling market

Con 1. Er.. property values are falling

While falling property prices may seem like a good thing, it can also create a potentially risky time to buy. This is because the amount of money borrowed for a home is fixed, even as property values move daily. Buying in a declining market means the home could potentially be worth less than the purchase price, although this is only a risk if the owner needs to sell their home within a short period of time, incurring a loss.

However, Australian home owners generally don’t sell within a short period of time. The median hold period of properties across Australia has averaged just over eight years for the past decade. Even when property values fall, people can generally keep up with mortgage repayments. In the current environment, mortgage serviceability has been boosted by higher assessment buffers by banks and lenders, a tight labour market and some momentum in wages growth.

Con 2. Mortgage rates are rising

The cash rate is rising at its fastest pace since the early 1990s, and banks have been passing these increased costs to borrowers. Average new variable rates for owner occupiers increased 64 basis points between April and June, from 2.41% to 3.05%. Considering the cash rate has increased by another 100 basis points since that time, it’s likely average mortgage rates are now a full percentage point higher than the published June averages.

This may not seem like a big increase, but it adds up when the size of a loan is hundreds of thousands of dollars. For example, a $500,000 loan with an interest rate of 2.41% over 30 years, assuming no fees, amounts to monthly loan repayments of around $1,950. If the loan amount is reduced 5%, to $475,000, but has a higher interest rate of 3.05%, monthly repayments are higher at $2,015 per month.

Property prices are expected to continue falling, but this is off the back of further expected rate rises. The trade-off for a lower purchasing price could be a higher cost of debt.

Con 3. Vendors don’t sell as much in a declining market

In the current environment, vendors are typically offering greater price discounts to get their properties sold. However, vendors do have another option: not to sell at all.

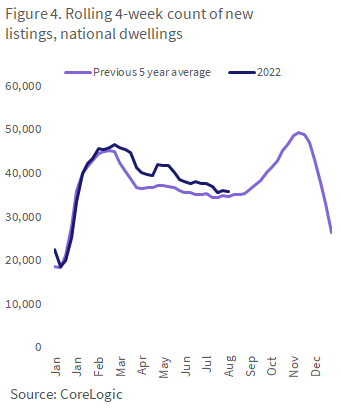

Property prices and listings volumes tend to move together. Fewer new listings might hit the market this spring selling season than last year, when sellers were cashing in on strong price rises.

Figure 4 shows how new listings counts nationally have been tracking in 2022 relative to previous years. As the housing market has started to come off a peak value in April, new listings have started to converge closer to the previous five-year average, suggesting a little less exuberance from sellers.

There may still be quality properties advertised over the coming weeks amid the spring selling season, because not all vendors are concerned with maximising profit. For example, people who have held their property for decades in many parts of the country, but need to move, will still make a sizeable gain from selling.

The higher interest rate environment also means not as many people are buying. With less competition, properties take longer to sell, reflected in the total advertised stock levels, which are already starting to accumulate as a result, even as the rate of new properties being added to the pool of listings slows.

So Eliza… is now a good time to buy?

Overall, market conditions do not determine whether it is a “good” time to buy your first home. Low mortgage rates will generally mean higher prices and more competition, while falling prices often mean finance is more expensive, or harder to get, and the rate at which new stock is advertised slows down.

The perfect time to buy comes down to personal circumstances. These include things like current living situation, whether that is renting, or living rent-free with parents. It might depend on whether you have enough of a deposit to offset higher mortgage costs.

The security of your employment is also an important consideration, as well as your ability to service a mortgage and how you feel about home ownership and property investment more broadly.

Keeping across market trends can be useful, but so is careful assessment of your own situation and personal goals.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.