Aussie house price falls are slowing, as shown in this diagram

House price falls are slowing, as depicted in this artist's rendition Via Getty

The speed with which house prices are hurtling back to Earth is finally easing up, CoreLogic’s Tim Lawless says.

But perhaps temporarily. And only slightly.

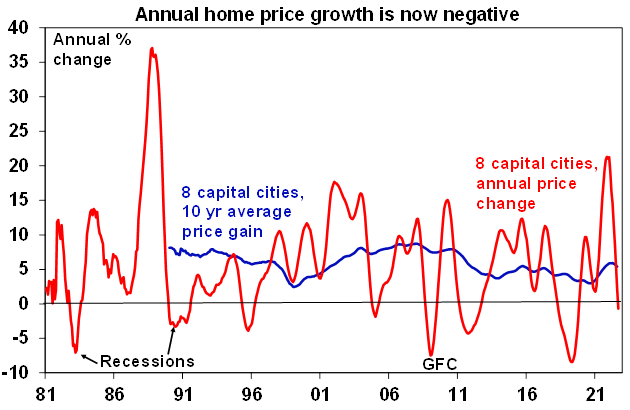

Certainly values are still (unmistakably) on an Earth-bound trajectory, but math and people paid to do it says the rate of decline did ease down -1.4% for September from a -1.6% fall in August.

Good news?

Possibly.

Regrets?

I’ve had a few.

But before we get into any of those, let’s bring in Tim Lawless (CoreLogic).

According to Tim Lawless, there’s no saying if we’ve moved through the worst of the downturn.

“It’s possible we have seen the initial shock of a rapid rise in interest rates pass through the market and most borrowers and prospective home buyers have now ‘priced in’ further rate hikes.”

Here comes the but, as Tim Adds:

“If interest rates continue to rise as rapidly as they have since May, we could see the rate of decline in housing values accelerate once again.”

Now from Doctor Shane Oliver (AMP Capital) and his PHD in Harsh Realty Reality:

“We expect national average property prices to fall further over the next 9-12 months.”

“Assuming the cash rate tops out around 2.85% as we expect then average prices are likely to fall 15-20% from top to bottom with the low likely being reached around the September quarter next year.”

Why Shane, Why!?

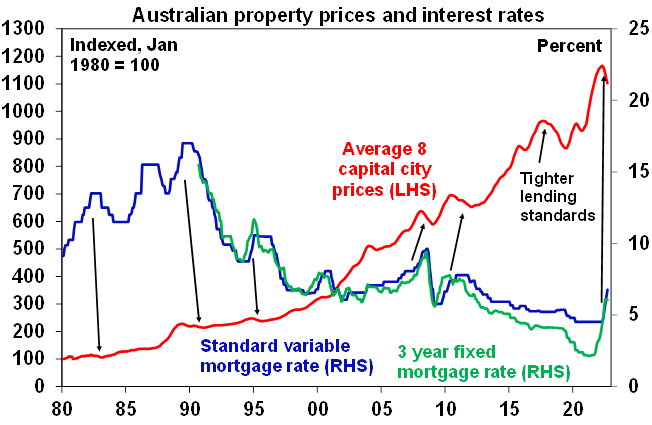

- Poor affordability

- Rising fixed mortgage rates

- Further rate hikes from the RBA pushing up variable rates

- High inflation which is making it even harder to save for a deposit

- Higher supply as we see some increase in distressed sales particularly as fixed rate borrowers roll over to much higher interest rates through 2023 and as the economy slows; and

- A continuing rotation in consumer spending back towards services as reopening continues which will reduce housing demand.

Ah. I see. So that’s it?

“The main downside risk to our forecasts would be if the cash rate is raised to the 4.1% or so that the money market has priced in – this would more than double average household interest payments and push total (interest and principal) mortgage repayments to record highs relative to household income.”

And if that were to happen, Doc?

“(It would) drive a 30% or so fall in prices.”

Yikes!

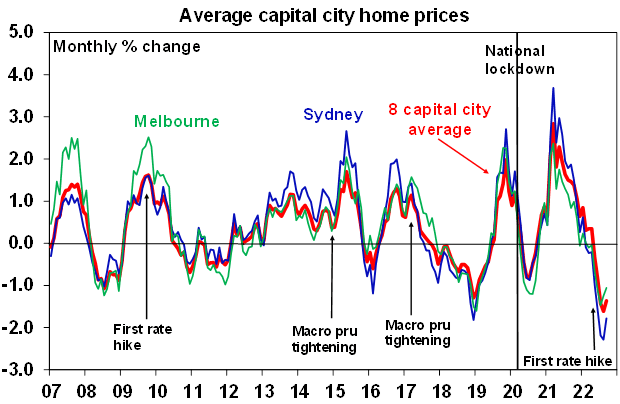

Sydney continues to record the fastest and largest falls, with housing values now -9.0% or -$104,300 below the city’s January 2022 peak.

And that’s also where we see the worst of the worst.

The largest cumulative falls have been concentrated in areas of Sydney’s Northern Beaches – we’re talking Warringah, Pittwater and Manly – where housing values are down at least -14.5% since hitting a peak in early 2022.

There’s big falls too in the flood affected areas across the Richmond – Tweed region, Tim says.

“These areas saw housing values rise between 38% and 62% through the growth cycle, so most home owners are still well ahead in terms of equity in their home.”

And waking up to the crash at last is sleepy Bris Vegas – home of Nadine McGrath, UQ and er… a river – which has almost caught up with Sydney’s descent, to be -4.3% / -$33,600 below its June 2022 peak.

(Two) small villages still hold out…

Corelogic notes the slowdown in falling values was nationwide through September, but for Adelaide and Perth, where housing value falls accelerated.

It’s worth remembering that Adelaide and Perth have been fairly insulated from the overall crash in prices relative to the other capitals. I like to think of it this way, where the Romans are falling dwelling values:

Corelogic’s monthly rate of decline from August to September:

- Sydney from -2.3% in August to -1.8% in September

- Melbourne from -1.2% to -1.1%

- Brisbane from -1.8% to -1.7%.

Darwin remains the only capital city where housing values haven’t started to trend lower (although dwelling values remain -10.1% below the 2014 peak).

We’ll always have the pandemic

There’s a still very considerable buffer between where housing values are now and where they were when we all met the virus in March 2020 and property prices got weird.

For the combined capital cities, prices are some 13.5% higher than before COVID-19.

Melbourne, which saw a softer upswing than other regions (+17.3% from trough to peak), and is generally a home for softer types of things, would only need to see a -4.3% fall in values before returning to pre-COVID levels.

The reduction in the rate of decline came alongside an improvement in other indicators.

“Auction clearance rates also trended upwards, albeit subtly, in September and consumer sentiment nudged a little higher as well on the back of strong labour market conditions,” Lawless said.

“We’ve also seen the flow of fresh listings continue to slide through the first month of spring, which is uncommon for this time of the year.”

The combined regionals index, which recorded stronger growth conditions through the upswing (41.6%), peaked two months later than the capital cities (June 2022), with values down -3.6% through to the end of September (approximately -$21,700).

“We are still seeing some resilience to value falls around the more affordable areas of Adelaide and Perth, as well as some regional markets associated with agriculture, mining and tourism,” Lawless said.

A floor?

Dr Oliver says with consumer confidence down around recession levels and a flow through to slower consumer spending could well ultimately help limit how much the RBA will have to raise the cash rate by.

“Expanded access to home deposit schemes, the Federal Government’s ‘Help to Buy’ scheme, NSW first home buyers swapping stamp duty for land tax next year, the tight rental property market, rising immigration levels and in the case of Brisbane, the axing of the onerous land tax changes in Queensland, will ultimately help to provide a floor for property prices but for now the property market will be dominated by the cyclical impact of rising interest rates.”

“And so we see the peak in the cash rate being well below 4.1%, but the risk to our cash rate forecast is on the upside.”

There are two possible (but unlikely) saviours. (Think Hollywood, 1998…)

If inflation quickly subsides allowing the RBA to soon start easing. Unlikely:

and/or; A rapid rebound in immigration exacerbating the shortage of housing evident in very tight rental markets: More unlikely:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.