You might be interested in

Mining

Fortescue is dialled in to critical minerals; here's some areas the major miner is tuned into

Mining

Reporting Rodeo Pt 3: With a week to go who else could light up reporting season?

Mining

Around the wide world share markets were largely higher by the end of last week, engorged on the tasty news out of the US that interest rates look like having peaked.

At home it was far more topsy-turvy, with the benchmark surging mid-week and clocking a near two-month high of 7,105 points – after the good US news on inflation supercharging risk-on confidence that interest rates have peaked.

The September wages read came in at an all-time record high – but this was tempered by the recognition in the September quarter of the Fair Work Commission’s wage review, which included minimum wage fun and the long-overdue correction to workers in the Aged Care sector.

And thank you, BTFW, aged care workers.

The jobless figures for October revealed a +0.1% increase to 3.7% – okay – and at least moving in the right direction as far as the RBA is concerned.

So that was all pretty volatile stuff for the local market – but overall positive for the ASX200 – closing up +1.05% after registering the seven-week high on Wednesday. It was easier going on Wall Street, but the significant decline in Australia’s 3-year bond yields from 4.24% to 4.1% was a good enough added extra to lift our stocks higher as well.

The 10-year bond yields fell by 15-20 basis points on optimism major central banks have finished raising rates.

For the week US shares rose +2.25%, Eurozone shares gained +3.25% and Japanese shares rose +3.2%.

Chinese mainland markets fell -0.5% and why not with the ongoing concerns about the Chinese property market.

On the local small cap map, Kula Gold (ASX:KGD) – with a +150% price hike – brought home the best bikkies.

A double tap of announcements direct to the head of the market set off the buying – confirmation the drills are set to spin at the company’s “substantial” Cobra Lithium Prospect in WA next week and that the drilling operation is ready-funded, thanks to a handsome $650,000 boost from a placement of shares at the issue price of $0.013 a pop.

TechGen Metals (ASX:TG1) also had a cracker last week – up +144% off the back of an exploration update.

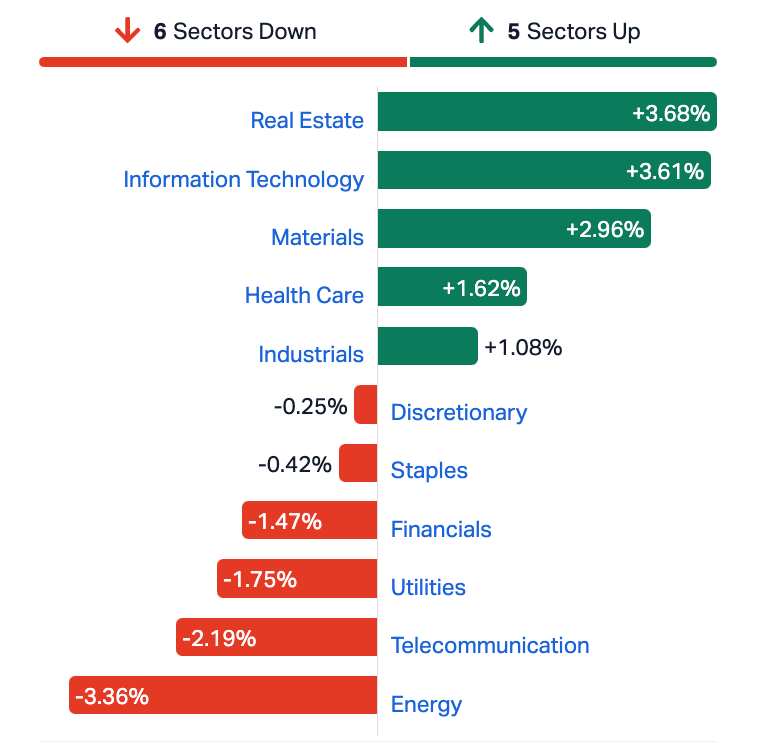

Our stocks were led by Property, Tech, Material and more runs on the board for Health Care.

Energy stocks were absolutely caned last week after oil prices fell for a fourth straight week, this time on rising inventories. Metal and iron ore prices were lower by Friday.

Elsewhere, it really does appear that labour markets in both Australia and the US have clearly turned, according to Westpac economist Ryan Wells who noted that the jobless rate here inched back up to 3.7% last month and total hours worked seems to be levelling out.

In the US jobs growth has also slowed, leaving market participants to begin spitballing about when will central banks reverse course and start cutting rates.

Yet for Australia, Westpac notes, the question remains whether the RBA still has further to go with rate increases.

We aren’t there yet, says the economics team at Westpac. Here’s some of their recent observations on where we are vs inflation, featuring a gorgeous economy in both words and economics:

“Australia can be viewed as being six or so months behind some other countries in its disinflation journey. Like the United States earlier in the year, Australia is still in the phase of being surprised how slow services inflation declines at first.

“A further wrinkle here is that the shock to energy prices following Russia’s invasion of Ukraine last year only flowed through to domestic retail electricity costs in July this year. In this sense, the dynamics of the inflation cycle can also be a little slower.

“The other main driver of the later expected turning point for rates is that the RBA has, for a variety of reasons, seemingly chosen a ‘not quite as high for longer’ strategy.”

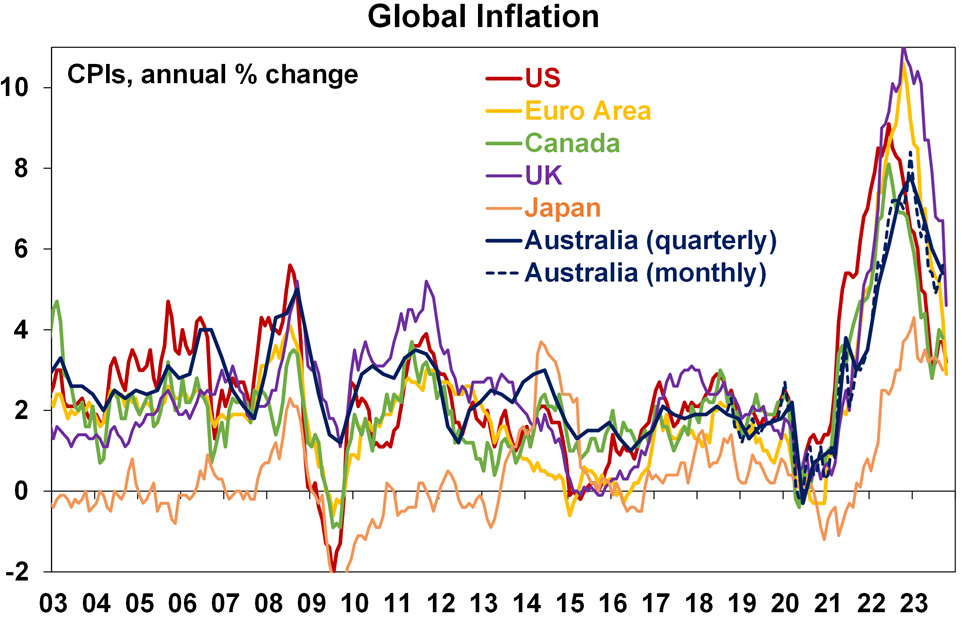

The good news on inflation is evident via the next chart from Shane Oliver, head of investment strategy and chief economist at AMP, which shows the various inflation rates – in brilliant technicolour for some of the major developed countries, including us truly…

Shane says that while there is high anxiety about sticky services inflation, on the whole inflation is continuing to fall ‘about as quickly as it went up.’

“Relative to the US, Canada, Europe and the UK, Australian inflation lagged on the way up and peaked a little later (partly reflecting the slower reopening from covid) and it’s doing the same on the way down so there is no reason to be alarmed that its higher than in North America and Europe. More broadly because the surge in global inflation led that in Australia, the decline in global inflation points to a further decline in Australian inflation ahead.”

The big market mover last week – US consumer prices – came in dazzlingly flat for October against the united fears of a +0.1% gain, leaving annual inflation at 3.2%yr from 3.7%yr in September.

That was all equity markets needed, though there was more – the falling oil prices were the main cause of the monthly inflation-deceleration, but it was the decline in core prices – below expectations at +0.2% which has traders pumped.

Within that core basket, goods prices have fallen for five straight months. Frankly, any shopper will tell you that doesn’t seem to be the case. Here or in the States.

Disinflation also looks to be broadening through services ex-shelter, indicating softer consumer demand and business pricing power. As shelter retreats in coming months, the FOMC’s 2.0%yr will come within reach, likely mid-2024.

Despite these developments, commentary from FOMC members remains cautious. Chicago Fed President Goolsbee highlighted the importance of rents to the next leg down in inflation, while San Francisco Fed President Mary Daly warned against prematurely claiming victory over inflation.

Firstly, at about 5pm on Sunday night in Sydenham, ahead of the cricket, which we won (right? right?), the SPI Futures are pointing to a solid +0.4% open on Monday morning, thanks to the bulls being unleashed across EU markets on Friday and some late but positive moves on the commodities front, with oil and metals regaining lost ground.

On the global stage – there’s a week ahead of preliminary manufacturing and services PMIs for France, Germany, the Euro Area, the UK and Japan.

Then there’s some central bank action with interest rate decisions slated for the crazypants team at the Central Bank of the Republic of Türkiye, led by Governor Hafize Gaye Erkan whose crew has hoisted its key interest rate to 35% from 8.5% since June.

With price growth in Turkey looking like it has more in the legs at a cool 60%, Erkan promised Turkey that she has the backing of President Recep Tayyip Erdogan to do whatever’s needed in terms of raising rates until the madcap inflation’s been whipped.

That’s probably because the notoriously fickle Erdogan sacked Turkey’s previous three governors, before appointing Erkan in June.

Elsewhere, central banks meet in Sweden, South Africa, and Indonesia, while Germany will publish its Ifo Business Climate report.

It’s Thanksgiving week in the United States.

Once Wall Street crawls past the release of the November Fed minutes on Tuesday in New York, and then the durable goods orders on Wednesday morning, it’ll be slam the doors and lock up the kids as the exodus for the Hamptons begins in earnest.

Until then whatever focus is left will rest on those two majors and then a few services, and manufacturing PMIs from S&P Global as well as US home sales.

Closer to home, the People’s Bank of China (PBoC) is expected to hold its loan prime rates (LPR) unchanged following the hold of its medium-term lending facilities. But honestly, China – who knows?

In Japan, it’s all about October’s inflation print as a porous yen is likely the culprit behind higher consumer prices, which would add to the pressure on the Bank of Japan (BoJ) to give up on its crazy-ultra-loose policy.

Japanese PMI data for November is also due.

Elsewhere, Thailand will unveil its Q3 GDP, while Malaysia and Singapore drop their CPI for October.

Back in the States, where it’s eternally earnings season, there’s exciting reports dropping from Zoom, Nvidia, Lowe’s, Analog, Dell, Autodesk, HP, Dollar Tree, Best Buy, and Deere & Company.

Wall Street is closed on Thursday and closes early on Black Friday – a brief and oft pointless session marked by the absence of anyone.

Japan is also closed on Thursday.

The RBA minutes are the only blemish – dropping on Tuesday – in an otherwise data-free week at home.

On the corporate front, Technology One (ASX:TNE) Webjet (ASX:WEB), and Virgin Money UK (ASX:VUK) drop earnings.

And we are mid-AGM season, with a whole host of diggers facing the shareholders.

Josh Gilbert, market analyst at eToro, shares his three things to watch in Australia in the coming days… (aside from this HIGHLY suspicious attempt at a Movember ‘tache…)

Materials AGMs

This’ll be a big week on the ASX materials front with a gaggle of key miners in the sector rolling out their respective AGMs, says eToro’s winner of the coveted eToro Best Looking Cornish Analyst 2022/2023, Josh Gilbert.

Josh says the two big names worth watching are Pilbara Minerals (ASX:PLS) and Core Lithium (ASX:CXO)

“Both stocks have had a miserable 12 months as Lithium prices continue to free-fall. Worse still, Core Lithium has seen shares plummet by 75% in that time, so this is a key AGM to reassure investors of what’s ahead.

“Elsewhere, we have updates from gold miners Bellevue Gold (ASX:BGL) and Evolution Mining (ASX:EVN). Both these stocks have performed in stark contrast to the lithium names, gaining more than 40% each in the last 12 months.”

This is thanks in part to the recent rally in Gold prices, as geopolitical tensions cause uncertainty across global markets and central banks buy gold at record levels, Josh says.

“AGMs are an important time for shareholders and the business itself. A poor AGM can impact investor confidence, but a solid AGM can drive positive investor sentiment. It’s a great time for investors to get a sense of if the business is delivering and what’s ahead. With lithium’s slump largely driven by slow demand against a glut of supply, material investors will be hoping for strong indications of increased lithium demand in the tech and hardware sector going into 2024.”

Michelle Bullock Speech & RBA Minutes

On Tuesday, the man from beautiful Truro in gorgeous Cornwall says, the latest RBA minutes will be released against the backdrop of the ASIC Annual Forum, where RBA Governor Michelle Bullock is due to address a fired-up crowd of regulators.

“The meeting minutes will give some good insight into the central bank’s decision to raise the cash rate by 25bps, particularly given it was such a live meeting. However, the bigger picture sentiment will tell us what we already know; while other central banks increasingly head towards a softer tone, Australia is far from out of the woods – and the RBA’s hawkish bias will likely stay intact for now.

“At the forum, investors will still be looking for any hits of doveish sentiment from Bullock, similar to what we saw in the statement following the decision. It’s highly unlikely they will get that, though, with this week’s unemployment and wage figures causing further headaches for Bullock and the board heading into the year’s end.

“Unfortunately, anyone hoping for the 28th of November’s retail figures indicating the economy is cooling may have their hopes dashed – and a December rate pause will not signal the hike cycle is over, especially once retail figures drop in January following both the Christmas and Black Friday flurry.”

Nvidia Earnings

NVIDIA investors will be gearing up for what is likely to be an impressive set of earnings on Tuesday, US time, Josh says.

“NVIDIA more than delivered in Q2 with eye-watering results, along with a solid forecast for the upcoming quarter, guiding for revenue of US$16 billion, well above estimates of US$12.6 billion.

“Even with the Magnificent Seven going in hard on AI, NVIDIA is still leading the pack when it comes to converting hype into profit. Earnings are expected to rise by just under 500% next week, putting AI monetisation front and centre.

“The stock has continued to perform impressively, sitting near record highs after gaining 240% this year. Recently, shares experienced a 10-day winning streak in November, following a dip in October. The good news for AI investors broadly is that demand is set to stay high, with use cases exploding and businesses continuing to spend big.”

Source: Westpac, Commsec, Trading Economics, S&P Global Research, AMP

TUESDAY

Australia RBA Meeting Minutes (Nov)

WEDNESDAY

Australia Westpac Leading Index (Oct)

THURSDAY

Australia Judo Bank Flash PMI, Manufacturing & Services

Monday

China (Mainland) Loan Prime Rate (Nov)

Thailand GDP (Q3)

Malaysia Trade (Oct)

Germany PPI (Oct)

Taiwan Export Orders (Oct)

Tuesday

South Korea PPI (Oct)

New Zealand Trade (Oct)

Switzerland Trade (Oct)

United Kingdom Labour Productivity (Q3, prelim)

Hong Kong SAR Inflation (Oct)

Canada Inflation (Oct)

Canada New Housing Price Index (Oct)

United States Chicago Fed National Activity Index (Oct)

United States Existing Home Sales (Oct)

United States Fed FOMC Minutes

Wednesday

South Africa Inflation (Oct)

Taiwan Unemployment (Oct)

United Kingdom CBI Industrial Trends Orders

United States Durable Goods Orders (Oct)

Eurozone Consumer Confidence (Nov, flash)

United States University of Michigan Sentiment (Nov, final)

Thursday

United States, Japan Market Holiday

UK S&P Global/CIPS Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

Singapore GDP (Q3, final)

Singapore Inflation (Oct)

Norway GDP (Q3)

Indonesia BI Interest Rate Decision

Taiwan Industrial Production (Oct)

Taiwan Retail Sales (Oct)

Turkey TCMB Interest Rate Decision

South Africa SARB Interest Rate Decision

Friday

United States, India (Partial) Market Holiday

Japan au Jibun Bank Flash Manufacturing PMI

US S&P Global Flash PMI, Manufacturing & Services

New Zealand Retail Sales (Q3)

Japan Inflation (Oct)

Malaysia Inflation (Oct)

Singapore Industrial Production (Oct)

Germany GDP (Q3, final)

Germany Ifo Business Climate (Nov)

Mexico GDP (Q3, final)

Canada Retail Sales (Sep)