Trader’s Diary: Everything you need to get ready for the week ahead

News

News

We had some top shelf volatility last week, bookended by some wonderful, characteristically contradictory data out of China.

Monday delivered hopelessly anaemic retail data – sales crashing more than 11% year on year, almost twice what was reckoned with. Industrial output fell almost 3%. And that’s what happens when you lock-down your working population.

The People’s Bank of China, (PBoC) the central bank of Xi Jinping, disappointed as new bank lending in China wallowing at its lowest ebb in circa five years – despite Beijing allowing for a wee trim in mortgage loan interest rates for a segment of home buyers. Token, token effort.

Tuesday to Friday arvo was a catalogue of volatility as the tension between rising rates and faster rising inflation played out to a backdrop of war, (looming) famine and ongoing supply chain disintegration.

US shares fell more than 3% last week, making it seven weeks of losses on the trot.

All was rather lost on both a fiscal and an emotional Friday morning, until our dormant friends at the PBOC, up and cut the key five-year Loan Prime Rate by 15bp to 4.45% – an unusually deep cut.

I (and my mum) believe I said it best on the day – something about buyers bargain hunting in arvo trade, reassured to the hilt that Beijing will ensure the struggling property sector remains totally in play and that it all smells a lot like some stimmy is in the post.

Ending the week on a high, Chinese shares rose 2.2% and our shares gained 1% largely on China’s monetary easing as tech, utility and material stocks more than offset falls in consumer and energy names.

From peak Wall Street a few months ago, US stocks are now down some 20%, the tech-laden Nasdaq, 29%. Tesla’s Elon Musk can probably accept some blame, he was everywhere doing nothing. Although he has started to sound a bit like ex-US President and reality TV host Donald Trump.

UK inflation rose again in April to 9% YoY, leaving the Brits’ central bank on track for more rate hikes, while Fed player James Brian Bullard CEO and president of the St. Louis clique, reiterated the Fed’s mantra on clubbing inflation and hiking rates to above neutral with a near-term series of 50bps hikes, and that markets had repriced according to Fed guidance.

He did say the Fed could still be cutting rates in 2024.

Our jobless rate was 3.9%, unchanged from the downwardly revised March figure of 3.9%. Together with the 0.7% Wage Price Index (WPI) data, these were considered a miss. CBA’s Queen of Calculation, senior economist Katrina Clifton, says the bank is sticking with its forecast of the RBA nudging the cash rate ahead by 25bp at their next, June 7 meeting.

Westpac’s rate pack of Andrew Hanlan, Bill Evans, Elliot Clarke, Justin Smirk, Matthew Hassan, Michael Gordon, Nathan Penny, Ryan Wells & Satish Ranchhod reckon an RBA hike of 40 basis points in June “is still the best policy.”

Scott Morrison was Prime Minister on Friday. This morning that is no longer the case.

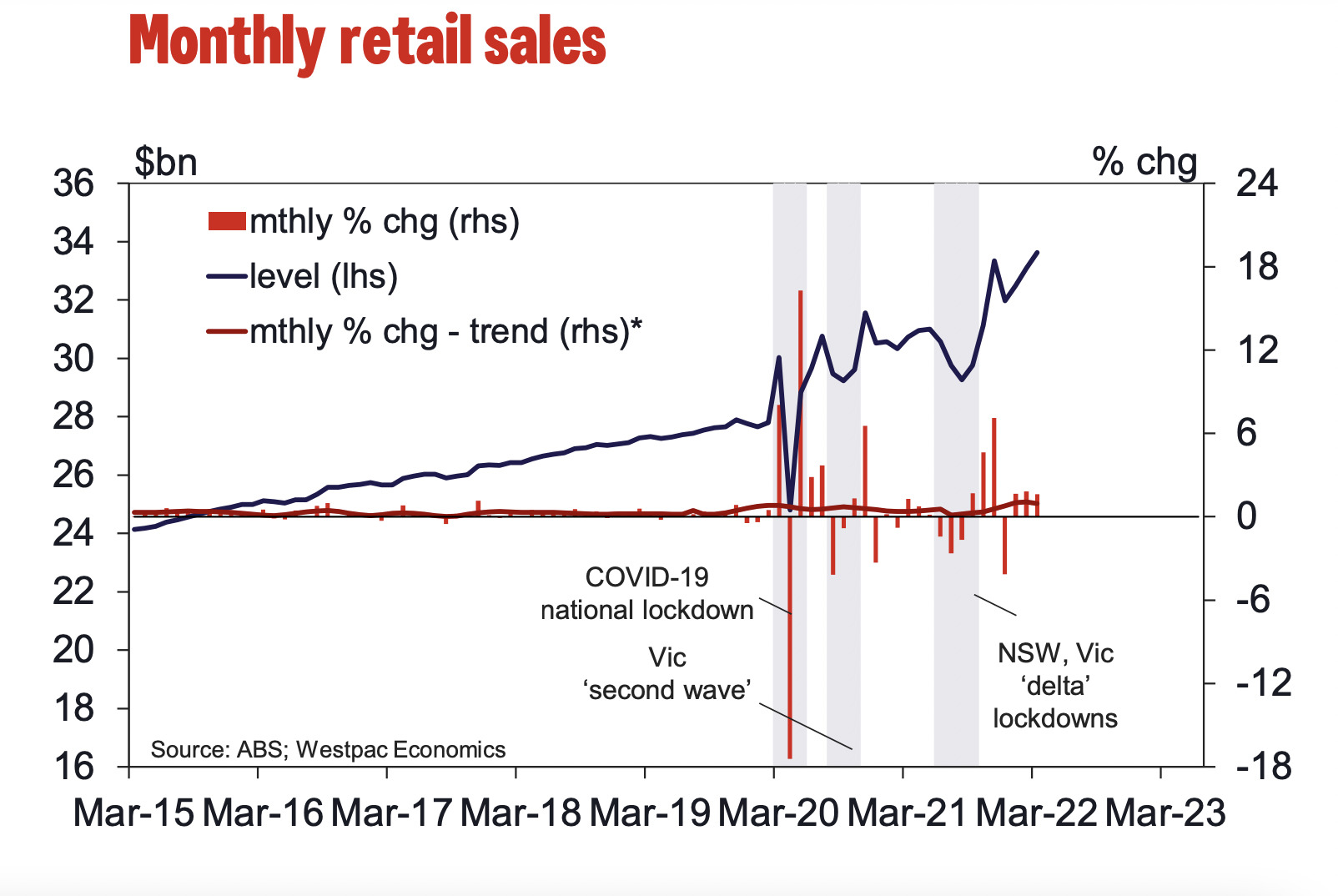

Looking ahead, at home we’re doing retail data on Friday… and on the global calendar it’s totally a PMI week.

Sources: Commsec. Westpac, Trading Economics

MONDAY

RBA Assistant Governor Kent is speaking at 9:05am

WEDNESDAY

Q1 construction work done

RBA Assist’ Governor Ellis speaking at 9:45am.

THURSDAY

Q1 private new capital expenditure and 2022/23 capex plans

FRIDAY

April retail sales

MONDAY

German May IFO business climate survey

UK May Rightmove house prices

US Apr Chicago Fedspeak

TUESDAY

Japan May Nikkei services PMI

Japan May Nikkei manufacturing PMI

EU May S&P Global manufacturing PMI

EU May S&P Global services PMI

UK May S&P Global manufacturing PMI

UK May S&P Global services PMI

US May S&P Global manufacturing PMI

US May S&P Global services PMI

US May Richmond Fed index

US April new home sales

WEDNESDAY

NZ RBNZ policy decision

US Apr durable goods orders

US FOMC May meeting minutes

THURSDAY

US Q1 GDP, annualised

US Initial jobless claims

US April pending home sales

US May Kansas City Fed index

FRIDAY

NZ May ANZ consumer confidence

China April industrial profits

EU April M3 money supply

US April wholesale inventories

US April personal income, spending

US April PCE deflator

May University of Michigan sentiment read

The Lottery Corporation (ASX:TLC)

Listing: 24 May

Tabcorp Holdings (ASX:TAH) is planning to demerge its Lotteries and Keno business into The Lottery Corporation.

The Australian lottery operator and provider of Keno products has operations in all Australian states and territories except for Western Australia, and distribution through retail outlets, Keno venues and online.

Bellavista Resources (ASX:BVR)

Listing: 25 May

IPO: $6.5m at $0.20

The explorer is targeting large, high-grade base metal and battery mineral deposits in Western Australia.

The company has a large and highly prospective tenement package that covers approximately 100km of strike of the northern margin of the highly prospective Edmund Basin.

The projects include Brumby Deposit, Vernon Base Metals, Vernon Nickel-PGE and Gorge Creek which are highly prospective for zinc, copper, silver, PGE and uranium deposits.

Listing: 26 May

IPO: $6m

This explorer is focussed on assets prospective for nickel, lithium and gold in the Goldfields-Esperance region of WA.

It actually holds the largest land package ever held by one company in the history of exploration within the Lake Johnston Greenstone Belt and says the region has been historically overlooked and underexplored – with the Lake Johnston project never the main focus for nickel majors that previously held the ground.

Listing: 27 May

IPO: $6m at $0.20

The company has two lithium projects – the Solonopole Project in Brazil and the Napperby project in the NT.

Solonopole’s permits cover historic artisanal mining sites previously mined for lithium, Coltan (tantalum and niobium) and tin.

And Napperby is in the Pine Creek Pegmatite province – which hosts Core Lithium’s (ASX:CXO) Finniss project.