Trader’s Diary: Everything you need to get ready for the week ahead

News

News

Last week the one-for-all-for-one All-Ordinaries index rose by 3.2% after a 0.8% fall the week before.

In Hong Kong, Chinese stocks, which crashed dead Monday, rallied hard Wednesday after some awfully reassuring moves from Beijing that really amount to – we’ll stop being mean and just be supportive of everyone for a bit.

The likes of Alibaba (NYSE:BABA) jumped 36%.

US stocks also rallied after the positive, dulcet tone on economic growth out of the US Federal Reserve, particularly the velvet glove and tonsils of Chair Jerome Powell. There’s going to be a lot of varied Fedspeak from various governors over the next five days – they should be able to cover all options.

Meanwhile US inflation returned to a 40-year high, recording 7.9% over the last year, ensuring the Fed increased the official cash rate by 0.25%.

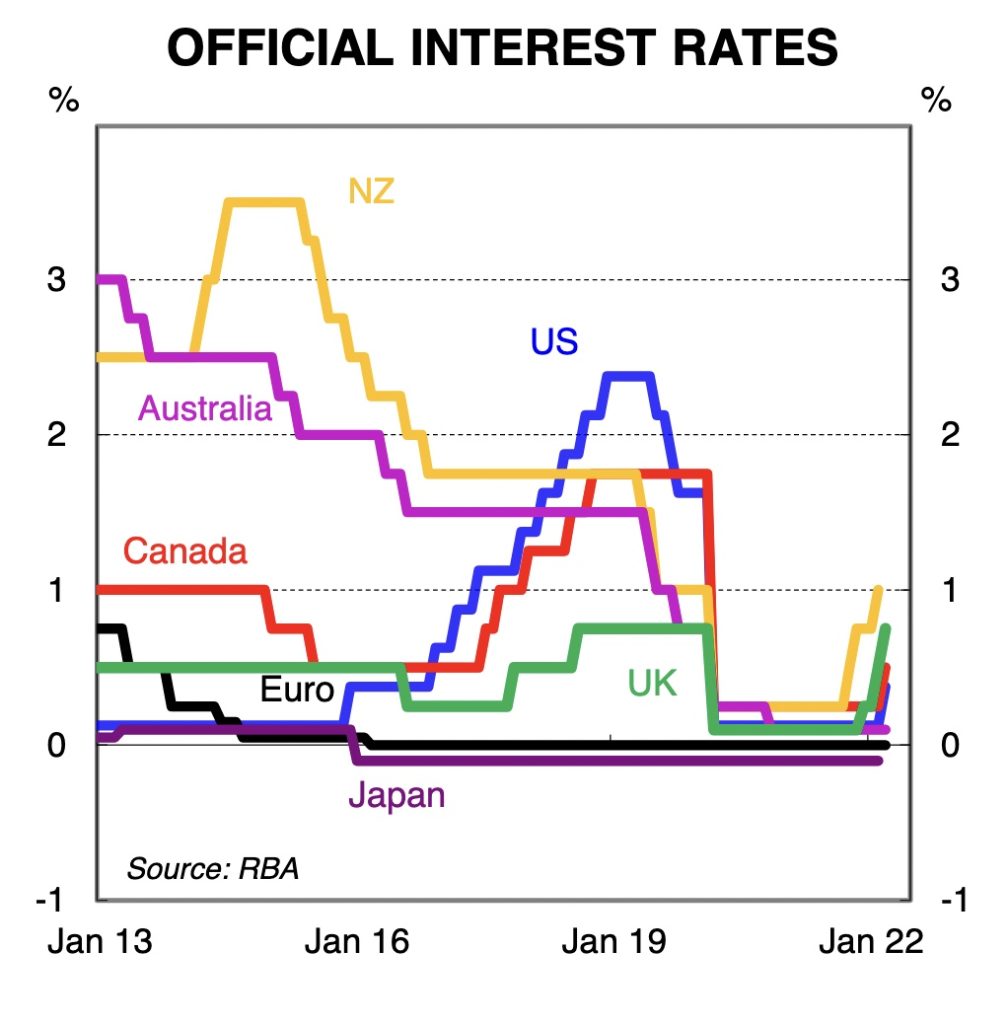

The Poms started the rot, though. The Bank of England raised its benchmark by 0.25% to 0.75%, making it the first central bank to restore rates to what was normal a few years ago before living within a pandemic became normalish.

Taiwan’s central bank also hiked rates by 0.25%, which surprised markets and the usually unsurprisable senior market analyst Asia Pacific for OANDA, Jeffrey Halley.

“Taiwan normally hikes in 0.125% increments, so this was aggressive for them,” Halley noted. “They quoted inflation concerns.”

“And this week Bank Indonesia did what I expect most of Asia to do – leave rates unchanged to support growth.”

Australian and US equity markets remain in bearish-mode, blood pressures simmering away over what horrors Russia might next perform in Ukraine to destabilise Europe and hurry-up already high oil, gas, and grain prices.

This is adding to existing worries about central banks withdrawing support for bonds and lifting official cash rates to fight some of that runaway inflation.

Aussie public policy economist and adviser, Percy Allan, says nevertheless, “the likelihood of global stagflation stemming from supply disruptions associated with the Ukraine war and Russian sanctions still concerns investors”.

Allan says it is far from clear that these kinds of current share rallies can be sustained.

Jeffrey Halley says oil spiked higher on the IEA oil supply warning although Asian buyers for the last couple of previous sessions had enthusiastically bought the dips under $100 a barrel. A weaker US Dollar was also a tailwind, and it was the main reason that gold also continued rallying.

Halley has also been on China watch (as well as Six Nations rugby watch) this weekend.

“With China having effectively said they will backstop the stock market; markets probably want to see the colour of their money through action now.

“China announces its 1 and 5-year Loan Prime Rate decisions on Monday, and the 1-year should be a prime candidate for a trim, short of sneaky RRR cut. Shenzhen appears to be reopening after its Covid lockdown, but the news is just coming out that authorities are recommending people in Shanghai work from home. How that story develops might have a bigger bearing on the Mainland markets on Monday than a rate cut.”

It’s all quiet on the southern and largely on the western fronts next week. It is, however, still especially crap on the eastern European front, so not a bad time to skip any major data releases next week in Australia.

The RBA Governor Lowe will give an address on Tuesday at the Walkley Awards for Business Journalism, where Stockhead continues its unofficial boycott in protest at not having won anything mainly because our journalists don’t have enough time to apply. We could pay them more, or push them less, but there’s no award for that.

Lowe has not yet provided the the title of the speech but we are really hoping he will finally go with, ‘How Lowe can business journalism go?’

But that’s understood – we’ve been a bit spoiled with regular central bank comms so far this year. We enjoyed the unabridged March 2022 Board meeting Minutes, as well as two speeches from the Governor last week which was welcome running commentary.

The main event is probably the UK CPI print for February, where CPI inflation has been given an extra kick by furious energy prices, sporry supply chains and rising food prices against strong demand.

The Bank of England expects the CPI to accelerate from 6% in February and March to circa 8% in April.

NZ Feb trade balance

Aus RBA Governor speaking at Walkleys

NZ Q1 Westpac–MM consumer confidence

NZ Q1 Westpac–MM employment confidence

Feb Chicago Fed activity index

Fedspeak

Mar Richmond Fed index

Fedspeak

Feb new home sales

Fedspeak

February durable goods orders

Initial jobless claims

March Markit manufacturing

March Markit services

March Kansas City Fed index

Fedspeak

February pending home sales

March Univiersity of Michigan sentiment

Fedspeak

People’s Bank of China – Loan Prime Rate (LPR) Fixings, for 1y LPR and for 5y LPR

(Although PBoC didn’t cut its MLF rate on 15 Mar, there is a small risk banks trim 1y LPR fixings following official comments last week pledging support to China’s wobbly economy and markets.)

Japan March Nikkei services

Mar Nikkei manufacturing

China Q4 current account balance

MONDAY

UK March Rightmove house prices

Europe March consumer confidence

UK February CPI

NATO/G7/EU – President Biden to Europe for an emergency NATO summit. A G7 meet will also take place the same day.

Biden then joins EU leaders later to continue discussions. While no major announcements are expected, the meetings are likely to drive at a bit more of a commitment to heaps more armament support for Ukraine, perhaps a continued push toward the EU cutting off Russian energy imports.

Eur Mar Markit manufacturing

Mar Markit services

UK Mar Markit services

Mar Markit manufacturing

Eur Feb M3 money supply Credit data also due.

Ger Mar IFO business climate survey

UK Mar GfK consumer sentiment

Feb retail sales

(sources: Commsec, Refinitiv, Westpac)

Listing: 22 March

IPO: $5.5m at $0.20

The gold and uranium focussed explorer has the Roger River gold project in Tasmania, and the Orroroo uranium project in South Australia.

Norfolk Metals intends to execute on two consecutive exploration programs within 12 months of listing, including 2,000-3,000m of diamond drilling at Roger River with the aim of identifying epithermal gold occurrences in targets defined from ground-based gravity and airborne aeromagnetic survey.

At the Orroroo project, exploration will kick off with reverse circulation drilling to further understand the Gamma anomalies identified by previous drill campaigns in the Walloway basin.

Listing: 23 March

IPO: $5.5m at $0.20

This explorer is focused on kaolin, with the current market at around $6.4 billion due to a global shortage and it’s expected to hit $8.23 billion by 2024.

Pinnacle holds the Bobalong and Holly projects in WA and the White Knight and Camel Lake projects in SA.

Notably, White Knight is adjacent to active kaolin exploration projects held by Andromeda Metals (ASX:ADN), OAR Resources (ASX:OAR) and PepinNini Minerals (ASX:PNN).

The company plans to kick off exploration at Bobalong and Holly Kaolin and, subject to being granted the tenement applications for Camel Lake and White Knight, will take advantage of substantial historic datasets and integrate these with the latest exploration techniques and mineralisation models.

Pathify Holdings (ASX:PTH)

Listing: 25 March

IPO: $10m at $0.40

The tertiary education student online portal service provider has complete mobile/web parity with a native mobile app that allows for mobile push notifications.

Institutions are charged an annual licence fee based on student enrolment, the modules they subscribe for and the access they activate.

The company is focused on the US market and – as of 31 December 2021 – had secured 61 higher education customers across a wide range of higher education categories including research universities, leading state universities, community colleges and more.