You might be interested in

News

As Swoop makes a play on regional Australia, these other ASX telco stocks are jostling for position

News

The Pentanet juggernaut continues to roll in the over-performing ASX telco sector

Coinhead

News

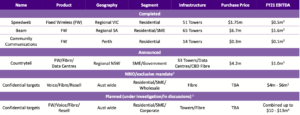

On Monday, telco Swoop (ASX:SWP) raised $41 million via a fully underwritten placement to fund the recent acquisition of regional provider Countrytell for $4.2 million – plus a bunch of planned acquisitions across fixed wireless, voice, fibre infrastructure and resale providers.

In July, the company acquired Beam Internet – a regional player in South Australia – for $6.7 million.

In June, Swoop nabbed Perth-based fixed wireless player Community Communications as well as regional Victorian wireless broadband provider Speedweb for $1.75 million.

And Swoop isn’t done picking up regional players, launching a $5 million share purchase plan on Tuesday to further boost its acquisition kitty.

Speaking with Stockhead, Swoop CEO Alex West said the company has a few targets in the pipeline who have signed non-binding offer letters with aggregate FY21 EBITDA of between $4-6 million.

“We have two companies that we’ve signed non-binding indicative offers with and we’re close to closing the deal,” he said.

“We expect the capital to be deployed in the next one to two months.

“Then there’s a third target that’s likely to be closed the end of December.”

Plus, Swoop is in active discussions with several targets with aggregate FY21 EBITDA of between $10–13 million, however the terms of any potential acquisition haven’t been agreed and are not guaranteed.

“We wouldn’t be completing those transactions until mid-next year – so end of the first quarter calendar and third quarter financial year,” West said.

West said since the company listed in May, it’s been clear about its plans to pursue infrastructure deployment in regional centres.

“We’re going after larger populated centres in regional areas that are currently poorly served by the existing technology,” he said.

“We’re looking to put in a higher speed, more reliable, fixed wireless infrastructure that’s advanced over the last five years to provide better speeds and products for customers in these regions who may be aware of the high-speed broadband that’s available, but they don’t necessarily have access to it.”

The company’s acquisition spree is a clear-cut pathway to rapid expansion.

“We get access to existing services in operation without necessarily incurring the upfront customer acquisition and connection costs,” West said.

“In terms of the previous acquisitions, we’ve been provided with immediate access to turnkey infrastructure in regions that would have been on our expansion roadmap anyway.

“It also adds depth to our team, provides opportunities for synergies and, as we go forward provides opportunities to expand the types of services and products we have in market.

“And then also adding additional products allows us to have that cross-sell opportunity to a broader client base.”

Swoop also increased its FY22 guidance to between $43m–$45m FY22 revenue and between $10.5–$11 million FY22 EBITDA based on the recent acquisitions.

“We’ve upgraded our guidance with the inclusion of CountryTell, and then any acquisition that we have planned would be on top of that as well,” West said.

“So, there’s potentially upside to our guidance for any future acquisition – but the timing of when they occur and what impact they’ll have on the financial year can’t be said at this point.”

And importantly, the company has the management team to pull off all these acquisitions, with extensive experience growing companies like Vocus, Amcon, Superloop (ASX:SLC) and Telstra (ASX:TLS).

“We have lots of years of experience both in growing companies from very small to very large, both organically and also through M&A,” West said.

“I’ve previously integrated somewhere between 40 and 50 different organisations so I have a lot of experience in that space.

“And experience is always good, because we’re not trying to learn as we go with somebody else’s money – we’ve already done this once before.”