Think Big: How to adapt after five years of digital change just took place in ‘around eight weeks’

News

News

In the fallout from COVID-19, much has been made of the ability of companies to function in a remote-working environment.

That shift was initially driven by necessity. But looking ahead, the discussion has turned to how much of the digital transition will become more permanent.

During the last week of April, global consulting firm McKinsey ran a “Digital Sentiment Survey” in the US and what emerged was that the crisis has driven a rapid acceleration of the uptake in digital services — particularly banking, entertainment and groceries.

In fact, one CEO told McKinsey that what is happening in the US economy “will surely be remembered as a historic deployment of remote work and digital access to services across every domain”.

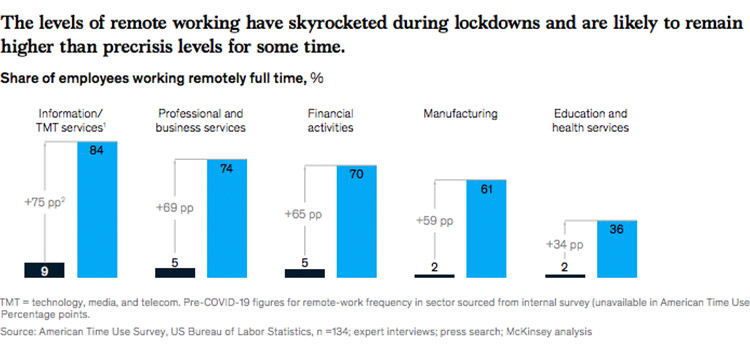

This chart illustrates the scale of the move, based on the percentage of professional staff who have shifted to remote-work:

Pre-coronavirus, the uptake of remote working solutions in the US accounted for less than 10 per cent of the industry. One health crisis later, that number immediately jumped to 84 per cent.

So one could argue it stands to reason that not all of those gains will quickly reverse if the health crisis is contained.

According to McKinsey, the “uptick in the use of digital services is here to stay, at least to some degree”.

The net result is a colossal acceleration to a new working environment, which previously was changing at more of a snail’s pace.

By McKinsey’s estimates, “recent data show that we have vaulted five years forward in consumer and business digital adoption, in a matter of around eight weeks”.

While the US is only one example, a similar transition has played out in other advanced economies such as Australia and the UK.

And the McKinsey analysts said businesses would have to move fast to adapt to this new paradigm. They outlined a 90-day plan, initially based on expanding network infrastructure and then establishing effective tools to measure performance.

It’s a strategy that ties in with recent comments by Glenn Flower from ASX-listed telco 5GN Networks (ASX:5GN).

Speaking with Stockhead at the end of April, Flower said the company was now focused on expanding cloud capability, to offer clients access to a larger pool of real-time data.

“The next six months will be critical,” Flower said. “I think what we’re doing is tied to the changing nature of business models and what the future might hold. Companies are realising they’ve got to future proof their business as opposed to doing what we’ve always done.”

McKinsey also highlighted the complexities involved as companies readjusted in an environment where distancing restrictions were being rolled back (and may have to be reintroduced) in waves.

In that context, McKinsey highlighted three key structural changes to consider, starting with the permanent nature of digital adoption outlined above.

Companies that don’t address material lags in their digital offering will fall behind more quickly in the new paradigm.

“If China offers us any lessons, digital laggards will be substantially disadvantaged during the recovery,” the analysts said.

Secondly, they emphasised the challenges involved from what would inevitably be an uneven recovery, by both geography and business sector.

In that environment, a focus on flexibility is key; excessive demand in some industries will be offset by “structural overcapacity” in others.

The analysts put a priority on good capital management and efficient supply chain practices, while companies should look to “transition their fixed costs to variable costs aggressively wherever possible”.

Lastly, the analysts advised companies to consider whether the remote-work models borne out of necessity during COVID-19 were efficient enough to warrant a more permanent change in strategy.

They said remote-work solutions often allowed businesses to mobilise teams faster, conduct high-level project reviews with “20 — or 200 — people”, and drive efficiencies in customer-facing aspects such as product information and sales support.

“Remote ways of working have, at least in part, driven the faster execution drumbeat that we’re all experiencing in our organisations,” McKinsey said.

“This step-change in remote adoption is now arguably substantial enough to reconsider current business models.”