The world’s first vegan ETF gained 68pc in 12 months, but there’s more to it than just Beyond Meat

News

News

It’s been two years since the world’s first vegan ETF was launched and the past year has been particularly solid.

The US Vegan Climate ETF (NYSE:VEGN) has returned 67.9% in the 12 months to August 31, 2021 ahead of the 57% return on the S&P 500 in that same time period.

Since inception it has returned 30%, ahead of the 24% made by the S&P 500.

The fund is operated by Beyond Investing headed by CEO Claire Smith who in a previous life worked for UBS.

Smith hailed the fund’s performance noting the tides had turned so far as ESG investing has gone in the past couple of years. Not just in the sense that many companies with higher ESG metrics did well but insofar that those with lower ESG metrics didn’t do well.

“The overall green trend has helped us enormously in terms of us not having underperforming stocks in the portfolio,” she said speaking with Stockhead from Geneva on Friday.

“And these underperforming stocks have been in areas where we excluded, so we don’t have exposure – we don’t have fossil fuels (we saw the oil price sink like a stone last March).

“We don’t have hotels, restaurants and a lot of the hospitality sector because eating meat is a big aspect of that sector and also things like airlines and cruise lines which are serving meat and advertising that as their offering and they are high carbon intensive industries.”

You might automatically think Beyond Meat (NYSE:BYND) would be a given for a vegan ETF and indeed that company is one of the vegan ETF’s investments.

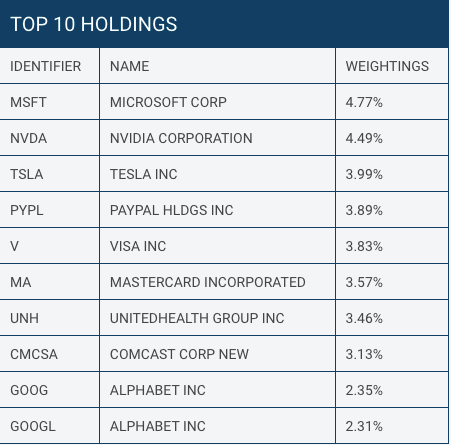

However Beyond actually isn’t one of its largest holdings.

The US Climate Vegan ETF isn’t just an investor in companies that make vegan foods, but companies that don’t engage in animal exploitation.

Smith says there’s more to veganism than just not eating meat.

Her fund starts with the S&P500 as a benchmark and invests in many of those stocks but also those in her view that are soon to be included.

One example of the latter was Tesla, which was in the fund before it joined the S&P500 last November.

“We intended for this to be incorporated within the class of ESG products which are broad based market products, not for this ever to be a sort of basket of smaller capitalisation vegan-only product companies,” Smith said.

“And this misunderstanding of the product has dogged us a bit since the beginning as a lot of people don’t know the definition of vegan or understand how vegan principals can apply to a portfolio.

“Our screens remove animal exploitation which is in keeping with definition of vegan which avoids harm to animals.

“It attempts to avoid harm and exploitation which means we retain all the other stocks in the market not involved in exploitation of animals.

“We have added to the standard ESG models people are using with an additional vector in the vegan philosophy.”

Smith says the reason Beyond is a small holding is because it is a small stock compared to the rest of the S&P500 with a market capitalisation under US$10 billion.

“Beyond is included in the ETF but I have a small position because it is a small stock,” she said.

“It is not in the S&P500 and compared to the large stocks which are hundreds of billions, Beyond is short of $10b and so evidently its position is going to be much smaller.”

In an information sheet provided to Stockhead, the fund purports a lower carbon footprint (-77%), waste footprint (-98%), and water footprint (-93%) per unit of revenue than the S&P 500 and many other ESG indexes 2.

Furthermore, VEGN is the only US Equity Fund that scores this highly across all of As You Sow’s ESG fund screener “Invest Your Values:

Fossil-Free (A)

Deforestation-Free (A)

Gun-free (A)

Weapons-free (A)

Tobacco-free (B)

Gender Lens (B)

Although it does not appear to own ASX stocks at the moment, that is set to change next year.

It owns a small stake in Square (NYSE:SQ) which thanks to its takeover of Afterpay (ASX:APT) will be partially listed on the ASX once that deal is complete.