The Housing Swan Dive: When to buy with Professor Peter Swan, AM AO FRSN FASSA and LEGEND

Via Getty

This is about where property prices are going and why.

But let’s start with Peter Swan, UNSW Professor of Finance and his post-nominal acronyms, which I’ve always enjoyed.

AM and AO: The General Division of the Order of Australia has four levels: Companion of the Order (AC) Officer of the Order (AO) Member of the Order (AM) and er, another one.

FASSA: That’s a Fellow of the Academy of Social Sciences in Australia. And in 2018 Peter was elected a Fellow of the Royal Society of New South Wales (FRSN).

LEGEND: He’s a really, really good fellow.

Rightio.

The Aussie property market has a cycle and we’re at the start of the next one. The cycle just ended was characterised by high prices getting higher everywhere and at a faster clip than the usual insanity.

The next cycle which they’re calling a downturn isn’t just the opposite of the above. That’d be good, but so would having sex in 2022.

The more likely scenario will be a multi-speed housing market and its shape, length and diversity will be largely shaped by the pace and extent of monetary policy – or how fast the banks raise the cost of borrowing.

We’re already seeing this schism as the mega-markets of Sydney and The Other One have been flatlining since after Christmas, then at the other end of the spectrum there’s region areas still going off, and hotspots like BrisVegas where the pace of growth remains stubbornly high.

The determining factor, I reckon is pretty simple – does the property market favour the seller or the buyer – and in Fortress Oz, it seems like it’s always been on the side of they which already own the house.

But cracks in the ediface are appearing.

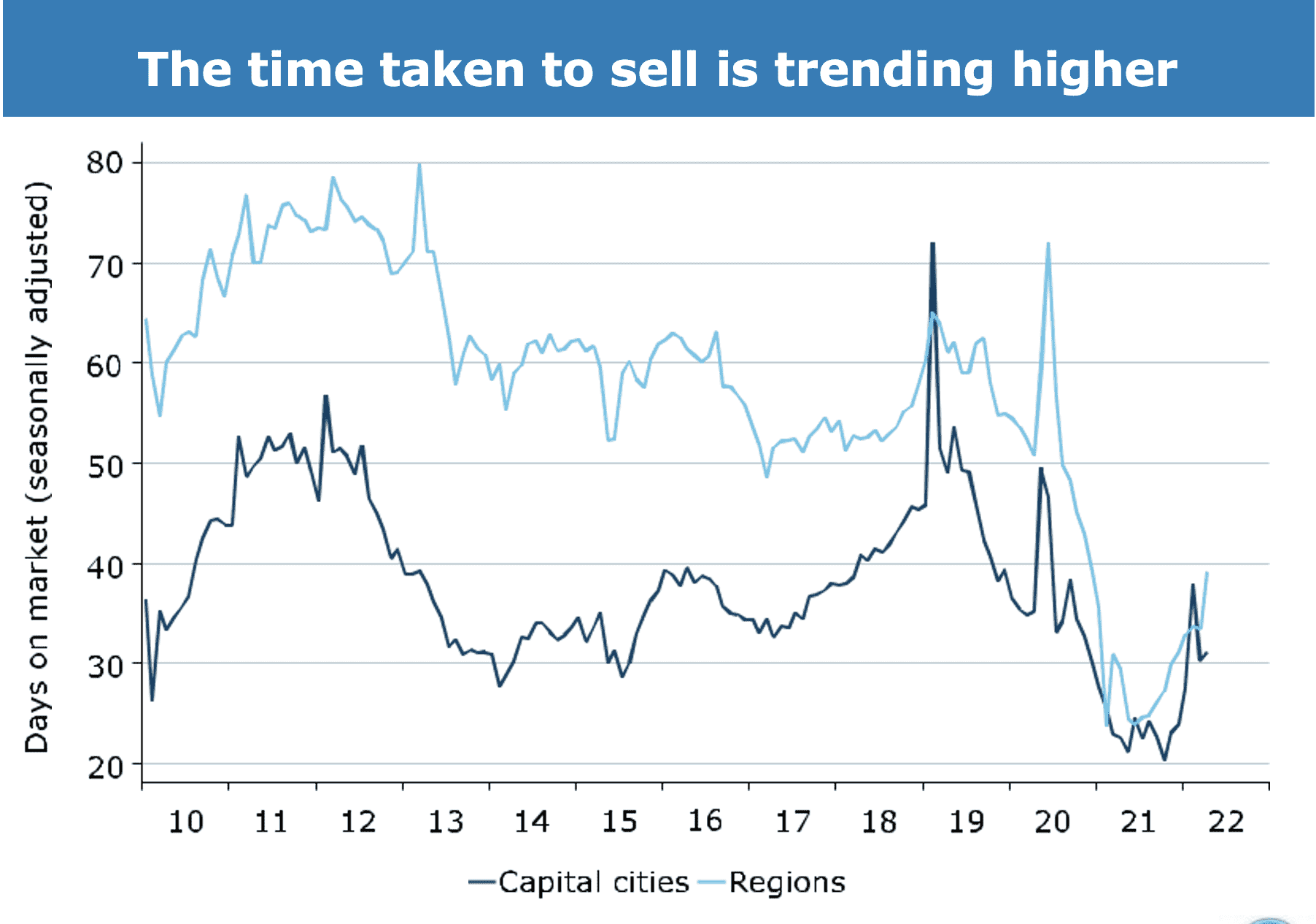

So, new housing data I like – it now takes eight more days than in November 2021 to get a house sold in Australia.

It used to be 20 days, now it’s 28 days.

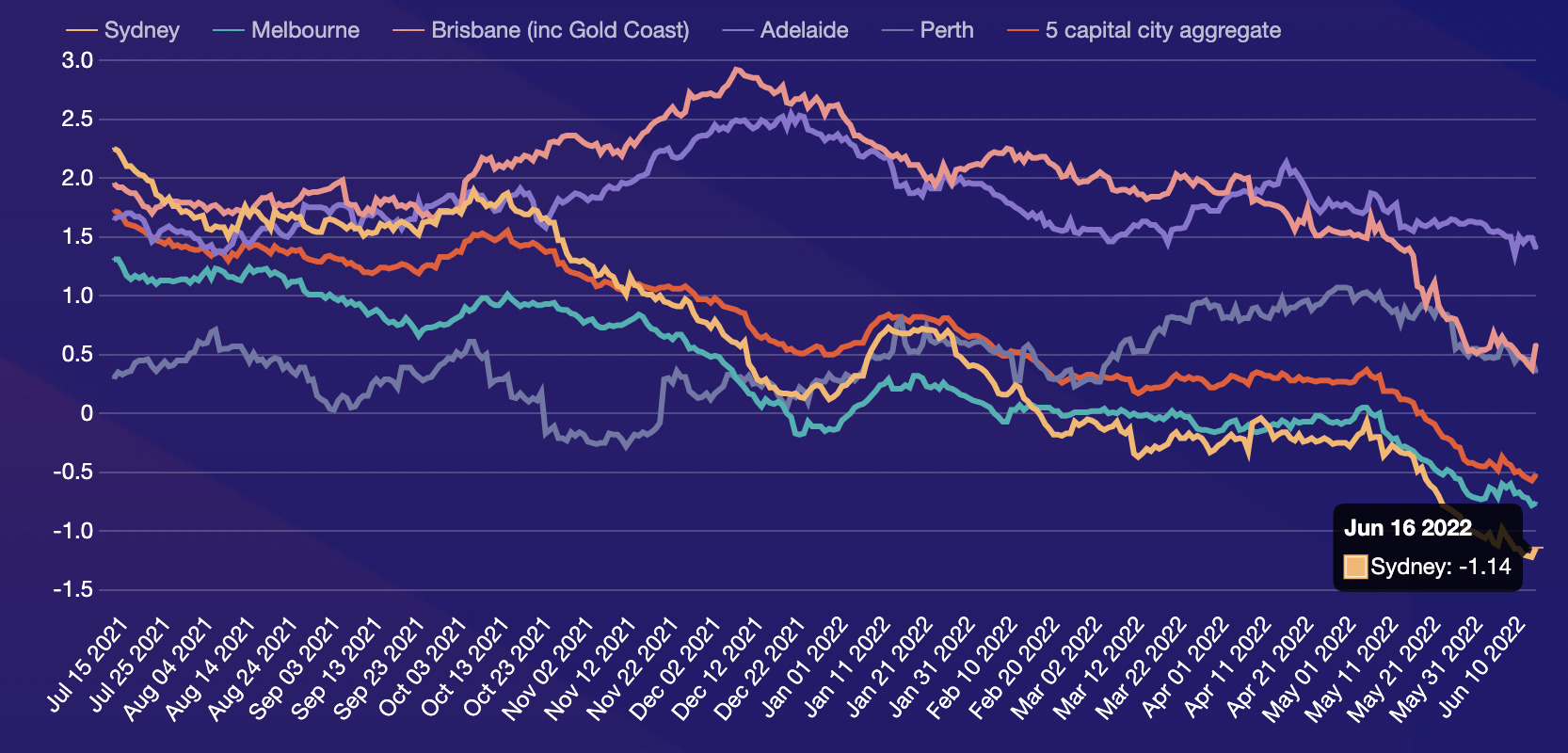

Conveniently for us, the chart below also describes – in outstanding technicolour – the 28-day rolling average change in capital city dwellings and the five major city market aggregates.

These synchronous, quiet little measurements (again, thanks CoreLogic), speak volumes to the changes – the Kafkian metamorphosis – taking place in a property market most Australians have only ever known as expensive and getting more expensive.

The rolling four-week change in capital city dwelling index values

The state of your rate

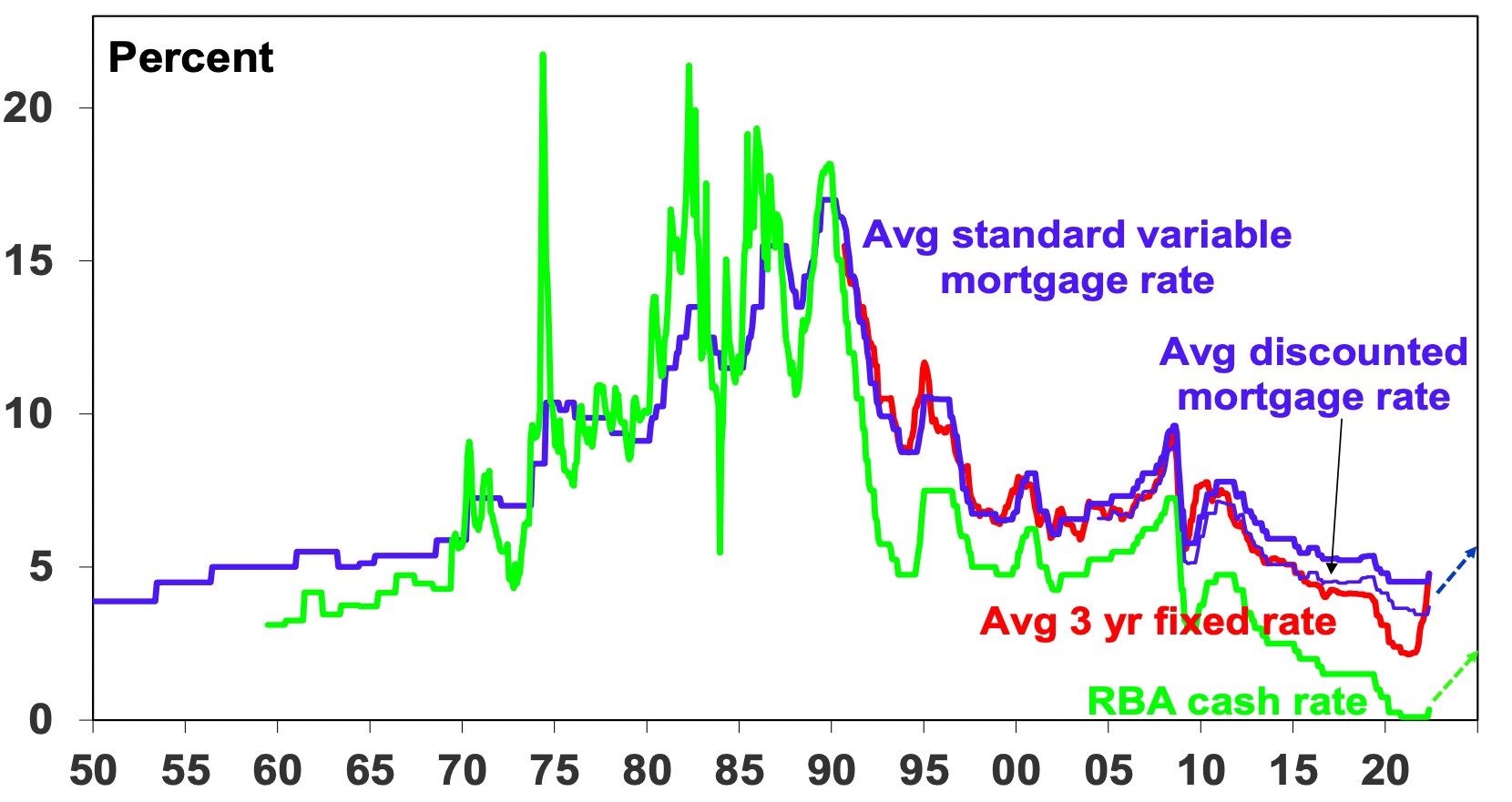

Lenders have been ahead of the curve that sucks up our credit and makes them money by using the last 12 months to raise fixed mortgage rates. Long before the Reserve Bank shed its reservations over inflation – roughly doubling since this time last year.

“Combined with an increase in the interest rate serviceability buffer from 2.5% to 3% this has crushed what new home buyers can borrow and hence their capacity to pay,” says Dr Shane Oliver chief economist and also legend at AMP Capital.

“As a result, the share of fixed rate home lending has fallen back to around 15% but variable rates are now rising too as the RBA continues to raise the cash rate.”

While fixed rates have already risen sharply, the about turn in the record low cash rate will flow through to variable mortgage rates, lifting minimum repayments and culling borrowing power.

Diana Mousina, senior economist at AMP Capital, told Stockhead the cost and pace of rising rates is going to come get us thick and fast.

“We now see headline inflation peaking at 7% in the September quarter and trimmed mean inflation peaking at 5.5% in the December quarter.

“There are no changes to our expectations for the cash rate from the lift in energy prices. RBA rate hikes won’t change the issues causing the temporary lift in energy prices. But, the broad lift in Australian inflation means an aggressive RBA rate hike profile over coming months.”

The Biggest Four lenders – NAB, ANZ, Westpac and the Bank of Us Tasmania, no, wait it’s the Commonwealth Bank – have also opted to pass on the Reserve Bank’s first 50 basis point (bps) rate rise through to customers via a further home loan rate rise.

Also serving the banks well was the last year of stupendous property values which jumped everywhere at the fastest annual acceleration ever taking the entire pool of Australia private residential property ahead by almost $2 trillion.

It’s not all-way traffic in terms of price pressure – post-COVID immigration is back on, falling unemployment and rising wages as well as rising exports and a strong economy will be supportive factors – but overall the net effect here is a sharp downturn in home buyer demand.

What put the bang in the property boom

So things already out of hand got downright weird during the pandemic. The total value of the Aussie resi-property market surged to $9.9 trillion after growing at the fastest annual pace on record last year, because of:

- record, stupendously long and low mortgage rates

- a fire-sale government incentives

- investor excitement at the recovery from the pandemic lockdowns

- COVID-19 inspiring a change in our spending away from services (like new lending about a year ago, compared to a norm of around 15%)

- and of course, the ongoing structural lack of supply – not enough bloody housing

Already slim housing pickings got slimmer

Doc Oliver’s seven causes of the property about-turn

- deteriorating affordability with the 29% surge in prices since the pandemic comparing to wages growth around 2.3% annually

- a more than doubling in fixed mortgage rates from around 2% to around 5%

- the start of RBA monetary tightening which is pushing up variable mortgage rates

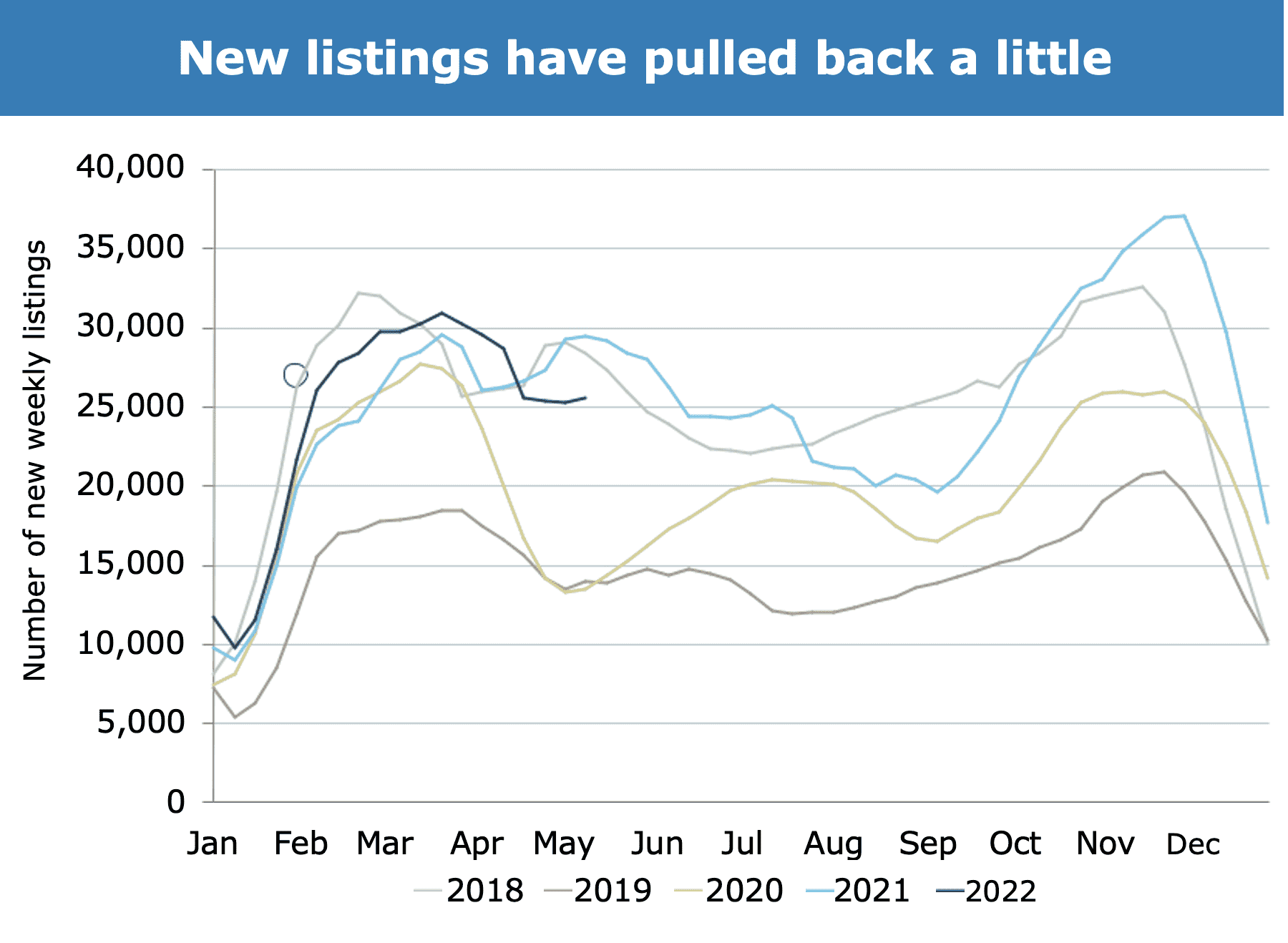

- a rise in new listings in Sydney and Melbourne

- a rotation in spending from goods back to services

- high inflation making it harder to save for deposits; and

- a decline in consumer and home buyer confidence

Taking the ludicrously low road

“The interest rate – that is the cash rate – went up by 0.5 of a per cent,” explains UNSW Business School’s Professor Peter Swan. “It’s a sizeable increase that was, I think in part because they were far too low last time.”

“It signals a return to more sensible interest rates and greater normality in the markets.”

So what’s a normal Aussie property market? And where does it leave the real estate keen beans – with and without their first properties?

Professor Swan, who actually established the Finance Department at the University of Sydney before heading back to UNSW and running the Australian Graduate School of Management (AGSM) where I used to stack chairs for a living, says record elongated low cash rates helped Aussie house prices leap by nearly a full third in the last two years, and that’s what’s led us to the edge of a property price recession.

“The ludicrously low-interest-rate policies pursued by the RBA in this time, and the massive injection of cash and stimulus into the economy of towards a trillion dollars as the government borrowed to the hilt over the period of its COVID-panic and with the debt of the states climbing to half a trillion…

“All of this led to the sizeable increase in house prices, which are far too high.

“There is no real justification for the 30% rise other than buyers working from home seeking more attractive places to live, especially along the coast.”

Australia now has some of the highest prices in the world relative to incomes, Professor Swan says. But don’t hold your breath for a price collapse which opens any doors.

“What tends to happen in a recession is that fewer properties come onto the market, and this ameliorates price falls.

“We also saw that very few properties were left on the market after the price hikes a year or so ago, and it is only recently that houses have come back onto the market.

“This may also have contributed to the slight fall in house prices recorded so far.”

So where are house prices off to then?

Dr Andrew Wilson, chief economist My Housing Market, has built this cracker of a chart, excellent colour coding, which outlines his following property market forecasts for 2022.

Wilson, also an acknowledged legend of a property economist, has rubbished an earlier Commonwealth Bank forecast of rate rises handing housing values a potential 10% crash by next year as “simply ridiculous”.

Professor Swan adds that while some punters have speculated mega price reductions – in the realm of 20% to 25 % – he agrees that prices will not fall that much.

“But what we are going to see is a correction to those massive price increases in areas where they have gone up more than the market can support. In areas where people are well off, like Sydney’s eastern suburbs, property values are going to be much of the same as properties are withdrawn from the market.”

And the out of city regional zones which have outperformed during the pandemic, is too late to get in there?

“The places along the coast that people escaped to during the COVID pandemic, those types of ‘good locations’ are also going to remain in demand.”

Oh.

Moreover, Michael Yardney, legend and property guru says you can expect the peculiar migration to the north will continue. Queensland it is.

“Freed from the constraints of needing turn to a CBD office each day, and sick and tired of being locked down in our southern states, many Aussies migrated to South East Queensland last year.

“And now that our borders have opened up and considering the price differential and the perceived lifestyle benefits, it’s likely that the northern migration will continue into 2022.

“Add to this positivity off the back of employment growth and the long term benefits of hosting the Olympics and the extra infrastructure building that will occur, this part of Australia is looking particularly positive, Mr Yardney writes in his property update.

It’s a rate watching game of patience

How this plays out is that interest rates have a long way to go up, before they even consider heading back down and renewing the cycle, Professor Swan says, although he pins the outsized price boom on the lapel of central bankers asleep at the wheel.

“The RBA thinks that the inflation rate is going to come down from around 7% to only 2 to 3% in the next year or so.

“This is wishful thinking.

“It is a continuation of their heads-in-the-sand mentality that worldwide inflation is temporary and simply due to COVID supply constraints and other temporary factors.

“It does not seem to consider the fact that the Federal Reserve has been even worse than the RBA in terms of encouraging inflation and bringing interest rates down while being terribly slow to increase them. The stimulus has gone on – not just in Australia, but globally.

“Combined with factors such as the reduction in the supply of fossil fuels with (US Pres Joe) Biden banning a major pipeline and placing more controls on producers, the Russia-Ukraine war, and massive forthcoming electricity price hikes, inflation and affordability are going to get a lot worse.

“And what the RBA has indicated through its most recent 0.5 per cent increase is that in the future they are going to act with more realistic increases, far faster than people expected.”

At the time of writing the US Federal Reserve has finally moved to aggressively deal with inflation.

So is now a good time to property-up, dammit?

Well, no, says the Professor.

“Generally speaking, it is not a suitable time to rush into buying a house right now. In a recession (which is quite possible currently), you should not be looking to make your first house purchase.”

“Millions of mortgage holders are going to be financially constrained in very tight conditions in the next year or two, so, hold off.

“But if you have saved a lot during COVID, accumulated sizeable financial reserves, and feel confident, we may see some modest price reductions in the next few months as interest rates climb.

“This could improve the housing position for you to make the purchase.”

For first-time homebuyers the professor says there’s a glimmer of hope with the new Albo Government holding court in Marrickville.

“First-home buyers might want to take advantage of some of these offers coming from the new Albanese government. For example, his ‘Help to Buy’ shared equity scheme, where the government is a co-owner of your property.”

If he’s about to say you’re better off renting, better look it this chart first

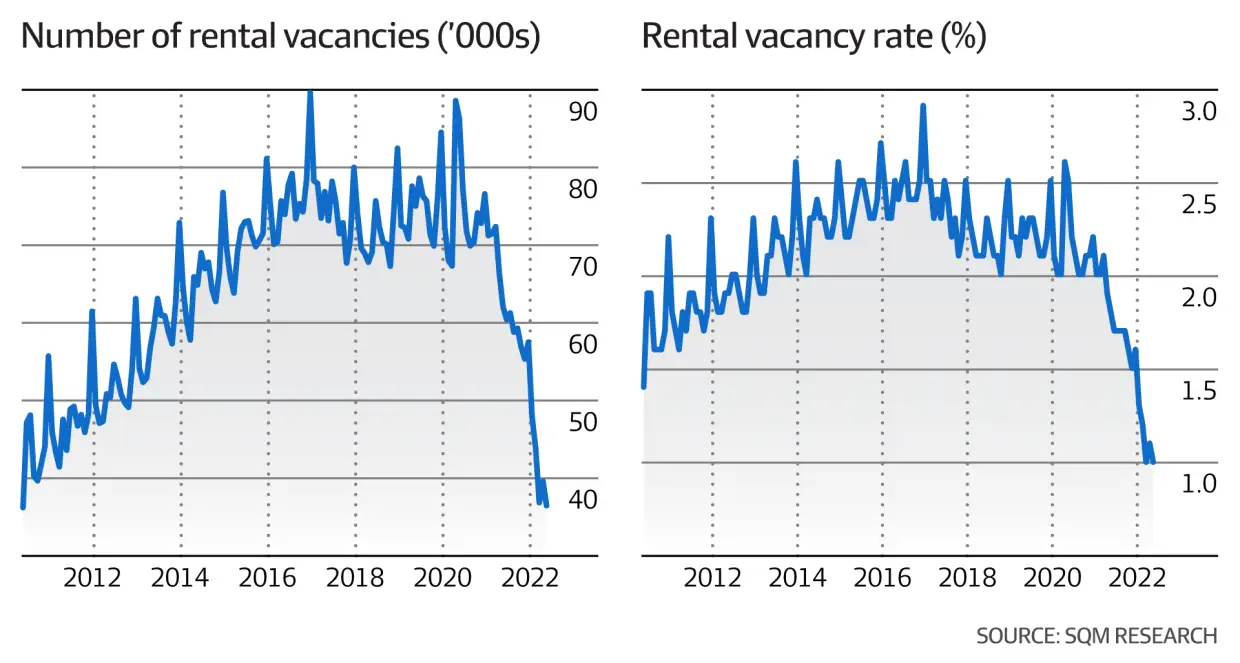

Louis Christopher, Managing Director of SQM Research, told Stockhead the rental market is tight and tightening and there’s nothing to stop it.

“The national rental crisis continues on unabated and as a result, asking rents are skyrocketing. Sydney combined rents have risen by

17.5% just over the past 12 months. Brisbane is up by 18.6% for the same period. Melbourne up by 14.8%.”

Nevertheless Professor Swan – and try to remember here he’s just a few capital letters away from an OBE for economics – says if you’re really at the margin, it’s probs better off renting for now, he warns, and he knows that’s tough because the outlook is still diabolical.

But, in cruder terms than an economist might put it – blood could be spilled soon, and it’d serve you to avoid shedding your own and take advantage of them that bleed:

“There is no point pushing tens of thousands of people into marginal positions in housing such that they face potential bankruptcy once interest rates continue to climb with house prices falling further once you have purchased,” Professor Swan says.

“So, I would hang off.”

Alright, what makes money safer than houses?

Professor Swan says while lots and lots of people have certainly done well out of housing investments, there’s one small catch.

“It is important to remember that there is no way that owners can collectively sell, despite having made very considerable capital gains on their property or properties, as they will need to purchase elsewhere.”

And then there’s our current situation, like the world at large.

“There are going to be radical changes around the world, stemming from the war in Ukraine and elsewhere.

“And this is going to open a lot of profitable opportunities for investment outside of property investment. But with the interest rate rise impacting the stock markets, you must be incredibly careful in terms of the kinds of investments that you are making.

“Interestingly, rising interest rates are going to make it a lot easier for retirees or those looking for a stable return on investment, particularly once interest levels are back around reasonable levels of 3 or 4% and so long as inflation is also contained.

This is because they can invest in Australian Government Bonds (AGBs), considered the safest type of bonds, and get the sort of reasonable returns that they have been denied by the actions of reserve banks around the world during the period of the ‘great panic’ caused by the pandemic.

And for all those Bolshevik investment minds lingering around Stockhead, while the impact of a recession is not for sneezing at it can mean a right shake-up in equities which can make a contrarian investment strategy advantageous.

“Those looking to invest can buy in when prices are low and make higher returns later. That means taking the risk of buying when other people are selling as part of a ‘contrarian strategy’, which is often what pays off in asset markets.

Basically, he says, don’t do what everyone else is doing.

“My research has seen me follow the daily trades of over a million people in Finland over decades. The non-professional, ‘mum and dad’ investors generally outperform professional investors. They are investing modest amounts in a small number of stocks and being very contrarian in their strategy.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.