Lost Property: How Albo could bring the housing market back to Earth

Via Getty

The good news is there’s just not a hell of a lot to distinguish the macro policies of Tweedle-Dum and Tweedle-Albo. Which, for our purposes, suggests minimal impact on the benchmark ASX 200 nor the bold little ASX small cap index.

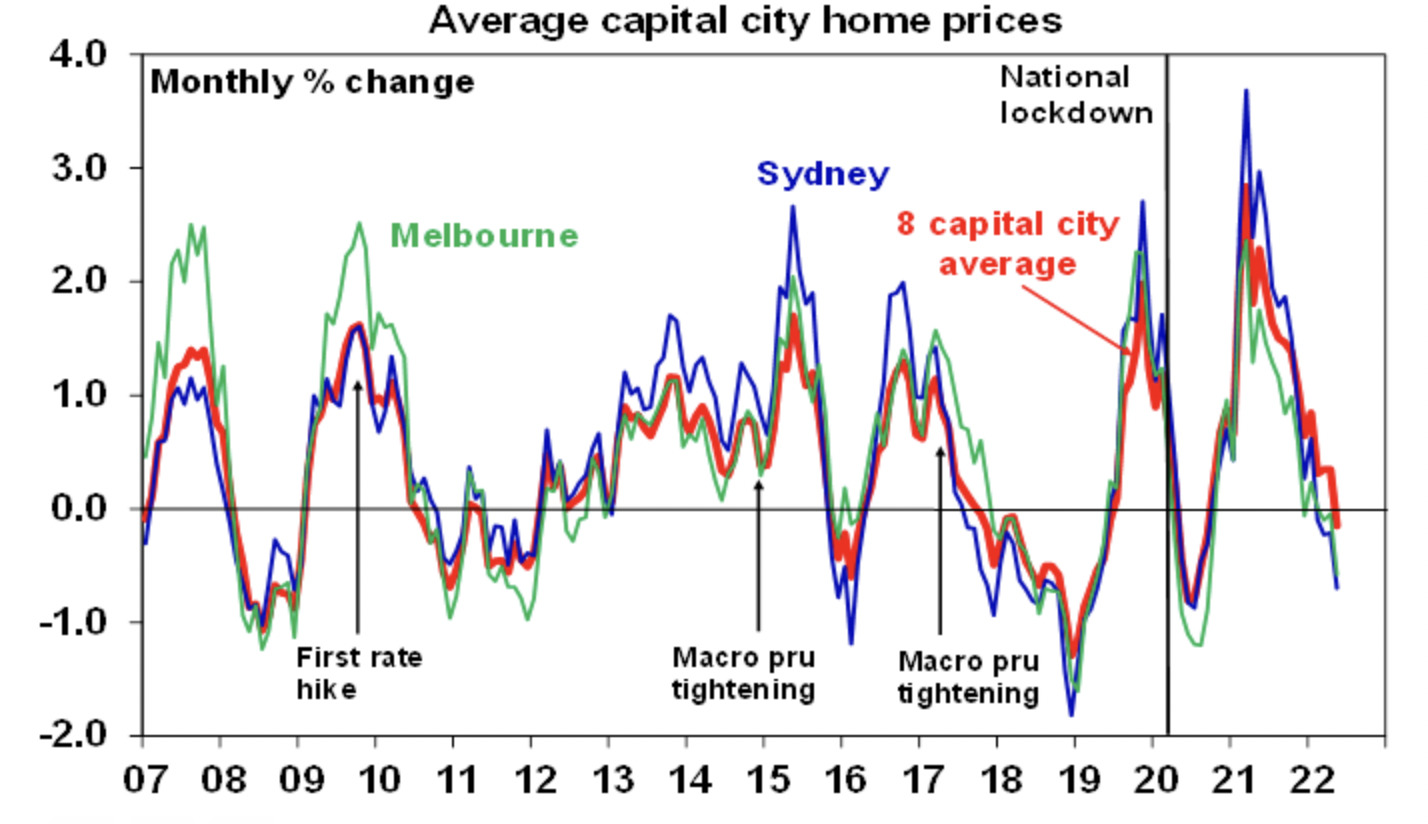

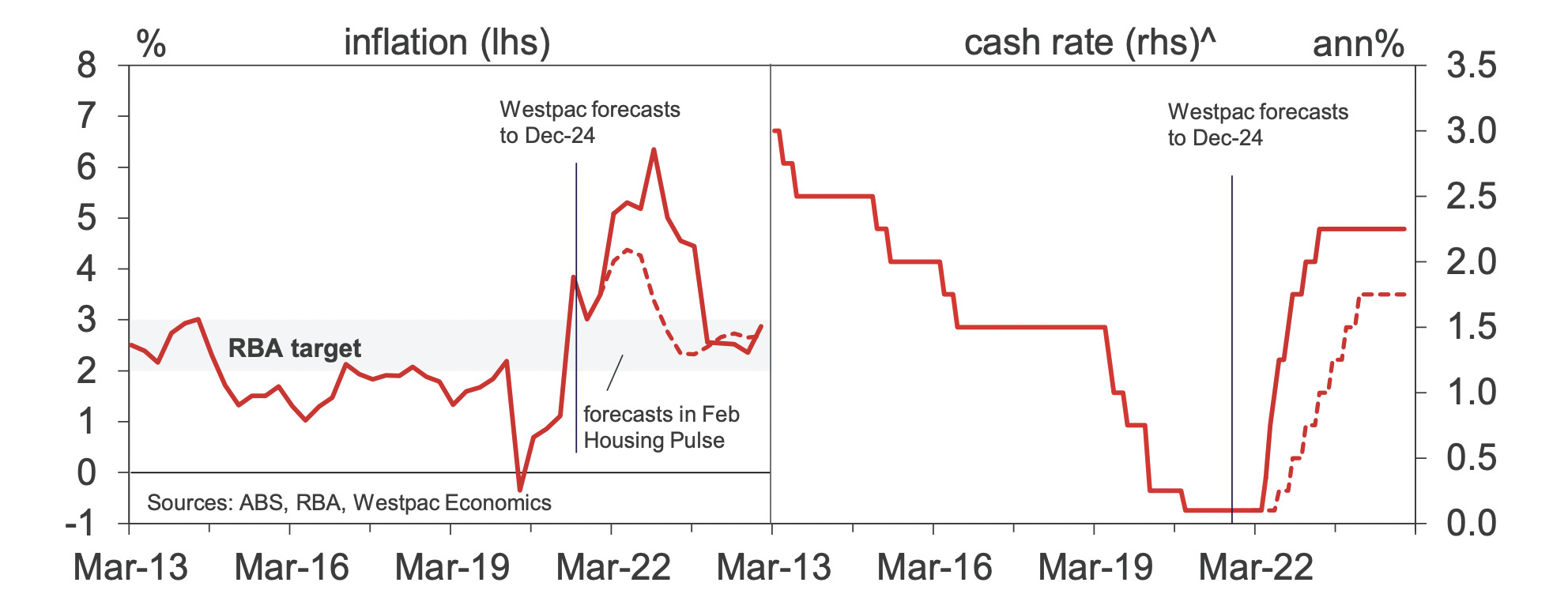

Obviously the bad news is either party would be facing the same economic problems, which relates to inflation, the interest rates we hope will stop it and the housing market and its inherent unaffordability – the three of them intricately connected – with higher inflation and accelerating rate hikes impacting the pace of property values and the capacity of owners and mortgage holders to pay down debt. Okay.

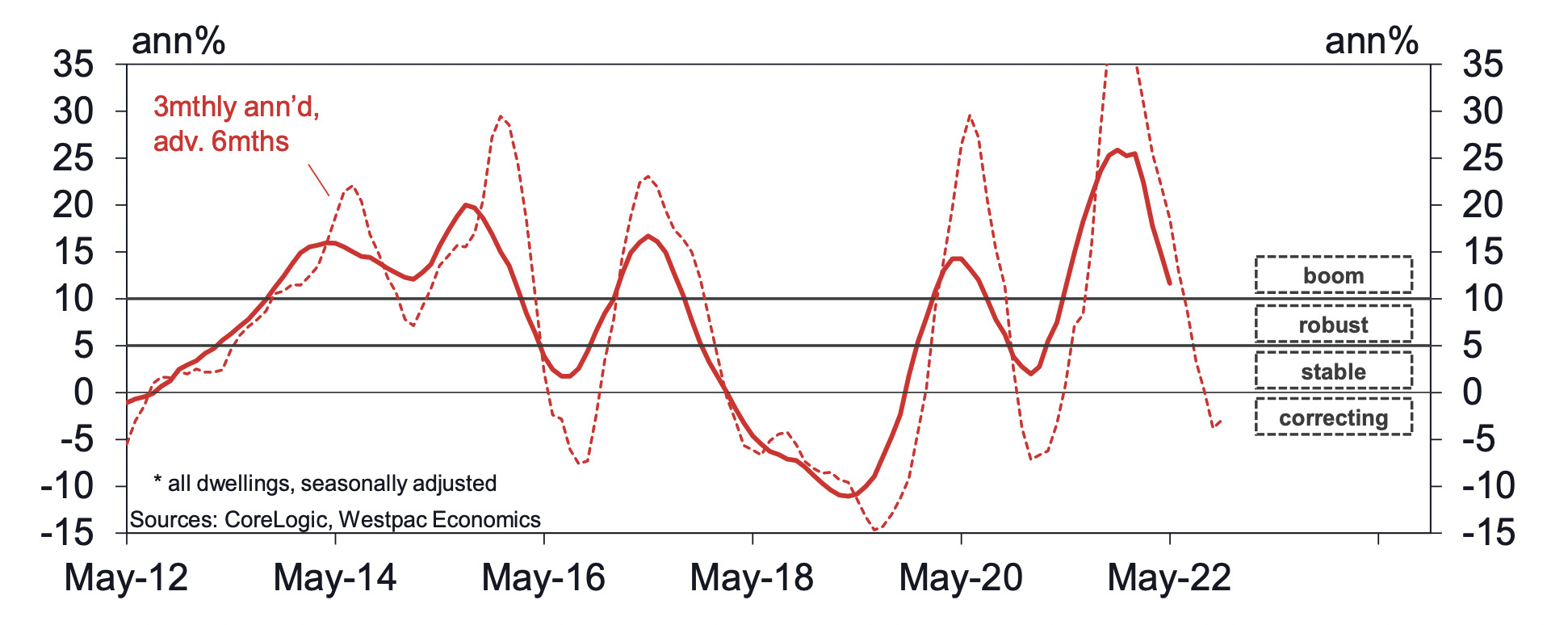

So, house values grew at their fastest clip in a generation during the pandemic on the back of demand, record low rates, government support schemes and regardless of record low immigration and population growth.

Aussie house prices are now starting to show signs of falling, while the RBA last month increased interest rates for the first time since 2010. Lloyd Edge, managing director of Aus Property Professionals, says higher inflation will in turn bring on further interest rate rises.

“It is more important than ever that home buyers prepare themselves for a series of rate hikes, by borrowing under their maximum capacity and not biting off more than they can afford,” he says. “Otherwise, we will see a lot of distressed sellers.”

Certainly the property boom is well and truly over in NSW, with dwelling values in Sydney heading down fast since Christmas.

Sydney dwelling values

Turnover has fallen back sharply since the start of the year; even Sydney prices now copping the early days of sliding prices.

Westpac economist Matthew Hassan says the bank’s raft of sentiment-based indicators suggest Sydney will be the focal point of these movements and there’ll be more coming in the near-term.

“Market turnover is off by nearly a quarter from its December peak to be back near its pre-COVID levels and below long run averages as a share of the dwelling stock. The latest price data is also showing a very clear signal, Sydney posting slight declines through each of the three months to April and the May month to date.”

“Ultimately market values will be guided by changing interest rates,” says CoreLogic’s Eliza Owen,”with price falls starting to accelerate across Sydney and Melbourne amid the cash rate rise.”

“There’s not a lot governments can do about that in the short-term,” Eliza reckons.

“However long-term, investment in technology, innovation and labour reform could take pressure off the RBA to take interest rates to record lows in the wake of the next negative economic shock.”

Not a lot any political party can do

According to SQM Research managing director Louis Christopher, from a housing market perspective, the change of Federal Government is unlikely to impact the ingrained trends currently moving the Aussie marketplace. It’s simply too big of a bugger to turn around just like that.

“There is no policy that comes into play, which would move the dial right now.”

The Labor Government’s shared equity scheme, once in place, is unlikely to move the market one way or the other due to its caps and limited places of 10,000 a year, Louis says.

The issue of course comes back to inflation. So the next step for the market is the RBA meeting for June 7. Will they lift the cash rate again and if so by how much?

“If the RBA treads too lightly and inflationary pressures do not abate, the housing market will bottom out and start to take off again at least in nominal terms,” Louis told Stockhead.

“On the other hand, if the RBA is too aggressive, prepare for a hard landing in housing – and the wider economy.”

But Albo could deal with this crisis:

Louis says – according to reams of SQM data – “the one thing we do have right now is a housing rental crisis.”

The question is, will a Labor Government attempt to address this and what policies could Albo’s team consider?

Louis says he’s glad someone asked:

“Okay. A couple of emergency initiatives they could try include (I’ll count them so you can put them in a table, or bullet points)*

1) A vacancy tax – similar to what was introduced by the Victorian State Labor Government

2) A rental subsidy booster – keeping in mind some states already have this.”

(*Thanks Louis.)

Both measures have their pros and cons, he reckons.

“Resolving the rental crisis over the short term will be very difficult. However there is a rising chance of the crisis resolving itself, by simple virtue of more people deciding to share accommodation.

“We are having this rental crisis to begin with due to household size reducing which had an immediate affect of soaking up surplus stock as more people went out there looking for properties to just live on their own or with just a partner.

“But Covid largely behind us and sky rocketing rents, there is a good chance household size could go back to normal levels once more, but until that happens those rents are likely to continue to rise which will affect the CPI read for the remainder of the year,” Louis concludes with a bit of a mic drop.

So. What’s Albo got at home for you?

The fact is neither major party really sought to revolutionise the market during the election.

Instead, Eliza Owen thought the overall strategy of both parties was to lower the deposit hurdle and diminish upfront costs for homebuyers, all while making really bloody sure the broader market didn’t cop excessive declines in demand.

“One of the big points of difference is that Labor have a smaller, more targeted scheme that would hopefully assist lower-to-middle income buyers, whereas the Libs were very much focused on expanding demand-side policies which could have reached more people, but would have likely pushed up prices or offset declines in prices.”

In the end, these are Albo’s housing support policies the government says it will now try to go with:

- $10bn Housing Australia Fund to build 30,000 social homes over five years

- Help to Buy scheme with the Government to take up to 40% equity in up to 10,000 first home buyer home purchases a year

- Support for the Coalition’s 50,000 low deposit purchase scheme with an additional 10,000 places in regions

- Support for the Coalition’s super concessions for downsizers over the age of 55

- Establishment of a National Housing Supply and Affordability Council to help boost supply

Help to Buy Scheme

Of the Labor Government’s initiatives, CoreLogic flags the headline ‘Help to Buy’ scheme as providing a more affordable entry point for buyers on lower-to-middle incomes.

Starting in July, the Help to Buy scheme will contribute to more equality in rates of home ownership and could create more opportunities for key workers to live in more central areas by sharing up to 40% of the purchase price with the government, along with only a small deposit and opportunity to save on lender’s mortgage insurance.

Cons include transactional costs, stamp duties, legal costs and bank fees as well as risks associated with buying on a small deposit.

“With the housing market probably heading into a downturn over the coming year or years, some buyers may find their home is worth less than the debt held against it,” CoreLogic’s Tim Lawless notes.

Regional First Home Buyer Support Scheme

The Regional First Home Buyer Support Scheme extends the existing First Home Loan Deposit Scheme by providing an additional 10,000 places specifically for regional first home purchases.

Based on the property price cap which varies by region, from $350k up to $800k (to be reviewed half yearly), the scheme is okay if you’re looking for lower-priced regional housing, or an apartment, since CoreLogic’s analysis of regional Australian suburbs puts only a third of median houses inside the scheme price cap, while well over 70% of units meet the cap.

And although the Labor Party kept suggesting during the election campaign that ‘the housing crisis is hitting regional Australia the hardest’, this isn’t necessarily true from a purchasing perspective, Lawless also notes.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.