The Ethical Investor: Which ASX stocks made ESG moves this week?

Environmental, Social and Governance (ESG) is no longer just a goal for governments and companies, central banks have also started to incorporate ESG into their policies.

That’s according to an analysis from global investment firm, T.Rowe Price.

The report argues that it will become harder for investors to predict central banks’ action going forward, as more factors are taken into consideration.

“For example, a central bank might ignore inflation overshooting if unemployment remained high in a particular group of society,” says Quentin Fitzsimmons, a T.Rowe Price portfolio manager.

On the positive side, the report noted that central banks are also likely to play an active role in the green evolution.

The prospect of bond programs being altered by central banks to align with climate change goals is likely to influence companies to make changes as well, the report concluded.

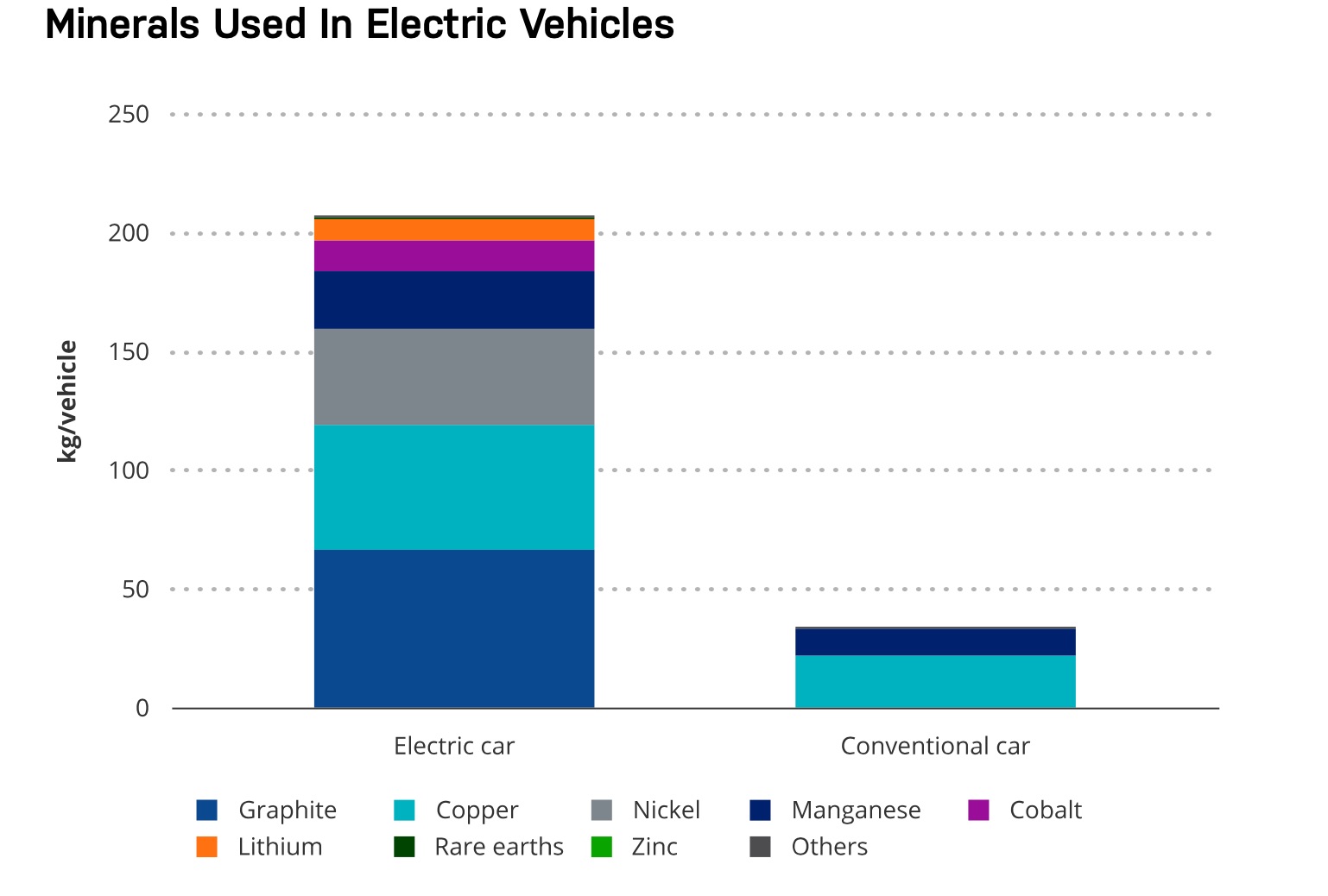

Meanwhile, global fundie Van Eck says that one single fully-electric bus could require a whopping 370kg of copper.

By 2030, total demand for copper from electric vehicles (EV) and associated infrastructure could be as high as 2.6 to 3.2 million tonnes, or approximately 13-15% of 2020 global supply, according to Van Eck.

What’s happening in Australia

Greenpeace Australia Pacific has just released a scathing report on Australian ASX 100 companies, titled “Hero to zero: uncovering the truth of corporate Australia’s climate action claims”.

The report found that 41 companies in the ASX 100 have set net zero carbon targets, but only 14 of those have set 100% renewable electricity goals.

The report also found that companies without 100% renewable electricity targets are relying on carbon offsets elsewhere to meet their climate commitments.

“In almost all circumstances, such carbon offsetting schemes are ineffective and no more than corporate greenwashing,” the report bluntly said.

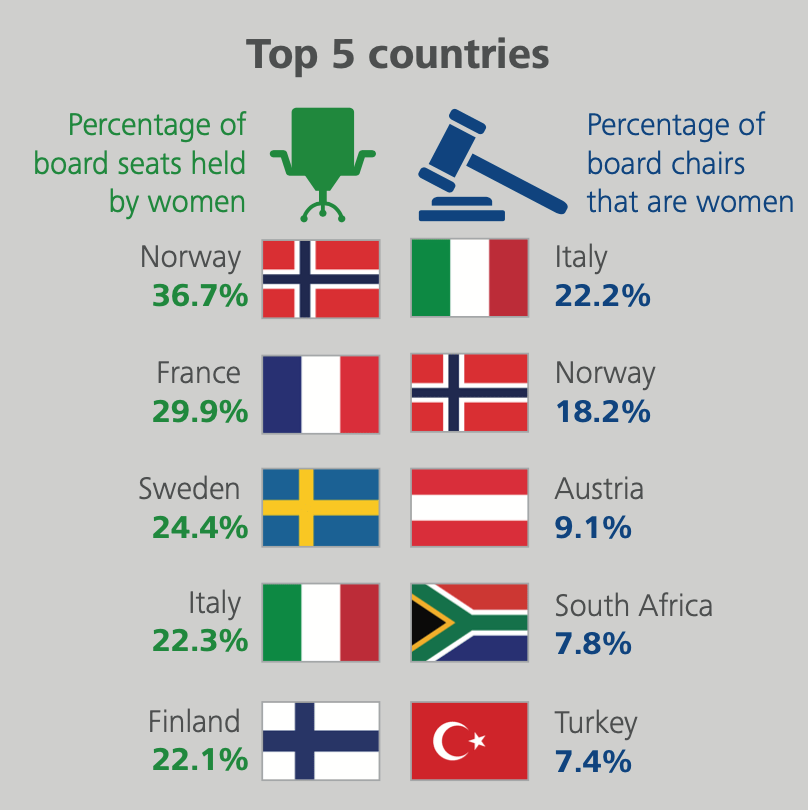

Meanwhile we’ve made progress in leaps and bounds on the corporate governance front, but more work is still required to catch up to the world, according to the Australian Institute of Company Directors.

With the appointment of women directors on the boards of Chalice Mining (ASX:CHN) and Silver Lake Resource (ASX:SLR) announced last month, there’s no longer an all-male board on the ASX 200.

But compared globally, Australia still falls behind.

Notable ESG-related ASX announcements during the week

The lithium brine explorer has partnered with leading sustainable supply chain traceability provider Circulor to underpin its ESG performance.

Under the agreement, Circulor will establish full lithium traceability and dynamic CO2 and ESG tracking of the company’s lithium brine assets in Argentina’s lithium triangle.

This will enable Galan to demonstrate sustainability and compliance with regulatory requirements such as the EU Battery Regulations, as well as other international legislations.

The company says the popularity of cobalt-free batteries continues to grow as lithium market hits a new high.

LIT’s subsidiary VSPC is now progressing its plans to establish a strategic position in the market for cobalt- and nickel-free lithium-ion batteries.

The lithium miner has has successfully completed a $200 million placement to accelerate its dual renewable energy and lithium development strategy.

The funds were raised from existing and new institutional investors, including ESG-focused institutions.

Proceeds will be used to support Vulcan’s goal of becoming the world’s first fully integrated renewable energy and Zero Carbon Lithium company.

The company released its sustainability report this week, but fell short of setting specific targets for sustainability performance other than occupational injury rates.

PAN said it’s been a transitional year due to COVID-19, and it intends to develop meaningful metrics and stretching targets for the operations once steady-state production is reached.

The industrial services tech company announced that global decarbonisation investor Carbon Direct Capital Management has invested €15m for a 6.98% equity stake in Calix subsidiary, the LEILAC Group.

Calix will continue to own the remaining 93% of LEILAC, the exclusive licensee of Calix’s Low Emissions Intensity Lime and Cement.

LEILAC is described by Calix as a research project that enables large cement and lime companies to mitigate their carbon dioxide emissions.

The world’s biggest miner released its annual ‘climate change report’, which is now called a ‘climate action report’.

The new report says that BHP wants to target net zero not just for its own operations and shipping but also for “direct suppliers” by 2050.

BHP also says it has committed to lobbying and working with its partners on reducing emissions toward net zero – and promised to review its membership of lobby groups it’s aligned with.

FMG will establish a ‘culturally safe’ mining joint venture to mine the East and West Queens deposits on Eastern Guruma country.

The company has established a co-management framework with members of Wintawari Guruma Aboriginal Corporation, to oversee the development of new mines at Fortescue’s Solomon Hub operations.

The 10-year mining services contract awarded to the new joint venture is estimated to be worth over $500 million, making the contract the largest ever awarded to an Aboriginal business by Fortescue.

Share prices today:

At Stockhead we tell it like it is. While Galan Lithium is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.