The Ethical Investor: The problem with ESG ratings, and an interview with ClearBridge’s Mary Jane McQuillen

The Ethical Investor 13 May 2022. Picture Getty Image

- ESG ratings are becoming a source of confusion and obstacle for many investors

- MSCI has come to dominate the ESG ratings business

- Stockhead speaks to ClearBridge’s Head of ESG, Mary Jane McQuillen

There’s a huge amount of demand for ESG investing at the moment, but a healthy dose of scepticism too.

The market is struggling with growing and genuine concerns about greenwashing, a common marketing tactic used by funds to over-amplify their ESG credentials.

A key problem is the lack of common industry standards, where ratings and rankings are being performed by non-regulated providers.

One company that has come to dominate the ESG rating business is MSCI, an offspin of Morgan Stanley based in New York.

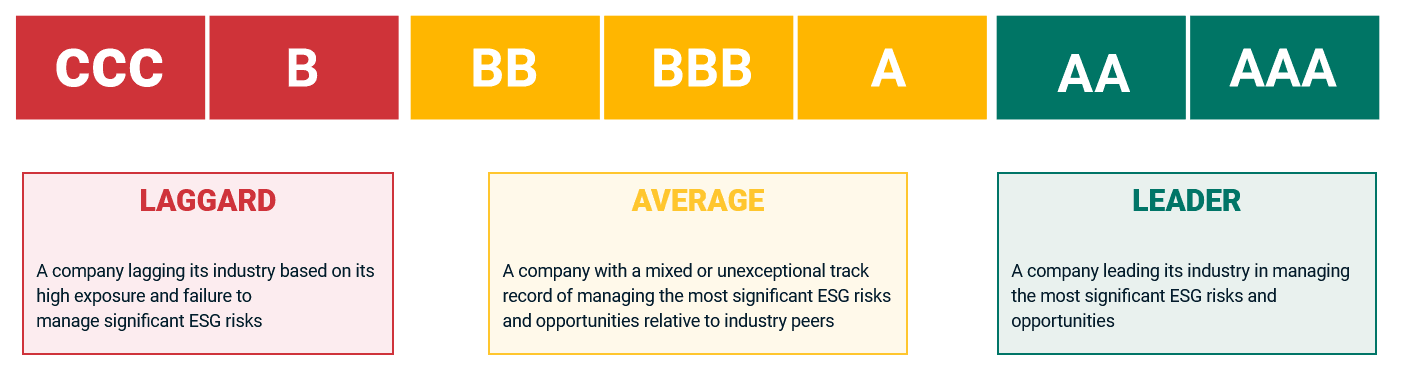

MSCI’s rating system looks just like those of credit ratings agencies S&P and Moody’s, with alphabets that span from AAA to CCC.

Not many understand what goes into making those ratings, but they have nevertheless become the basis of the multi-trillion dollar ESG industry.

“By mimicking a credit rating which is regulated, which is based on regulated data, MSCI has created kind of an aura of respectability, an aura of confidence for the investing world around these ratings,” said Cam Simpson, a senior international correspondent for Bloomberg Businessweek.

What does MSCI have to say?

For its part, MSCI has tried to answer critics by recently releasing a ratings methodology white paper.

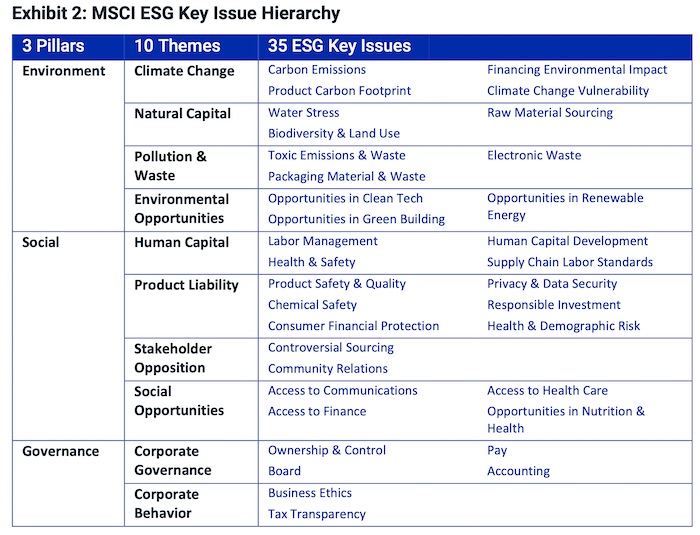

At the core, MSCI stated that its ESG ratings model seeks to answer four key questions about companies:

1. What are the most significant ESG risks and opportunities facing a company and its industry?

2. How exposed is the company to those key risks and/or opportunities?

3. How well is the company managing key risks and/or opportunities?

4. What is the overall picture of a company, and how does it compare to its global industry peers?

To arrive at a final ESG rating of AAA (best) and CCC (worst), MSCI takes the weighted average of the three pillars and normalises them relative to industry peers.

“These assessments are not absolute but are explicitly intended to be interpreted relative to a company’s industry peers,” MSCI wrote.

ESG investors not convinced

But the critics still aren’t convinced.

“Instead of focusing on what’s important for environmental sustainability, ESG ratings often focus in on what’s significant to a company’s bottom line,” said Simpson.

“If you’re a company that’s included in the S&P 500 for example, your ESG rating can really significantly help you lower your cost of capital, which also can help you get included in one of these ESG funds,” he said.

In addition, a lack of any legislation also means that a fund’s credentials are largely left up to the individual investors to check on.

But amongst this confusion, one valuable tool that has become a proxy for accurately measuring a fund’s ESG impact is the framework provided by the United Nations Sustainable Development Goals, or SDGs.

“It’s an incredibly powerful tool for an investor because ultimately, it’s pretty binary,” Amy Clarke, chief impact officer of Tribe Impact Capital told the FT.

“You either invest to deliver the SDGs, or you’re working against them – which means you’re working to further destabilise socially, environmentally and economically, this incredible system that we all live in,” she added.

Interview with ClearBridge Investments’ Mary Jane McQuillen

To understand what fund managers do to convince investors, Stockhead reached out to ClearBridge Investments‘ Mary Jane McQuillen.

Owned by Franklin Templeton, ClearBridge operates with investment independence from its headquarter in New York and global offices that include Sydney – managing around US$190 billion in assets globally.

McQuillen is a portfolio manager and head of ESG at Clearbridge.

What does ClearBridge do to ensure the companies it invests in are not greenwashing?

“The ClearBridge teams engage with companies that we invest in. We engage with the senior company representatives — CEOs, CFOs and others,” McQuillen told Stockhead.

“These interactions are primarily one-on-one meetings, but can also include company site visits, phone calls, email exchanges, and in some cases formal letters to a company’s senior management team or board of directors.

“During our engagements, we ask questions about the business and often provide feedback.

“For example, we will share our investment philosophy and expectations on relevant fundamental and ESG topics; inquire about a company’s sustainability goals and activities; and set objectives for the future.

“Our engagements include all facets of environmental, social and governance, and discussions are company and industry specific; accordingly, they range in scope and timeframe.

“Some engagement topics, such as sustainability-related disclosures, labor practices, diversity and inclusion and governance issues, are generally relevant to all companies and therefore are themes raised frequently in meetings, regardless of industry.

“These engagements help improve our understanding of a business, and its potential for long-term success.”

What has ClearBridge done internally to uphold your own ESG credibility?

“ClearBridge has also committed to diversity, equity and inclusion (DEI) internally,” McQuillen said.

“We signed the Access to Medicine Foundation Global Investor Statement in support of an effective, fair and equitable global response to COVID-19.

“It’s a call for a fair and equitable global response to the pandemic, specifically through committing to engagement with health care companies to promote bolder industry action.

“We recently signed the As You Sow 2021 Investor Statement Regarding the Need for Corporate Workplace Equity Transparency, a statement to support increased disclosure of DEI data.

“We also had firmwide support in our proxy voting on a shareholder proposal to Amazon regarding global gender pay gap reporting, for example.”

ClearBridge is a top 20 shareholder in more than 275 US public companies. Could you reveal three of your top stocks?

“Three top stocks where ClearBridge is a top 20 shareholder, and that we hold in the ClearBridge Sustainability Leaders Strategy that I co-manage, are UnitedHealth Group, TE Connectivity, and Eaton,” McQuillen explained.

“UnitedHealth (UNH), in the health care sector, is a leading diversified health care company that offers health benefits through its divisions.

“In our view, UnitedHealth’s ability to improve health care outcomes and manage costs will be increasingly important as health care cost inflation and an aging population continue to drive health care costs higher over time.

“TE Connectivity (TEL), in the IT sector, makes connectors for a wide range of uses, from automobiles to data centers and medical devices.

“It is a major beneficiary of the secular trend of vehicle electrification (EV), enjoying double the per-vehicle content for EVs compared to traditional internal combustion engine vehicles.

“Eaton (ETN), in the industrials sector, is a market share leader in the electrical equipment industry with a broad array of products.

“Eaton’s products enable the electrification of the power grid and, importantly, electrical vehicle charging infrastructure.”

Do you see the current market volatility as a big disruptor to your ESG portfolio?

“Looking ahead, inflation and rising rates are likely to continue to cause market volatility,” McQuillen said.

“We believe, however, the US economy remains more or less healthy and most of our holdings are performing at a high level, in terms of both growth and profitability.

“Among other sustainability themes we invest in, such as improving health and workplace safety, sustainable food, and diversity and economic inclusion, climate change is a top priority.

“The current market environment — rising rates, booming fossil fuel prices — creates some headwinds for renewable energy, but we think these are transitory compared to the long-term project of decarbonisation to which governments and corporates are increasingly committing.

“Rather than simply slow the energy transition by retrenching into more oil and gas production, current energy crises should accelerate energy transition trends, such as Europe’s need for domestic energy production and the improving economics of renewable energy relative to fossil fuels.

“Energy efficiency and innovations in renewable energy technologies such as solar panels, energy storage, green hydrogen and carbon capture remain key long-term growth stories with potential for alpha across sectors.”

Other ESG news on the ASX this week

As reported by Stockhead’s green expert, Jessica Cummins:

Fortescue Metals Group (ASX:FMG)

Fortescue’s green machine, Fortescue Future Industries, is looking to give ageing coal plants an extreme makeover – this time focusing on repurposing coal infrastructure for green hydrogen production in North America.

The proposed green hydrogen production plant would enable the decarbonisation of hard-to-abate sectors of the North American economy and support the development of a Pacific Northwest green hydrogen hub.

Neometals’ battery recycling joint venture, Primobius, has executed an agreement with Mercedes-Benz recycling subsidiary, LICULAR, to develop a sustainable recycling approach for lithium-ion batteries.

The cooperation will begin and become legally binding upon the receipt of an agreed form purchase order from LICULAR to Primobius for the supply and installation of equipment for the construction, commissioning, and operation of a LICULAR Recycling Plant.

Oil and gas producer Buru Energy has 50% operating interests in the Rafael gas discovery and Ungani oilfield in Western Australia’s Canning Basin but the company is also exploring natural hydrogen and helium through its subsidiary, 2H Resources.

2H Resources is focused on undertaking initial prospecting work on its South Australian permits spanning 29,000sqkm, using in-house technology such as hydrogen measuring equipment once all approvals are in place.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.