The Ethical Investor: Tackling modern slavery in the supply chain with Misio’s co-founder Jeremy Biggs

Pic: Getty

- Modern day slavery is a real global phenomenon today

- It can occur at all stages of the supply chain

- A look at what Aussie platform Misio is doing about it

The Ethical Investor is Stockhead’s weekly look at ESG moves on the ASX. This week’s special guest is Misio’s co-founder and CEO, Jeremy Biggs.

If you’re wondering how important Modern Day Slavery issues are to investors, you only have to look at the British fashion retailer Boohoo.

The UK-listed Boohoo (LON:BOO) has plunged by more than 70% over the past 12 months, after US authorities launched an investigation into allegations of forced labour at its UK factory last year.

The investigation was launched after charity Liberty Shared sent a petition to the Customs and Border Protection, outlining problems at Boohoo’s factory in Leicester UK where owners were apparently ignoring employment law “with impunity”.

Boohoo’s is not an isolated case, other fashion retailers have also been named and shamed for exploiting workers.

In November last year, global charity Oxfam released its Naughty or Nice list, an annual campaign meant to disclose how fashion brands treat their garment workers.

In the latest “naughty” list, brands shamed by Oxfam included Zara, Jay Jays, Just Jeans, Lorna Jane, Myer and Peter Alexander — companies that Oxfam said were failing to be transparent on whether their garment workers are being paid a living wage.

Who are the victims of today’s slavery?

While we’d like to think that slavery has been banished to history, it’s actually a modern day phenomenon affecting 40 million victims who are making $350 billion worth of goods that you and I use.

According to the UN, countries with the world’s highest rates of modern day slavery are: North Korea, Eritrea and Burundi. Meanwhile India, China and Pakistan are home to the largest number of victims in terms of pure magnitude.

Women and girls are the most vulnerable, with many being exploited by practices including forced labor, forced marriage, debt-bondage and domestic servitude.

What’s Australia doing about it?

Slavery can and does exist in all stages of the supply chain — from the picking of raw materials such as cocoa or cotton, to the manufacturing of goods such as mobile phones, all the way to when the final products are shipped.

Unfortunately, the complex supply chains that global commerce has built over the last decades makes it difficult to oversee who’s working where, and under what conditions.

In Australia, the Modern Day Slavery Act was enacted in 2018, which requires mandatory reporting for businesses with an annual consolidated revenue of at least $100 million.

But four years later in 2022, Australian companies haven’t achieved much according to a recent study by researchers at Monash University.

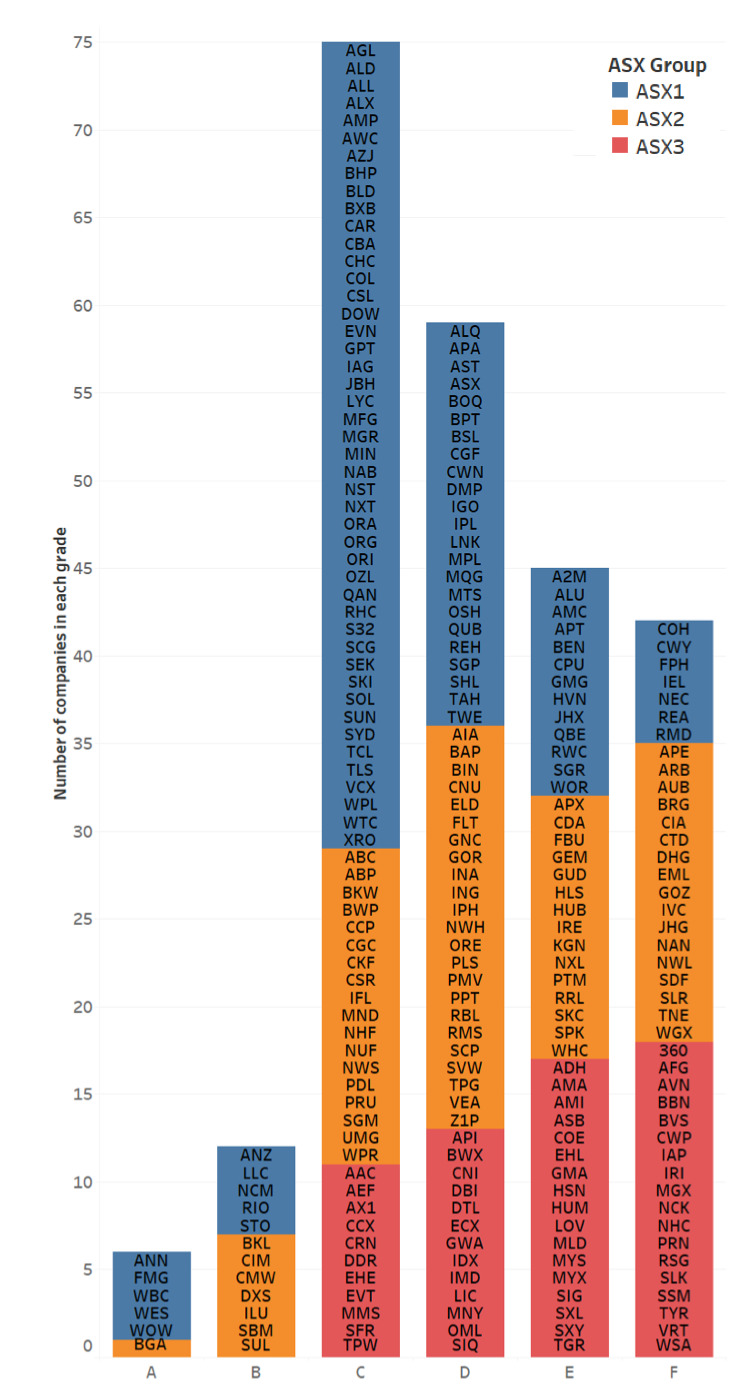

Only six companies in the ASX 300 received an A-grade rating from Monash for their Modern Day Slavery missions : Bega Cheese (ASX:BGA), Woolworths (ASX:WOW), Fortescue Metals (ASX:FMG), Wesfarmers (ASX:WES), Westpac (ASX:WBC), and Ansell (ASX:ANN).

Here’s how other stocks on the ASX 300 ranked, according to Monash :

For the full report, click here.

But what about unlisted companies? Or those that fall under the $100m threshold? How could we, as consumers, be confident about their supply chains?

To answer those questions, Stockhead reached out to Misio, an Australian company that’s trying to tackle the ethical supply chain problem.

Misio is a B2B and B2C social platform that connects companies, and aligns them with ethical practices as well as the next generation consumers.

Interview with Jeremy Biggs, co-founder and CEO of Misio

Biggs is a serial entrepreneur with about 15 years under his belt working in global supply chains.

He’s built other businesses around technology and advanced deep learning in the past – but was drawn towards the issues surrounding modern day slavery and solutions to eradicate it.

.

What’s the incentive for companies to become ESG compliant?

“In 2025, 60% of decision makers will be the millennial generation like mine, whose values are unique in that we care deeply about the environment, the planet, and social injustice,” Biggs told Stockhead.

“This generation wants to support brands and businesses that are developing and progressing on ESG.

“The consumers that are buying the products ultimately hold the power behind whether ESG accelerates or doesn’t accelerate. Furthermore, companies that are not aligned with ESG won’t be able to attract the right team members.

“So in the next five to ten years, if you’re a business that doesn’t have a solid ESG strategy in place, I don’t think you’re going to be able to survive.”

Why is it difficult for smaller companies to report ESG metrics?

“ESG is not well understood below the top tier,” Biggs explained.

“There are thousand of data points and hundreds of man-hours a year needed in order to be fully compliant with the non financial reporting standards.

“In other words, it takes a lot of resources, time and money to do ESG reporting properly.

“A lot of small and mid tier companies don’t have the budget, and they don’t have the tools available to comply with that kind of standard.

“And that’s the big challenge we have not just in Australia, but all over the world.

How does Misio help with this problem?

“What Misio does is basically help make incremental improvement over time for these companies to accelerate certain areas of their business,” said Biggs.

“If you’re a company that’s not sure how to progress and align with principles of ESG and implement them in your business, we’ve built a platform that can connect and help you on that ESG journey.

“There are two core pillars that we’re focused on right now – carbon footprint and modern day slavery.

“So if you’re a company registered on the Misio platform, the two key questions that are being asked are : how do you reduce your carbon footprint, and how do you get rid of modern slavery in your supply chain.

“If your first level suppliers refuse to provide any documentation around carbon footprint and modern slavery, that’s fine. But if they do have a certification around it, that certification can be shared on the platform to create more trust with other members.

“So what the Misio platform does is very much a collaboration around the ESG activity within the supply chain ecosystem.

Give examples of how the platform works in practice

“Let’s say for example, you would like to do an investigation in your supply chain to understand whether there’s any modern slavery involved,” Biggs said.

“You could create a request in Misio, and the platform would then share that request out to all of our ESG marketplace providers around the world.

“We then match the geolocation, skill set, company size, revenue, priority, and data points that we collect on the businesses, and we intelligently match them using our algorithm.

“You can also invite partners to your network that you want to work with on a specific ESG issue – whether it’s sustainability, net zero targets , or even modern day slavery.

“Note that we’re not a certifying body, but a connector that helps people accelerate change in the world.”

Will the marketplace platform be the way forward for ethical sourcing?

“It all comes down to demand, and if the market demand increases then the ESG marketplace needs to grow as well,” said Biggs.

“All of this is predicated on the value exchange, and a byproduct of value creator is commercial return.

“In other words if we’re not creating value in our ecosystem, then there won’t be a commercial return which means that it would fail.

“But based on the increasing demand to comply with ESG through both regulation and market pressures, we believe the pressure is on for companies to do something.

“And for listed companies in Australia, I believe we need to start thinking about how the ASX views ESG, and what the listing criteria needs to be in the future.”

Other ESG news on the ASX this week

As reported by Stockhead’s green expert, Jessica Cummins:

ASX vanadium play, Australian Vanadium (ASX:AVL), has been awarded a $49mn Federal manufacturing collaboration grant this week, which will be used in the development of the Australian Vanadium Project, near Meekatharra and Geraldton to create an Australian green fuelled vanadium industry

Fluence Corporation (ASX:FLC) secured its first SUBRE MABR plant upgrade contract yesterday, designed to increase wastewater treatment plant capacity from 125,000 people to 167,000 people in China’s Anhui province – an increase of 33% pc while preserving treatment quality.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.