The Ethical Investor: Major themes for ESG investing in 2023 according to Janus Henderson

News

News

The headwinds associated with the current backdrop, ie; high inflation and interest rates, are well publicised.

But there’s always an opportunity in a crisis, and Janus Henderson reckons there are great ones for sustainable investors in the year ahead.

Of course, certain global events cannot be forecast with any accuracy, such as the success of central banks in taming inflation, or the outcome of the war in the Ukraine.

But what’s certain is that we’re starting to see the pace of inflation easing, despite the US Federal Reserve telling investors not to expect any slowdown in rate hikes in 2023.

Hamish Chamberlayne, Head of Global Sustainable Equities at Janus Henderson (ASX:JHG), says there is a lot to look forward to in 2023, and has identified three clear themes for sustainable investing.

According to Chamberlayne, the next economic cycle will be driven by the green industrial revolution – ie: society shifting from a fossil fuel-based economy to an economy that is built on low carbon, digital and electric infrastructure.

This has been reiterated by world policymakers who have put sustainability at the core of their country’s policies.

“We will see strategically important industries be brought closer to home to create economic resilience and foster sustainability at the same time,” says Chamberlayne at a journalist conference attended by Stockhead.

“As a result, we anticipate a capital investment boom on the horizon.”

Chamberlayne says this change has already started happening for some of society’s most strategically important industries.

For example, Asia is already moving swiftly to produce the bulk of semiconductors, essential components of electronic devices which enable many clean technology industries.

Many, however, believe that Asia will not be able to hold on to this manufacturing dominance.

Tim Cook, CEO of tech giant Apple, stated: “I think you will wind up seeing a significant investment in capability in both the US and Europe to try to reorient the market share of where silicon is produced”.

Apple silicon unlocks a new level of performance for our users. And soon, many of these chips can be stamped “Made in America.” The opening of TSMC's plant in Arizona marks a new era of advanced manufacturing in the U.S. — and we are proud to become the site’s largest customer. pic.twitter.com/rBoiEUwZaX

— Tim Cook (@tim_cook) December 6, 2022

The energy crisis will continue to be a topic of focus in 2023, and Janus sees technology playing an important role in mitigating energy inflation by offering cheaper alternatives.

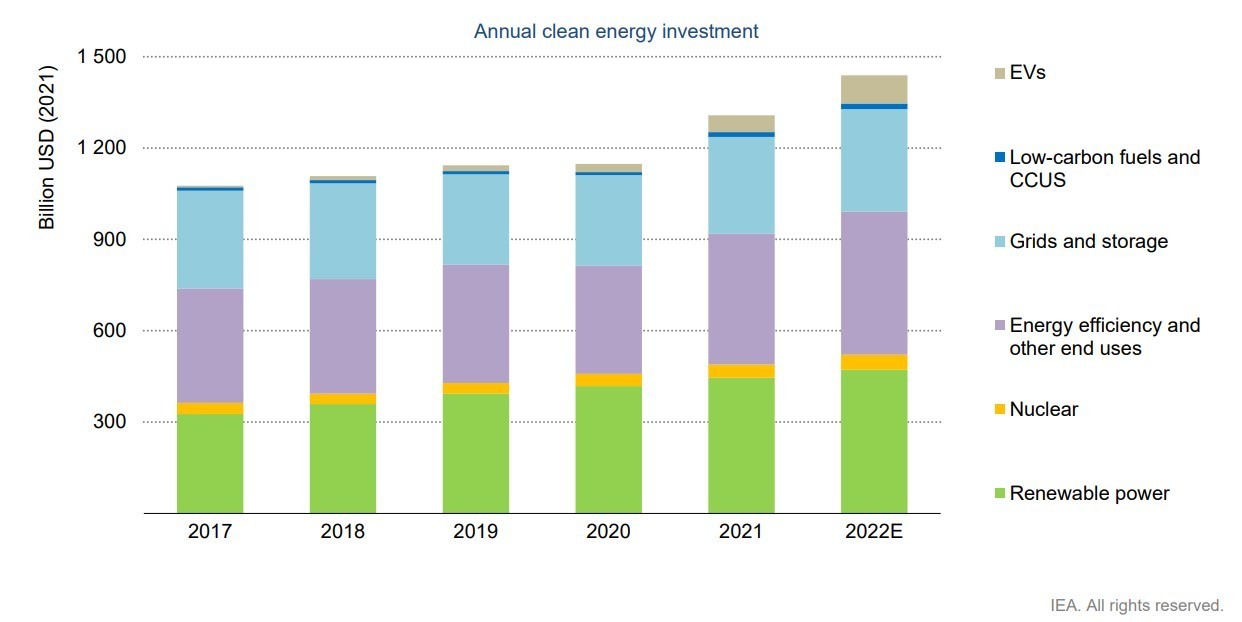

Policymakers have made clear that clean energy is key to meeting energy security needs, with the European Union’s Green Deal and the US Inflation Reduction Act investing €1,800 billion and US$370 billion respectively in the green transition.

In 2022 alone, investment in renewables such as solar projects was up 33%, reaching a record-breaking US$120 billion, and wind project financing up 16% to US$84 billion.

“As well as being integral to energy security, renewables are much cheaper than many other power generation technologies,” Chamberlayne explained.

“In fact, today they are the cheapest source of energy for two-thirds of the global population making up 75% of global GDP.”

As energy prices keep rising, the economics of clean technologies are compelling.

As such, Chamberlayne says he expects the industries surrounding clean energy to be a key focus in 2023.

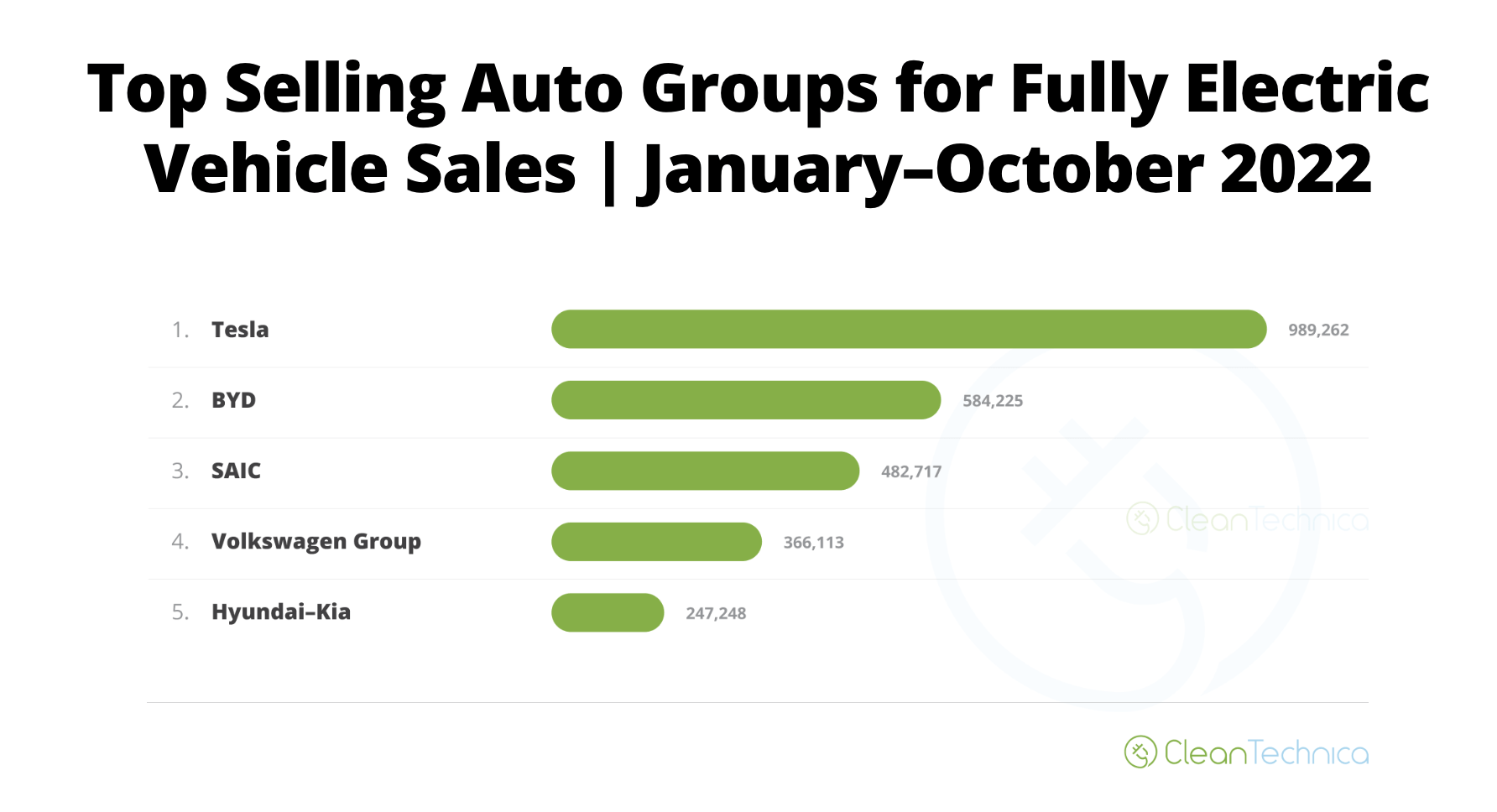

In recent years, we’ve seen an increasing adoption of electric vehicles (EVs) as their economics have become more attractive.

In Europe alone, over 16.5 million electric cars hit the road in 2021, a tripling in just three years.

“As a result, we expect demand for transportation fuels, which represent around 60% of oil demand, will begin to taper in the second half of the coming decade,” said Chamberlayne.

“We consider these changes to be indicative of an inflection point in the s-curve of electrification.

“We believe electrification is well and truly in a strong growth stage, with innovation creating better and more efficiency vehicles at cheaper prices.”

Over the coming decade, Janus predicts that more than 50% of all automobile production will shift to electric.

“Along with EVs we will see an uptick in innovation in all aspects of electrification including buildings and industry,” added Chamberlayne.

Chamberlayne believes that today’s geopolitical fragmentation will be the catalyst for tomorrow’s green economy.

“When we look at companies, fundamentals remain important as ever,” he says.

“We focus on businesses with robust balance sheets and the ability to generate cash flow through times of economic turbulence, which will be inevitable in the coming year.”

Equally, Chamberlayne says Janus will focus on companies that are aligned to the development of a sustainable economy, and which will flourish in an environment of reshoring, resilience and electrification.

“Company valuations have been discounted significantly, and yet we still see plenty of secular growth opportunities ahead.”