Tech-Heavy: Elon can’t sleep; Fed can’t make the kill shot; We’re only halfway through US earnings

Via Getty

Belinda Allen from CBA notes that Wall Street fell and bond yields rose on Friday in response to a strong US non-farm payroll which jumped by some 517,000 American jobs in January, a decent beat on consensus of (+189,000.)

Important? Yeah.

Exciting? Nah.

It’s just that happy US news – like heaps of jobs – is a bad thing right now. In short, it means their central bank isn’t stifling inflation despite trying to strangle the American economy. Moreover, it bores you, annoys me and terrifies Wall Street.

…So, US indices were weaker by the end of Friday’s session as decent rate-hike-fearing Christian (and non-denominational) traders had trouble accepting the stronger economic data following The US Fed’s subtle ‘We’re Cooling our Jets’ signals out of last week’s meet.

Principal Asset Management’s chief global strategist Seema Shah told Stockhead that this looks and feels like “a US Federal Reserve approaching the end of the tightening cycle”.

Still, a strong jobs read and all the unwinding talk is back on the ropes.

At the close Friday, the Dow Jones index was short 0.4% and the S&P 500 index lost 1%.

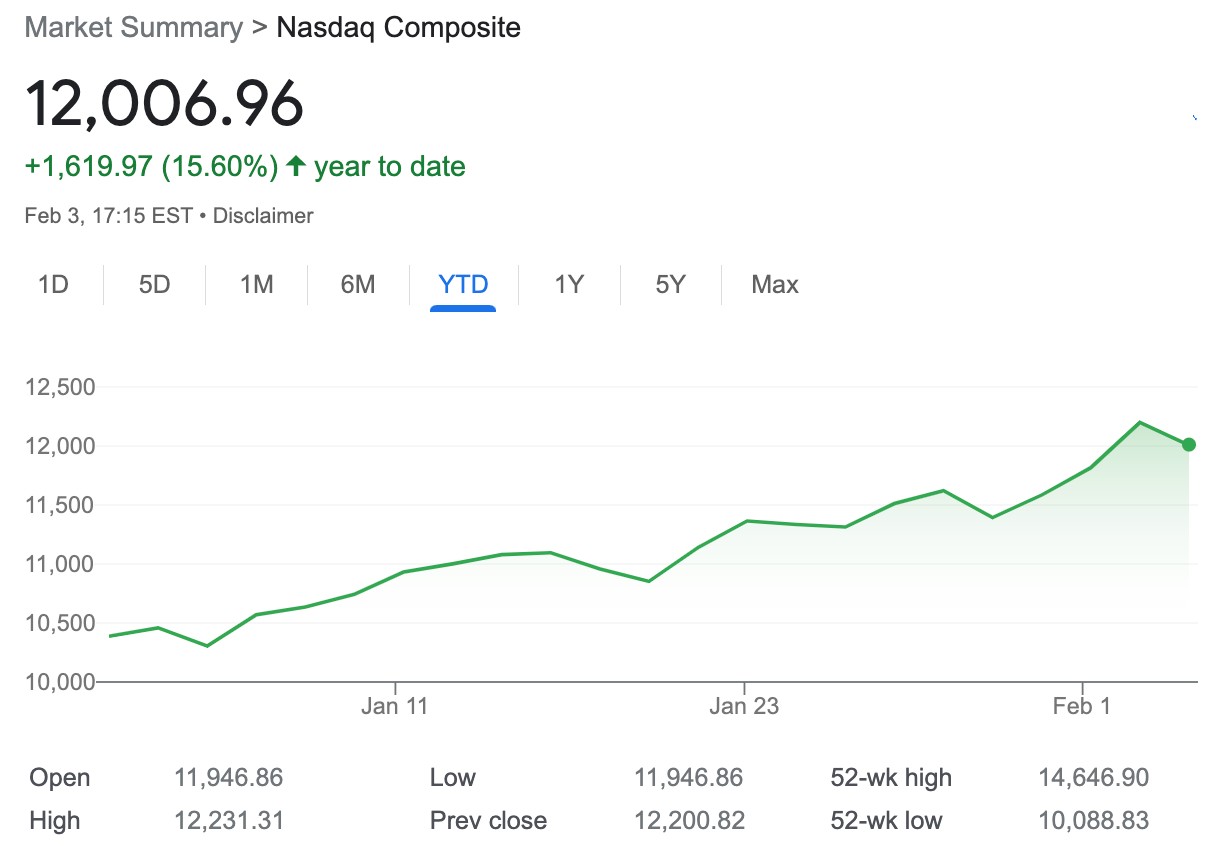

And glittering, Tech-Heavy Nasdaq Composite you ask?

That bad boy gave away 1.6% on Friday like it didn’t even matter.

And it didn’t.

Because even so, the tech-heavy ended last week up by 3.3%, posting its fifth straight win.

Now, I don’t know what you’ve been doing since New Year, but I’d bet you’re not up by 16%.

What a monster.

US Q4 corporate earnings

About two-fitty of The S&P 500 have delivered their Q4 earnings report, with FactSet suggesting only about 7 out of 10 have had a win over expectations, well down on the 79% (or circa 8/10) which is the rolling average over the last three years.

But hey, some of those beats we’re memorable.

Meta Platforms (META) take a bow.

Microsoft (MSOFT), still knows how to turn a dollar.

Amazon (AMZN). We won’t lose any sleep over one hit and one miss.

But both Apple (APPL) and Google-Dad/Mum Alphabet (NASDAQ: GOOGL), are both in the naughty corner of shame.

The AlphaBaby, Google, is holding a big old ‘search and AI’ shindig which might very well be getting rejigged as a redemptive opportunity to drop some positive news after the ordinary earnings.

We’ve got a stack of detail on those big tech earnings as well as a handy preview for Uber, which drops Thursday. You’ll have to wait until tomorrow morning to read it though.

This week some 90 names will report.

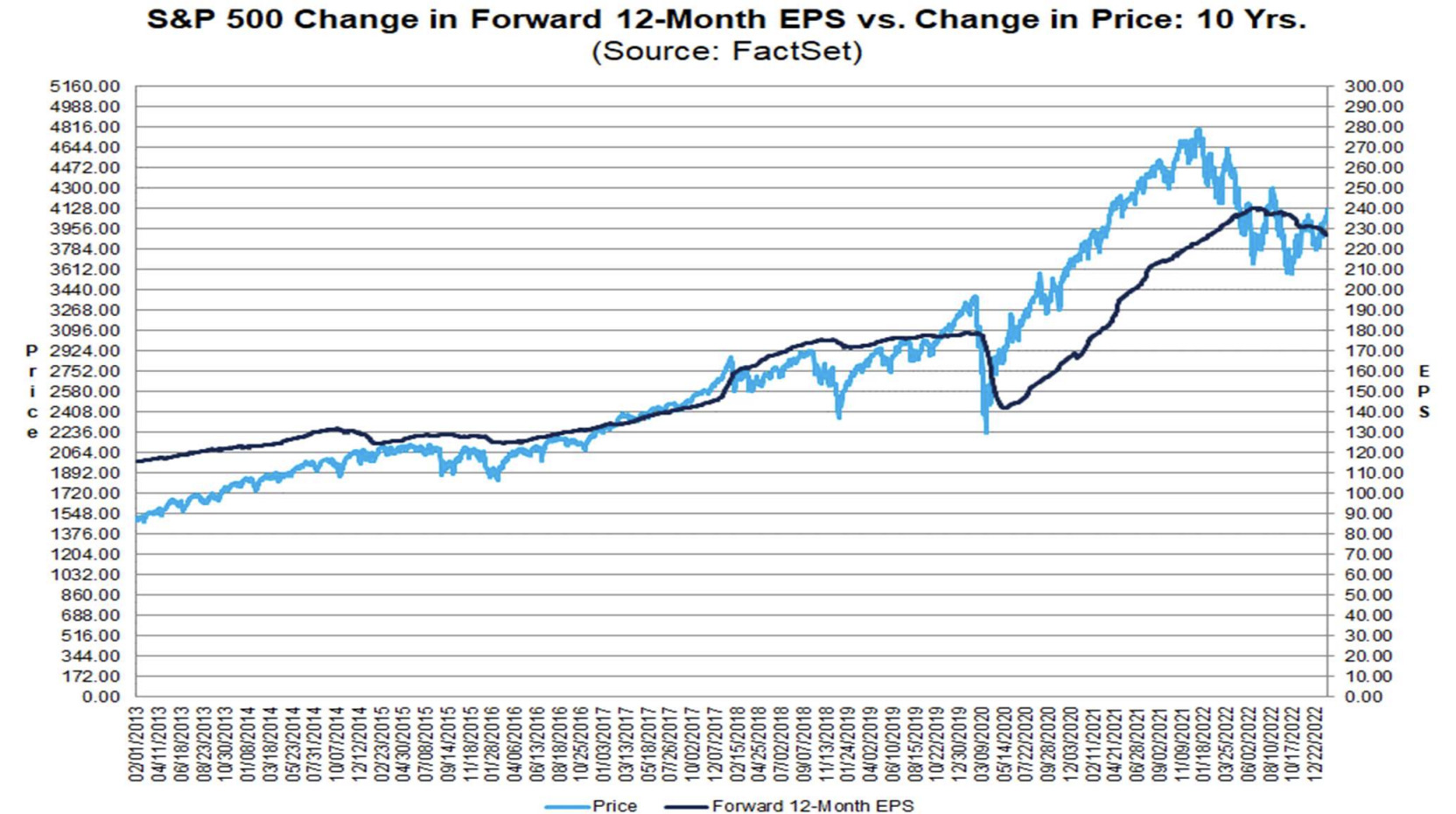

Here’s where we stand at halftime (again, courtesy FactSet) for Wall St Q4 2022:

- 50% of S&P 500 companies reporting actual results

- 70% of S&P 500 companies have reported a positive EPS surprise

- 61% of S&P 500 companies have reported a positive revenue surprise

- For Q4 2022, the blended earnings decline for the S&P 500 is -5.3%. (Eh, if -5.3% is the actual decline for Q4, it’ll mark the first time the index has reported a year-over-year decline in earnings since Q3 2020 (-5.7%)

- Earnings Guidance: For Q1 2023, 37 S&P 500 companies have issued negative EPS guidance and 6 S&P 500

companies have issued positive EPS guidance- Valuation: The forward 12-month P/E ratio for the S&P 500 is 18.4. This P/E ratio is below the five-year average (18.5) but above the 10-year average (17.2)

The Nitty Gritty

There’s whispers abroad already on Wall Street that the Disney (DIS) share price – like its streaming TV channel (full of incredibly rude grown-ups cartoons) – is undervalued. Possibly. I don’t really mind. I buy tickets and get disappointed enough when the new Star Wars is crap, without having to worry what it might do to my portfolio.

That said, The House of Mickey is dropping an earnings report on Wednesday and the Street is expecting the company that owns Avatar, Pixel, Marvel et al to smash it, even if US consumer confidence is not.

Among some interesting corporates this week we’ll be getting a taste of just how rattled that confidence is as PepsiCo (PEP) and Chipotle (CMG) are among the big names reporting Q4 in the next few days.

After 2022’s ordinary year for equities, LGT Crestone’s Scott Haslem says there’s even more emphasis this year, and this quarter on just how well a company can do when it comes time to drop its pants and cough.

“Valuations are more reasonable, (they are, see below) yet at same time interest rates are higher, so the outlook for multiples (up or down) is muted. This puts the performance for the market squarely on the shoulders of corporate earnings, and their path through 2023,” Scott says.

Elon Watch

Disponibile in Italia!

Well. This is great news, but might be a little frustrating for my MUM, who doesn’t require much from her Starlink set-up in beautiful Batemans Bay, other than enough internet out of Elon’s ‘constellation of satellites’ to email me and my brother to tell us that the internet we convinced her to get – doesn’t work.

Starlink is a satellite constellation system that aims to deliver global internet coverage. This system is ideally suited for rural and geographically isolated areas where internet connectivity is unreliable or nonexistent.

That’s how we sold her on it.

But again, disponibile in Italia! – magnifico!

Disponibile in Italia! https://t.co/Q1VvqV58aK pic.twitter.com/CbTQCMg7oT

— Elon Musk (@elonmusk) February 5, 2023

Meanwhile…

Some bad news is that Elon is ‘tired, his back hurts and his mom (sic) wants him to get some sleep.’

Some good news is that’s probably because he’s now working 120 hours a week as Boss of All.

I’m just going to refer me to some WSJ, because it’s great and since I’m paying for it and I don’t see why you should too.

The journal must’ve had someone at the recent cranky Tesla people trial, offering this juicy tidbit:

“I had trouble sleeping last night, so unfortunately, I’m not at my best,” the billionaire entrepreneur recently told a lawyer during a trial in San Francisco…

Later, Mr. Musk added: “I’m sorry for squirming around. I have quite severe back pain.”

The WSJ goes on to gush, (a little out of nowhere) that (Elon’s) tenacity has led to superhuman-like accomplishments, such as landing space rockets and making electric cars sexy.

But this all-in approach — at age 51 — comes at a cost to him personally.

Since taking ownership of Twitter Inc. in late October, Elon’s workload has exploded to more than 120 hours a week, he told investor Ron Baron in November:

“I go to sleep, I wake up, I work, go to sleep, wake up, work — do that seven days a week,” Mr. Musk said. “I’ll have to do that for a while — no choice — but I think once Twitter is set on the right path I think it is a much easier thing to manage than SpaceX or Tesla.”

Following publication of the WSJ story Elon, tweeted this:

Last 3 months were extremely tough, as had to save Twitter from bankruptcy, while fulfilling essential Tesla & SpaceX duties. Wouldn’t wish that pain on anyone.

Twitter still has challenges, but is now trending to breakeven if we keep at it. Public support is much appreciated!

— Elon Musk (@elonmusk) February 5, 2023

A lot to unpack in there, but what I really want to know is if owning Twitter has taken all the fun out of Tweeting?

US Q4 22 earnings: What I’ll be watching, anyway

Monday, February 6

Activision Blizzard (NASDAQ:ATVI), Tyson Foods (TSN), Take-Two Interactive (TTWO).

Tuesday, February 7

BP (BP), Chipotle (CMG), Dupont (DD), Royal Caribbean (RCL), Lumen Technologies (LUMN)

Wednesday, February 8

Disney (DIS), MGM Resorts (MGM), Dominion Energy (D), Uber (UBER)

Thursday, February 9

Kellogg (K), PepsiCo (PEP), Philip Morris (PM), PayPal (PYPL), Ralph Lauren (RL), Lyft (LYFT)

Friday, February 10

Lyft (LYFT), Enbridge (ENB), Magna International (MGA).

US IPO watch:

Hesai Group (HSAI) is a LiDAR – Light Detection and Ranging — firm working out of China with claims of being the first to deliver over 10K LiDAR units per month. LiDAR is a remote sensing method used to examine rough terrain with geo-mapping and other practical uses.

Treasure Global (NASDAQ:TGL), Forza X1 (NASDAQ:FRZA), and LuxUrban Hotels (NASDAQ:LUXH) are among the US co’s going public this week.

For more on the US (and global) economic calendar, head over to Eddy Sunarto’s latest … wait up. No... I did it this week.

It’s still ok. And the data’s solid.

Or. I can just tell you it’s a quiet week Stateside. Go get a cup of tea.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.