LGT Crestone’s CIO Scott Haslem says turbulence ahead so hold the line on equities, Australia

Via Getty

As you all well know. I am not a man easily excited or given to flights of hyperbole. (Woah, Pigeon!)

So when I say LGT Crestone’s Scott Haslem is on my laminated list of All The People Best At Their Jobs, (between Craig Bellamy and Santa Claus) then you will read on, assured in the confidence that here is a man who knows his stuff.

“Here is a man who not only had a brilliant mind and a wonderful wit, but could also sing…”

A quick walk through:

Before running the shop at LGT Crestone Wealth’s high-functioning Chief Investment Office, Scott Haslem was the face, tonsils, guts, heart, legs and arms as well as the chief economist, managing director and head of macro for Australia and New Zealand at UBS.

While doing that he was the brains behind APAC’s most consistently accurate and its consistently top-rated economics team. Over more than a decade. Never one for individual accolades, he garnered a treasure trove of individual accolades, rating the No. 1 broking economist for 10 out of the past 11 years.

The Melbourne Storm of Aussie economists

But Scott joined UBS last century (in 1998). Before that he spent 7 years inside the Reserve Bank of Australia, bringing it down from within. And also doing some economic forecasting.

Before that he snagged an Honours in Economics from the University of Queensland (before it was political) and a Master of Economics from the Australian National University (before it stopped being political).

Mnsr Haslem, as you’re about to discover, does the lot when it comes to making money into more money.

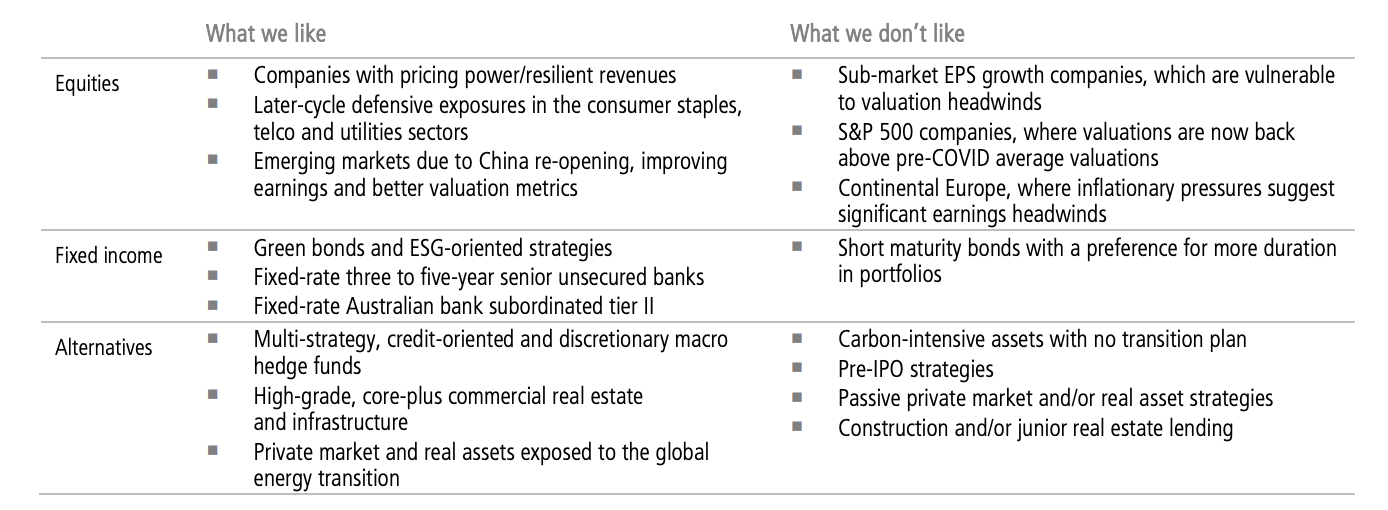

Below is where a breathless summation of where Scott’s LGT Crestone team are right now in terms of strategic and tactical asset allocation, portfolio construction and manager selection across equities, fixed income and alternative assets.

Where LGT Crestone stands at the start of February

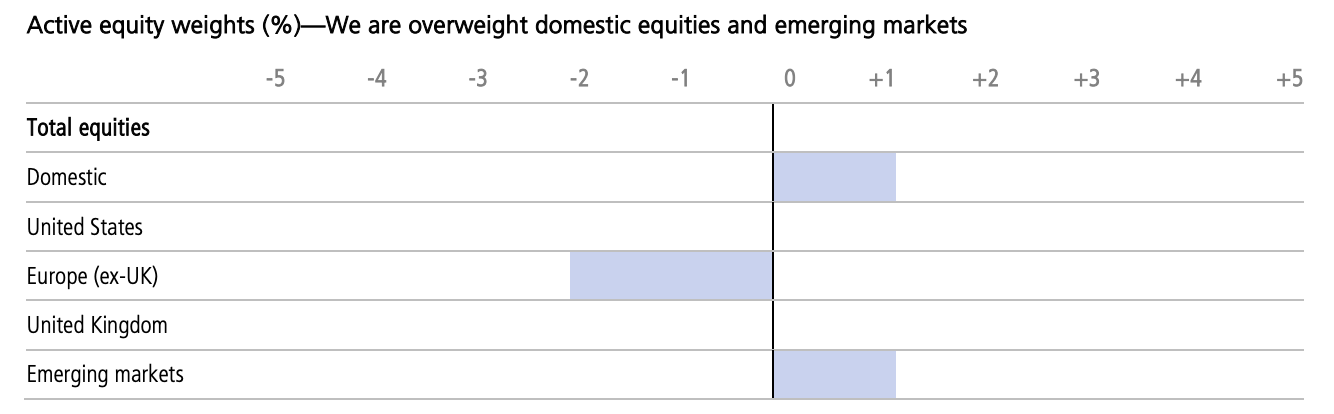

- They’re overweight domestic equities: In a relative sense, Australia remains a preferred regional allocation.

- We look good, with Aussie economy’s leverage to a re-opening China (here you can think: education, tourism, real estate, and commodities demand);

- And not only, but also: A dividend yield almost twice that of the MSCI World index, Australia remains an overweight, albeit the valuation support has diminished.

- After 2022’s ordinary year for equities, Scott says valuations are more reasonable, yet at same time interest rates are higher, so the outlook for multiples (up or down) is muted. This puts the performance for the market squarely on the shoulders of corporate earnings, and their path through 2023.

- Year so far has revealed clearer signs we’re all passing the peak in inflation and the central bank hawkishness, at the same time China’s accelerated re-opening and Europe’s warmer-than-expected winter have both improved the macro outlook.

- Scott says: For equities, we remain neutral, highlighting the risk of near-term weakness, while encouraging portfolio rebalancing where equity allocations have drifted above their tactical targets.In December, we remained neutral equities, largely on valuation grounds.

- However, we reallocated some of our overweight to Australia to emerging markets, given both the recent stellar outperformance of domestic equities and now more compelling emerging market valuations (and positive China news).

- He also says without any hint of triumph: Both decisions have added significant value between early December and now.

A challenging backdrop to equities

Still, Scott notes, there’s a challenging backdrop to equities, probably exacerbated by the cracking start to the year and large recent gains.

“If history is any guide, a likely material slowing in economic growth, with still elevated inflation and interest rates, is yet to be adequately reflected in equity market earnings.”

And the US market remains one of the most stretched on these metrics, LGT Crestone’s CIO maintains.

In December, global equity markets suffered their 3rd worst December in 20 years (2002 and 2018 were just awful), falling 4.3%.

But then global equities jumped 6% in January was its second-best start to a year in almost 30 years.

All sectors rallied in January, but market positioning was clear–quintessential defensive exposures, such as consumer staples, utilities, and healthcare, were significant laggards to more cyclical sectors.

According to UBS estimates, falling inflation and declining interest rates have supported an 11% S&P 500 rally since October, whilst China’s reopening have added 2%. However, Scott says, weaker economic activity and EPS downgrades have represented a headwind of approximately 7%, suggesting the S&P 500 has overshot its fundamentals by around 4%.

“There is likely to be an ongoing re-allocation from equities to bonds (as bonds become more attractive at higher levels of

interest rates), which will prove to be a headwind in terms of allocating to equities at current levels.

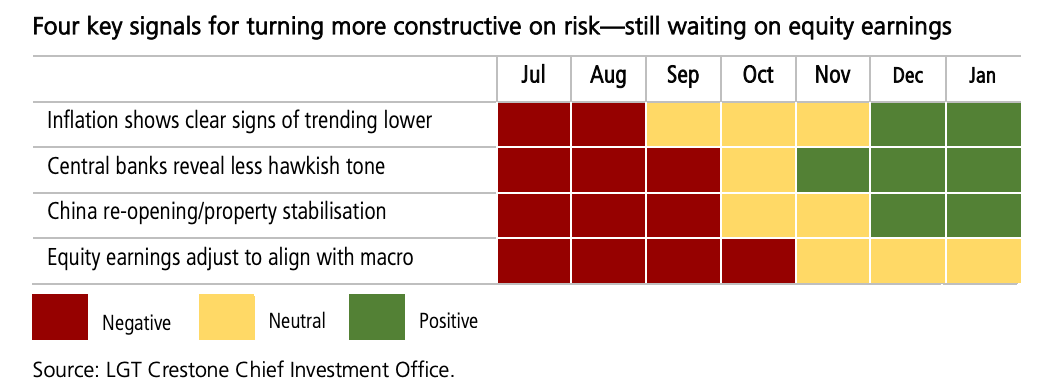

“As shown in our signals table (below), we are yet to fully achieve the four signals required to take an overweight (US) equity view.”

“The final earnings signpost is likely to be clearer by end-February, as US, European and domestic equity reporting seasons wrap up.

“For now, we continue to see 2023 as a game of two halves,” Scott says.

And so does S&P Global in one important way at least.

S&P Global Market Intelligence Trade Forecast: Also a Year of 2 Halves

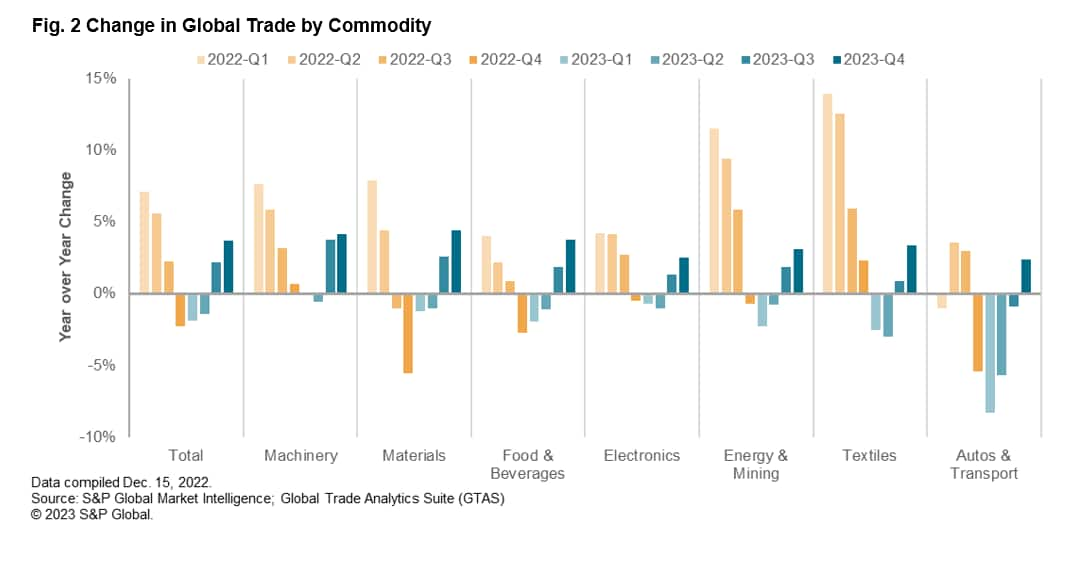

S&P Global Market Intelligence’s global trade forecasts, (shown below), find that a downturn in the automotive and consumer goods trade will be offset by machinery and electrical goods.

“Boom time demand and supply chain inflation will both reverse in 2023, dragging on the volume and value of global trade.”

That will be reflected on a national basis, the firm says, with improving exports out of China and South Korea outpacing Japan’s downturn while EU and US. imports will fall.

“In aggregate, we forecast global trade activity in real terms will fall by 1.9% year over year in Q1’23 and by 1.4% in Q2’23 before recovering later in the year to reach 0.6% growth overall in 2023.”

Post-peak inflation = slow growth, slower profits

Scott reckons there’s market turbulence in the post, so check your calendars.

Higher rates will create macro weakness that translates to cuts to corporate earnings outlook.

“An ongoing re-allocation by market participants from equities to bonds (given bonds are now an attractive asset class) is likely to add to this volatility.

“The ‘other half’ should be a period of stabilisation as the earnings backdrop steadies and moderately improves. We expect this initial market weakness will eventually force central banks to pause hiking rates around the end of Q1, and for the most advanced (and aggressive) central bank, the Fed, we expect a so-called ‘pivot’.

“However, the extent of the market weakness that will force such a central bank pivot, the magnitude of that pivot, and subsequent macro and market recovery remain key uncertainties,” he adds.

On the positive side, he says the Aussie economy kept the momentum going in late 2022, with only wee signs of a forecast growth slowdown ahead.

“The lagged impacts of sharply higher policy rates are expected to weigh heavily on housing and consumer spending, as interest servicing costs jump. Unemployment is expected to start rising through Q1 2023.

“Still, the tempering in the pace of rate hikes in the final quarter of 2022 and China’s re-opening have added to confidence that while growth will likely slow materially ahead, Australia can avoid recession and should outperform growth in other developed economies.”

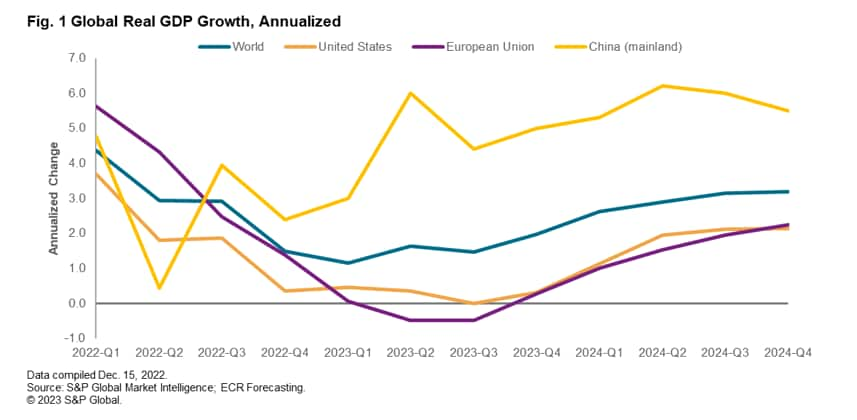

After 8.4% in 2021, China’s growth slowed to 3.0% in 2022, but it’s looking pretty good in contrast to most other key economies.

UBS expects China’s growth to accelerate to 4.9% in 2023 (upgraded from 4.5%), Goldman Sachs recently cut its 2023 forecast from 5.7% to 4.8%, while CBA recently lifted its forecast from 4.9% to 5.5%.

Aussie equities, Scott is Overweight:

- Domestic equities rose 6.2% in January, the best start to a year since 1986.

- The S&P/ASX 200 index is now down less than 1% from its all-time highs in August 2021.

- The January rally erased the 3.4% fall seen in December, which had been the largest December pull-back in almost 50 years (only 1974 was worse).

- Excluding the utilities sector, which saw all its constituents fall, each sector rallied at the beginning of the year. Materials led the way (up 11%), followed

He says watch for these 6 potential curly prospects:

- Equity markets could retest previous lows (or move meaningfully toward them).

- Because of worsening corporate earnings / renewed pressure on profit margins, as well as a) the recognition that rates are higher than at the lows in 2022 (implying lower price/earnings (P/E) ratios now), and b) the likelihood that interest rates will be, on average, higher than pre-COVID.

- This suggests pre-COVID peak P/E ratios are a significant return hurdle in the future.

- The market decline could happen between now and the end of Q1, or soon thereafter, as the market digests a likely lower earnings outlook.

- US P/E valuations are above average and not far below pre-pandemic peaks.

And now here’s what I reckon we’ll call Scott’s 6 pillars for dealing with all this:

- Growth is likely to slow materially in 2023 — As the lagged impact of 2022’s energy cost spikes and monetary policy tightening weigh. Scott says: While a peak in interest rates will support only a relatively moderate growth slowdown this cycle, it also underpins only a modest recovery in growth through 2024.

- Geo-politics and all things ‘security’— From energy, food, technology, and supply chains—will be increasingly important drivers to economies and company earnings. Scott says: Key questions centre on the level to which inflation will settle over the next couple of years, which will impact the willingness of central banks to re-engage zero bound rates in the years ahead.

- Inflation volatility is likely to persist—Inflation is falling near term. Scott says: But fading impacts of globalisation, structurally tight labour markets, and geopolitical impacts on supply chains suggest less deflation and more inflation.

- A return to ‘normal’ interest rates—Peaking inflation is likely to foster a near-term peak in central bank hikes. Scott says: But stickier inflation than over the past two decades is likely to limit a return to near-zero interest rates.

- Geo-political volatility likely to be enduring —Russia’s invasion of Ukraine has ended a long period of benign globalisation. Scott says: Ongoing decoupling of leading edge technology, political and trade alignment, as well as military and energy security, are all key potential drivers of growth and profits.

- Diversification may matter more — Scott says: In a world of heightened volatility and fewer long-cycle trends, it is important to maintain portfolio diversification, avoiding over-exposure to individual markets, sectors and other specific return drivers. Unlisted investments are likely to grow in favour.

Scott also likes what’s cooking further (and in some cases) closer afield.

(Emerging Market) equities and he isn’t the only one.

“We are overweight emerging market equities,” he says:

- Earnings gains in China and India may stand out this year in a world where growth is shaping up to be a scarce commodity.

- Consensus expects both markets to post double-digit 2023 EPS growth, which can extend across the region and into broader emerging markets.

- China’s emergence from COVID-zero restrictions has caught global investors off-guard, given their significant underweight to the region.

And just personally, I like this straight-shooting table:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.