Morgan Stanley is making a big move out of Wall Street and into Emerging Markets

Via Getty

Jitania Kandhari is the managing director at Morgan Stanley’s Emerging Markets Equity Team.

Her plate is full.

She’s helping run Morgan Stanley’s US$1.31 trillion in assets at a time of market discord and cracking uncertainty.

Right now the deputy chief investment officer of the Solutions and Multi-Asset Group, co-lead portfolio manager for the Active International Allocation Strategy and head of Macro and Thematic Research for the Emerging Markets Equity team is on the blower, rousing enthusiasm for Morgan Stanley’s big move into Emerging Markets.

The thesis is thus:

Every 10 years or so, a new leader emerges across the global market.

For the last decade, mega-cap tech, mainly out of the States, has enjoyed the twin engines of super-low interest rates and real-world innovation which has supercharged the valuations of these big name growth and tech stocks, a space where the US and to a lesser extent China have thrived.

In the coming decade, Jitania Kandhari‘s team says, the growth outlook, cheaper valuations, and favourable demographics all point to a changing of the guard resulting in an overdue outperformance for emerging markets and their equities.

And while Chinese equities currently represent 30% of the MSCI emerging markets index, Morgan Stanley IM says it probably won’t play nearly the kind of role as a catalyst for growth as it previously did.

China hasn’t dealt with systematic issues which are only now starting to become real world issues. The ageing and declining demographics, the diminishing position in global supply chains, the deterioration of transparency and trust, a massive debt burden, youth unemployment, a foolish property debacle…

For these reasons and more the fund manager is turning to the next iteration.

The aim is to bail out of these lumbering Wall Street positions and jump into India, Vietnam, Thailand, Mexico, Brazil and Indonesia.

The strategy is simple and it’s been working.

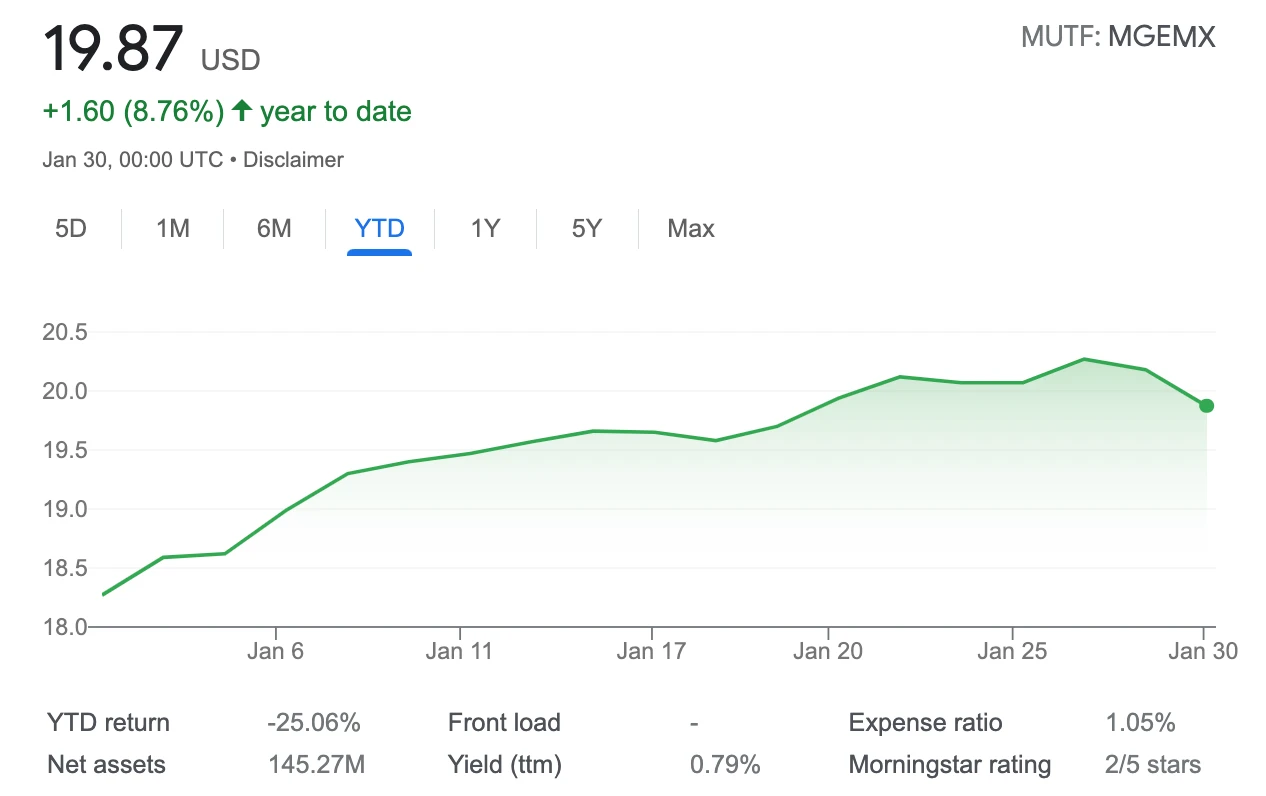

The MGEMX Fund goes in for “long term capital appreciation by investing primarily in growth oriented equity securities of issuers in emerging market countries”.

The general policy is that at least 80% of the fund’s total assets will be invested in equity securities of issuers located in emerging market countries.

Morgan Stanley Institutional Emerging Markets Portfolio

Morgan Stanley’s peers appear to be up for it too.

This week First Trust Portfolios revealed via the SEC that it’s bumped up its ownership (some 9.20 million shares) of Morgan Stanley Emerging Markets Domestic Debt Fund.

First Trust now holds 13.94% up from 11.07%, only last week, an increase in its stake of 25.58%.

“Every decade, there is a new leader in the market. In the 2010s, it was US stocks and mega-cap tech. Leaders of this decade can clearly be emerging-market and international stocks,” she told Bloomberg.

The International Monetary Fund (IMF) has reported this week that emerging economies are expected to grow 2x as fast as developed ones this year alone and Jitania says GDP will drive these EM well beyond established economies.

As the growth differential between EM nations and the US, EU and other developed economies widens, EMs will outperform over the next 10 years, she told Bloomberg overnight.

China is ‘the eye of a deglobalisation storm’

Supply chains will move away from post-pandemic China, and the Middle Kingdom’s emerging neighbours like India, Vietnam, and over in the Americas, Mexico should benefit too.

“Everything that is not working for China is working for India,” she says.

China is “at the eye of a deglobalisation storm”.

Morgan Stanley believes that while the 2000s saw the last surge of the Old China and the 2010s the rise of New China, the 2020s will be the decade of “China 3.0” – where a government under Xi Jinping prioritises “hard sciences and frontier technologies”.

“Currently, China 3.0 is a small part of the (MSCI EM) Index, with only a few interesting constituent companies positioned for this decade.

“It’s time to look beyond China’s 30% weight in the index and focus on markets, sectors and companies that look structurally better as new trends emerge,” Jitania says.

Emerging markets: Long-term outperformers

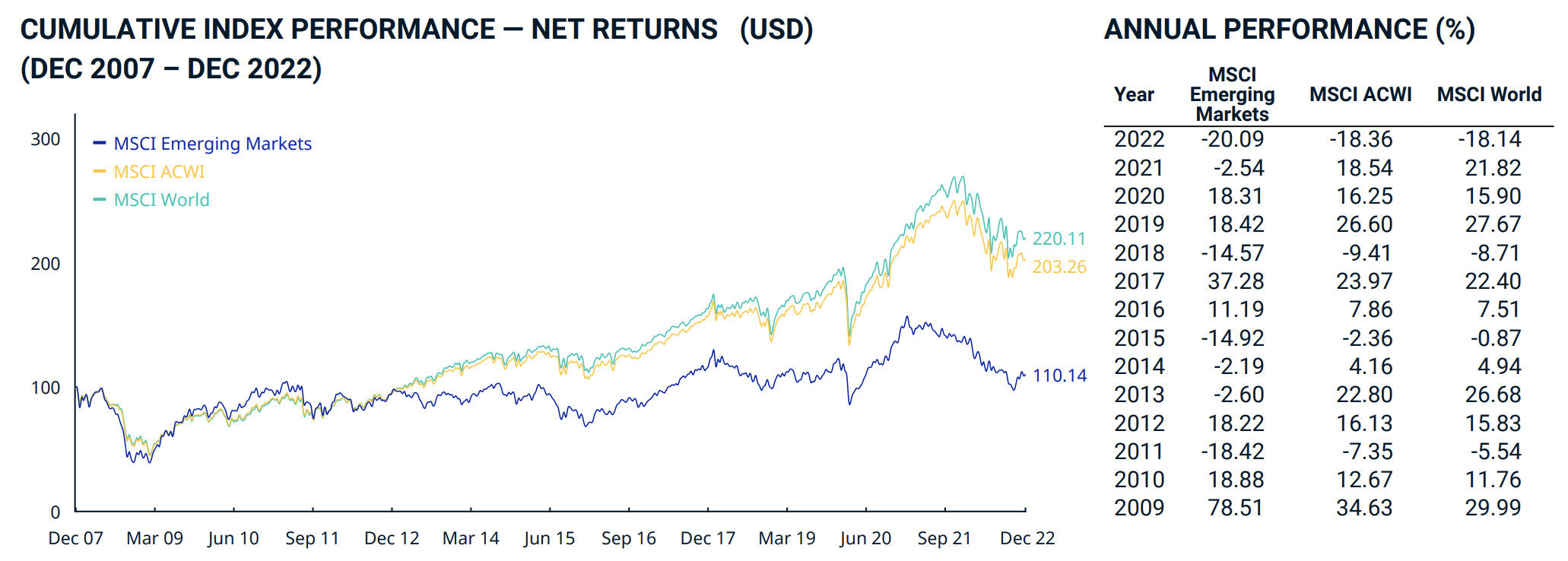

“Since the inception of the MSCI EM Index in 1988, despite weathering many financial and economic storms, emerging economies have outperformed developed markets, perhaps surprising many commentators,” Jitania says.

“Since 1988, the MSCI EM Index has gained 9.6% annualised, which is over 150 basis points above the MSCI World Index and higher than other asset classes, albeit with higher volatility.

According to Jitania, drawdowns in EM are “common and have historically offered the best entry points” for exposure to the long-term returns.

“We believe that the higher volatility in EM offers greater opportunity for active management to add value over the long term.”

The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries.

With 1,377 constituents, the index covers approximately 85% of the free float-adjusted market capitalisation in each country.

The MSCI EM Index is up over 10% in 2023 so far, the MSCI World Index is just half that, year to date.

Just before Christmas Jitania signalled Morgan Stanley’s intentions, laying out the case for a move back into emerging markets (EM), saying that in the 2010s, EM equities endured their worst performance since the 1930s.

She says the asset class returned just +49%, compared to an average of well over +200%, in the previous seven decades.

“Emerging market countries ran high twin deficits, which led to currency depreciation and forced a cleanup of excesses from their precarious balance sheets, a legacy of loose fiscal and monetary policies. An important factor inhibiting EM equity performance in the last decade was the deterioration in the growth differential between emerging economies and the developed world, the key driver historically of relative returns of the asset class.

“After lagging the developed economies (DM), especially US equities, for more than a decade, emerging markets are in a much stronger position to outperform developed countries this decade.”

2010s: Worst Decadal Returns for EM Since the 1930s

Emerging Markets Cumulative Total Returns Each Decade

Source: MSIM, Bloomberg, Factset, Haver. Equity Total Returns, USD

According to Morgan Stanley, several emerging markets have been thriving while the rest of the world has literally stumbled through despite a string of recent global crises – from COVID, Russia’s invasion of Ukraine, central bank vs inflation and a roid-raging US dollar.

Brazil, Mexico, India, Indonesia and the GCC (Gulf Cooperation Council) have not only outperformed the MSCI EM index but even the US so far in 2022. In fact 9 of the 10 top performing markets this year are emerging countries.

The headwinds of the past are becoming tailwinds in several markets, with the exception of China, that we believe should provide support for many years to come.

Jitania‘s case for Morgan Stanley’s EM pivot

She says that despite better growth, lower debt and lower inflation, EM equities are trading at crisis-level valuations.

“We believe that most investors are under-allocated to EM, considering the potential returns from the catalysts for this asset class for the next decade.

“The average active global equity fund allocation to EM is 5.2%, which is far below the 20-year average allocation of 9%. For many investors EM remains unloved and under-owned.

“The environment for investing in EM will never be easy, but by focusing on country selection, stock selection and structural themes, we believe investors can reap the rewards of buying into these markets particularly at this stage of their economic and market cycle.”

Five reasons EM outperformance is in the post:

-

Relative growth differentials now favour EM equities

-

EM sovereigns are in healthier shape vs DM governments (due to better public debt and fiscal situations)

-

EM corporates are in a better position vs DM corporates (due to deleveraging)

-

EM external balances have improved over the past decade

-

EM equities and currencies are trading at crisis-level valuations

MS: Relative Growth Differentials Favour EM

EM vs DM Real GDP Growth Differential and Relative Performance

Source: MSIM, Bloomberg, Factset, Haver.

Jitania says EM sovereigns look rosier mid-inflation/tightening cycle than most DM governments.

Basically, while developed economies just hit the QE button, in many emerging markets, there’s simply… “an absence of fiscal excess.”

Inflation in EM now lower than in the States

Headline CPI Inflation Rate by Region

MS: Relative EM Equity Valuations Are Also at Crisis-level Lows

EM vs DM Composite Valuation Indicator

Source: MSIM, Bloomberg, Factset, Haver. Composite measure of 6 valuation metrics: price/book, 12m-fwd. P/E, P/E, price/sales, price/cash earnings, dividend yield.

Currency valuations in emerging economies are critical as favourable currency moves on average have contributed to one third of total returns historically for dollar investors.

While the euro, pound and yen have tumbled against the USD this year, EM currencies have performed significantly better. In fact, the EM currencies are holding up much better than other DM currencies compared to past Fed hiking cycles in the last 25 years.

MS: EM Is the Long-term Performance Winner

Annualised Total Return Since 1988, USD

Source: MSIM, Factset, Haver.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.