Traders’ Diary: Everything you need to get ready for the week ahead

I know. Let's join the EU! Via Getty

What grabbed the headlines last week?

Let’s start with the obvious, or as some continue to call them, the British.

Last week as the streets of London filled with complainers, we learned that the Brexit hit to UK trade has been, in the words of Tony Blair’s Institute for Global Policy, “significant and may have occurred more quickly than previously assumed.”

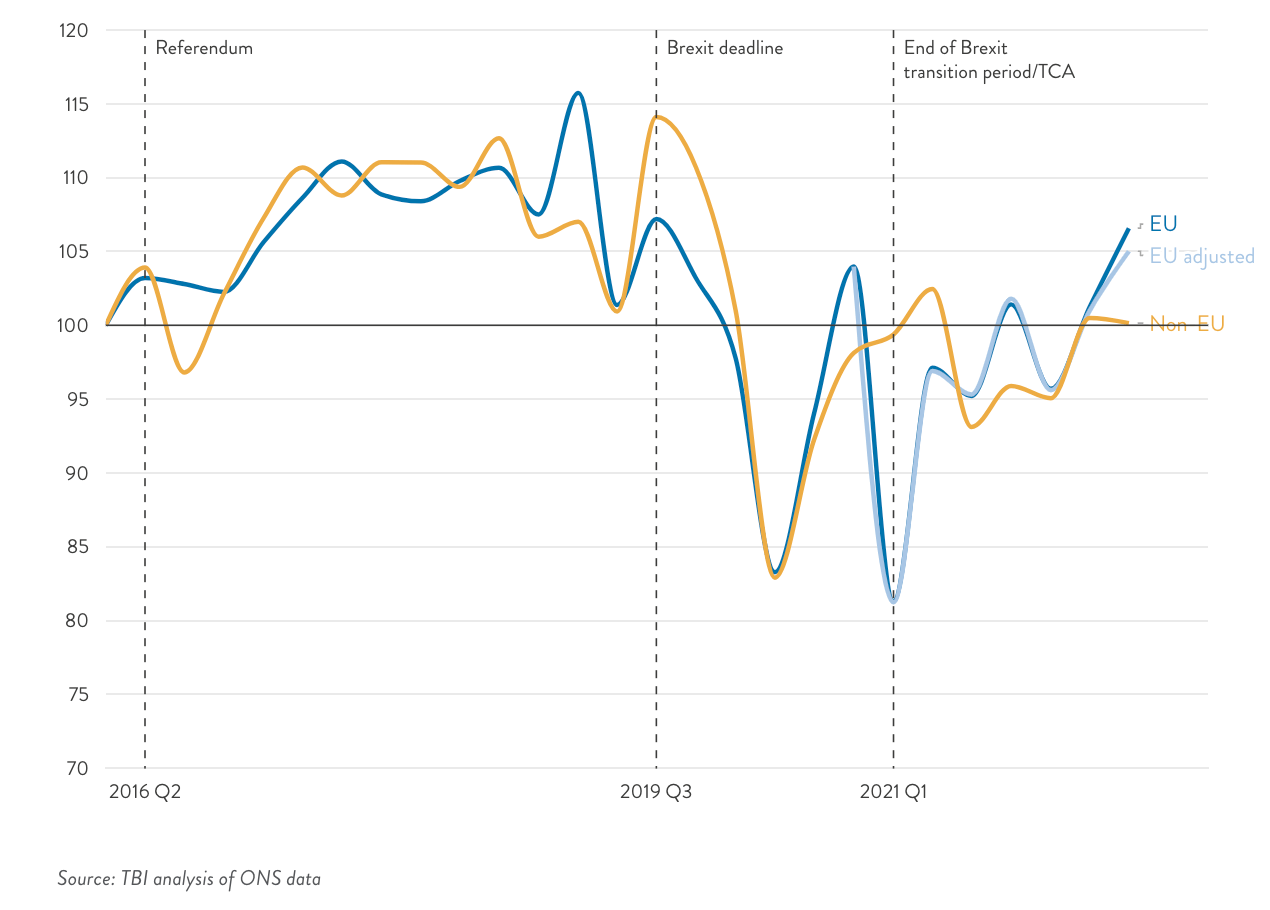

“Britain’s trade has been hit significantly by its departure from the single market. Trade in goods with the EU fell sharply after the Brexit transition period ended, with UK imports from the EU dropping by approximately 25 per cent more than UK imports from the rest of the world, a trend which persisted throughout 2021.”

A recent revision to the official trade data (marked as “EU adjusted” in the chart below) has shown a slight uplift in imports compared to previous data, but the EU imports are still badly underperforming.

The Bank of England (BoE) stepped up rates by 50bp but now expects a ‘much shallower’ recession than feared.

There’s still some work to do to tame inflation, although many eagle-eyed analysts noted that the obvious word ‘forcefully’ has been dropped from its list of things to do in forward guidance. The people who know are saying – this leaves the door ajar for smaller, happier sized 25bp hikes in the coming months.

All in all, Dr Shane Oliver from AMP Capital seemed to be pretty happy that “central banks are back in action”.

“After a nice six-week break – where markets were sort of left on their own to interpret data and assess the outlook and in the process pushed shares up and bond yields down.

“It’s a bit like the parents returning after the kids were home alone for six weeks – but so far so good with the Fed, Bank of England and the ECB all leaning less hawkish than they were late last year, albeit less so for the ECB.”

The more complex European Central Bank (ECB) hiked rates by 50bps.

The ensuing hyperbole (the huffing and puffing) came as expected amid the press pack surrounding La President Christine Lagarde who pledged to “stay the course in raising interest rates significantly at a steady pace”. The bank just came right out and said it intended to go again by another 50 basis points in March.

And just quickly on the Americans, Doc Oliver said:

“The Fed of course is key given its influence globally. It hiked again but is sounding a lot less hawkish and open to a cut this year.”

Oliver expects another 0.25% hike in March.

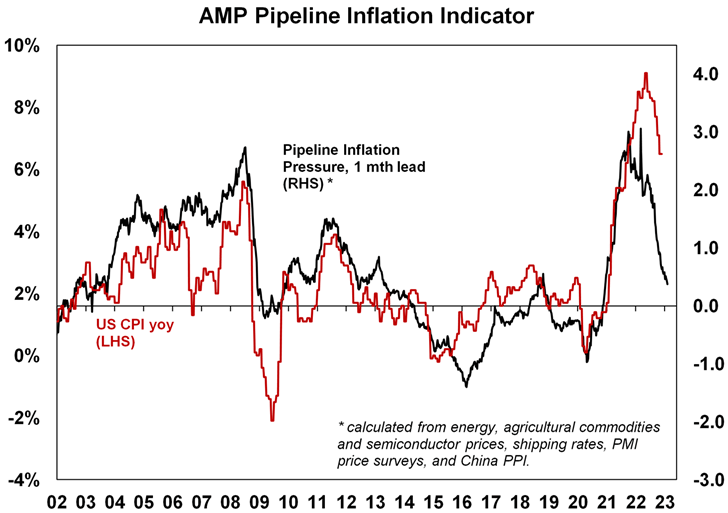

“But since we expect inflation to fall faster than the Fed does – as suggested by our Pipeline Inflation Indicator – we expect this to be the peak for the Fed ahead of rate cuts later this year.

“(Chair Powell) didn’t push back against the easing in financial conditions, and he indicated a willingness to ease rates if inflation falls faster than the Fed anticipates (which is what we and the markets are expecting). So it was less hawkish than feared.

Principal Asset Management’s chief global strategist Seema Shah told Stockhead that this is a US Federal Reserve approaching the end of the tightening cycle, there’s still distance to cover before they’re done squeezing.

“The Fed tried to deliver a reality check to markets this week, reiterating that while inflation has decelerated there’s still a long inflation road ahead. That road will take policy rates above 5%.

“However, Seema added that the overriding takeaway from the press conference will be that, even with two more rate hikes left to go, Inflation is finally on the right path.

“While they don’t have sufficient evidence to be fully confident, they have seen enough to be optimistic about the inflation outlook…. The ghosts of 1970 seem to be the main things weighing on Powell’s shoulders right now. Without them, Powell could maybe permit himself to sound a little more triumphant.”

The Americans shot a Chinese balloon into the Atlantic 10km off the coast of one of the Carolinas.

These balloons would be everywhere, all the time. So why now? And perhaps consider the signal it sends, the response from Beijing, and the impact that has on markets this week.

To the markets

Global share markets rose again over the last week, continuing their rally seen so far this year, helped by all of the above, with central banks largely less hawkish, albeit with mixed earnings news from US tech companies (see below).

For the week US shares rose 1.6% despite a fall back on Friday in response to stronger than expected US jobs data (therefore fear of rate hikes). In the EU shares rose 2.1%.

Closer to home, Chinese shares lost 1%. In Japan equities moved ahead by 0/5% and – reflecting the positive global lead – the ASX rose another 0.9% for the week, championed by Tech stocks, some Health and Real Estate names and a good show from Retail.

The ASX 200 is now just 0.9% below its all-time high.

Big Tech Earnings

Alphabet: Q4 misses on bottom and top line

As a result shares dropped -5%.

- Revenue: Came in at $76.05b, slightly missing consensus at $76.51b

- Google Cloud revenue was in line with estimates

- Google advertising revenues were one drag, coming in at $59b

- YouTube Ad revenues were another, undershooting consensus by 4%

- Operating income was $18.16b

- EPS: $1.05, missing consensus at $1.20 per share

Amazon: Q4 beat on expectations, misses on net income

As a result of that miss shares are also down -5%

- Revenue: Net sales beat estimates at $149.2b, +8.6% y/y and ~2% ahead of consensus

- North America net sales fell, so their core business of selling things online in the US has lost money for the 5th straight quarter

- AWS revenues missed consensus, coming in at $21.3b vs $21.7b

- Operating income was $2.74b, -21% y/y

- EPS came in at 3c, and the margin contracted for the 3rd consecutive quarter, coming in at 1.8% (below consensus at 1.85%)

Apple: misses on Q4 revenue, profit, sales, iPads and Macbooks

Share price also hit

- EPS fell -11% y/y and missed consensus by 3%

- Revenue missed consensus by 1%

- iPhone sales missed by 4%

- Mac missed by 20%

- iPad was ahead by 20%, and;

- Services was slightly ahead

- Gross margin was also in line with consensus

Meta: beats Q4 all over, broker upgrades follow

Meta Platforms’ upbeat surprise has led to a slew of analyst upgrades.

The market really liked:

- Reported revenue of $32.2b (about 2% ahead of consensus) and;

- Adjusted EPS of $4.32 (about 44% ahead of consensus)

- Ad revenues beat expectations

- Materially reduced expense projections, once again refining 2023 OpEx (now in the range of $89-$95b vs $94-$100b prior and initial $96-$101b) and;

- Announced this larger-than-expected buy-back; and

Finally. Uber reports this week.

See our incoming yarn for a preview with IG markets analyst Tony Sycamore.

The Economic Calendar

Monday February 6 – Friday February 10

All sources from Investing.com, TradingEconomics.com, Westpac and CBA

In our neigbourhood, central bank meetings at home and in India will be the highlights amid expectations of further hikes. Consensus expectations currently point to a 25-basis point hike in India.

Chinese inflation should be watcheed for the direction of prices now COVID-19 has been un-ZEROED. Last week Caixin’s China General Manufacturing PMI had inflation easing on the back of softening supply chain pressures.

MONDAY

New Zealand, Malaysia Market Holiday

Australia Retail Trade (Q4)

Thailand CPI (Jan)

Germany Industrial Orders (Dec)

Germany Consumer Goods (Dec)

Eurozone S&P Global Construction PMI* (Jan)

Germany S&P Global Construction PMI* (Jan)

Eurozone Sentix Index (Feb)

United Kingdom S&P Global/CIPS Construction PMI* (Jan)

Eurozone Retail Sales (Dec)

Germany CPI (Jan, prelim)

Indonesia GDP (Q4)

S&P Global Sector PMI (Jan)

TUESDAY

Japan All Household Spending (Dec)

Australia Trade Balance (Dec)

Philippines CPI (Jan)

Australia RBA Cash Rate (Feb)

Malaysia Industrial Output (Dec)

Switzerland Unemployment Rate (Jan)

Germany Industrial Output (Dec)

United Kingdom Halifax House Prices (Jan)

Taiwan Trade (Jan)

United States International Trade (Dec)

Canada Trade Balance (Dec)

S&P Global Metals and Electronics PMI* (Jan)

WEDNESDAY

Thailand BOT Meeting Minutes

Japan Current Account Balance (Dec)

India Repo and Reverse Repo Rate

United Kingdom KPMG/REC UK Report on Jobs* (Jan)

US Wholesale Inventories (Dec)

THURSDAY

Taiwan CPI (Jan)

US Initial Jobless Claims

FRIDAY

Australia RBA Monetary Policy Statement (Feb)

China (Mainland) CPI and PPI (Jan)

United Kingdom monthly GDP, incl. Manufacturing, Services and Construction Output (Dec)

United Kingdom GDP (Q4, prelim)

United Kingdom Goods Trade Balance (Dec)

US UoM Sentiment (Feb, prelim)

Taiwan GDP (Q4, revised)

India CPI Inflation (Jan)

China (Mainland) M2, New Yuan Loans, Loan Growth (Jan)

The ASX IPO calendar: Listing in February

Via the ASX.

SOUTH-EAST QUEENSLAND EXPLORATION (ASX:SQX)

Listing: 15 February

IPO: $5m at $0.20

SQX’s current focus is on copper and gold mineralisation at its Ollenburgs and Scrub Paddock Prospects, in the underexplored Esk Basin in southeast Queensland and situated near major regional infrastructure and population centres.

Scrub Paddock has been identified as a potential gold-copper porphyry, and features more than 20 mine workings and an area of comparable scale to Cadia/Ridgeway.

The company intends to drill high priority targets immediately upon listing, with the aim of defining an economic mineral resource.

TIGER TASMAN MINERALS (ASX:T1G)

Listing: 24 February

IPO: $8m at $0.20

Tiger Tasman Minerals has projects in WA and QLD focused on copper, lithium, nickel, manganese, silver, gold, base metals and industrial minerals (DMM) essential to the global clean energy transition, decarbonisation and a more sustainable future.

The projects are in proven and prospective jurisdictions including Paterson Province, Fraser Range, Earaheedy Basin, Ashburton and the Townsville region.

They are the Iron Skarn silver-copper-lead-zinc project (QLD), the Copper Canyon copper-gold project (WA), the Fraser Range lithium-nickel-copper project (WA), the Mt Minnie manganese project (WA), and the Crater copper-zinc-lead-silver-gold project (WA).

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.